9 minute read

NEws

from April 18, 2019

Light touch

Massacre Rim, a federal wildlife study area in northwest Nevada near Vya and Cedarville, California, has been designated a planetary “dark sky sanctuary.” Such designations are made by a private group called the International Dark-Sky Association which works to reduce light pollution. Nomination of the site was made by Friends of Nevada Wilderness, working with the Cedarville office of the U.S. Bureau of Land Management. There are petrogyphs and sage hen in the area.

Advertisement

In an earlier, similar designation in 2005, the Jarbidge Wilderness region in northeast Nevada was designated by Columbia University’s Center for International Earth Science and the Wildlife Conservation Society as one of the places on Earth least disturbed by humankind.

2020 caucus pLan sLated

The Nevada Democratic Party will hold a meeting in Tonopah at the end of the month to seek approval of its new plan for the Nevada presidential caucuses. The meeting will not be teleconferenced, local Democratic officials are being told by the state party, because Tonopah is not a good site for it. However, teleconferencing has been done routinely in the town by health care entities, the state judiciary and legal groups, and others in the last couple of years. Fibre optic upgrades were made in Nye County for just this purpose in late 2016 and early 2017.

In a release by the county’s electric co-op on Jan. 30, 2017, county information tech director Milan Dimic said, “We had many issues with response times before, including delays that were intolerable. The connections were inconsistent and unpredictable. Bandwidth would drop with no warning. Since the fiber was installed, I’ve had zero complaints.”

The caucus plan comes after complaints from participants who want to be heard but don’t want to participate in the traditional caucus process. They just want to vote and go, akin to a primary, and the plan is reported to accommodate them. In addition, the plan is reported to reduce the chance of a candidate gaining votes between the caucuses and the Democratic state convention based on subsequent, post-Nevada events, as Bernie Sanders was able to do in 2016, though his gains did not give him control of the Nevada convention, where national convention delegates are named.

The plan can be read at https://bit.ly/2U5y8j7.

Ward eLections?

Another effort at the Nevada Legislature to bring down the cost of running for municipal office is making progress.

Assembly Bill 282, which would change some city races from citywide to ward elections, has received a recommendation of “amend, and do pass as amended” to the full Assembly.

Businesspeople and particularly builders and developers in Reno prefer citywide elections because they allow more moneyed candidates to prevail more often. Past efforts to retain citywide elections have involved loaded language on a 2012 Reno city ballot measure intended to guarantee a particular result, and a 2017 veto by then-Gov. Brian Sandoval of a change to ward elections.

–Dennis Myers

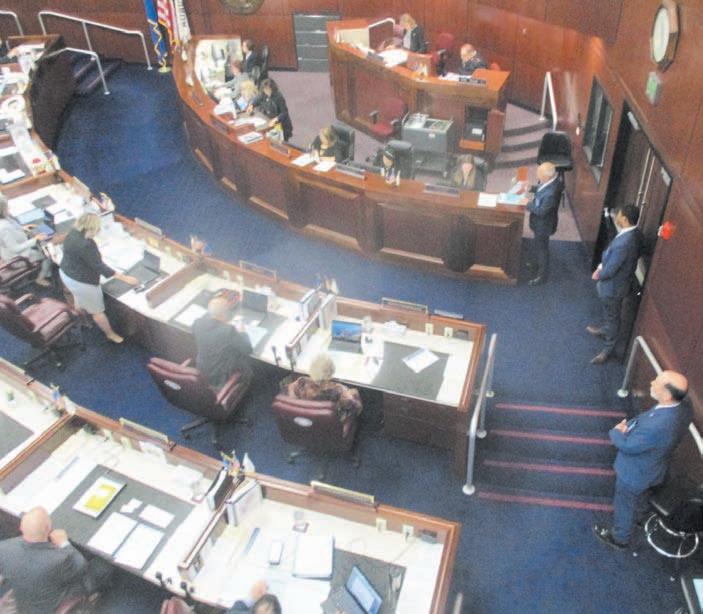

The Nevada Legislature’s action on payday loans is being closely watched.

PHOTO/DENNIS MYERS

Bidding war

Payday loan bills inspire giving

a flood of payday loan money flowed into campaigns in the last election, and it could succeed in stopping changes in Nevada law that would have curbed the high interest loan industry.

Democrats in the 1980 U.S. Congress, in thrall to deregulation, not only repealed federal usury (excessive interest) laws but imposed on the states a repeal of their usury statutes. The states could re-institute them, but many did not. “Financial deregulation (enacted by Democrats in 1980) legalized usurious lending and created a large pool of families (now around 12 million) who can’t afford a bank account and get ripped off by predatory lenders,” wrote economic journalist William Greider in 2008.

Credit card companies, banks and insurance companies were unleashed on the public, and a new “payday loan industry” evolved. As a result, a substantial portion of people in the United States have become trapped in debt, hampering the nation’s economic growth. The Federal Reserve Bank of New York said in February that household debt hit $13.5 trillion on Dec. 31. That was the eighth consecutive quarter that consumer debt hit a new historical high.

A recent audit by the Nevada Financial Institutions Division found that “33 percent of licensed payday lenders received a less-than-satisfactory examination rating annually over the last five years.”

At the Nevada Legislature, there are three bills dealing with the payday loans.

