ISSUE 193

PUBLISHING

Publisher / General Manager

Jules Kay

Associate Publisher / Head of Brand & Marketing

Richard Allan Aquino

Publishing Assistant / Marketing Relations Manager

Tanattha Saengmorakot

EDITORIAL

Editor

Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Digital Editor

Gynen Kyra Toriano

Editorial Contributors

Liam Aran Barnes, Bill Charles, Steve Finch, George Styllis, Jonathan Evans

CREATIVE & MARKETING

Head of Creative

Ausanee Dejtanasoontorn (Jane)

Senior Graphic Designer

Poramin Leelasatjarana (Min)

Digital Marketing Executive

Anawat Intagosee (Fair)

Senior Manager, Media & Marketing Services

Nate Dacua

Senior Executive, Media & Marketing Services

Piyachanok Raungpaka

Senior Product Lifecycle & Brand Manager

Marco Bagna-Dulyachinda

REGIONAL SALES

Director of Sales

Udomluk Suwan

Head of Regional Sales

Orathai Chirapornchai

Watcharaphon Chaisuk (Australia)

Monika Singh (India, Sri Lanka, and Australia)

Wulan Putri (Indonesia)

Tony Thirayut (Japan)

Kai Lok Kwok (Mainland China, Hong Kong, Macau, and Middle East)

Yiming Li (Mainland China, Hong Kong, and Macau)

June Fong (Malaysia)

Jess Lee (Malaysia)

Priyamani Srimokla (Middle East)

Marylourd Pique (Philippines)

Alicia Loh (Singapore)

Kritchaorn Mueller (Thailand)

Nguyen Tran Minh Quan (Vietnam)

DISTRIBUTION

Distribution Manager

Rattanaphorn Pongprasert

General Enquiries

awards@propertyguru.com

Advertising Enquiries petch@propertyguru.com

Distribution Enquiries ying@propertyguru.com

Property Report by PropertyGuru is published six times a year by

© 2025 by PropertyGuru Pte. Ltd. All rights reserved. No part of this publication may be reproduced without prior permission of the publisher KDN PPS 1662/10/2012 (022863)

EDITOR’S NOTE

It has been another monumental year for real estate across Asia. From the megacities of China to the resort enclaves of Southeast Asia, developers, investors, and policymakers have continued to shape a region in flux— one defined by ambition, innovation, and extraordinary momentum.

Yet as 2026 approaches, that momentum brings with it pressing questions. Chief among them: how to make sure the benefits of progress are shared more widely. Issues of affordability and inclusivity have become central to the industry’s future, with urbanisation and wealth gaps placing renewed pressure on governments and developers alike to ensure that those on the margins are not left behind in the rush towards gleaming new skylines.

In this issue, we turn the spotlight on some of the region’s most significant affordable housing projects—initiatives that demonstrate how smart planning, public-private collaboration, and ESGdriven development can build more equitable cities. We also examine how community-focused design and sustainability principles are helping level playing fields across Asia’s booming property markets.

Elsewhere, we explore The Orchard in Binh Duong, one of Vietnam’s most talked-about new urban developments; sit down with investor and academic Roy Ling to unpack Singapore’s property outlook; and track how markets across South Asia are showing resilience in the face of political and economic headwinds.

Duncan Forgan Property Report duncan@propertyguru.com

Unwrap

You won’t be out of place anywhere with these turn-ofthe-year essentials

Homebuyers are flocking to Binh Duong, where an awardwinning Singaporean developer is making a play for natureadjacent

Former

financier

Alex Bayusaputro builds with quiet confidence, crafting architecture that listens to its surroundings

Neighbourhood Watch: Ortigas Centre

Metro Manila’s second most important CBD after Makati is a thriving hub of malls, offices, residences, and culture

Special feature: Homes with heart

Real estate is no longer seen only as an engine of profit but as a measure of how societies value the people who build them

Destination: South Asia

South Asia’s real estate sectors are stirring back to life, buoyed by reform and renewed investor confidence

Dispatch: Betting against the house

Macau’s residential property market remains stuck on a losing streak, with little sign yet of a policy jackpot

Special feature: Progress, priced right

A new generation of developers is proving that affordability and quality design can build the foundation for a fairer urban future

Dispatch: Oppa limits

Seoul’s luxury housing market is surging again, driven by confidence, scarcity, and global capital 78

Market insights: The great reset

As Southeast Asia’s economies steady post-pandemic, its residential markets are being reshaped by deeper forces

Unwrap holiday joy for you and your kin with these must-have good tidings

POCKET-SIZED CHEER

Make sure your phone stays charged for all your tours this holiday season with the TravelCard Plus. A powerful bank with built-in cables, it weighs just three ounces and can easily fit most wallets like a credit card.

USD52, travelcardcharger.com

DETAILS | Gadgets

POWER LAP

Don’t let your laptop run out of juice. The Anker Prime Power Bank delivers a massive 300W output to charge multiple devices, including MacBooks, at top speed. With airport-friendly 99.75Wh capacity, it’s power you can travel with.

From 169.99, anker.com

PRINTED MATTER

Turn your holiday moments into instant mementos with the HP Sprocket. It prints photos from your phone, thanks to Bluetooth connectivity. A companion app even allows users to edit and personalise the photos before they become tangible keepsakes.

USD89.99, sprocketprinters.com

NO SILENT NIGHT

Cassette tapes are making a comeback, sort of, with the Headphone (1) by Nothing. The phone maker’s first foray into over-ear headphones features a distinct squarelike design, a callback to tapes, and offers superb noise cancellation.

USD299, nothing.tech

JINGLE ALL THE WAY

Give the gift of music anywhere with the JBL Clip 5. Its built-in carabiner clips to a Christmas tree or backpack while its waterproof design and powerful sound ensure the holiday tunes keep blasting.

From USD59.95, jbl.com

HOLLY JOLLY HOSTING

From the dining table to the cosy corners, discover the furniture and wares that will make your holiday gathering unforgettable

HEART OF THE HOUSE

The Aava dining table makes a major style statement this holiday season. The offset, perpendicular legs are instant head-turners while versatile wood finishes bring a sleek, contemporary edge to any holiday setup.

From USD519, wayfair.com

LIGHT AS TWIGS

Terrain’s faux Norway spruce tree, pre-lit with warm micro-LEDs, features hinged branches for a realistic look. Inspired by a real unsheared specimen, it has branches and needles in diverse shapes and instem connections for easy setup.

From USD958.40, shopterrain.com

CHRISTMAS CHEER

Villeroy & Boch is back with its annual limited-run Christmas Edition plate, this time in a charming Polar Express motif. Made of premium porcelain with real gold details, it’s a heartwarming way to serve meals this holiday season.

USD33.99, villeroy-boch.com

SOFT REPOSE

Get everyone in your living room in the mood for Yuletide with Pottery Barn’s Pinecrest pillow. A hand-embroidered touch to armchairs and window seats, this yarn-dyed cotton accent ensures your room looks party-ready and inviting.

From USD22.50, potterybarn.com

SLEIGH IN STYLE

Denver Modern’s Vail dining chair combines an ergonomic, channel-tufted design with premium upholstery options, ranging from genuine leather to boucle fabric. With a black powder-coated steel frame and a wood dowel accent, this handsome creation brings elegance to the table.

From USD746.25, denvermodern.com

POLE TO POLE

From the summery beaches of Australia to the Japan Alps, you won’t be out of place with these turn-of-the-year essentials

ALL-SEEING EYES

The Scott React Amp Pro goggles feature a magnetic, versatile lens system. The transition lens adapts from bright sun to flat light, offering superior contrast and reduced eye fatigue for confident skiing in any condition, from bluebird days to whiteouts.

