5 minute read

HOW, WHY & WHERE TO START INVESTING

from PMG ThinkBook

by PMG Funds

INVESTING

HOW, WHY AND WHERE to Start Investing

Advertisement

With WealthDesign’s John Barber

For the younger generations coming up through the ranks, navigating the investment world for the first time can be overwhelming. WealthDesign’s John Barber shares some of his advice on where to begin, KiwiSaver, averaging into the market and strategising like a dairy farmer.

five-year goals, John encourages his clients to take a picture of them and save it as their phone background.

“Because every time you pick up your phone, you’re actually seeing what you're trying to achieve. If it's important enough to you, that will just chip away at your brain and help you achieve the goals,” he says.

When it comes to investing, John starts with the KiwiSaver concept, then continues educating his young clientele around the power of compounding interest on long-term investments.

“KiwiSaver is a brilliant vehicle for young people to grow wealth over time. But it's a pretty blunt tool in the fact that you've got to hope that the fund manager is doing a good job and you've got very little control of where your money's invested within the tool,” he says.

“If you set a plan with KiwiSaver, you're going to pretty well cover your retirement… if you just stick to the plan.”

Research platforms like Morningstar provides WealthDesign access to performance results of each KiwiSaver fund,

As a young adult, it is hard to know when so they can help people make the right or where to start investing. While it might decisions. For example, a 25-year-old who feel like something you’d do with your plans to use $20,000 of their KiwiSaver funds money in your 40s or 50s, in reality you for a house purchase, shouldn’t invest in a should start as young as possible. growth fund where there’s a possibility of

We’ve enlisted Managing Director John losing 30% in a downturn. Instead, it’s better Barber from independent financial planning to invest in a conservative fund that aligns firm WealthDesign with their goal of to share his general accessing their capital thoughts on the in a short time frame. topic. WealthDesign Beyond KiwiSaver, is a boutique practice It's the diversity that John says to first save offering wealth three months’ worth management services you're looking for when of wages to build a to clients across “cash buffer.” Because New Zealand, from you're building a strategy without something investment planning to to fall back on, your mortgage broking. for long-term investing. investments will take

“We have a number of a hit if you ever need third-generation clients the cash quickly and in a provincial (aka liquidity). town like Palmerston For example, the North, you don't get to young married couple do that unless you are good at what you do,” with kids and no cash savings will hurt if John says. one of them gets made redundant. They’d

For new clients, they first look at what their have to look to sell any investments and only goals are before setting up a plan to achieve get 60 or 70% of their capital back if there’s them. After writing down one-, three- and a recession.

Investing then for young generations is about learning first hand, getting the right advice, and having liquidity, according to John.

“I tend to like buying shares in New Zealand and Australian markets that you directly own, in your own name, rather than giving it to a managed fund, because it actually teaches you about investing over time,” he says.

Rather than trying to pick the peaks and troughs, instead average into the market and have dividends reinvested. Monitor them yourself so you’re in tune with your money. It’s all about making the money you save work harder and faster for you, in order to achieve financial goals, like buying a house.

The consensus in New Zealand is to buy rental property (and more debt) to grow wealth, but that isn’t always the answer according to John.

“The biggest barrier we find for younger people wanting to save, is they want to borrow money and buy houses. Kiwis still have a love of rental properties,” John says, “despite the disincentives. There’s the five-year bright line tax test, where investors must pay capital gains tax on any profit. Also the market is now more difficult to break into than it was for previous generations.”

That’s where unlisted property (like PMG) and listed property (on the New Zealand stock exchange) offers greater opportunity.

“Listed property stock can trade higher than their net tangible asset (the assets of the company). Unlisted property stocks sell at their net tangible asset value, therefore, by having them as part of your portfolio you’ll reduce your overall risk. Having both unlisted and listed property stocks work together nicely for you.”

Commercial property has been said to have an old boys’ club mentality. John says that historically it was most likely because you could only buy into it if you had half the capital, and “it wasn’t seen as sexy.” But that isn’t the case with opportunities like PMG’s Generation Fund, where the current minimum investment amount is $1000.

“You're leveraging on guaranteed inflation,” John says of how you can make money in property.

“You're pretty well guaranteed that a commercial building in Hamilton in 10 years’ time would cost more to build than it is [valued] today. So you can't help but make money over time out of commercial building as long as you've got good tenants.”

Content of this article is the opinion of John Barber and is not intended as personalised financial advice. You should seek independent financial advice from an authorised financial advisor before making any investment decisions.