Assembly Bill 118, sponsored by Clark County Democrat Heidi Swank, would have created a 36 percent interest rate cap. This measure died when it failed to clear a deadline for action.

A.B. 360, sponsored by Clark County Democrat Dina Neal, would have moved some lenders into a different section of Nevada statutes to regulate them like traditional installment loan firms. It was supported by Dollar Loan Center. The measure also failed to meet a deadline and died.

Senate Bill 201, sponsored by Clark County Democrat Yvanna Cancela, provides for a database to determine when applicants apply for multiple loans. It would fold into Nevada law some of the protections for military servicepeople in the U.S. Military Lending Act because the Trump administration has stopped enforcing it. This measure is still alive.

In preparation for this legislative session, the industry went to work. • Dollar Loan Center gave $17,000 to 16 candidates. • Advance America gave $37,750 in 47 contributions to candidates and entities like party caucuses. • Check City gave $38,650 in 25 contributions to candidates and one Democratic PAC (Leadership in Nevada). • Security Finance gave $23,000 to 27 candidates.

Cancela’s bill would require the state financial institutions commissioner to develop a database of loans made in Nevada, so loan companies can find out if their applicants already have outstanding loans and may be in over their heads, akin to the way pharmacies can find out through a statewide database when customers have already filled prescriptions at different pharmacies. The payday loan companies seem to badly want not to know that kind of information. State law limits how much of a borrower’s income loans can tie up. Witnesses for Dollar Loan Center have suggested the database could put DLC out of business and them out of jobs.

DLC employee Gloria Diaz: “I was able to assist [her children] in getting an education. … With Dollar Loan Center, I’m able to provide for my family. In the near future, I will find myself taking care of my elderly mother and my disabled brother, and without Dollar Loan Center this will not be possible.”

DLC employee Candace Tracy said she uses Dollar Loan herself: “DLC is a great place to work. … I’m able to provide help to people in need, and it’s ultimately fulfilling to me. … Working at DLC reassures me that my family and I will have our own shot at the American dream. … I should be able to go next week and get something [with a DLC loan]. The database is going to tell me that I can’t. If I have the money to pay it off, and I’ve proven that I can do it, the database shouldn’t stop me.”

But such witnesses did not explain how the database would threaten the business or their jobs. To the contrary, some of them claimed DLC already complies with what the database would require—and their companies are still in business.

Legal services that try to help overburdened low income workers who are in over their heads say the problem is not just multiple loans. It is also “rollovers.”

Legal Aid Center of Southern Nevada attorney Tennille Pereira: “The lenders often say, ‘OK, we’ll write a new loan to pay off that old loan.’”

Bailey Bortolin with the Nevada Coalition of Legal Service Providers said loan customers who are being pursued with collection agency tactics may actually not be a legitimate targets and can be aided.

“They’re reached a desperate situation by the time they’ve gotten [to legal aid],” she said, and then it is discovered that “this loan is not in compliance with Nevada law.” They inform the loan company, which stops harassing the borrower. “I wish that every violation that we see goes into the public record,” she said.

One witness testified against the database not on loan issues but on privacy.

Latin Chamber of Commerce President Peter Guzman: “Databases, intended to help I’m sure, end up being databases of minorities and in particular Latinos. … We are vehemently opposed to the idea of keeping and tracking in the form of a database that will end up being a database full of Latinos. We are adamantly against that. That means this will be a database that has a risk of being hacked. … These names could end up in the hands of people who don’t like immigrants.” He urged larger traditional banks to get into the business of helping small loan applicants.

The measure is in the Senate Commerce and Labor Committee, and its membership shows the way payday loan money permeated the process:

Committee chair Pat Spearman received $1,000 from Dollar Loan Centers (DLC), $250 from Advance America (AA), $500 from Check City (CC) and $500 from Security Finance Corporation (SFC).

Member Marilyn Dondero Loop: $1,000 DLC.

Member Nicole Cannizzaro: $500 AA, $1,000 DLC, $5,250 CC (in two payments), $500 SFC.

Member Chris Brooks: $500 AA, $2,000 DLC (in two payments), $500 SFC.

Member Joseph Hardy: $1,000 DLC.

Member James Settelmeyer $1,000, $750 CC, $1,000 SFC.

Member Heidi Seevers Gansert $1,000 DLC, $1,000 CC.

Some of the pre-election investments were less than prescient. Check City, for instance, gave Committee Chair Spearman—who is in the Democratic majority—$500. But they gave Gansert, least senior member of the committee, who is in the GOP minority, $1,000.

And companies raced to copper their bets after the election, giving money to candidates they’d neglected who won anyway.

Gov. Steve Sisolak, incidentally, would have to sign any legislation approved by the lawmakers. He ranks this way: $2,500 AA, $4,000 (in two payments), $2,500 SFC.

At an election forum during the campaign, Sisolak praised the database proposal.

Former state legislators like Marcus Conklin and William Horne have been hired by the loan companies to lobby for them. Ω

One down, one up

The building that once contained the Silver Club in Sparks has been leveled and now work is underway on another structure—an amphitheatre—to replace it. Marnell Gaming, which owns the Sparks Nugget, is planning to use the site for outdoor concerts and programs associated with downtown special events like Hot August Nights.