From USD162, scott-sports.com

DETAILS | Style

PEAK PERFORMANCE

K2’s Reckoner 102 skis are versatile, poppy, and incredibly fun. This twin-tip freeride ski handles everything from groomers to powder, turning the entire mountain into your personal park with its energetic, responsive flex.

USD649.95, evo.com

LIFE’S A BEACH

It’s not always easy to get up from a beach chair. The Shibumi Tall Chair remedies that with a 17-inch-high seat for seamless standing. Its wide frame and breathable mesh back offer the ultimate in waterfront lounging.

USD195, shibumishade.com

WINTER WARRIOR

Get top-tier insulation on the slopes with the Helly Hansen Alpha Lifaloft jacket. It features smart details like underarm vents, a RECCO rescue system, and a special pocket, among many others, to maintain your phone battery in the cold.

From USD480, hellyhansen.com

CHILL ALL DAY

Resembling a doctor’s bag, the All Day Julienne Cooler by Stanley packs serious style and innovative functionality. Made from recycled polyester, it carries a day’s worth of provisions and keeps them cold for hours, sans the leaking.

USD180, stanley1913.com

FRUIT OF THE BOOM

Vietnamese homebuyers are flocking to Binh Duong, where an award-winning Singaporean developer is making a play for nature-adjacent living

BY AL GERARD DE LA CRUZ

RISING LIKE A TREEHOUSE VILLAGE AT THE HEART OF THE ORCHARD, THE CANOPY CLUBHOUSE SHELTERS MORE THAN 20 AMENITIES AND PROVIDES ELEVATED VIEWS OVER THE COMMUNITY

Christmas came early for property seekers in Vietnam as award-winning developer CapitaLand Development (CLD) Vietnam handed over its first project in Binh Duong province.

When homeowners received their keys in August, they entered a gated community painstakingly planned and designed as a self-contained natural habitat.

The project, called The Orchard, is the first completed fruit of Sycamore, an 18.9-hectare, SGD1-billion (USD772 million) master-planned development jointly developed by CLD and United Overseas Australia (UOA).

The Orchard’s rapid success—the subdivision is nearly sold out—is linked to the metamorphosis of Binh Duong. The government plans to merge the once-quiet province with Ho Chi Minh City and Ba Ria-Vung Tau province, forming an unstoppable economic triangle and megacity in southern Vietnam.

Physical links will cement this merger, especially with the Metro Line connecting Binh Duong to central Ho Chi Minh City, set to begin construction in 2027.

“With its dynamic urbanisation, strategic positioning, upcoming infrastructure enhancements, and impending

merger of Ho Chi Minh City, Binh Duong, and Ba Ria-Vung Tau, Binh Duong is poised to evolve into one of Vietnam’s most vibrant economic and residential epicentres, offering exceptional opportunities for both homebuyers and investors alike,” says Tan Wee Hsien, CEO of CapitaLand Development Vietnam and International.

Such conviction prompted CLD’s late-2021 acquisition of the prime site from Becamex IDC, the primary force behind Binh Duong New City. The land deal set the stage for Sycamore and CLD’s ambitious entry into large-scale Vietnamese residential development.

For The Orchard, CLD assembled a dream team that included Singapore’s Formwerkz Architects and Ong & Ong for the architecture, and Thailand’s Land Sculptor Studio for the landscape.

The arrival at The Orchard is a theatrically choreographed sequence from CLD’s design collaborators. Residents pass under freestanding, treetop-inspired canopies at the entrance, leading down a tree-lined boulevard.

This green interlude ends up at the clubhouse, fittingly called The Canopy. A modern take on the treehouse, the clubhouse is designed as a series of elevated structures overlooking a 30-metre lap pool and a naturalistic children’s pool.

THE CLUBHOUSE OFFERS A RESORT-LIKE ESCAPE WITH ITS SERENE, AQUATIC LANDSCAPE OF POOLS AND WATERFALLS, PROVIDING A TRANQUIL SANCTUARY FOR RESIDENTS

Here, the architects blurred indoors and out through extended decks and a natural material palette. Facilities soar across multiple levels, including a basement with a steam room and hot pool; a ground floor with lounges; and upper levels featuring a wine bar, private dining rooms, and open decks for outdoor cooking and yoga.

Heading deeper into the community, themed gardens and water features come into view. The team excavated a meditative pond at The Pier; manicured a multipurpose open lawn at The Island; and cultivated sensory gardens between homes, featuring butterfly-attracting plants, ferns, and rockeries integrated with outdoor fitness stations.

The greenness of The Orchard is less for show than a strand of the project’s technical DNA. The greenery works out to an estimated 80% shade coverage for communal areas, mitigating the urban heat island effect. The entire Sycamore development is designed to achieve EDGE certification through techniques ranging from rainwater harvesting to allocating dedicated bicycle lots.

In many ways, the development is ready for the world of tomorrow. The Orchard introduces several firsts for the area, including a three-tiered security system with QR-code visitor registration and Binh Duong New City’s first electric vehicleready infrastructure. Jogging and cycling paths run for an

impressive 3.5 kilometres, keeping sedentary lifestyles at bay.

“As Vietnam increasingly emphasises sustainable development, new opportunities that play to CLD’s strengths in sustainability have also emerged,” says Jonathan Yap, CEO of CLD.

The homes themselves are in service of nature. The terrace houses’ varied, articulated façades are engineered for efficiency, channelling natural light and cross-breezes to cool interiors passively, while deep overhangs provide shade. This strategy ensures that even the most compact 90-square-metre home feels roomy, a sensation amplified by soaring seven-metre ceilings. The requisite inclusion of a private garden—every home must have a tree—creates tangible links to the Binh Duong biome.

The architects expressed their vision for The Orchard in other typologies. While the terrace houses create a more communal streetscape toward the rear, the semi-detached villas, positioned in the middle rows, are conceived as clusters of seclusion. Their design employs a thoughtful vertical layout: Common living areas unfold on the ground floor, private bedrooms retreat to the second, and a versatile third floor or mezzanine serves as a flexible space for a family room. This ascent culminates in a rooftop terrace, a private respite extending the outdoor space to the skies.

Binh Duong is poised to evolve into one of Vietnam’s most vibrant economic and residential epicentres, offering exceptional opportunities for both homebuyers and investors alike

DEEPENING ROOTS

Few international players have deftly taken advantage of Vietnam’s economic transformations as persistently as Singapore’s CapitaLand Development (CLD). After planting its flag in Vietnam in 1994, it went on a decadelong jaunt of developing serviced residences and commercial projects, steadily grafting itself onto a growing property market.

A milestone came in 2007 with the launch of The Vista in Ho Chi Minh City, marking its formal entry into the residential sector.

In 2024, as it celebrated 30 years of operations in Vietnam, the company announced one of its boldest bets yet: growing its residential portfolio to 27,000 units by 2028.

The figure was impressive, representing a 70% increase from its holding of approximately 16,000 homes. Anchoring this existing portfolio were two colossal projects: the 3,500-unit Sycamore in Binh Duong, home to recently completed project The Orchard, and the 4,000-unit Lumi Hanoi in the capital.

Strong sales have since fuelled CLD’s expansionist vision from north to south. Following the success of The Orchard, CLD last year launched Orchard Hill, Sycamore’s first high-rise component, offering 774 units across two 24-storey towers. The next phase, Orchard Heights, launched in April, achieving 98% bookings on the strength of its duplex offerings.

Such is a bellwether of taste and appetite in a market that embraced the low-rise offerings of The Orchard—and Vietnam’s mushrooming middle class.

“Through decades of efforts, we are heartened to have built strong brand recognition for CapitaLand as a trusted developer of choice in Vietnam, especially known for our top-notch residential offerings of superior quality,” says Jonathan Yap, CEO of CLD, in a statement.

