16 minute read

Vaping

Vape Crusaders

Vaping is big business in Ireland, with 5% of the population using e-cigarettes, up 25% on the previous year.

IT is estimated that 5% of the Irish population use e-cigarettes, an increase from 4% in 2018, according to the Healthy Ireland Survey 2019, funded by the Department of Health. 38% of those who made an attempt to quit smoking over the previous year used an e-cigarette during this attempt, and use of e-cigarettes among ex-smokers rose by 30% over the year. Indeed, use of e-cigarettes among ex-smokers increased to 13% in 2019, up from 10% in 2018. Use of e-cigarettes among nonsmokers remains extremely low, at just 1%, which was the same in 2018.

The Irish Heart Foundation and Irish Cancer Society recently called for a ban on e-cigarette flavours, claiming that certain flavours are aimed at under-18s. However, Vape Business Ireland (VBI) responded by arguing that flavours play an important role for adult smokers looking for a less harmful alternative product. The intention of flavours is to give consumers product choice, and it is not intended for use by those under 18, a VBI statement maintained, arguing that there is no evidence to support the assertion that vaping is “normalising smoking” or that it is a gateway to smoking. “99% of those who vape in Ireland are adult ex-smokers according to the 2019 Healthy Ireland Survey, released by the Department of Health in November,” the statement continued. Indeed, VBI has continually called on the Minister for Health and the Department of Health to bring forward legislation to prohibit sale by, and to, those under the age of 18.

VBI spokesperson Joe Dunne said, “There is no reason why the Minister continues the delay in dealing with this issue. Vape Business Ireland has long campaigned for the legislation what would prohibit the sale by, and to, those under the age of 18. Due to the inaction by the Minister and in the absence of legislative measures to prevent the sale of vaping products to under 18s, VBI developed a Code of Conduct on this matter, which has been signed by all members, to ensure that if in doubt of a customer’s age, the retailer/seller is encouraged to ask for identification. The Code of Conduct covers in-store sales, online sales, as well as the marketing of vaping products.”

It is the view of VBI that vaping products are a product of choice for adults and should never be sold to those under 18. Therefore, marketing and advertising of vaping products should be socially responsible and directed only at adults.

Martin Dockrell, from Public Health England, the UK state agency under the auspices of the Department of Health and Social Care has said, “Banning flavours would likely provoke vapers to relapse back to smoking, leading to more adult smoking role models for young people, which we know is the key driver in young people starting to smoke.”

Vaping was in the news for the wrong reasons during the past year, when an outbreak of lung-disease in the US hit the headlines. However, the United States Centers for Disease Control and Prevention (CDC) identified Vitamin E acetate as the ‘very strong culprit’ for the outbreak of lung-disease. This suggests that the outbreak was

linked to people using illegal liquids, predominantly THC oils, which are illegal black-market marijuana products and they have been ‘cut’ or expanded by the Vitamin E acetate additive. Such products are illegal in Ireland.

In Ireland, vaping products and e-liquids are highly regulated. All products for sale in Ireland are first notified to the HSE, where detailed submissions have to be made in relation to ingredients. There are strict rules on what ingredients can be used, including the maximum nicotine strength of e-liquids and the maximum amount of liquid per bottle, as well as how products are labelled. This acts as a barrier to any products that do not adhere to EU standards entering the Irish market.

Logic Compact The Logic Compact range of e-liquids from JTI Ireland is expanding to include two new flavours, Blueberry and Mixed Berries. From February, your vaping customers will now have even more options to choose from for use with Logic’s newest and smartest device. The two new flavours are available in 6mg and 12mg nicotine strengths and mean that Ireland’s adult vapers can now choose from a total of 10 Logic Compact flavours of different strengths in retail.

The Logic Compact range of e-liquids from JTI Ireland is expanding to include two new flavours, including Blueberry.

Logic’s mission is to make vaping simple for Ireland’s adult vapers, and with Logic Compact, things couldn’t be simpler. The pre-filled e-liquid pods click into place magnetically, meaning there is no re-filling, no mess and no fuss. It really is that simple. This user-friendly approach has clearly worked: Ireland’s vapers have responded by making it one of the leading pod devices on the market since its launch in 2019 (Source: Nielsen YTD Dec 2019), and the launch of Blueberry and Mixed Berries options means there are now two more reasons to choose Logic Compact.

