16 minute read

How Exness work in India

Understanding How Exness work in India is crucial for Indian traders looking to enter the world of online trading. Exness is one of the leading global brokers, known for its user-friendly platforms, comprehensive educational resources, and competitive trading conditions. This article provides an in-depth look into how Exness operates within India, covering everything from regulatory compliance and account setup to trading platforms and customer support.

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

Exness in India: A Comprehensive Overview

Exness has made a significant impact on the trading landscape in India over the years. As an international broker, it offers a wide range of financial instruments, including forex, stocks, commodities, cryptocurrencies, and indices. With its emphasis on providing traders with innovative solutions and a seamless trading experience, Exness has attracted numerous Indian clients eager to explore the financial markets.

The broker's reputation is built on transparency, reliability, and exceptional customer service, which are vital factors for Indian traders. The increasing interest in online trading among Indians, combined with Exness' tailored services and features, make it an appealing option for both novice and experienced traders.

The Rise of Online Trading in India

The rise of online trading in India can be attributed to several factors, including the proliferation of internet access, increased awareness of financial markets, and the availability of user-friendly trading platforms. As more individuals realize the potential of financial markets to generate income, they seek reliable brokers that can provide them with the necessary tools and resources.

Exness caters to this demand by offering various educational materials, webinars, and market analyses to help traders sharpen their skills. Additionally, its commitment to keeping up with technological advancements allows it to provide state-of-the-art trading tools that appeal to a wide array of traders.

👉 Visit Website Exness Official ✅

Why Choose Exness?

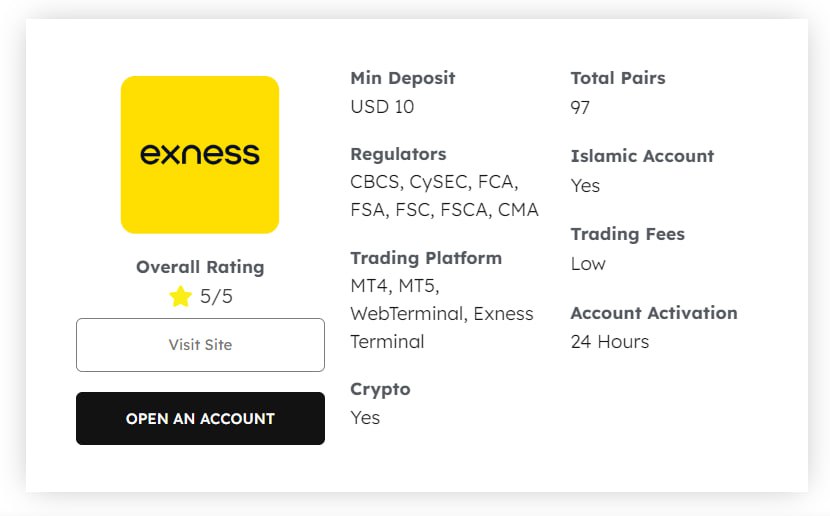

Traders often choose Exness due to its extensive range of offerings, including multiple account types, various trading instruments, and advanced trading platforms. It also boasts competitive spreads, high leverage options, and efficient deposit and withdrawal methods. These factors, coupled with its strong regulatory framework, make Exness a compelling choice for Indian traders seeking a reliable partner in their trading journey.

Ultimately, understanding how Exness works in India is essential for anyone looking to engage with the platform effectively. By leveraging the advantages that Exness provides, traders can enhance their trading experience and capitalize on market opportunities.

Understanding Exness's Regulatory Compliance in India

Regulatory compliance is a critical aspect for any broker, especially when operating in diverse international markets like India. Exness is known for its strong adherence to regulations, ensuring that its operations are transparent and ethical.

Licensing and Regulation

Exness is regulated by multiple financial authorities around the world, which helps build trust among traders. While it does not hold a specific license from the Securities and Exchange Board of India (SEBI), it complies with international regulations, which assures traders of a safe trading environment.

The company is licensed in jurisdictions such as Cyprus (Cyprus Securities and Exchange Commission) and the Seychelles (Seychelles Financial Services Authority). These regulatory frameworks impose stringent standards on brokers concerning client fund segregation, risk management practices, and reporting requirements.

👉 Visit Website Exness Official ✅

Importance of Regulatory Compliance for Indian Traders

For Indian traders, understanding the regulatory landscape is crucial. Even though Exness may not be SEBI-registered, its adherence to international regulations provides a level of safety. It ensures that clients’ funds are safeguarded and handled transparently.

In addition, regulatory compliance protects traders from fraudulent activities and malpractice. When choosing a broker like Exness, it's important to understand how these regulations affect your trading experience and the safeguards in place to protect your investments.