DIVERSE VILLAS AT THE ORCHARD OFFER PERSONAL RETREATS IN A TREELINED SETTING, WITH POCKET GARDENS AND PATHWAYS RIPE FOR DISCOVERY

Rows of single villas, flanking the gateway to the development, command prominent positions and natural vistas. With land areas stretching to over 270 square metres, these residences are designed to be enveloped by nature, each standalone home being hemmed on all sides by yards and gardens.

The significance of The Orchard was manifest at its groundbreaking in February 2024, an event attended by highlevel officials, including Vietnam’s construction minister and the Singaporean consul general in Ho Chi Minh City.

Spurred by the project’s strong sales, CLD is rapidly expanding. Sycamore’s second phase, Orchard Hill, was launched in August last year; the third, Orchard Heights, followed in April. Sycamore, which will ultimately feature over 3,500 homes and is uniquely positioned adjacent to Binh Duong New City’s 75-hectare central public park, is targeting completion by 2027.

“Vietnam continues to be a core market for CLD, where we emphasise innovation, sustainability, and lasting value across every development,” says Tan. “They reflect CLD’s unwavering focus on quality and our vision to create desirable homes and sophisticated lifestyles developed for the increasingly discerning homebuyers in Vietnam.”

Accolades, including the sought-after Best Housing Development title at the PropertyGuru Vietnam Property Awards last year, only stoked buyer interest. Over 90% of residences in The Orchard have been sold.

The sales success of The Orchard is proof of concept for CLD’s wider ambition. The company has set a long-term strategy to expand its residential portfolio in Vietnam to 30,000 homes by 2029. Ronald Tay, former CEO of CLD Vietnam and now head of its Singapore operations, said the awards “will continue to motivate us to deliver high-quality sustainable projects that will make a meaningful impact in the country.”

As Ho Chi Minh City flowers amid Vietnam’s great remapping, The Orchard is beginning to stir with life. From the red earth of Binh Duong, an antidote to urban sprawl is germinating: a firm belief that sustainability and suburbia can coexist.

“We look forward to working closely with the authorities and our partners to contribute meaningfully towards Vietnam’s economic development and urbanisation journey,” says Yap.

SCULPTURAL, TREETOP-INSPIRED CANOPIES FORM THE GATEWAY TO THE ORCHARD, MARKING THE TRANSITION FROM VIETNAM’S URBAN BUSTLE TO A PRIVATE PARADISE

ROY LING’S CAREER SPANS THE TRADING FLOORS OF GLOBAL BANKS TO THE MEASURED CALM OF BOARDROOMS

The Ling Game

He built his name in the breakneck world of high finance. Now, Roy Ling preaches patience, focusing on legacy over short-term returns

BY AL GERARD DE LA CRUZ

LING CHALLENGES STAKEHOLDERS IN SINGAPORE TO THINK BIGGER, ACT RESPONSIBLY, AND AIM HIGHER

The world of global finance thinks in quarters, driven by earnings, exits, and arbitrage. Its native tongue is the language of immediacy.

Roy Ling, a constant in that otherwise fleeting corporate elite, has become fluent in a different dialect: the long term.

The Singapore-based board chair, independent director, and professor is what the business world might call a “value architect,” his career spanning from the trading floors of global banks to the measured calm of boardrooms.

Plucked by Salomon Smith Barney out of the National University of Singapore in the early 2000s, the US-trained chartered financial analyst earned his stripes at Goldman Sachs in Singapore before shuttling between Hong Kong and Tokyo with Lehman Brothers’ elite Global Real Estate Group. The INSEAD Global EMBA graduate also mastered the intricacies of Southeast Asian investment banking at JPMorgan and later served as managing director of RL Capital Management.

The industry took notice early. Publications such as Institutional Investor and Singapore Business Review named him Rising Star and, later, Real Estate Executive of the Year.

“I started my career in investment banking, and those early years taught me to think on my feet, manage complex transactions, and make decisions under pressure,” he

reflects. “There were moments of high stakes and intense learning—from negotiating landmark deals to navigating market volatility—that shaped not only my technical skills but also my appreciation for patience, resilience, and perspective.”

Somewhere between those high-stakes negotiations and bouts of market turbulence, Ling began to see capital not merely as a tool for profit but as a force for building responsible, enduring enterprises.

“Over time, I realised that my experience in capital markets could be leveraged to create a broader impact beyond deals,” he says.

That insight led him toward board directorships, where he now guides listed companies in linking financial performance with long-term governance, environmental, and social principles.

The analytical rigour of banking became the foundation for his stewardship at companies such as VinFast—the electricvehicle maker trading on Nasdaq—and Advanced Systems Automation Ltd., a semiconductor stalwart listed on the Singapore Exchange, where he serves as independent board chair.

He now pays that expertise forward by teaching executive MBA students at institutions including his Singapore alma

PROJECTS THAT INTEGRATE SUSTAINABILITY AND MAKE A MEANINGFUL DIFFERENCE IN COMMUNITIES STAND OUT FOR LING

mater and SKEMA Business School in China. At FollowTrade, the company he founded in 2021, he helps families and friends share and follow each other’s investment journeys, turning trading from a solitary pursuit into a communal one.

There’s another passion he returns to often. Since 2011, Ling has served as a judge for the Singapore series of the PropertyGuru Asia Property Awards, helping identify the city-state’s finest developments. This year, he steps up as chairperson of the programme, influencing the benchmarks for real estate excellence. For him, it’s another kind of boardroom—one where his philosophy of taking the scenic route sets the agenda.

“Reflecting on my journey, I see a common thread,” he says. “Whether in a boardroom, a classroom, or a project site, it’s about building trust, thinking long-term, and creating sustainable value. It’s a perspective I bring to every board I serve on.”

What do you hope to bring to the PropertyGuru Asia Property Awards (Singapore) as its new chair?

As Chair, I see my role as more than overseeing an awards process. It’s about inspiration—raising the bar for what excellence in Singapore real estate truly means. I want to challenge the judging panel to look deeper: to recognise projects that create long-term value, integrate sustainability, and make a meaningful difference in communities.

The Awards should not only honour present achievements but also inspire the future of Singapore’s real estate. By encouraging bold thinking and fresh perspectives, we can highlight projects with future-proof qualities. Ultimately, it’s about challenging all stakeholders—judges, developers, and investors alike—to think bigger, act responsibly, and aim higher.

From your perspective, what qualities distinguish truly outstanding developers and projects in today’s market?

Outstanding developers balance ambition with responsibility. Beyond iconic design and strong sales, they pair vision with environmental and social awareness. They embrace innovation—whether through smart-building technology or sustainable construction materials—to create projects that enrich communities.

How do global macroeconomic trends impact Singapore’s real estate sector?

Global shifts inevitably ripple through Singapore. Rising interest rates may slow transactions, and shifting capital flows may affect liquidity. Yet Singapore’s political stability, good governance, and transparency make it a haven. Increasingly, global capital is seeking sustainable and techenabled projects, positioning Singapore to lead in green finance and smart real estate innovation.

LING SAYS SUSTAINABLE DESIGN SHOULD GO BEYOND AWARDS AND CERTIFICATIONS TO CREATE PROJECTS THAT GENUINELY SERVE COMMUNITIES

How is Singapore’s residential market evolving amid changing buyer demographics and government policies?

The residential market is becoming more diverse and sophisticated. Buyers now seek flexible layouts, integrated amenities, and community-focused spaces while government policies promote sustainable development. Developers who combine lifestyle insight, adaptive design, and responsible practice will set new standards for Singapore homes.

How can developers continue innovating in Singapore’s land-scarce environment?

Land scarcity compels creativity. Innovation now means more than maximising space—it’s about smart design, adaptive reuse, and mixed-use developments that combine living, working, and community spaces. Sustainability is key, with energy-efficient buildings, green spaces, and resourceconscious construction now expected rather than optional.

