16 minute read

How to trade Gold in Exness

Gold trading has been a popular investment strategy for traders and investors alike, especially during times of economic uncertainty. In this article, we will delve into How to trade Gold in Exness, providing you with comprehensive insights and practical tips to successfully navigate the gold trading landscape using this renowned brokerage platform.

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

Understanding Gold Trading with Exness

Gold is often regarded as a safe haven asset, attracting attention from traders who seek stability and potential profits in fluctuating markets. Trading gold involves speculating on its price movements, which can be influenced by a variety of factors such as geopolitical tensions, currency fluctuations, and central bank policies. Exness provides a robust platform for gold trading, offering various instruments and features tailored to meet the needs of traders at all levels.

The Appeal of Gold Trading

Gold is universally recognized as a valuable asset and has a long history of being used as a form of currency and wealth preservation. Its appeal lies not only in its intrinsic value but also in its ability to hedge against inflation and economic downturns. This makes it an attractive option for both short-term and long-term trading strategies.

Traders are drawn to gold for several reasons. Firstly, it typically exhibits lower volatility compared to other commodities or stocks, allowing for more predictable trading outcomes. Additionally, gold’s liquidity ensures that traders can easily enter and exit positions without significant slippage, making it easier to manage trades effectively.

👉 Visit Website Exness Official ✅

How Exness Facilitates Gold Trading

Exness provides a user-friendly trading environment equipped with advanced tools and resources that enhance the trading experience. With competitive spreads on gold pairs, high leverage options, and real-time market data, traders can capitalize on price movements efficiently. Furthermore, Exness supports various trading platforms, including MetaTrader 4 and MetaTrader 5, which allow for seamless execution of trades and access to technical indicators and charting tools.

The brokerage also offers educational resources to help traders understand the nuances of gold trading. From webinars to articles and tutorials, Exness empowers its clients to make informed decisions while navigating the complexities of the gold market.

Opening an Exness Account for Gold Trading

To start trading gold on Exness, the first step is to open an account with the brokerage. This process is simple and straightforward, designed to cater to both novice and experienced traders.

Registration Process

The registration process begins by visiting the Exness website, where potential traders can find the 'Sign Up' button prominently displayed. Completing the registration form requires basic personal details, including name, email address, and phone number. Once registered, users will receive a confirmation email containing a link to verify their account.

After verifying the account, traders must complete the KYC (Know Your Customer) process. This typically involves submitting identification documents such as a passport or driver’s license, along with proof of residence like a utility bill or bank statement. Ensuring that these documents are clear and valid is crucial for a smooth verification process.

Funding Your Account

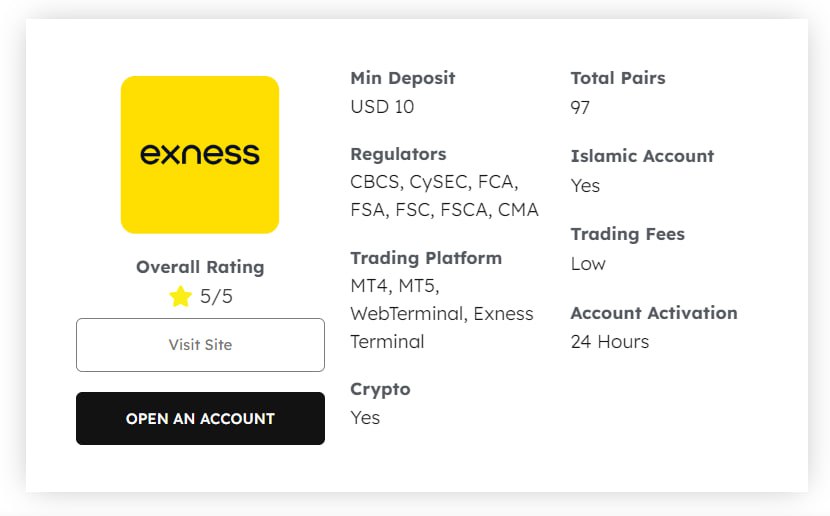

Once the account is verified, traders need to fund their accounts before they can start trading gold. Exness offers a variety of deposit methods, including credit/debit cards, e-wallets, and bank transfers. Each method has its own processing times and fees, so traders should choose one that aligns with their preferences.

It is essential to familiarize oneself with the minimum deposit requirements for the selected account type, as different accounts may have varying thresholds. Traders should also consider the currencies available for trading, as this can impact conversion rates and overall profitability.