THREE INVESTMENT STRATEGIES from WealthDesign

2

3 1

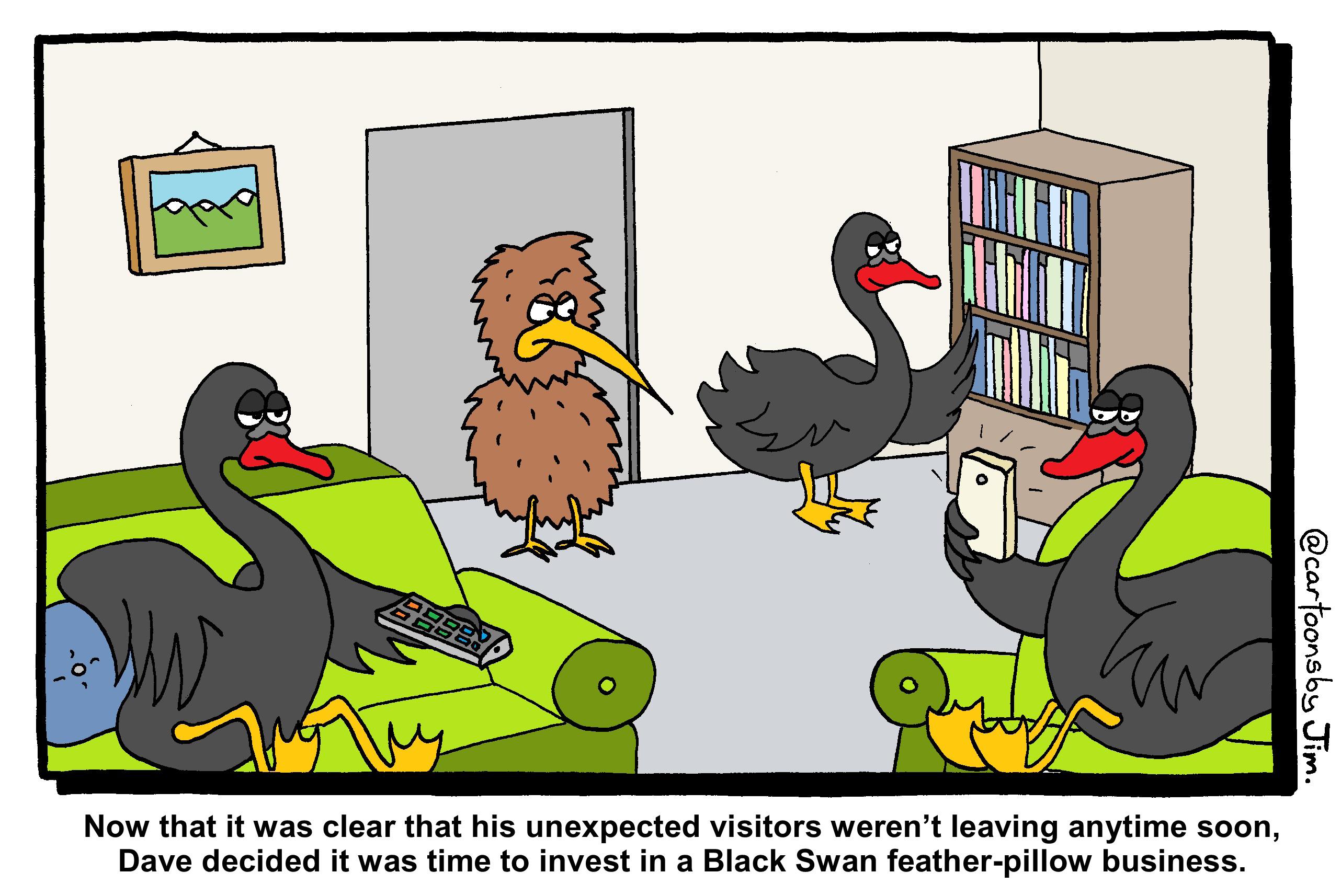

1. THE RACEHORSE OWNER

“The first one is the racehorse owner, and he's the guy who only ever has one investment. If it works, you're a hero. If it doesn't work, it's a disaster.”

2. THE SHEEP FARMER

“Then the second… is the sheep farmer. They buy a sheep to sell to somebody else to make a profit. Now, that is what I call the fund managers. They're trying to buy and sell something to make a margin.”

3. THE DAIRY FARMER

“The third strategy, the one that I always use, is what I call the dairy farmer. You have a range of assets that spit out cash flow and you hold for a long period of time. One of them may not work but the other 99% do; it's the diversity that you're looking for when you're building a strategy for long-term investing.”