Logistics and industrial assets are seeing strong demand, driven by e-commerce and regional trade. Residential continues to evolve alongside hybrid office and retail trends. The developers who thrive will combine foresight, agility, and sustainable practices to create value for both investors and communities.

What governance practices should property developers and REITs prioritise today?

Governance is no longer about mere compliance—it’s about credibility, purpose, and trust. Boards should strengthen transparency in capital allocation, embed ESG and climate considerations into strategy, and engage meaningfully with investors, regulators, and communities.

For REITs, this means maintaining capital discipline and prudent leverage. For developers, it’s about responsible land use, innovation, and social impact. Boards that combine financial rigour with sustainability will not only weather uncertainty but also set the benchmark for excellence.

What are the most meaningful ways developers can go beyond “green labels” to achieve true sustainability?

Sustainability goes beyond awards and certifications. It’s about designing projects that reduce environmental impact, enhance liveability, and genuinely serve their communities. Developers should integrate ESG principles and smart technologies from the earliest planning stages. This includes energy efficiency, resilient design, water management, and spaces that foster wellbeing.

LING IS CONFIDENT SINGAPORE WILL CONTINUE TO SERVE AS A TRUSTED GATEWAY FOR GLOBAL INVESTORS ENTERING SOUTHEAST ASIA

Balancing profitability with ESG and community impact isn’t a zero-sum game. Projects that prioritise long-term sustainability attract discerning tenants, boost investor confidence, and mitigate operational risks. Future-proof developments create both commercial success and meaningful community value.

How is the shift toward net-zero carbon influencing project financing and valuations?

Net-zero commitments are reshaping finance. Lenders and investors increasingly reward projects with strong ESG credentials and tech-enabled efficiency through better financing terms and higher valuations. Developers who embrace energy-efficient, resilient design early will attract more capital, meet regulatory demands, and enhance longterm asset value.

Tell us more about your journey from investment banking to education.

I have always enjoyed mentoring the next generation of leaders. Executive education came naturally—it allows me to share my experiences with emerging professionals, helping them navigate complexity, make principled decisions, and understand that leadership is about influence, not authority.

How will digital-finance models like tokenisation and fractional investing integrate with mainstream property investment in Singapore?

Digital finance is democratising access to property investment. Tokenisation and fractional ownership increase liquidity and open new funding channels, though they also bring regulatory and cybersecurity challenges. The opportunity lies in combining innovation with strong governance, ensuring these models complement traditional investment while maintaining trust and stability.

What does the future of Singapore real estate look like?

In the next five years, sustainability, technology, and lifestyle shifts will drive demand. Developers will need to build energy-efficient, digitally connected, and adaptable spaces. Over the next decade, Singapore real estate will be defined by resilience, smart design, and community focus—continuing to serve as a trusted gateway for global investors entering Southeast Asia.

Genius at work

Alex Bayusaputro builds with quiet confidence, crafting architecture that listens to its surroundings and celebrates the spirit of place

BY LIAM ARAN BARNES

When Alex Bayusaputro established Genius Loci in Singapore in 2002, Asia’s cities and the design scene in the Lion City itself were running on adrenaline. Towers climbed higher each year, new districts promised global sophistication, and spectacle had become a measure of success.

Bayusaputro’s response was to slow down and design with a sense of meaning and place.

“It was a time when everyone was looking outward,” he recalls. “But I wanted to build something that looked inward. Something grounded.”

A graduate of New York’s Fashion Institute of Technology, Bayusaputro began his career with Tony Chi & Associates, the New York firm celebrated for its plush, luxury hotel interiors, and Steven J. Leach, one of Asia’s leading multidisciplinary design consultancies. The experience instilled in him a balance of artistry and precision.

“At Tony Chi, I was once asked to spend an entire day in a hotel lobby, just observing how guests moved, paused, and interacted,” he says. “That moment changed how I understood design: it’s not about what we create, but how people inhabit it.”

As such, Genius Loci, Latin for “spirit of place,” was conceived as a practice that listens before it draws. From its earliest commissions, the firm approached architecture as a process of observation and translation, studying materials, light, and movement to express what each site already possessed.

This measured approach soon distinguished Genius Loci from the region’s more rapidly moving studios and laid the foundation for its expansion. From its Singapore base, the firm grew steadily as clients sought design that felt grounded rather than generic. Early hospitality and retail interiors focused on light, circulation, and texture, favouring clarity over embellishment. The result was spaces that encouraged guests to slow down and truly connect with their surroundings.

Offices in Surabaya, Shanghai, Kuala Lumpur, and Chengdu followed, each serving a distinct role within the practice. Surabaya supports fabrication and sourcing across Indonesia, while Shanghai and Chengdu handle larger mixed-use and commercial developments. Kuala Lumpur manages hospitality and residential projects, with Singapore remaining the creative and administrative hub.

“Growth was never the goal,” he says. “It came naturally as clients asked us to bring the same sensitivity to different cities.”

Each new market, he adds, became a way to deepen the firm’s understanding of local context and culture, or what he calls “the living vocabulary of place.”

The firm’s guiding line, “Great Design Makes You Smile,” captures this outlook: design not as a statement, but as experience. Whether creating a café, residence, or hotel, Bayusaputro explains that he aims to design spaces that engage the senses and encourage emotional ease.

A boutique hotel in Yogyakarta exemplifies the approach. The team spent weeks

ALEX BAYUSAPUTRO OF GENIUS LOCI APPROACHES ARCHITECTURE AS A PROCESS OF OBSERVATION AND TRANSLATION

Design has become more collaborative and analytical. That’s healthy. It forces us to prove the value of our ideas

walking neighbourhood streets and studying local crafts to capture the city’s rhythm in material form. Timber screens, clay finishes, and filtered light evoke what he calls “a sense of quiet familiarity, like returning home, even when you’re far away.”

A resort renovation in Bali reinforced those lessons. What began as a structured plan was reworked after the team observed how wind, shadow, and temperature shifted throughout the day. They replaced closed structures with open pavilions and shaded courtyards, creating a sequence of spaces that respond to the site’s natural rhythm.

“Design begins with listening,” Bayusaputro says. “The site always tells you what it needs.”

Awards have brought international recognition, but the studio remained compact.

“We’ve always preferred depth over scale,” he says.

Inside the studio, architects, interior designers, and graphic specialists collaborate from concept to completion, testing ideas through sketches, models, and simulations to maintain a unified vision.

That rhythm underpins the firm’s more recent work. Projects such as a high-rise mixed-use tower in Jakarta and a hospitality development in Singapore explore façades that minimise solar gain. Smaller commissions, from cafés in Surabaya to villas in Seminyak, act as laboratories for detail and proportion, with lessons carried forward into larger schemes.

The firm’s evolution mirrors broader shifts in Asian design. Where early projects once drew heavily on imported aesthetics, today’s

developers expect architecture shaped by local climate and culture. Lifecycle analysis, energy data, and material sourcing have become standard parts of every brief.

“When materials come from nearby, they age more naturally, they’re easier to maintain, and they belong to the landscape,” Bayusaputro says.

Now entering its third decade, Genius Loci remains independent and self-funded, with about 60 staff across six cities. Its client base is evenly split between private owners and corporate developers, many of whom return for successive projects. The firm, meanwhile, continues to focus on Southeast Asia and China while exploring opportunities in Taiwan and the Middle East through established networks.

That regional perspective gives the practice a distinctive position in Asia’s design landscape: large enough to manage complex developments, yet small enough to stay closely involved at every stage. Bayusaputro acknowledges that the industry is moving faster than ever but sees discipline, not disruption, as the real measure of progress.

“Design has become more collaborative and analytical,” he says. “That’s healthy. It forces us to prove the value of our ideas.”

Staying true to its founding ethos, Genius Loci continues to refine a quiet, contextdriven approach. In an era often defined by spectacle, its work endures through restraint, a reminder that attentive design, grounded in place, remains one of architecture’s most enduring expressions.