👉 Visit Website Exness Official ✅

Setting Up Two-Factor Authentication

For added security, Exness encourages traders to enable two-factor authentication (2FA) on their accounts. This additional layer of protection ensures that even if someone obtains login credentials, they cannot access the account without the second factor, usually a verification code sent to the trader's mobile device.

By taking these initial steps, traders can efficiently set up their Exness accounts and prepare for engaging in the exciting world of gold trading.

Choosing the Right Gold Trading Account Type

When trading gold on Exness, choosing the right account type is vital for maximizing your trading potential. Different account types offer distinct features, trading conditions, and benefits that can significantly impact your trading experience.

Overview of Exness Account Types

Exness offers several account types, each tailored to specific trading styles and preferences. Among them include Standard, Pro, Zero, and ECN accounts. Each account type comes with its characteristics, such as spreads, commissions, and leverage options.

Standard accounts typically suit beginners due to their simplicity and low entry barriers. These accounts often feature fixed spreads and no commissions, making it easy for new traders to get started without feeling overwhelmed by complex trading conditions.

On the other hand, Pro accounts cater to more experienced traders who demand tighter spreads and higher leverage. This flexibility allows for greater profit potential while trading gold, provided that traders can manage their risks effectively.

👉 Visit Website Exness Official ✅

Evaluating Trading Conditions

Before selecting an account type, it’s essential to evaluate the specific trading conditions associated with each option. Consider factors such as:

Spreads: A narrower spread means lower costs when entering and exiting trades. Compare the spreads on gold across different accounts to determine which best meets your strategies.

Leverage: Leverage can amplify profits but also increases risk. Understand the leverage offered with each account type and how it aligns with your risk tolerance.

Commissions: Some accounts charge commissions per trade, while others rely solely on spreads. Factor these costs into your overall trading strategy to ensure profitability.

Assessing Personal Trading Goals

Ultimately, the choice of account type should align with your personal trading goals and strategy. If you are a beginner, starting with a Standard account may provide the necessary experience to build confidence without risking excessive capital. Conversely, seasoned traders looking to implement advanced strategies might benefit more from the features of a Pro or ECN account.

By carefully considering these elements, traders can select the most suitable account type for trading gold on the Exness platform.

👉 Visit Website Exness Official ✅

Navigating the Exness Trading Platform for Gold

Once you have established your account and chosen the right account type, the next step is to familiarize yourself with the Exness trading platform. This platform serves as the primary interface for executing trades, accessing market data, and analyzing charts.

Overview of the Trading Interface

Exness provides multiple trading platforms, including the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer intuitive interfaces that facilitate efficient navigation and trading. Users can customize their layouts, switch between different chart types, and access various tools to enhance their trading experience.

Upon logging in, traders can find different sections dedicated to market analysis, trade execution, and account management. Familiarizing yourself with these areas will ensure that you can quickly respond to market changes and execute trades effectively.

Analyzing Gold Charts

Analyzing price charts is a critical component of successful gold trading. Exness’s trading platforms offer a range of chart types, including line, candle, and bar charts. Each chart type presents data differently, enabling traders to identify trends and potential entry or exit points.

Utilize various time frames when analyzing gold charts. Shorter time frames, such as 15-minute or hourly charts, can reveal short-term trends, while longer time frames, such as daily or weekly charts, provide insights into broader market movements. By assessing price action across different time frames, traders can develop a well-rounded understanding of the market.

Utilizing Technical Tools

Technical indicators can significantly enhance trading decisions. Exness’s platforms come equipped with a selection of built-in indicators, including moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. Traders can apply these tools to identify potential points of support and resistance, trend reversals, and overbought or oversold conditions.

Additionally, drawing tools, such as trend lines, Fibonacci retracements, and channels, can help visualize potential price movements and develop targeted trading strategies. Experiment with different combinations of indicators and tools to find what resonates best with your trading style.

By mastering the Exness trading platform and its features, traders can gain a competitive edge while navigating the dynamic world of gold trading.

👉 Visit Website Exness Official ✅

Essential Technical Analysis for Gold Trading

Technical analysis is a cornerstone of successful trading, particularly in the volatile gold market. By studying historical price data and utilizing various indicators, traders can make informed decisions about potential future price movements.

Understanding Price Patterns

Price patterns often precede significant market moves. Familiarize yourself with common patterns, such as head and shoulders, double tops/bottoms, and triangles. Recognizing these formations can help traders anticipate potential trend reversals or continuation patterns.

For instance, a double top pattern indicates that the price has reached a resistance level twice but failed to break through, suggesting a potential bearish reversal. Conversely, a double bottom signifies that the price has tested a support level twice without breaking below, indicating a possible bullish reversal.