Navigating Challenges with Regulation

While Exness complies with international regulations, Indian traders should remain aware of the challenges posed by local laws regarding forex trading. The Reserve Bank of India (RBI) has specific guidelines and restrictions on forex trading to prevent illegal capital outflow. Thus, it’s essential for traders to stay informed about these regulations to ensure they remain compliant while trading with Exness.

By understanding the regulatory framework surrounding Exness in India, traders can make informed decisions, thereby minimizing risks and maximizing their trading potential.

👉 Visit Website Exness Official ✅

Account Opening and Verification Procedures with Exness in India

Opening an account with Exness is a straightforward process. However, understanding the verification procedures is equally essential to ensure smooth trading experiences.

Step-by-Step Account Registration Process

To begin trading with Exness, Indian traders need to follow a simple registration process. First, you must visit the official Exness website and click on the “Open Account” button. You’ll be prompted to fill in some personal information, including your name, email address, and phone number.

Once the initial form is completed, you'll receive a confirmation email. After confirming your email, you will have access to the Exness client area, where you can complete the registration and select your preferred account type – standard or professional.

Document Verification Requirements

Verification is a crucial step in maintaining security and compliance. To comply with Know Your Customer (KYC) regulations, Exness requires users to submit identification and proof of residency documents. Typically, this includes a government-issued ID (like an Aadhar card or passport) and a recent utility bill or bank statement showing your address.

The verification process is usually swift, taking only a few hours to complete. Once verified, you can start trading immediately, allowing for a smooth transition from registration to actual trading.

Importance of Timely Verification

Timely verification is essential for Indian traders to avoid unnecessary delays in accessing funds or executing trades. If there are discrepancies in the submitted documents or if the verification process is stalled, it can hinder your trading plans. Thus, ensuring that all documentation is accurate and submitted promptly is crucial in avoiding potential hiccups.

Being well-versed in the account opening and verification processes can significantly enhance the trading experience with Exness, allowing Indian traders to focus on what truly matters – trading.

👉 Visit Website Exness Official ✅

Trading Platforms and Tools Offered by Exness to Indian Traders

A robust trading platform is key to a successful trading experience. Exness offers various platforms equipped with advanced tools designed to meet the needs of Indian traders.

MetaTrader 4 and MetaTrader 5

Exness primarily supports two popular trading platforms - MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely recognized in the industry for their user-friendly interfaces, powerful analytical tools, and automated trading capabilities.

MT4 is particularly well-regarded for its extensive charting tools, technical indicators, and expert advisors (EAs). It serves as an ideal platform for both beginner and seasoned traders focusing primarily on forex trading.

On the other hand, MT5 expands on the functionalities of MT4 by offering additional features such as more timeframes, advanced order types, and improved charting capabilities. For Indian traders interested in diversifying into different assets, MT5 presents a broader array of trading instruments.

Mobile Trading Applications

In today’s fast-paced trading environment, mobile accessibility is essential. Exness offers mobile applications compatible with both iOS and Android devices, enabling traders to manage their accounts and execute trades on the go.

The mobile app mirrors the functionality of the desktop platforms while allowing for real-time notifications and price alerts. This feature significantly benefits Indian traders who may need to monitor positions during busy hours or while traveling.

Advanced Analytical Tools and Resources

Beyond the core trading platforms, Exness provides a wealth of analytical tools and resources to enhance trading strategies. From economic calendars and market news to technical analysis and trading signals, these resources enable traders to make informed decisions.

Moreover, Exness regularly hosts webinars and educational content aimed at improving traders' knowledge of the markets. This emphasis on education empowers Indian traders with the insights needed to navigate the complexities of financial markets successfully.

By understanding and utilizing the trading platforms and tools offered by Exness, Indian traders can elevate their trading game and maximize their potential for success.

👉 Visit Website Exness Official ✅

Deposit and Withdrawal Methods Available for Indian Clients

Effective deposit and withdrawal methods are crucial for seamless trading operations. Exness recognizes the importance of offering a variety of payment options for Indian clients to facilitate easy transactions.

Local Payment Methods

Exness provides several local payment methods tailored specifically for Indian traders. Some of the popular options include UPI (Unified Payments Interface), NetBanking, and e-wallets like Paytm and Skrill. These methods are convenient and allow for quick deposits without excessive fees.

Using local payment methods also mitigates currency conversion issues, making it easier for traders to transfer funds without incurring additional costs. The ease of use of these platforms enhances the overall trading experience for Indian clients.

International Payment Options

In addition to local payment methods, Exness supports several international options, including credit and debit cards (Visa and MasterCard), wire transfers, and various e-wallets. These options cater to traders who prefer to use international banking services or require alternative funding methods.