At Agora Mall, movement defines the design. The floor’s tonal gradients act as visual guides, leading visitors through a continuous field of light and geometry. Overhead, timber ceilings soften daylight and create warmth against the precision of stone finishes below. “We wanted people to feel the rhythm of the city, not escape it,” says Bayusaputro. “Each texture mirrors the energy outside.” Designed to connect rather than overwhelm, the space finds order in motion. Every gradient, line, and surface reflects how people actually move, turning the experience of circulation into a subtle choreography of light, pattern, and material.

Agora Mall, Jakarta, Indonesia

Casa Ducati translates the brand’s engineering precision into spatial form. Built entirely without touching the host structure, the pavilion uses prefabricated frames and Ducati Red panels to create both strength and speed. “We couldn’t rely on the building,” says Bayusaputro. “Everything had to stand on its own, like the machine.” Light tracing along the metal seams enhances the sense of motion, while reflective finishes create depth within a compact footprint. Every component is modular and reusable, designed for assembly, disassembly, and transport, a demonstration of mobility and craft working in unison.

Casa Ducati, Mandalika, Indonesia

With only 10 metres of width, Moie Nest became an exercise in vertical calm. Living spaces revolve around a narrow pool that reflects daylight through the home’s core, bringing light and ventilation to every floor. Bedrooms overlook the water, and a rooftop terrace opens to the city skyline. “Every metre had to perform,” says Bayusaputro. “Light and air became structural elements.” The façade, finished in timber and stone, softens the building’s urban profile while maintaining privacy. Inside, neutral tones and clean geometry promote a sense of calm within a dense neighbourhood.

Moie Nest Residence, Jakarta, Indonesia

Rasa Nya Steamboat, Kuala Lumpur, Malaysia

Rasa Nya reinterprets Malaysia’s Peranakan heritage through a modern lens. Bronze, green fluted glass, and dark timber frame a lantern-lit interior that blends Chinese and Malay influences with contemporary detailing. “We wanted continuity, not nostalgia,” says Bayusaputro. “Heritage should feel relevant, not preserved.” The restaurant’s zoning moves from a bright entrance to intimate dining areas, creating a rhythm between openness and enclosure. Intricate tiles, rattan textures, and patterned glass recall traditional homes while staying deliberately understated. Every layer contributes to a story of connection, a dining space that celebrates community through craft and light.

At Tianyi, the act of cooking defines the architecture. A copper ceiling flows like liquid metal, while a droplet-shaped hood above the fryer becomes the restaurant’s sculptural focal point. The design mirrors the precision of Japanese cuisine: controlled, minimal, and calm. “Tempura is about timing,” says Bayusaputro. “We wanted the space to hold that same sense of transformation.” Soft lighting creates focus on the chef’s counter, while raw materials such as stone and timber offset the warmth of metal. The interior balances theatre and restraint, turning an everyday culinary process into a composed, almost meditative experience.

Tianyi Tempura, Shenzhen, China

Yaki Soul explores fire as both element and idea. Charred timber, red leather, and brass form a palette of warmth and contrast, while pivoting panels open the bar to the street outside. The design draws from the koi’s ascent to dragon form. “Fire destroys and purifies, and that duality guided every choice,” says Bayusaputro. The lighting, inspired by the glow of a grill, animates textures across the interior, creating a sense of movement that shifts with the evening crowd. The space channels the energy of an izakaya without imitation, a confident blend of craft, character, and atmosphere.

Yaki Soul, Kuala Lumpur, Malaysia

Centre of attention

BY JONATHAN EVANS

Ortigas Centre has evolved into Metro Manila’s second most important CBD after Makati, a thriving hub of malls, offices, residences, and culture

The Residences at The Westin Manila

This 56-floor, 344-unit tower is prestige personified. A collaboration between Handel Architects, FBEye International, and CREARIS, The Residences at The Westin Manila by RLC Residences embodies modern luxury through a sleek glass, steel, and wood-accented façade. Tall ceilings and contrasting tones define interiors across spaces for business, leisure, wellness, retail, and dining. Residents also enjoy lounges, a private theatre, a playhouse, a fitness centre, and an indoor lap pool. SKY 51 crowns the tower—a rooftop retreat with panoramic city views. Sustainable touches include LED lighting, a sewage treatment plant, dual-flush toilets, and rainwater harvesting, while pocket gardens, water features, and sculptures lend a calming outdoor aesthetic.

The Residences at The Galleon

This 43-floor, 509-unit showpiece is set for completion in 2028. Designed by Architecture International Ltd, GFP Architects and Associates, and AJ Moldez Landscape and Design, The Galleon by Ortigas Land is a two-tower mixed-use development combining residential, office, and retail spaces. Inspired by the ManilaAcapulco galleon trade, its refined finishes and efficient layouts reflect comfortable modern living. Amenities include a fitness centre, sauna, outdoor pool, landscaped gardens, a mini-theatre, lounge, and games room with a golf simulator. Energy efficiency is prioritised through doubleglazed windows that reduce heat gain, while spire-like tower tops echo traditional ship masts. Inside, porcelain tile floors, balconies, premium kitchens, and rain showers offer a calm, contemporary sanctuary.

San Miguel Corporation (SMC)

Headquartered in Mandaluyong, San Miguel Corporation is synonymous with the Philippines’ most iconic beer. Founded in 1890 as a brewery, it has since expanded into finance, infrastructure, oil, transport, and real estate. Its flagship beer—often mistaken for being Spanish—is now exported to more than 60 countries. The company was named after the suburb where its first brewery stood and was transformed by Pedro Pablo Roxas, who made it the first in Southeast Asia to use modern brewing methods. By 1896, San Miguel Beer outsold imported brands five to one and gained even more popularity after the Philippine Revolution. Today, it thrives under multiple sub-brands and remains a national institution.

Ortigas Centre began in the Spanish era as Hacienda de Mandaloyon, a vast estate owned by the Augustinian Order that spanned what are now Pasig, Quezon City, San Juan, and Mandaluyong. Sold to local luminaries in 1920 and later to American firm Whitaker and Ortigas—whose partners included future president Manuel L. Quezon—the area was once little more than scrubland. By the 1960s, it had begun to modernise, and by the late 1990s, it was an affluent hotspot. Today, this dynamic district of malls, restaurants, condos, and parks draws families and professionals seeking a balance of convenience and community. Among its most notable landmarks are the EDSA Shrine, San Miguel Corporation HQ, SM Megamall, Shangri-La Plaza, and the Asian Development Bank.

4

This small but significant church of the Archdiocese of Manila—officially the National Shrine of Mary, Queen of Peace— stands on the site where two presidents, Ferdinand Marcos and Joseph Estrada, were toppled during the People Power uprisings. Built in 1989, it is designated an Important Cultural Property by the National Commission for Culture and the Arts. Designed by Francisco Mañosa with input from National Artist Leandro Locsin, the structure is a modern interpretation of Filipino tropical architecture. Its focal point, Our Lady of EDSA, Queen of Peace, is a striking statue of the Virgin Mary overlooking the intersection that shaped Philippine democracy.

5

Located in Pasig, this 1,500-seat performing arts venue hosts concerts, plays, and cultural events. Built in 1969 and designed by José María Zaragoza, it forms part of the Meralco (Manila Electric Railroad and Light Company) complex, which also houses adjoining offices. Memorable moments include the graduation of Maria Imelda Josefa “Imee” Marcos-Manotoc, daughter of former President Ferdinand Marcos and sister of current President Bongbong Marcos, who went on to produce the first Philippine animated feature. Over the decades, Meralco Theatre has staged classics such as Pippin, Giselle, Coppélia, Les Sylphides, Don Quixote, The Nutcracker, Cinderella, and Swan Lake, cementing its place as one of Metro Manila’s premier cultural landmarks.

