8 minute read

News

from July 10, 2014

Language slanted

The city of Sparks is circulating a questionnaire to businesspeople on a possible cannabis medication ordinance, but it likely was not drafted by professionals in the opinion survey field.

Advertisement

Instead of neutral language to describe its purpose, such as “to determine what impact the proposed regulations will have on your business,” it actually reads “to determine whether the proposed regulations … will impose a direct and significant economic burden upon your business, or directly restrict the formation, operation or expansion of your business” (emphasis added). This kind of language is normally used to elicit certain responses.

In Researching the Public Opinion Environment/Theories and Methods (Sage Publications. 2000), communications expert Sherry Devereaux Ferguson wrote, “Terms that suggest restraints on freedom or liberty tend to evoke negative responses (e.g., ‘constrain,’ ‘ban,’ ‘restrict,’ ‘control’ or ‘forbid’).”

Language corrected

Nevada Secretary of State Ross Miller has directed county voting officials to use the legal name of the Democratic Party and no other.

“In all applicable election materials that your offices produce, print, and/or publish, please be sure to use the correct reference of ‘DEMOCRATIC PARTY’ and not ‘DEMOCRAT PARTY,’” read a letter from Miller to county clerks in the smaller counties and registrars of voters in Washoe and Clark counties. “We have received some complaints lately and there was a recent article about the incorrect usage of ‘Democrat Party.’ ”

The party is legally incorporated in Nevada as the “Democratic Party of Nevada” (“Election office uses Publican Party tactic,” RN&R, June 26), though its incorporation is currently listed in default.

Republican leaders around the nation use the term “Democrat Party” as a tactic because it grates on the ear and because they dislike the notion of describing the party with a favorable term. Rank and file GOP workers are less enamored of the tactic. During 2008 Republican National Convention platform committee hearings, delegates led by Indiana delegate Jim Bopp insisted on using the party’s proper name in the platform. “We should afford them the respect that they are entitled and call them by their legal name,” said Bopp, and that position prevailed by a vote of the committee.

Some language reference books now define the term “Democrat Party” as an epithet.

Out of left field

Dan Kennedy, a Boston journalism professor who writes criticism of the media, was surprised last week to receive a message from Washoe County Republican legislative candidate Rex Crouch.

“I read how you support the Communist Bill Ayers and even lied in support of the Communist Bill Ayers,” Crouch’s message began. “Why do you support Communism? Yes, if you support Ayers, you support Communism.” The capitalizing is in the original.

After that ice-breaker, Crouch went on to write emotionally about a variety of things, like China, Islam, and use of language. (“I’m nonresponsive to the Liberal hater nouns of Racists, Islamophobe, Homophobe.”)

Kennedy wrote about Ayers a few times, mostly during and right after the 2008 presidential campaign, when Barack Obama’s relationship with the 1960s radical was in the news, and most recently in 2013 when Kennedy corrected a Howie Carr claim that Ayers is a “convicted terrorist.”

Kennedy told us, “For the record, I do not ‘support’ Bill Ayers.”

Crouch is running in Assembly District 27. He defeated Rodney Bloom in the GOP primary and is opposed by Democrat Teresa Benitez-Thompson, who was unopposed in her primary.

—Dennis Myers

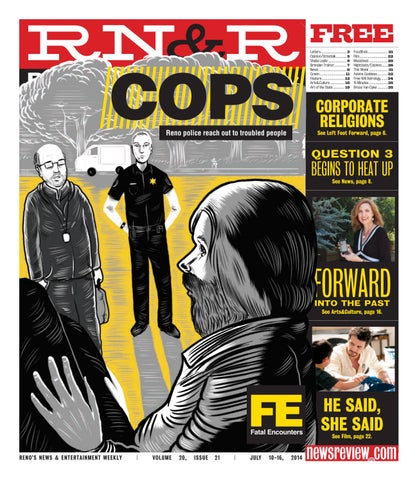

Business owner Alejandro Sabogal speaks with public radio reporter Anh Gray about his support for Question 3 while in the background, other supporters gather on the courthouse steps.

Competing to reform

Legislators ducked making taxes stable, so Question 3 backers try

Credo Technology Group owner Alex Sabogal is not accustomed to public speakby ing. At a rally on the steps of the Dennis Myers Washoe County Courthouse, he nervously fingered the two pages of his text. “We need to act now,” he said. “We as small business owners are helping students on tight budgets, donating computers, supporting whoever wants to learn, and we

Dee Ann Roberts Washoe County teacher

welcome people into our business daily to try to teach the skills, attitude, ethics and integrity that are so important. … Better student performance attracts businesses, better education is better income for households, better education means better health.”

