17 minute read

Which Exness account is best

Which Exness Account is Best

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

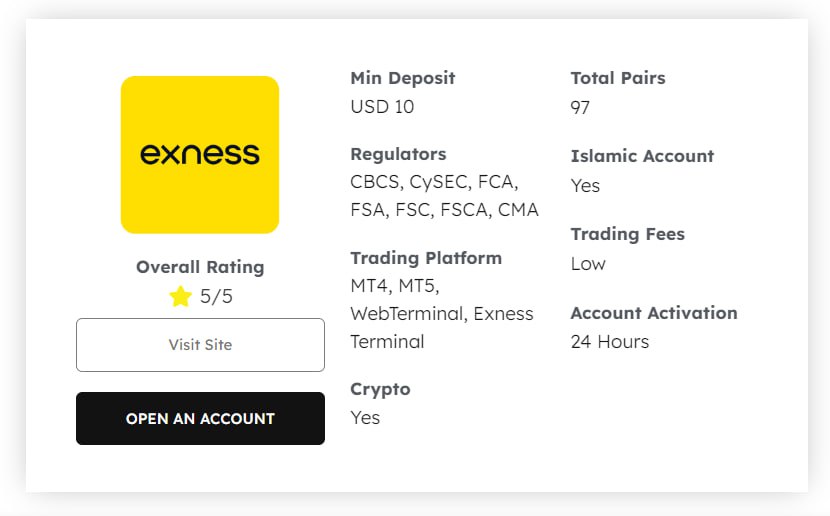

When it comes to trading in the financial markets, selecting the right brokerage account can significantly impact your overall trading experience and success. This is particularly true with Exness, a well-known broker that offers various types of accounts tailored to different needs. In this article, we will comprehensively explore which Exness account is best for you based on your trading style, experience level, and financial goals.

💥 Want to learn about Exness’s trading features, spreads, and reliability? Read our full Exness Broker Reviews now!

Choosing the Right Exness Account: A Comprehensive Guide

Choosing the right account with Exness involves understanding the different types of accounts they offer, your personal trading strategy, and what you aim to achieve as a trader. Exness has built a reputation for being user-friendly and accommodating both beginners and seasoned traders.

In this section, we will delve into the primary factors you should consider while making your decision. It’s crucial to remember that aligning your choice with your financial objectives can lead to a smoother trading journey.

Understanding Your Trading Goals

Before diving into account types, it's essential to clarify your trading goals. Are you looking to trade casually or are you aiming to become a full-time trader? The answer to this question could dramatically affect which Exness account is best for you.

Casual traders might benefit more from accounts with lower spreads and fees, while day traders may require accounts with higher leverage and tighter spreads to maximize profits. By identifying your goals early on, you can save yourself time and effort when it comes to selecting the right account type.

Assessing Risk Tolerance

Another key factor is your risk tolerance. If you're comfortable taking risks and can manage them effectively, you might prefer accounts that offer higher leverage options. On the other hand, if you are cautious and want to minimize losses, a Standard Account may suit you better.

Understanding how much risk you are willing to take not only helps in choosing the account but also influences your trading strategy moving forward.

📌 Choosing a Forex broker is crucial. Don’t miss our honest and updated Review Forex Broker to help you decide wisely.

Evaluating Trading Style

Your trading style—whether it be scalping, day trading, swing trading, or position trading—greatly affects your choice of Exness account. Each account type has its unique features that cater to different styles:

Scalpers often prefer accounts with low spreads and fast execution times.

Day traders may seek accounts that allow quick trades with minimal commissions.

Swing traders might prioritize accounts that offer leverage, allowing them to hold positions longer without needing substantial capital.

Think about how you plan to approach the markets, as this consideration is integral in determining which Exness account is best suited for your objectives.