6

Shangri-La Plaza

One of the most upscale shopping malls in Mandaluyong City, Shangri-La Plaza is known for its elegant ambience and array of luxury retail, dining, and entertainment options. Anchored by Rustan’s department store, it also offers cafés, restaurants, and Streetscape, an indoor-outdoor lifestyle zone launched in April as a curated meeting place for discerning diners. Red Carpet, its luxury cinema, features state-of-theart technology, while a direct connection to the adjacent Shangri-La Manila hotel adds to the convenience. Since opening in 1991, the mall has been a key community hub, hosting the annual Fête de la Musique festival and wellness events such as the Stride Walkathon.

EDSA Shrine

Meralco Theatre

RESILIENCE AND RECOVERY

After years of turmoil—from political upheavals to a pandemic and debt defaults—South Asia’s real estate sectors are stirring back to life, buoyed by reform and renewed investor confidence

BY GEORGE STYLLIS

SECONDARY CITIES IN SRI LANKA SUCH AS KURENEGALA ARE BEGINNING TO SPARK INTEREST FROM INVESTORS

For a while, it seemed their hold on Sri Lankan politics would never break. For two decades, the Rajapaksa brothers, Mahinda and Gotabaya, ruled the South Asian island with their hands firmly on the levers of power. Then, in 2022, it all came crashing down.

After a string of blunders and a tanking economy, protesters stormed Gotabaya’s official residence and forced him to flee. No image captured the moment better than jubilant citizens splashing in his swimming pool while he escaped the country by plane.

Relief swept through a population weary of corruption, mismanagement, and entitlement among the ruling elite. Yet the sense of victory was quickly tempered by crisis. Alongside an economic meltdown came political instability.

Tourism had already collapsed during the pandemic, and prices of food and fuel soared as Russia’s war in Ukraine upended global supply chains. A series of reckless policy decisions—selling off foreign-exchange reserves to prop up the currency, borrowing heavily for grandiose infrastructure projects, and slashing taxes—left the economy exposed and on the brink.

The property sector was among the hardest hit. Investors ran short of cash, materials became expensive, and construction was stalled by Covid-era restrictions. The Colombo Land and Development Company, developer of Liberty Plaza mall, described the market as “static as investors adopted a wait-and-watch mode,” while the National Construction Association reported that two-thirds of projects were suspended due to high costs and fuel shortages.

“Due to the pandemic and the present economic crisis, many contractors found it difficult to proceed because of import restrictions, inflation, foreign-exchange shortages, and transportation issues,” noted a study by industry experts. “Investors are not willing to fund projects in this situation, which has become a huge issue for contractors and clients.”

By mid-2022, confidence had collapsed. “Business confidence is probably at its lowest since I’ve been in business,” says Vish Govindasamy, chairman of the Ceylon Chamber of Commerce. “It’s probably the most difficult time we have faced. But we are resilient.”

Stability began to return after former president Ranil Wickremesinghe secured an IMF bailout worth USD347

Compared with 18 months ago, momentum is positive and demand is increasing. If interest rates remain stable we can expect further development over the next year and beyond

The threat of high inflation continues to loom large over Pakistan’s real estate market. It proved to be one of the biggest obstacles to growth in 2023, averaging at 30.7%, and in 2024, even at the lower rate of 12.6%.

This year, it came down to a respectable 4.73% over the first ten months of the year and was expected to finish around 5% by the end of the year.

The Central Bank said in July that inflation had “somewhat worsened in the wake of higher than anticipated adjustment in energy prices.”

That means prices are likely to rise further, warned the governor, Jameel Ahmad.

Compounding the problems have been clashes with Afghanistan, which prompted border closures. This, along with the floods in August, which killed 1,000 people, has disrupted trade and worsened food shortages.

Yet any improvement on last year’s inflation rate will be welcome. Even a modestly stable rate could help revive stalled projects and restore buyer confidence.

PAKISTAN

EXPERTS SAY THAT MUMBAI’S LUXURY APARTMENT SECTOR IS ON THE UP FOLLOWING A PROLONGED COOLING PERIOD

million, supported by Chinese debt-relief assurances. His administration embarked on a programme of structural reform—reinstating the Pay-As-You-Earn tax system, raising VAT, privatising underperforming state enterprises, and allowing the rupee to float freely in early 2022.

According to Nirmal De Silva, CEO of Paramount Realty, those reforms have helped restore faith in the sector. “There is a degree of stability that has returned to the country,” he says. “With interest rates staying low, we’re seeing renewed demand for real estate.” As of October, the Sri Lankan Central Bank’s policy rate stood at 7.75%, the lowest in years.

Colombo remains pricey and land-scarce, but secondary cities such as Kurunegala and Hiriketiya are seeing rising interest. “People are once again looking at residential real estate and freehold land as investments,” says De Silva. “Compared with 18 months ago, momentum is positive and demand is increasing. If interest rates remain stable, we can expect further development over the next year and beyond.”

In 2024, the Rajapaksas attempted to re-enter politics, with Mahinda’s son Namal contesting the presidency. He finished fourth—a result widely seen as symbolic of a new era. “The economy will probably grow around 4% by the end of this year,” says De Silva. “I see good times ahead.”

Across the Palk Strait, a different kind of reset was underway. India’s property market, sluggish for much of the last decade, has been regaining momentum since 2021. After the exuberant boom of 2008–2010, developers had vastly overestimated demand, particularly for luxury apartments in cities such as Mumbai, Bengaluru, and Pune. The result was a glut of unsold inventory, falling prices, and a wave of stalled projects.

Between 2013 and 2023, growth slowed as the government introduced sweeping regulations to protect buyers and promote transparency. These reforms—though crucial for long-term stability—temporarily disrupted the sector as developers adjusted to stricter compliance and disclosure norms.

The cooling period was dramatic. In Mumbai, high-end apartment sales fell by 25–30% between 2014 and 2017, according to Knight Frank, while nationwide new project launches declined from over 350,000 units in 2013 to roughly 200,000 by 2018, PropEquity data shows.

But housing markets are cyclical. “The new cycle started in 2021,” says D. B. Mehta, president-elect of the Confederation of Real Estate Developers’ Associations of India. “I’m 100% confident it will go until 2029. The sharpest and fastest growth usually comes at the end of the cycle, so I expect annual returns of around 15-18%.”

BANGLADESH

Ajai Kapoor, CEO of 360 Degrees Real Estate Services, agreed that the current phase looks promising. “Unsold inventory across the top cities is broadly stable year-onyear at around 560,000 units, showing neither glut nor shortage,” he says. “Developers are selectively launching more high-value projects and acquiring new sites for the next few quarters.”

India’s urban population is projected to hit 600 million by 2031, a demographic shift that underpins the market’s resilience. Massive infrastructure projects such as the Delhi–Mumbai and Surat–Chennai expressways, along with metro expansions in Jaipur, Pune, Kolkata, and Bengaluru, are expected to open new corridors for housing and commercial development.

With plans and reforms being enacted, the outlook for the industry in Sri Lanka and India looks promising.

Premium and ready-to-move-in properties continue to perform especially well, buoyed by strong domestic demand and steady foreign investment. With the wider economy holding firm and consumer confidence improving, India’s property market is firmly in recovery mode—disciplined, transparent, and geared toward long-term sustainability.

Few areas in Bangladesh better reflect the country’s appetite for luxury living than Dhaka’s Gulshan Avenue, where glass-clad towers line leafy streets. The nation’s high-end housing market had enjoyed a remarkable run in recent years—but since August, momentum has slowed sharply. The anti-government uprising that month, which led to the ouster of Prime Minister Sheikh Hasina, triggered widespread jitters among investors.

From January to July last year, 728 luxury flats priced between BDT6 crore and BDT21 crore were officially registered. Between August and March, however, only 39 such apartments were recorded.

