9 minute read

NEws

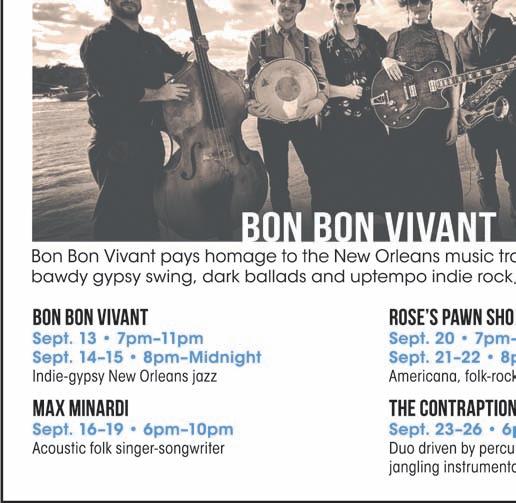

from Sept. 13, 2018

A wider view

Republican candidate for governor Adam Laxalt, in running against the state of California, has given very few reasons for his objections to the Golden State—cherry-picking certain laws to make that state sound silly, though some of those he cites have not actually been enacted there, only proposed. His choices include sanctuary cities, bathroom policies for transgender students, gun control, cancer warnings, and bans on plastic straws in restaurants.

Advertisement

Since he has been so selective, we thought we would add a few of California’s other laws that have been passed this year to put his criticism in some perspective. • After new Trump appointments to the Federal Communications Commission enabled the FCC to repeal net neutrality (a policy that protected consumers from preferential pricing), California re-imposed it within its own jurisdiction. The Nevada Legislature next year will consider a similar measure sponsored by Sen. Nicole Cannizzaro. • The California Legislature this week made it illegal for local governments to use minor municipal infractions to impose large fees for things like legal costs on citizens. News reports brought to light the way some Southern California governments ran up massive legal bills while prosecuting minor code violations and then tried to stick the offender with them. • Last week, California legislators enacted a plan providing for 100 percent of the state’s energy to come from carbon-free sources by 2045. That comes after the state beat a previous benchmark, a 2006 law that imposed targets for reducing greenhouse gas emissions to 1990 levels by 2020. The state achieved it four years early while creating jobs faster than the rest of the nation. • After a lawsuit settlement tried to earmark California’s share of a 2012 national settlement with deceptive mortgage lenders to be used on projects of the litigants’ choosing, the legislature allocated the state portion of the settlement to pay for housing bonds approved by voters. A judge overruled the state, whereupon this week the legislature passed a law overruling the judge. State attorneys general chronically try to go around legislatures, who represent the public, by inserting language in lawsuit settlements that earmarks public funds without accountability to lawmakers. • Golden State lawmakers last month adopted a law to crack down on hospitals dumping patients, “ensur[ing] that certain conditions are met as part of the discharge process of a homeless patient.” In 2013, the Sacramento Bee reported that Nevada hospitals gave 1,500 patients one-way bus tickets out of state—usually to California, the state Laxalt now finds objectionable.

Laxalt, incidentally, put his name to a court brief last year in a California lawsuit filed to keep names of contributors to the Americans for Prosperity Foundation secret. The foundation was set up by corporate polluters Charles and David Koch, who were major contributors to Laxalt’s campaign for attorney general. —Dennis Myers

U.S. Senate candidates Jacky Rosen (left) and Dean Heller are not debating how to save worker pensions under the failing 401(k) systems.

The 401(k) debacle

Worker retirements at risk

“with today being National 401(k) day, I am writing to suggest a story idea for Reno News & Review about why this is a critically underappreciated holiday,” wrote publicist Christa Balingit on Sept. 7 to us and, presumably, hundreds of other media entities. “Consider this: Some 30 million Americans don’t have access to 401(k)s through their employer and even those who do have access are often left mystified by how the whole system works.”

Before you worry that you didn’t have a date on National 401(k) Day, consider this: “Our nation’s system of retirement security is imperiled, headed for a serious train wreck.”

That’s John Bogle, a retired mutual funds exec who was among those who sold the country on the 401(k). He and other 401(k) pioneers say it has failed. Nevada’s congressional candidates don’t talk about this in the campaign.

It’s not that 401(k)s don’t make a good living. Lawyers specializing in suing employers who fail to comply with the requirements to try to get the best deal for workers make a good living.

Before 401(k)s, eight out of 10 employees in companies of a hundred or more workers were enrolled in traditional company plans providing lifetime pensions which professional stock analysts decided how to invest. Back then, employers paid most worker’s pension costs, a gift from the fast-declining labor unions. But under the 401(k) regime, most pension costs have shifted to workers. Little wonder employers gave 401(k)s the hard sell to their workers in the 1980s.