👉 Visit Website Exness Official ✅

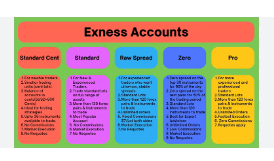

Exness Account Types: A Detailed Comparison

Exness provides several account types designed to meet diverse trading requirements. Understanding these accounts can help you make an informed decision on which one aligns best with your individual needs.

Overview of Available Accounts

Exness primarily offers the following account types:

Standard Account: This account type is suitable for beginners. It offers a straightforward trading experience with competitive spreads and no commissions on trades.

Pro Account: Ideal for more advanced traders, Pro Accounts come with tighter spreads but charge a commission per trade.

Raw Spread Account: As the name suggests, this account provides some of the tightest spreads available, but users must pay a commission on trades.

Zero Account: This account offers zero spreads under certain conditions but also includes a commission for each trade executed.

Understanding the differences between these accounts will allow you to determine which Exness account is best for you.

👉 Visit Website Exness Official ✅

Comparative Analysis of Features

Each account type has its advantages and disadvantages, depending on what you value most in your trading experience. Below are some critical features to compare:

Spreads: The difference between the bid and ask price can greatly influence trading costs. Raw Spread Accounts generally offer the narrowest spreads.

Commissions: Some accounts charge commissions that can eat into your profits. Depending on your trading volume, it may be worth examining whether the lower spread compensates for the added cost.

Leverage Options: Different accounts may offer varying degrees of leverage, allowing traders to magnify their gains (and losses).

Minimum Deposit Requirements: What do you need to fund your account? Some accounts may have higher minimum deposit requirements than others.

By weighing these features against your trading preferences, you can form a comprehensive comparison that goes beyond simply asking which Exness account is best.

Examining Account Accessibility

Finally, consider the accessibility of the accounts. Some accounts might require additional verification or documentation, especially if they're designed for professional traders. Ensure you’re fully aware of the requirements for opening and maintaining each account type, as this plays a significant role in the ease of trading down the line.

👉 Visit Website Exness Official ✅

Standard Account vs. Pro Account: Key Differences and Suitability

When trying to decide which Exness account is best, a common point of contention arises between the Standard Account and the Pro Account. Both serve different trading needs, and understanding their distinctions can guide your decision.

Overview of Standard Accounts

The Standard Account is often viewed as a good entry point for newer traders. Its features include:

No commissions on trades, meaning your cost is solely determined by the spread.

Competitive spreads that allow for reasonable trading costs.

User-friendly interface suitable for beginner traders, enabling them to focus on learning rather than complex account management.

If you are just starting out or don’t execute high volumes of trades, the Standard Account may provide the simplicity and cost-effectiveness you need to develop your skills.

👉 Visit Website Exness Official ✅

Exploring Pro Accounts

On the flip side, Pro Accounts are better suited for experienced traders who demand tighter spreads and are willing to pay a commission for the privilege. Key features include:

Reduced spreads compared to Standard Accounts, allowing for potentially better profitability on each trade.

Commissions that apply to trades, which are justified by the savings in spread costs.

Enhanced trading tools and resources, catering to those with a deeper understanding of market dynamics.

For seasoned traders engaging in high frequencies or larger volumes of trades, the Pro Account can offer significant savings that increase overall profitability.

Making the Right Choice

Ultimately, the choice between a Standard Account and a Pro Account boils down to your trading frequency, skill level, and how you prefer to manage costs. For casual traders who prefer simplicity, the Standard Account may be sufficient. Conversely, for those who trade regularly and are comfortable navigating a more complex trading environment, the Pro Account may yield better results in the long run.

👉 Visit Website Exness Official ✅

Which Exness Account is Best for Beginners?

As a beginner entering the world of trading, you are likely overwhelmed with choices and information. It is crucial to select an account that allows you to learn while minimizing costs.

Benefits of Choosing the Standard Account

For new traders, the Standard Account often stands out as the best choice. Here are several reasons why:

Simplicity: The absence of commissions simplifies the entire trading process. You won’t have to worry about calculating fees per trade, making it easier to focus on learning the market.