The launch of the new Mixed Berries flavour is another reason to choose Logic Compact.

To optimise vaping’s potential in-store, it is important to know the category and know your customer, educate your staff, merchandise correctly and stay stocked up. JTI’s sales force and customer services team is on hand to provide expert support and advice about Logic Compact, the wider Logic range and the overall vaping category.

You can order Logic products through the JTI Engage web ordering portal, your local JTI trade marketer, by calling JTI customer services on (01) 4045400, or through your local cash and carry.

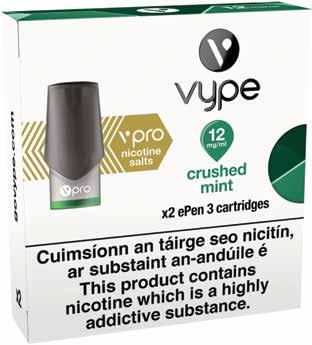

PJ Carroll As one of the world’s largest vapour companies, providing high quality products to more than nine million consumers, PJ Carroll takes its consumer safety responsibilities very seriously. “Here at PJ Carroll, we apply industry-leading product quality and consumer safety standards to all our Vype devices and e-liquids because it is vital that we provide a safe product for adult smokers looking for a potentially reduced risk alternative to smoking,” noted a company spokesperson. “Before we put our products out onto the market Vype from PJ Carroll, one of the leading vaping brands on the Irish market.

and let consumers use them, we must be assured that they’re up to our standards of quality.”

Quality and safety testing are a crucial part of the way PJ Carroll develops and manufactures its products and the company has a team of over 50 toxicologists around the world who are responsible for scrutinising the ingredients in these products. So, for example, when they are developing e-liquids, they make sure that the nicotine, vegetable glycerol and propylene glycol going in are pharmaceutical quality.

The company’s global R&D centre, based in Southampton, has over 1,500 scientists and world-class lab facilities, and is focused on the development of innovative alternatives to smoking, particularly vaping products.

All Vype products are tightly regulated, comply with Irish and EU laws, and all ingredients are notified to the HSE.

Oils containing THC are not, and have never been, added to Vype products. The flavours of the e-liquids must be food-grade flavours. Eating and inhaling are fundamentally not the same, so PJ Carroll has developed a set of criteria by which the company screens each ingredient that goes into its flavours, to make sure they’re up to standard.

“At the end of the day it’s a stewardship, or duty-of-care, process. We also make sure we understand if there are any changes when it's heated,” the spokesperson explained.

As found by the Department of Health’s own annual Healthy Ireland Survey 2019, 99% of vapers are ex or current smokers. The same survey in 2018 found that 41% of those smokers who quit used vaping to do so, highlighting the significant role that vaping plays in helping smokers move away from tobacco. PJ Carroll is committed to providing consumers with a range of high-quality products so that Irish adult consumers have access

PJ Carroll is committed to providing consumers with a range of high-quality products so that Irish adult consumers have access to, and awareness of, a wide range of potentially reduced risk alternatives to conventional tobacco products. to, and awareness of, a wide range of potentially reduced risk alternatives to conventional tobacco products.

“We encourage our customers to only use the product as intended, not to tamper with it, not to use any substances which are not meant for vaping, and to only buy vaping devices and e-liquids from trusted retailers,” concluded the PJ Carroll spokesperson. Juul Labs Juul Labs, the leading start-up in vaping technology in the United States, has continued its rapid Irish growth as it announced a new partnership with BWG Foods, which will see Juul products sold in Spar, EuroSpar, Mace, Londis, and XL stores across the country.

“We are delighted to be working with BWG Foods as we continue our Irish expansion and this partnership highlights the growing demand there is for our products

nationwide,” said Gareth Smyth, General Manager of Juul Labs Ireland. “Our aim is to be available in as many outlets that sell cigarettes as possible – as long as they adhere to our ‘Challenge 25’ policy – in order to offer adult smokers an alternative to traditional cigarettes. Furthermore, we fully support the introduction of legislation to prevent the sale of e-cigarettes to under-18s, which we have been campaigning for since we launched in Ireland in May 2019.”