Sabogal spoke at a kickoff last week for Ballot Question 3, an initiative petition intended to get more tax revenue for schools. The petition has been around for months, as signatures were gathered, and it qualified for the ballot. Only now has marketing it directly to the public in a major way begun—though its opponents have been pretty active all along.

One teacher who spoke at the rally, Dee Ann Roberts, tried to impress on the crowd how difficult even the simplest of needs are in schools in a high tech era.

“And let’s talk about pencils,” she said. “It’s hard to believe that this basic resource would be an issue in 21st century classrooms, but it is. What teacher in the last few years hasn’t become frustrated with poor quality pencils that break as soon as the student puts them to paper? There is a constant line at the pencil sharpener, wasting instructional and work time. Sometimes the pencils won’t even sharpen because the lead is actually broken in pieces inside the wood— so we just throw those away and reach for a new one. Wouldn’t it be nice to just have quality pencils in the first place? … Old buildings need to be rewired, teachers need to be trained, and enough technology must exist to be placed in the hands of every child every day. Thirty minutes a week in a lab with old computers to practice math facts is not going to cut it.”

The ballot measure would create a 2 percent tax on gross revenue— each dollar a company takes in. The first million dollars is exempt, but after a company reaches that level, the full amount is subject to taxation, not the amount above the million.

Question 3 is the latest of several efforts over the years by education advocates to draft a tax measure to aid schools. Some businesspeople have faulted previous proposals for various reasons, so this proposal in part sought to respond to those criticisms. But other business figures don’t like this one much better. In an essay in the Reno Gazette-Journal on June 17, corporate accounting executive John Solari wrote that Question 3 “is a direct threat to the reputation and reality of Reno as a small business-friendly city that incubates entrepreneurial growth. It will be a deciding factor for businesses calculating whether to move to Reno. … Nevada business and education leaders need to keep Nevada’s future in mind, go back to the drawing board and create an education funding proposal that is fair and equitable and does not harm Nevada’s economy.”

Alternative sources

One of the questions facing advocates of Question 3 is why they are seeking more tax revenue after a major tax package was approved in 2003. In fact, they are using the same sales pitch used to sell the $800 million tax increase at the 2003 Nevada Legislature. Posters at that legislature read, “MAKE BIG BUSINESS PAY FOR OUR SCHOOLS” over photos of children in school. At the courthouse rally for Question 3 last week, school volunteer and parent Doug Smithson said, “The leaders of this state are incapable of improving the schools of this state because their legislators are deadlocked and hamstrung by politicians who refuse to tax the giant multinational corporations that take advantage of the minimum wage workers that this state’s schools produce.”

But the 2003 tax increase was approved by the legislature. So why is this new tax hike necessary? Progressive Leadership Alliance of Nevada director Bob Fulkerson said the original 2003 proposal was not adopted, that the kind of tax originally recommended at that legislature by Gov. Kenny Guinn was changed before the tax hike was approved. Nevertheless, the tax hike was approved. Does it matter where the money comes from? Fulkerson said another goal of the

petition is to make state taxes less regressive, less reliant on the poor and middle class.

“Well, it does [matter], because right now two-thirds of the state budget comes from sales and gaming taxes,” Fulkerson said. “Because if you recall in 2003 it was not a corporate profits tax or anything like that, it was just a modified business tax. [Gov.] Kenny Guinn wanted a gross receipts tax in 2003. Now the idea is to join 47 other states that have taxes like the ones we propose to make these giant corporations pay.”

He said sales and gambling taxes are “volatile, undependable, narrow,” and have led to substantial injury to state schools in hard times.

It is well known in Nevada that state government has experienced major budget crises during economic downturns in 1981-82, 1990-91, 2001, and beginning in 2007, each time damaging education badly. State legislators have often been urged to create a tax program that is both more stable and less regressive. Such crises will likely continue unless the state’s reliance on those tax sources changes, Question 3 supporters argue.

Another obstacle the backers of Question 3 may face is that their measure will appear on the ballot alongside another measure that will definitely “tax the giant multinational corporations”—specifically, foreign mining corporations. Ballot Question 2 would, if enacted, remove a 19th century mining tax loophole from the Nevada Constitution. Some businesspeople can be expected to argue that Question 2 renders Question 3 unnecessary. Most mining corporations are based out of state or out of the United States. The mining measure was placed on the ballot by the Nevada Legislature.

Other disputes that could dog Question 3 are the question of whether it goes too far—the Nevada AFL/CIO had intended to support a 0.8 percent tax, but bailed out when the Nevada State Education Association went for 2 percent—and whether this type of tax is coming or going. Its advocates say it is used by all but three states, while its critics say it is a type of tax that is dying out in the states. Ω

Alex Sabogal Business owner

Flower child

City worker Stacy Leary tends to the hanging plants on the Sierra Street bridge. The plants line the river throughout the downtown and at their height each summer produce abundant batches of flowers.