Each option varies in terms of processing times and fees. Credit and debit card deposits are typically instant, while bank transfers may take longer to process. Awareness of these differences helps traders strategize their funding approaches effectively.

Withdrawal Processes and Timeframes

Withdrawal processes with Exness are generally straightforward and user-friendly. Indian traders can withdraw funds using the same methods used for deposits, ensuring consistency across transactions.

Processing times for withdrawals vary depending on the chosen method. E-wallets tend to offer the quickest turnaround, often processing within a few hours, while bank transfers may take a couple of business days. Familiarizing oneself with the withdrawal processes and expected timeframes is essential for effective cash flow management in trading.

Having a robust understanding of the deposit and withdrawal methods available for Indian clients enhances the trading experience with Exness. Traders can efficiently manage their funds and concentrate on their trading strategies with peace of mind.

👉 Visit Website Exness Official ✅

Exness's Spreads, Commissions, and Trading Costs for Indian Markets

Understanding the trading costs associated with any broker is fundamental for the profitability of trading. Exness is known for its competitive pricing structure, which appeals to Indian traders.

Spreads and Commission Structures

Exness primarily operates on a spread-based model, meaning that traders pay the difference between the buying and selling prices of assets. This spread can vary based on market conditions and the account type chosen.

For instance, ECN accounts typically enjoy tighter spreads, benefitting traders engaging in high-frequency trading or scalping strategies. Conversely, Standard accounts may have slightly wider spreads but come with no commission fees, appealing to those who trade less frequently.

Understanding the nuances of spreads based on account types allows Indian traders to select the most cost-effective option suited to their trading style.

Impact of Market Conditions on Trading Costs

Trading costs can be influenced by various factors, including liquidity, volatility, and market hours. During major economic events or announcements, spreads may widen temporarily due to heightened volatility. Being aware of these fluctuations allows traders to strategize accordingly and avoid potential pitfalls during active trading periods.

Additionally, traders should keep an eye on the market sentiment, as shifts in supply and demand can impact how spreads behave in real-time. By staying informed, Indian traders can adapt their tactics to mitigate costs and optimize profits.

👉 Visit Website Exness Official ✅

Overall Cost Analysis for Indian Traders

When considering Exness as a broker, Indian traders should conduct a thorough analysis of the total trading costs involved. This includes not just spreads and commissions, but also potential overnight swap fees, withdrawal fees, and any other related costs. Gaining a holistic view of these expenses is essential for sound financial planning and effective trade execution.

An understanding of Exness’s spreads, commissions, and overall trading costs empowers Indian traders to make informed decisions, enhancing their trading profitability over time.

Leverage and Margin Requirements for Indian Traders on Exness

Leverage is a powerful tool in trading, allowing traders to magnify their positions and potential returns. However, it also comes with inherent risks. Exness provides flexible leverage options suitable for Indian traders, but understanding margin requirements is crucial.

Understanding Leverage Options

Exness offers a variety of leverage ratios, commonly ranging from 1:1 up to 1:2000, depending on the account type and asset traded. High leverage can be advantageous for experienced traders seeking substantial exposure with limited capital.

However, it’s important to recognize that increased leverage also amplifies losses. Therefore, traders must approach it with caution and develop a clear risk management strategy to safeguard their investments.

Margin Requirements Explained

Margin is the amount of equity required to open and maintain leveraged positions. Depending on the asset and leverage employed, Exness stipulates specific margin requirements that must be met to avoid margin calls or forced liquidation.

For instance, when using high leverage, the margin requirement will be lower; however, it requires constant monitoring to ensure that the balance remains above the required threshold.

Risk Management Strategies

To effectively manage risks associated with leverage and margins, Indian traders should consider implementing risk management techniques, such as setting stop-loss orders and adjusting position sizes. Diversifying portfolios can also help mitigate risk by spreading exposure across various assets and reducing reliance on single trades.

By comprehensively understanding leverage, margin requirements, and risk management strategies, Indian traders can navigate the complexities of trading with Exness confidently and responsibly.

👉 Visit Website Exness Official ✅

Security and Risk Management Practices at Exness for Indian Clients

Security is paramount in online trading, especially when dealing with personal and financial information. Exness prioritizes security measures to protect its clients against potential risks.

Regulatory Safeguards and Fund Protection

Exness employs multiple regulatory safeguards to protect client funds. As previously mentioned, it follows strict regulations imposed by reputable authorities and segregates client funds into separate accounts. This means that client deposits remain protected even in the event of company insolvency.

Additionally, Exness offers negative balance protection, ensuring that traders cannot lose more than their invested capital. This practice further instills confidence in Indian traders, knowing they won’t face unexpected liabilities due to market fluctuations.