Juul Labs welcomes and fully supports the proposed Public Health (Tobacco Products and Nicotine Inhaling Products) Bill which will prohibit the sale of e-cigarettes to under-18s. Juul products are only for adult smokers looking to move away from cigarettes and no non-nicotine users, Pictured are (l-r): Alan Peyton, Director of Sales, Juul Labs Ireland, and Gareth Smyth, General Manager, Juul Labs Ireland.

most especially youth, should ever try Juul. Globally, Juul Labs has taken the most stringent actions of anyone in the industry to proactively prevent any potential underage use.

Juul Labs’ Irish operations are underpinned by its industry-leading code of practice, going above and beyond to ensure responsible and restrictive advertising, marketing and age-gated product access. All retail partners must comply with Juul Labs’ ‘Challenge 25’ policy, whereby any customer who looks under the age of 25 must produce ID to prove they are over the age of 18, and retailers will be regularly monitored through an auditing programme to ensure adherence, or they will be excluded as Juul stockists.

Juul is a simple, intuitive system requiring no buttons, leads or wires. The functional design helps smokers to switch from combustible tobacco, while the limited range of flavours assist in the switch by including flavours that move away from the tastes of traditional cigarettes. Irish smokers can now purchase a full range of Juul products, including a starter kit, device kit and six Juul Pod flavours: Alpine Berry, Apple Orchard, Golden Tobacco, Glacier Mint, Mango Nectar and Royal Crème.

50 SCIENTISTS, 1000s OF HOURS OF TESTING BEFORE IT REACHES YOU

ORDER NOW ON: B2B.PJCARROLL.IE

Designed for adult smokers. Not for sale to minors.

NOT FOR SALE TO MINORS: This is an age-restricted product and age veri cation is required at sale. JUUL is an e-cigarette. Learn more at JUUL.ie TM and © 2020 JUUL Labs, Inc. All rights reserved.

The alternative for adult smokers.

No smoke No ash No tar

What will the ’20s bring?

Steve Gotham, MCA & HIM Market Insight Director, examines the potential implications of five major trends on the grocery store over the next decade.

GIVEN that we are at the start of a whole new decade, it’s a good time to consider the trends that will shape the decade ahead in grocery retailing. Foodservice delivery, sustainability, healthier eating, the growth of discounters and plantbased eating are not new trends, but their trajectory cannot be ignored. How will these trends evolve in the 2020s? What impact will they have on grocery retail?

1. Supermarkets will target takeaway The leading supermarket chains are already offering online ordering and delivery. Many already have cafés, restaurants and hot food counters. We expect the foodservice delivery market to continue growing strongly over the next three years.

A coming together with existing and possibly new delivery specialists, either via strategic partnerships or acquisitions, appears a natural fit and one that could serve to form an ‘extended life intermediary service’ to help fulfil a wider spectrum of food & beverage requirements of busy householders. It is also not too much of a leap for this to potentially encompass some form of dark kitchen/virtual brands too as supermarkets look to reconfigure excess, under-utilised superstore space.

2. Meat-free will be the default option The relentless rise of growing consumer responsibility around more personal health, animal and planetary welfare will catalyse further growth in meat-reduction dietary preferences. Vegetarianism and veganism will potentially become sufficiently popular normal practices that a tipping point will be reached whereby the tables are turned and meat dishes will be the versions consumers have to ‘opt-in’ for. This is clearly evident within the Irish market, with the likes of the Happy Pear brothers growing in popularity; they originally ran a small, vegan focused café but now have supermarket ready to go ranges, cook books, and a café in the airport). Another success is the proliferation of operators like Sprout (healthy salad bars), who are growing Steve Gotham, MCA & HIM Market Insight Director.

in outlet numbers, with seasonality as a selling point. While it will be long time before meat-free is the default option, this is the direction of travel.