Adding to the uncertainty are bank interest rates of up to 15%, which have further constrained demand. “Amid economic uncertainty and looming elections, demand for mid- to high-end real estate has slowed significantly,” says Arup Sarker, senior executive director at Concord Real Estate Ltd.

Even so, some developers believe the downturn will be short-lived. “It is tough to do business in the country without significant reforms and an honest and strong administration,” says Masadul Alam Masud, chairman of the Bangladesh Steel Manufacturers Association.“Political stability is important for economic development.”

PROGRESS, PRICED RIGHT

As Asia’s cities expand, a new generation of developers is proving that affordability and quality design can build the foundation for a fairer urban future

BY LIAM ARAN BARNES

SINGAPORE’S HDB ESTATES REMAIN A TOUCHSTONE FOR AFFORDABLE HOUSING DEVELOPMENT IN SOUTHEAST ASIA

Morning light cuts through the haze in Mumbai’s Ghatkopar East suburb as the clang of corrugated tin ricochets down the alleys. For decades, that sound has meant eviction, families pushed from the city’s core to its margins.

This time, the promise is different. The people watching the bulldozers work are told they will return, not to distant rehousing blocks but to new homes on the same ground.

The INR8,498 crore (USD1.02 billion) Ramabai Ambedkar and Kamaraj Nagar redevelopment is set to deliver 4,345 flats across 11 towers, each about 300 sq ft, to more than 3,600 displaced households. The Mumbai Metropolitan Region Development Authority (MMRDA) has secured an INR1,500 crore loan from the Bank of Maharashtra to finance construction, while families receive rent support during the build.

In early 2025, MMRDA commissioner Sanjay Mukherjee called the scheme “a significant step towards inclusive and self-reliant urban regeneration,” framing it as more than routine redevelopment.

It’s an ambitious statement in a city where trust in slumrehabilitation schemes has worn thin, but it reflects a wider shift across Asia. Affordability is no longer just a social goal; it’s becoming the fault line of the region’s urban future.

Asia’s cities are swelling faster than any in history. UN-

Habitat projects 1.2 billion new urban residents by 2050—a migration that the region’s housing stock is nowhere near ready for.

The Asian Development Bank estimates that more than 200 million affordable homes must be built by 2030 to meet demand. Without intervention, growth itself could deepen inequality rather than reduce it. Rising land prices, inflation, and stagnant wages have pushed home ownership out of reach for many middle-income families, prompting governments and developers to reassess the role of housing in economic planning.

Across Asia, policymakers are reframing housing as infrastructure rather than a subsidy. At the 2025 ASEAN Sustainable Urbanisation Forum, UN-Habitat regional director Atsushi Koresawa said that “affordable and resilient housing will determine whether Asia’s cities remain inclusive amid rapid urbanisation”—a view now shaping policy across the region.

In Vietnam, that principle is being tested at scale. Deputy Minister Nguyen Van Sinh has described the government’s million-unit social housing plan as “a key driver of economic growth and social equity,” pairing public land with private capital to attract both domestic and foreign investment.

Indonesia’s long-running One Million Homes initiative has delivered more than 2.6 million units since 2015 through mortgage subsidies and land grants. Meanwhile, in China,

Developers are rethinking how homes are built, priced, and lived in, translating policy ambition into real neighbourhoods

authorities are converting unsold private stock into subsidised rentals to steady oversupplied markets.

Yet, as Knight Frank’s Asia-Pacific Residential Review 2025 notes, “affordability ratios have worsened in most major Asia-Pacific cities, with first-time buyers facing the steepest barriers in over a decade.” It’s a reminder that ambition still trails reality.

That tension between ambition and access is reshaping what gets built and how. Developers and planners are experimenting with modular construction, adaptive reuse, and mixed-use neighbourhoods that blend residential, retail, and social space.

In Hanoi’s EHome developments, low- and middle-income families now own two-bedroom flats built with prefabricated panels, shaded courtyards, and shared gardens. In Bangkok and Bengaluru, compact communities near transit lines combine apartments with schools, clinics, and small markets, cutting commuting costs and anchoring daily life.

The concept of affordability is widening beyond price to include access, durability, and well-being. Post-pandemic priorities—light,

ventilation, and proximity to green space— are informing building codes and buyer preferences alike.

And as the World Bank’s 2025 Housing and Climate Brief observed, “viewing housing as core infrastructure rather than consumption will be essential to resilience and growth.”

Even so, progress remains fragile. Cost inflation, funding gaps, and bureaucracy still slow delivery. Climate risks add new uncertainty. The challenge now is to make affordability—long the blind spot of Asia’s boom—a permanent pillar of its urban future so that the promise in places like Ghatkopar— to rebuild rather than replace—finally holds.

What this shift looks like on the ground varies from country to country. In Malaysia, the Philippines, Indonesia, and Thailand, a new wave of developers is rethinking how homes are built, priced, and lived in, translating policy ambition into real neighbourhoods.

baé by Faire Development Johor Bahru, Malaysia

In Johor Bahru, baé by Faire Development explores what affordable landed living can look like when wellness and landscape take priority. The freehold community of two-storey terrace homes sits within a gently contoured site woven with jogging paths, shaded gardens, and an open-air amphitheatre. The design favours natural ventilation and step-free interiors that suit multi-generational families while reducing dependence on mechanical cooling. Every detail—from the tree-lined streets to the amphitheatre doubling as a social commons—serves both practicality and connection. The result is a development that feels distinctly human-scaled and a counterpoint to the vertical norm of urban Malaysia. For families seeking space, greenery, and permanence, baé demonstrates how careful planning and modest architecture can deliver comfort without excess.

M Terra by Mah Sing Group Berhad Kuala Lumpur, Malaysia

M Terra by Mah Sing Group Berhad shows that urban density need not mean compromise. Recognised nationally for its design value, the high-rise in Kepong integrates more than 40 shared amenities across a vast elevated deck—from a floating gym to co-working spaces and a full-length pool. Apartments are compact yet efficiently planned, with layouts encouraging cross-ventilation and daylight. Prefabricated components and standardised materials control construction costs, while landscaped podiums and outdoor lounges extend living space vertically. Within reach of Kuala Lumpur’s transport network, M Terra appeals to first-time buyers and young families drawn to functionality over frills. It’s a study in how scale, design discipline, and a focus on communal wellbeing can turn affordability into a genuine urban advantage.

Kaya Homes by FIESTA Communities Inc. Pampanga, Philippines

In Pampanga, Kaya Homes by FIESTA Communities Inc. makes ownership possible for households often left behind by the high-end market. The four-hectare neighbourhood delivers more than six hundred house-and-lot units designed for gradual improvement, with solid concrete shells that owners can personalise over time. The architecture is simple and durable, maximising airflow and natural light. Parks, a community hall, and planned commercial lots anchor daily life and create opportunities for small enterprise. Developed under the Philippines’ socialised housing framework, Kaya Homes provides secure tenure and access to subsidised financing, turning renters into owners. True to its name— “capable”—it represents an incremental, realistic approach to housing equity that balances affordability with agency.

Plumera Mactan by Johndorf Ventures Corporation Cebu, Philippines

On Cebu’s Mactan Island, Plumera Mactan by Johndorf Ventures Corporation brings a touch of resort calm to everyday living. The eight-storey condominium adopts a modern tropical palette of concrete, timber, and greenery, arranged around courtyards that channel light and breeze through each floor. Water features and planted walkways temper the heat while creating a sense of retreat from the surrounding city. Communal amenities—a wellness pavilion, playground, and shaded lawn—foster connection across the development’s compact footprint. Located within reach of Cebu’s growing business parks and airport, Plumera Mactan offers attainable urban living that values airflow, open space, and community over ornament.