Lower Costs: Lower spreads can make trading less intimidating financially. You won’t feel pressured to make a profit on every single trade, allowing for a more relaxed trading experience.

Risk Management: With fewer variables to consider, you can better implement risk management strategies at this stage of your trading career.

Starting with a Standard Account gives you the foundational knowledge and experience necessary to build your trading skills without the stress associated with more complicated accounts.

Learning Resources and Support

Exness also offers a range of educational resources, tutorials, and customer support services specifically aimed at helping beginners navigate their first steps in trading. This aspect further solidifies the Standard Account as a suitable option for novices.

However, it’s important to recognize that as you grow and develop as a trader, you may want to transition to different account types that better reflect your evolving trading style and goals.

👉 Visit Website Exness Official ✅

Decision-Making Factors for Beginners

Before you finalize your account choice, consider the following:

How much capital are you initially willing to invest?

What type of trading strategy appeals to you?

Do you foresee yourself trading frequently or occasionally?

Answering these questions will help you make an informed decision about which Exness account is best for you as a beginner.

Exness Raw Spread Account: Is it Right for You?

As you evaluate different account types, the Exness Raw Spread Account can seem appealing due to its ultra-tight spreads. However, whether this account is right for you depends on various factors.

Understanding the Raw Spread Concept

The Raw Spread Account allows traders to access raw market spreads directly from liquidity providers. While the spreads are significantly narrower, keep in mind that there are commissions involved.

This means that while you may save on spreads, you'll incur costs through commissions that can pile up based on your trading volume.

Who Should Consider a Raw Spread Account?

This account is ideal for:

Day Traders: If you're executing multiple trades daily, the reduced spreads are beneficial as they can add up to significant savings over time.

Scalpers: For traders aiming for small profit margins on numerous trades, having a low-cost structure is essential, making the Raw Spread Account attractive.

Experienced Traders: If you're already knowledgeable about managing costs and understand how to implement effective trading strategies, this account can enhance your trading edge.

However, for retail traders or beginners still familiarizing themselves with the trading environment, the complexities of a Raw Spread Account may be unnecessary and create additional pressure.

Potential Drawbacks of the Raw Spread Account

While the benefits may sound enticing, there are downsides to consider:

Commissions: The introduction of commission charges removes the simplicity found in other account types. You'll need to ensure that your trading strategy can adequately cover these costs.

Complexity: Managing an account with multiple variables requires a deeper understanding of trading mechanisms.

Higher Capital Requirements: Higher trading volumes will typically be necessary to justify the account's structure and derive real benefits from tight spreads.

Ultimately, carefully weighing the pros and cons will guide you toward whether the Exness Raw Spread Account is suitable for your trading ambitions.

👉 Visit Website Exness Official ✅

Exness Zero Account: Advantages and Disadvantages

The Exness Zero Account boasts unique features that attract traders looking for cost-effective trading solutions. However, like any account type, it carries advantages and disadvantages.

Understanding the Zero Account Structure

The Zero Account is designed to offer zero spreads under specific conditions. While this sounds appealing, it’s essential to understand the mechanics:

Even though you may not pay spreads, commissions will apply to your trades. These can vary based on the asset class.

Tighter spreads may only be available during specific periods of optimal market conditions.

This account can be excellent for those who strategize their trades around specific times, but it may not be suitable for everyone.

Evaluating Advantages of the Zero Account

There are several benefits to utilizing the Exness Zero Account:

Cost Efficiency: With zero spreads, you have the opportunity to maximize your profits, especially if you can identify profitable trading moments.

Flexibility: This account is suitable for various trading strategies, including scalping and day trading, due to its cost-effective nature.

Transparent Pricing: Knowing exactly what you will pay in commissions can help you strategize better, minimizing your emotional responses during trading.

Who Can Benefit from a Zero Account?