The 401(k) was sold to employees the same way ballot Question 3 is being sold to Nevadans this year—as consumer “choice.” The pitch was, “You can choose your own investments.” Employers did not provide experts to advise workers, many of whom were in the dark. Those with the advantages in life—affluent families, advanced education, high pay—tended to understand investing better and ended up with better results. But those with little experience in financial markets did the best they could and hoped for the best. The results look like the U.S. economy—top heavy. Even some of the people who invented the 401(k) plans are shocked by the dismal, lopsided results. It’s easy to say, as one Forbes columnist has, “What if employees had professional financial planners guide them into allocations that were right for their age and risk tolerance? What if they knew how to diversify properly to avoid the stock debacle of a 2008 or 2000?”

This is a considerable amount to ask of workers for whom survival is the big issue, who in the last 40 years were being squeezed tighter economically every year, who may be working more than one job, whose spouses before the advent of the 401(k) may well have been staying home and raising the children but were eventually forced out into the workplace. A 401(k) study by Boston College said, “[I]ndividuals are on their own, and no one really knows what they will do.”

If workers do have some knowledge about investing, they may discover their company has not met its fiduciary responsibility of trying to get workers the best possible plan. And workers can’t very well take their business across the street to another retirement plan. They are bound to their employer’s plan. And there is a legal limit on how much they can put into their individual retirement accounts.

It’s amazing that anyone ever thought it would work. Workers were expected to take over most costs of pension plans on their same pay. A 401(k) account was, in effect, a pay cut for workers in an era of stagnant wages. And because some plans included an employee match, it was sold as a pay increase.

Today, headlines like “For millions of Americans, the 401(k) is a failure” (CNBC), “Why the 401(k) Isn’t Working” (Fiscal Times) and “Why 401(k)s Have Failed” (Forbes) are common.

So why aren’t the politicians talking about it? In Nevada’s U.S. Senate race, the silence is loud. We have been unable to find any public statements Democrat Jacky Rosen has made on the topic, and when we asked for one, her press aide said we could attribute it only to the aide, not Rosen: “Congresswoman Rosen supports efforts to help Nevada workers save and plan for retirement. She is a co-sponsor of the Lifetime Income Disclosure Act, bipartisan legislation that would help people better plan for retirement by requiring retirement benefit statements to include a lifetime income disclosure in addition to the standard total amount of savings.”

The act cited is H.R. 2055, introduced in the House 17 months ago. It has not moved an inch in the GOP Congress since then. The measure would require quarterly statements for participants in pension plans. There must also be annual assessments of whether the participant is on track to a good retirement.

Republican Dean Heller, has more of a history on the issue. On March 12, 2014, Heller participated in a hearing on “The state of U.S. retirement security: Can the middle class afford to retire?”

Heller heard financial experts say things like this:

“Workers under-contribute for three main reasons. Either they are not earning enough, which is one of the major problems here we are dealing with. They do not trust 401(k)s and financial markets in general, or they may not have the financial literacy to understand how these plans work or how much to contribute.”

Section 401(k) was slipped into a 1978 tax bill by a congressmember with Kodak and Xerox in his district and was intended to help those corporations shelter profit sharing funds. The section was written by a Kodak lobbyist. The Reagan administration—which disapproved of judges legislating from the bench—legislated by regulation to give the section broader application. Soon thousands of companies, driven by evangelistic mutual fund firms, used it to dump most of their pension costs onto their workers, a step that had a role in the decades-long shrinking of the middle class. Workers had to pay the employer’s share without any additional pay. It became just one more component in the process of redistributing wealth upward.

At one point in the hearing, Heller had this exchange with Robert Hiltonsmith, an economic policy analyst then at Demos, now

at the Economic Policy Institute. Heller: “Mr. Hiltonsmith, do you have a 401(k)?” Hiltonsmith: “I do, indeed. I have two of them.” … Heller: “In your testimony, you talked about reforming or replacing them. Do you want to reform or replace your own 401(k)?” Hiltonsmith: “I spent the last two years doing that at Demos, actually. We had a poor plan, and I think this actually indicates one of the difficulties. … You can Congress never even have the knowledge of portfolio diversification and fees but, through your employer, have intended to little opportunity to change the invent 401(k)s plan your employer selected if it is not good.” In his hearing opening statement, Heller said workers “are still struggling to save for retirement.” Since the hearing, Heller has rarely mentioned 401(k)s and when he does it is in an upbeat manner suggesting he is pitching them. In December, he said of H.R. 1, the Republican tax plan, “This tax bill protects and expands the medical expense deduction for our nation’s most vulnerable, as well as preserves popular retirement savings options such as 401(k)s and individual retirement accounts.” Heller has never introduced legislation to remedy any of the ills he heard about at the hearing. Ω The Boston College report can be read at tinyurl.com/y825l9dh.

Contradiction in terms