The implications for the farming

industry will clearly be immense, but the strong likelihood is that meat consumption will decrease, and will migrate towards lower quantity, but higher quality, more premiumised product with even higher provenance and sustainability credentials. The MCA Menu & Food Trends Report 2019 identifies provenance as a real opportunity, with 29% of consumers agreeing that operators should put a greater focus on locally sourced products.

In addition, product quality is growing in importance to consumers, particularly within convenience. The HIM Convenience Market Report 2019 shows that quality of fresh meat and fish, quality of fresh fruit and veg and quality of fresh bread and bakery were the three store KPIs that returned the highest annual increases in importance. Unfortunately for convenience, they were also the three that saw the largest decreases in customer satisfaction – highlighting a potential threat to the sector moving forward.

The sheer volume of plant-based and vegan NPD hitting the sector is gathering pace, and will need skilful demand assessment and shelf-space management. Certainly, demand will be stronger in catchments with higher proportions of younger adults, as opposed to those with a far more elderly skew.

3. Arrival of targeted health specialist products and services Thinking about how healthier eating is going to evolve, a logical next step is with more personalised and prescriptive food & beverage intake. Refill stations in stores are becoming more and more common and provide shoppers the opportunity to purchase products and quantities that are tailored to their needs. The HIM Future of Convenience Report 2020 indicates that 63% of shoppers think refill stations should be available within grocery stores. In many ways, this will be a second coming of ‘functional foods’, but with improved timing through more engaged and better-informed consumer audiences. Younger customers will be more knowledgeable via more widely accessible nutritional and allergy-related information and because of greater understanding of the advantages and disadvantages of plant-based diets. The HIM Convenience Market Report 2019 highlights that 45% of consumers are already actively trying to make healthier choices when it comes to diet.

In addition, scientific advances will open-up more prescriptive benefits for more niche consumer segments with specific conditions, along with targeted advantages for older consumers. Food and drink products specifically developed to improve energy levels, sleep quality, gut health, mental functionality and mobility, and to provide pain relief, will all become more popular. New product categories will emerge in supermarkets, and there will be growing numbers of dedicated health food shops and of more specialised cafés.

4. Discounter expansion drives further grocery consolidation and diversification Over the past decade, one of the most seismic events within grocery retailing has been the rise of the discounters. After significant physical expansion, Aldi and Lidl now have a combined grocery market share of 22.2% (Kantar, 12 weeks to December 29, 2019), which is far higher than in the UK. Certainly a 20%+ share in the UK would have major implications for UK grocers – and hence they have to look at other revenue growth sources.

Growing discounter penetration will inevitably further impact sales growth and profit margins at the supermarket giants. In addition, this will mean the attractiveness of diversification outside of core grocery retailing will increase further. Strategy departments will be busy running (and re-running) their slide rules over opportunities in non-food, wholesaling, delivery and/or foodservice.

5. Sustainability considerations acquire business critical importance For many, Greta Thunberg is already an early contender to be the person of the decade, and if that sounds a tad premature, it surely is difficult not to agree that in 10 years’ time, more of

us will be more worried about climate change than is currently already the case. Already, we are in the midst of a consumer-led revolution about the use of plastic, and grocery industry stakeholders are having to become increasingly mindful about their environmental impacts to not only avoid a consumer backlash, but also to better position themselves to capitalise on the gathering momentum behind more responsible consumerism. The HIM Future of Convenience Report 2020 highlights that 65% of shoppers think plastic free aisles make a store more appealing.

The 2020s will increasingly see consumers demand values alongside value, meaning that sustainability will increasingly guide business decision-making as companies look to reaffirm their various commitments to the environment, community and to investors. Sustainability audits and reporting will become more commonplace, and more operators will ensure they are not left behind regarding best practices. This is an international/ global imperative and one that would be suicidal for businesses to ignore.

Summary In summary, distilling grocery market predictions into a short-list of just five key developments is inevitably open to debate. No reference has been made to the consequences of Brexit, new trade deals or possible supply chain disruption. No inclusion either about the prospect of/need for growing internationalisation, to the rise of CBD or of an insect-led revolution. Come what may, the 2020s are not going to be dull and are only likely to see the pace of change accelerating. Dyed in the wool traditionalists need not apply.