Traders who are already skilled and have a clear plan for their trading can find the Zero Account advantageous. Those who can time their trades effectively and are committed to actively managing their positions can optimize their potential returns.

👉 Visit Website Exness Official ✅

Weighing the Disadvantages

While the Zero Account offers compelling benefits, it also has drawbacks:

Commission Fees: Losing sight of the fact that commissions exist can lead to unexpected costs if traders do not keep track.

Market Conditions: The advertised zero spreads may not always be available, especially in volatile market conditions. This variability can hinder trading decisions.

Requires Experience: Beginners may struggle to navigate the intricacies of timing trades, making this account less suitable for newcomers.

In summary, while the Exness Zero Account presents intriguing opportunities, it’s essential to weigh its pros and cons carefully against your trading profile and objectives.

Choosing an Exness Account Based on Trading Style and Experience

Your trading style and experience play a pivotal role in determining which Exness account is best suited for your needs. Every trader approaches the market differently, and understanding your unique traits can guide your decision-making process.

Identifying Your Trading Style

Before selecting an account, it is essential to assess your trading style, which may include:

Scalping: If you engage in high-frequency trading, requiring quick entries and exits, accounts offering low spreads and fast execution times would be ideal.

Day Trading: For those who close all positions within a single trading day, you'll benefit from accounts with minimal overnight fees and supportive trading environments.

Swing Trading: If you prefer holding positions for several days or weeks, look for accounts that offer favorable leverage and manageable costs over extended periods.

Position Trading: Long-term investors may need accounts that facilitate lower costs over prolonged periods, emphasizing growth rather than frequent trades.

Evaluating Your Trading Experience

Your previous trading experiences matter significantly. If you possess a strong grasp of market dynamics and advanced trading strategies, you may be inclined to choose accounts that feature tighter spreads and commissions, such as the Pro or Raw Spread Accounts.

Conversely, if you are still gaining confidence and honing your skills, opting for simpler options like the Standard Account can reduce stress and provide a more conducive learning environment.

Aligning with Your Financial Goals

Further, aligning your account choice with your financial goals is essential. If your objective is rapid growth through specialized strategies, accounts that support high volume trading and low costs may align best.

However, if your aim is gradual growth with defined risk management protocols, a more straightforward approach using the Standard Account may be appropriate.

In conclusion, recognizing your trading style and experience will be invaluable in your quest to determine which Exness account is best for your individual needs.

👉 Visit Website Exness Official ✅

Exness Account Funding and Withdrawal Options

Once you've settled on the desired account type, understanding funding and withdrawal options is the next step. This area significantly impacts your trading experience and ability to respond to market changes quickly.

Funding Your Exness Account

Exness supports a variety of methods for funding your account. These include:

Credit/Debit Cards: Popular among traders for their ease of use, card transactions allow for instant deposits but may involve processing fees.

Electronic Payment Systems: Services like Skrill and Neteller permit swift deposits and withdrawals. They often provide additional anonymity and faster processing times compared to traditional banking methods.

Bank Transfers: Although bank transfers may take longer to process, they are considered secure and reliable.

Cryptocurrency Deposits: Some traders prefer to use cryptocurrency for added privacy and security.

Comparing Transaction Times and Fees

Transaction times can vary significantly based on the chosen method. Electronic payment systems generally provide quicker processing times, allowing for immediate trading opportunities. On the other hand, bank transfers may take several days.

Additionally, you should be aware of any fees tied to each method. Being mindful of these costs can ensure you maximize your capital, especially if you frequently deposit and withdraw funds.

Withdrawal Processes

Withdrawing funds from your Exness account can also vary based on the method selected. Most methods used for deposits are also available for withdrawals, providing consistency in your transactions.

Review the following aspects of the withdrawal process:

Processing Times: Withdrawals made via electronic methods tend to process faster than traditional banking methods. Planning your withdrawals accordingly can help you maintain liquidity for trading.