Key Technical Indicators for Gold Trading

Several technical indicators are particularly useful for gold trading. Candlestick patterns, for instance, can provide valuable insight into market sentiment. Bullish patterns, such as engulfing candles, suggest buying pressure, while bearish patterns indicate selling pressure.

Moving averages are another powerful tool for identifying trends. The crossover of short-term and long-term moving averages can signal potential entry and exit points. For example, when a short-term moving average crosses above a long-term moving average, it may signal a bullish trend, prompting traders to consider entering a long position on gold.

Implementing Trading Strategies

Effective trading strategies rely on a combination of indicators, patterns, and market context. Develop a trading plan that incorporates technical analysis while maintaining flexibility to adapt to changing market conditions. Backtesting your strategies on historical data can further refine your approach, identifying which techniques yield the most success in various scenarios.

By employing solid technical analysis within your gold trading strategy, you increase your chances of making informed decisions and maximizing profitability on the Exness platform.

👉 Visit Website Exness Official ✅

Fundamental Analysis and its Impact on Gold Prices

While technical analysis focuses on price patterns, fundamental analysis delves into the underlying factors influencing gold prices. Understanding these factors is crucial for traders seeking to predict gold price movements accurately.

Economic Indicators Affecting Gold Prices

Gold is sensitive to a variety of economic indicators that affect both supply and demand dynamics. Metrics such as inflation rates, interest rates, and employment figures can significantly influence investor sentiment towards gold.

For instance, rising inflation typically prompts investors to flock to gold as a hedge against devaluation of fiat currencies. Conversely, increasing interest rates can lead to a stronger dollar, potentially putting downward pressure on gold prices as holding non-yielding assets becomes less attractive.

Geopolitical Factors

Geopolitical events, such as trade wars, military conflicts, and political instability, can create uncertainty in financial markets, resulting in increased demand for safe-haven assets like gold. Traders must stay informed about global developments that could impact gold prices, keeping an eye on key news releases and geopolitical headlines.

Additionally, central bank policies play a significant role in shaping gold market dynamics. Decisions regarding monetary policy, quantitative easing, and gold reserves can directly influence gold prices. Monitoring central bank statements and actions provides traders with valuable insights into potential price movements.

Sentiment and Market Psychology

Market sentiment can drive price movements independently of fundamental factors. Fear and greed often dictate trader behavior, and these emotions can lead to price bubbles or crashes. By gauging market sentiment through various indicators, such as the Commitment of Traders (COT) report or social media sentiment analysis, traders can better understand prevailing trends and make more informed decisions.

Incorporating fundamental analysis alongside technical analysis equips traders with a comprehensive view of the gold market, enabling them to anticipate shifts in price more effectively.

👉 Visit Website Exness Official ✅

Risk Management Strategies for Gold Trading on Exness

Risk management is a critical aspect of trading, particularly in a market as unpredictable as gold. Employing effective risk management strategies can safeguard your capital and ensure long-term success.

Setting Stop-Loss Orders

One of the fundamental principles of risk management is setting stop-loss orders. A stop-loss order automatically closes a trade when the market reaches a predetermined price, minimizing potential losses. Determining the appropriate stop-loss level is crucial, as it should be based on both technical analysis and your risk tolerance.

Consider placing stop-loss orders beyond key support or resistance levels to prevent premature exits from trades. This approach allows for market fluctuations while still protecting your capital.

Position Sizing

Position sizing refers to determining the amount of capital allocated to each trade. Proper position sizing helps mitigate risk and ensures that no single trade can significantly impact your overall portfolio. A common rule is to risk only a small percentage of your capital on each trade, often around 1-2%.

Calculate position sizes based on your stop-loss distance and account size. By adhering to a disciplined approach to position sizing, you can manage risk effectively and maintain a balanced trading approach.

Diversifying Your Portfolio

Diversification is another key component of risk management. While trading gold, consider incorporating other asset classes such as forex, stocks, or commodities into your portfolio. This diversification can reduce overall risk exposure, as different asset classes often react differently to market events.

By spreading your investments across multiple instruments, you can offset losses in one area with gains in another, creating a more stable overall portfolio.

Implementing robust risk management strategies not only protects your capital but also fosters a disciplined trading mindset, laying the foundation for long-term trading success.

👉 Visit Website Exness Official ✅

Developing a Trading Plan for Gold on the Exness Platform

A well-defined trading plan is essential for navigating the gold market successfully. This plan serves as a roadmap that outlines your trading strategies, risk management practices, and performance evaluation criteria.

Components of a Trading Plan

An effective trading plan includes several critical components:

Trading Goals: Define your objectives clearly, whether they be short-term gains or long-term wealth accumulation. Establish realistic expectations based on your trading style and market conditions.