Robust Data Encryption

To secure clients’ sensitive information, Exness employs advanced encryption technologies. SSL encryption ensures that data transmitted between clients and the broker remains confidential and inaccessible to unauthorized parties.

This level of security is critical in protecting against cyber threats and identity theft, which are increasingly prevalent in the digital finance space. Indian traders should feel reassured knowing that Exness takes their security seriously.

Risk Management Tools

Exness provides several risk management tools that empower traders to control their exposure effectively. Among these tools are stop-loss and take-profit orders, which allow traders to set predefined exit points, minimizing emotional decision-making during volatile market conditions.

Furthermore, Exness promotes the importance of risk management through educational resources and guides, encouraging traders to adopt responsible trading practices.

Ensuring security and implementing effective risk management practices enables Indian traders to engage in online trading with confidence, minimizing potential pitfalls while maximizing opportunities.

👉 Visit Website Exness Official ✅

Customer Support and Resources for Exness Users in India

Exceptional customer support plays a crucial role in enhancing the overall trading experience. Exness is committed to providing timely and responsive assistance to its clients in India.

Multi-Language Support

One of the standout features of Exness is its multi-language support, catering to a diverse clientele. Indian traders can access customer support in English, Hindi, and several other languages, ensuring clear communication and understanding of queries.

This multilingual support is particularly beneficial for new traders who may need assistance navigating the platforms or understanding complex concepts. Providing support in native languages fosters a sense of inclusivity and comfort for Indian clients.

Availability of Customer Support Channels

Exness offers various channels for customer support, including live chat, email, and telephone support. The live chat option is particularly advantageous for immediate assistance, allowing traders to resolve issues swiftly without extended wait times.

Moreover, the availability of 24/7 support works in favor of Indian traders, considering the dynamic nature of global markets. Whether traders have inquiries about account settings, trading conditions, or technical issues, prompt support is always within reach.

Educational Resources and Learning Opportunities

Apart from customer support, Exness invests significantly in educational resources for traders. This includes webinars, articles, tutorial videos, and market analysis, all designed to enhance traders' knowledge and skillsets.

Indian traders, regardless of their experience levels, can benefit from these resources to better understand trading strategies, market dynamics, and risk management practices. Empowering clients through education aligns with Exness’s mission of fostering responsible and informed trading.

By recognizing the value of customer support and educational resources, Indian traders can leverage the assistance provided by Exness to elevate their trading experience and make well-informed decisions.

👉 Visit Website Exness Official ✅

Exness vs. Other Brokers Operating in India: A Comparison

Choosing the right broker can significantly influence trading success. In comparing Exness with other brokers operating in India, it’s essential to analyze various aspects, including trading conditions, fees, user experience, and regulatory standing.

Trading Conditions and Instruments

Exness stands out for its broad range of trading instruments, encompassing forex, stocks, commodities, cryptocurrencies, and indices. This diversity allows traders to diversify their portfolios and capitalize on various market movements.

In comparison, other brokers may limit the range of instruments offered or provide higher spreads and commissions. Analyzing trading conditions is crucial for traders to assess which broker aligns best with their trading strategies and goals.

Fees and Commissions Structure

When evaluating brokers, fee structures play a vital role in determining overall trading costs. Exness is known for its competitive spreads and low or zero commission fees, especially on Standard accounts.

Other brokers may have higher fees or complex commission structures, impacting profitability. Understanding these costs helps traders make informed decisions about which broker provides the best value for their trading needs.

User Experience and Platform Quality

User experience is a critical factor for traders. Exness offers intuitive trading platforms, including MT4 and MT5, known for their reliability and advanced features.

Another broker may present clunky platforms or limited functionality, making trading cumbersome. Assessing the quality of trading platforms is essential for ensuring a smooth and efficient trading experience.

👉 Visit Website Exness Official ✅

Regulatory Standing and Trustworthiness

Finally, the regulatory standing of a broker is paramount. Exness is regulated by authoritative bodies, providing a level of safety and assurance for Indian traders.

Conversely, some brokers may lack sufficient regulation, raising concerns about the safety of client funds. Comparing the regulatory frameworks ensures that traders choose a broker with adequate protections in place.

In conclusion, a thorough comparison of Exness and other brokers operating in India equips traders with the insights needed to choose the right partner for their trading journey.

Conclusion

Navigating the intricacies of online trading in India requires an understanding of various factors, including regulatory compliance, account setup, trading platforms, and customer support. Exness stands out as a trustworthy and comprehensive broker, offering a plethora of tools and resources tailored for Indian traders.

Through its competitive trading conditions, commitment to client security, and dedication to education, Exness equips traders with the knowledge and support necessary for successful trading journeys. By understanding how Exness work in India, traders can make informed decisions and ultimately thrive in the exciting world of financial markets.