Limits and Fees: Some methods may impose limits on how much you can withdraw at once. Further, be aware that some options may carry fees that could offset your returns.

Choosing the Right Funding Method

To streamline your trading experience, align your funding and withdrawal options with your trading activity. If you trade consistently, consider methods that provide instant transactions. Alternatively, if you operate on longer timelines, bank transfers might offer the reliability you seek.

Ultimately, understanding how to efficiently fund and withdraw from your Exness account can contribute significantly to maximizing your trading potential.

👉 Visit Website Exness Official ✅

Leverage and Margin Requirements: Understanding the Implications

Leverage and margin requirements are crucial components of trading that can greatly impact your experience with Exness accounts. Understanding these concepts is essential for making informed trading decisions.

What is Leverage?

Leverage allows you to control a larger position size than your initial investment. For example, if you have 100:1 leverage, you can control a $10,000 position with only $100.

Advantages of High Leverage

High leverage can amplify profits, enabling traders to achieve significant gains with relatively little capital upfront. This characteristic makes it appealing to both novice and experienced traders looking to maximize their earning potential.

Disadvantages of High Leverage

However, increased leverage brings heightened risks. While profits can multiply, so too can losses. New traders often underestimate this dynamic, leading to substantial financial setbacks.

Understanding Margin Requirements

Margin refers to the amount of equity needed to open and maintain a leveraged position. If your account balance falls below the required margin, you may face a margin call, forcing you to either deposit additional funds or close positions.

Importance of Managing Leverage

Effectively managing leverage is paramount for successful trading. Consider employing risk management techniques, such as setting stop-loss orders and diversifying trades, to safeguard against excessive drawdowns.

Finding the Right Balance Between Risk and Reward

The key takeaway is to strike a balance between potential rewards and manageable risk levels. While high leverage can appear attractive, it necessitates responsible trading practices to mitigate the inherent risks.

Familiarize yourself with the leverage options available across different Exness account types, ensuring that your chosen account aligns with your risk tolerance and trading strategy.

Optimizing Your Exness Account for Profitability

Once you’ve selected your Exness account type, you’ll want to focus on optimizing your account for maximum profitability. This involves strategic planning and ongoing evaluation of your trading practices.

Setting Realistic Goals

Begin by establishing clear, achievable trading goals. Whether you aim for a specific percentage return or a dollar amount, having measurable targets will give you direction and motivation.

Utilizing Analytical Tools

Employing analytical tools can significantly enhance your trading approach. Platforms like MetaTrader provide a wealth of charting options, indicators, and analytical resources that enable you to analyze market trends effectively.

Continuous Learning and Adaptation

The trading landscape is continually evolving—financial news, economic data releases, and geopolitical events can alter market dynamics rapidly. Stay informed and be ready to adapt your strategy in response to new information and changing conditions.

Implementing a Trading Plan

A solid trading plan serves as a guiding framework for your trading activities. Outline entry and exit strategies, risk management techniques, and criteria for evaluating trades.

Regularly review and refine your trading plan to incorporate your lessons learned and align with current market conditions.

Emphasizing Discipline and Patience

Maintaining discipline and patience is vital. Avoid emotional reactions to short-term market movements, and stick to your plan. Successful trading often entails waiting for the right opportunity rather than constantly chasing after trades.

Conclusion

Determining which Exness account is best for you involves careful consideration of various factors, including your trading style, experience level, financial goals, and preferred trading strategies. Exness offers a variety of account types, each catering to distinct needs and preferences.

By understanding the strengths and weaknesses of each account, assessing your own trading objectives, and implementing strategic practices, you can optimize your trading experience and work toward achieving consistent profitability.

Remember, the journey of trading is one of continuous learning and adaptation. Choose wisely and stay informed as you navigate the ever-evolving landscape of financial markets.

💥 Read more:

Broker Exness Review 2025: Safe, Legit, Legal, a good Forex broker?

EXNESS Bangladesh Review 2025: is safe or scam, real or fake