Entry and Exit Criteria: Specify the conditions under which you will enter and exit trades. This may involve technical indicators, price patterns, or fundamental analysis triggers.

Risk Management Rules: Outline your risk management strategy, including stop-loss placement, position sizing, and diversification approaches.

Performance Evaluation: Regularly assess your trading performance against your goals. This evaluation should include tracking wins, losses, and overall profitability.

👉 Visit Website Exness Official ✅

Continuing Education and Adaptation

The financial markets are constantly evolving, and so should your trading plan. Commit to ongoing education by staying updated on market trends, economic events, and trading techniques. Attend webinars, read articles, and engage with trading communities to continuously improve your skills.

Adapt your trading plan based on lessons learned from past experiences. Embrace flexibility to adjust strategies based on changing market conditions while adhering to your core principles.

Journaling Your Trades

Maintaining a trading journal is an invaluable practice. Documenting each trade—including entry and exit points, reasons for entering the trade, and outcomes—provides insights into your decision-making process. Review your journal regularly to identify patterns in your trading behavior, enabling you to refine your strategies over time.

Developing a comprehensive trading plan empowers you to approach gold trading on the Exness platform with discipline and confidence, increasing your chances of achieving your trading goals.

Common Mistakes to Avoid When Trading Gold with Exness

Even seasoned traders can fall victim to common mistakes that hinder their trading success. Recognizing and avoiding these pitfalls can significantly enhance your gold trading experience.

Overleveraging Your Trades

While leverage can magnify profits, it can also amplify losses. Many traders underestimate the risks associated with high leverage, leading to account wipeouts. It’s essential to use leverage judiciously and maintain position sizes that align with your risk tolerance.

Adopt a cautious approach by limiting leverage during turbulent market conditions. Always prioritize capital preservation over chasing high returns.

Ignoring Market Fundamentals

Over-reliance on technical analysis can lead to neglecting fundamental factors that impact gold prices. Failing to monitor economic indicators, geopolitical events, and central bank policies can result in missed opportunities or unexpected losses.

Strive for a balanced approach that incorporates both technical and fundamental analysis. Staying informed about market drivers enables you to make more informed trading decisions.

Emotional Trading

Emotional decisions can cloud judgment and lead to impulsive actions. Fear and greed are powerful emotions that can cause traders to deviate from their trading plans. Avoid chasing losses or entering trades based solely on hunches.

Establishing a predefined trading plan and adhering to it can help mitigate emotional trading. Practice mindfulness and patience, remembering that trading is a marathon, not a sprint.

By recognizing and steering clear of these common mistakes, traders can foster a disciplined and strategic approach to gold trading on the Exness platform.

👉 Visit Website Exness Official ✅

Successfully Executing Gold Trades on Exness: Tips and Best Practices

Successfully executing gold trades requires a blend of knowledge, skill, and discipline. Here are some practical tips and best practices to enhance your trading experience on Exness.

Stay Informed About Global Events

Global events can dramatically impact gold prices. Stay updated on major news releases, economic reports, and geopolitical developments that can create volatility in the gold market. Utilize economic calendars to track important events and adjust your trading strategies accordingly.

Build a Routine

Establish a consistent trading routine that includes market analysis, strategy review, and performance assessment. Devote time each day to study the gold market and refine your approaches. This consistency helps build discipline and keeps you engaged with the market.

Engage with Other Traders

Participating in trading communities can provide valuable insights and perspectives. Engaging with other traders allows for the exchange of ideas, strategies, and experiences. Whether through forums, social media groups, or trading webinars, collaborating with fellow traders can enhance your knowledge and skills.

Practice Patience and Discipline

Successful trading requires patience and the ability to stick to your plan. Avoid the temptation to chase quick profits, as this often leads to poor decision-making. Focus on executing your strategy consistently, and allow trades to unfold according to your established criteria.

By implementing these tips and best practices, traders can enhance their effectiveness when executing gold trades on the Exness platform, positioning themselves for greater success.

Conclusion

In conclusion, How to trade Gold in Exness entails a comprehensive understanding of the gold market, diligent account setup, and disciplined trading practices. By mastering the intricacies of both technical and fundamental analysis, employing robust risk management strategies, and developing a well-defined trading plan, traders can navigate the challenges of the gold market with confidence.

As you embark on your gold trading journey with Exness, remember to remain adaptable and continually educate yourself. The financial markets are ever-evolving, and commitment to improvement is crucial for long-term success. With dedication, discipline, and a solid strategy, you can harness the opportunities presented by gold trading and work toward achieving your financial goals.