Spring Residence at Spring City by PT Sentul City Tbk Sentul, Indonesia

Set 440 metres above sea level, Spring Residence at Spring City Sentul pairs affordability with a rare sense of calm. The single-storey homes are compact but thoughtfully built—cross-ventilated, naturally lit, and equipped with smart home features. A restrained material palette and modular construction keep costs low while maintaining visual coherence. Shared parks, walking trails, and roundthe-clock security turn the enclave into a self-contained neighbourhood rather than a housing estate. Surrounded by mountains yet connected to major transport routes, it attracts young professionals and families seeking a balance between city access and outdoor space. For Indonesia’s expanding middle class, Spring Residence suggests that affordability can coexist with upscale design and environmental awareness.

Escent Bangna by Central Pattana Residence Co., Ltd. Bangkok, Thailand

Along Bangkok’s ever-expanding Skytrain line, Escent Bangna by Central Pattana Residence Co., Ltd. distils the group’s mixed-use expertise into a compact residential form. The eightstorey building, moments from the MRT Yellow Line, is conceived around the idea of connection between home, work, and leisure. Residents share co-working areas, a gym, and an open garden that links directly to the surrounding retail hub. Interiors make use of recycled materials and muted tones to create a calm backdrop for small-space living, while passive ventilation reduces energy demand. Targeted at younger professionals, Escent Bangna treats affordability not as a constraint but as an invitation to design better—lighter, greener, and closer to where life happens.

HOMES WITH HEART

Real estate is no longer seen only as an engine of profit but a measure of how societies value those who build it

BY LIAM ARAN BARNES

THE PLIGHT OF BANGKOK’S CONSTRUCTION WORKERS WAS HIGHLIGHTED EARLIER THIS YEAR WHEN A HALF-FINISHED 33-STOREY TOWER COLLAPSED, CLAIMING NEARLY 100 LIVES

The midday sun makes every surface hurt. Heat radiates off the concrete. Tin shelters line narrow alleys, patched with wire and tarpaulin. In the scant shade, children kick a ball through muddy puddles. Nearby, a mother scrubs dishes in brackish water next to laundry strung across poles. Beyond the corrugated perimeter, engines hum and the city pulses—powered by the same people confined within.

This is life inside a Bangkok construction camp: invisible to many, yet central to the city’s ascent. Thailand’s construction workforce numbers around 2.35 million people as of mid-2024, and a significant share live in temporary sites near their jobs. Thousands of children grow up in these makeshift settlements, often without stable schooling, safe play areas, or reliable sanitation.

Their parents build the towers and arteries that define Thailand’s supercharged capital, yet their own foundations remain fragile. In 2025, an elevated road collapsed in Bangkok, killing at least five workers. Weeks later, a half-

finished 33-storey tower collapsed during an earthquake, claiming nearly 100 lives. The tragedies sharpened a question long avoided: What does progress mean when those who construct it live without its benefits?

Across Asia’s fast-growing cities, that question is reshaping how governments, investors, and developers think about real estate. Some of the clearest answers are emerging from the public and non-profit sectors.

In Thailand, the Baan Dek Foundation (BDF) has spent the past decade working inside construction camps, where tens of thousands of workers and children live on the margins of the formal city.

Its Building Social Impact (BSI) initiative shows how small, inexpensive changes can transform daily life. Nationwide, more than 700,000 construction workers, along with roughly 60,000 children, live in on-site camps, according to Thanadon Chanthathadawong, director of systemic impact at BDF.

“These workers form the backbone of the country’s rapidly growing construction sector, yet many live without access to basic infrastructure or essential services,” he says.

The BSI programme’s interventions are simple— drainage to prevent flooding, shaded walkways, safe play corners, better waste disposal, and ventilation. Their impact is anything but. “These small but targeted actions immediately reduce health and safety risks while improving access to education,” Thanadon says. “They also have a positive effect on worker morale and productivity.”

The foundation’s approach relies on co-design, inviting workers and their families to identify priorities—particularly women and children, whose voices are often overlooked. This process uncovers practical needs such as safer toilets and bathing areas, better lighting for night-shift workers, and clean corners where children can study. When companies embrace this participatory model, engagement replaces resistance, and retention improves.

When real estate celebrates culture and community, it creates mutual benefit, strengthening goodwill and deepening relationships

THINK CITY: CULTURE AS CLIMATE STRATEGY

Malaysia’s Think City, a non-profit urbanregeneration agency backed by Khazanah Nasional, is expanding its work from heritage conservation in Penang to climateresilient neighbourhoods in Kuala Lumpur. “The concept of sustainability has gained tremendous popularity, but tradition and identity must remain at the core of how we build cities,” says managing director Hamdan Abdul Majeed. Recognised by UN-Habitat with a Special Citation in 2023, Think City’s Cultural Creative District aims to link cultural heritage, creative enterprise, and low-carbon design. The agency’s evolving model treats social, cultural, and environmental capital as inseparable foundations of Malaysia’s nextgeneration cities.

THE TRANSFORMATION OF CLARKE QUAY IN SINGAPORE COMBINED 19TH-CENTURY CONSERVATION WITH CLIMATE-RESPONSIVE DESIGN

“Systems tend to focus on physical standards, while developers prioritise cost and timeline,” Thanadon notes. “So the social dimension gets lost in between.”

The solution, he argues, lies in incentives: tax breaks, expedited permits, or public recognition for firms that meet verified social standards.

Ultimately, BDF measures success through the single lens of human security. When that sense of security takes hold, communities begin to invest in themselves. At one Chiang Mai site, a few shaded benches and proper drainage turned a muddy corridor into the social heart of the camp. “It quickly became a natural hub for the community,” Thanadon recalls. “When real estate celebrates culture and community, it creates mutual benefit, strengthening goodwill and deepening relationships.”

To move from local improvements to lasting systems, the machinery that builds cities—capital, standards, regulation—must reward social outcomes. That shift is tentative but visible. Lenders are asking for evidence,

exchanges are pushing disclosure, and governments are piloting sustainability-linked finance.

In Singapore, the Monetary Authority’s Green Finance Action Plan offers grants and incentives for certified green and sustainability-linked loans. In Thailand, the Securities and Exchange Commission now requires ESG disclosure from listed companies and has broadened the scope of its ESG Fund.

Vietnam and the Philippines are piloting sustainabilitylinked finance programmes linking borrowing costs to measurable impact. These moves are beginning to nudge developers toward viewing social and environmental performance not as costs, but as conditions for capital.

According to the International Capital Market Association, sustainable-bond issuance across Asia rose by around 17% in 2024 to nearly USD100 billion, reflecting investor demand for credible impact.

DEVELOPERS ARE BRINGING INCLUSION INTO OWNERSHIP IN VIETNAM VIA AFFORDABLE SOCIAL HOUSING UNITS

In Singapore, CapitaLand’s renewal of Clarke Quay shows how identity and climate can share the same blueprint. The 2006 transformation, led by architect Stephen Pimbley, combined 19th-century conservation with climate-responsive design.

Using the Venturi effect to draw river breezes through the site and the region’s first ETFE canopies for shade, it cut ambient temperatures by about 4C (39.2F) Commercial and entertainment activity rose more than 500%, turning the riverside into one of Singapore’s busiest leisure districts.

“It became a model for how to cover and ventilate streets sustainably,” Pimbley recalls. “A thought process that gave the district a new identity.”

Nearly two decades on, CapitaLand Integrated Commercial Trust is refreshing the site again through an SGD62 million upgrade. The plan keeps the warehouses intact while installing lighter, more efficient canopies expected to reduce solar heat gain by 70%.

WHEN ESG PAYS THE RENT

Evidence is mounting that sustainability drives returns. A 2025 CBRE APAC analysis found that green-certified buildings deliver up to 10% higher rents and 5–8% better occupancy rates in key regional markets. Meanwhile, Switzerland-based Asia Green Real Estate achieved a GRESB 5-Star rating and developed Ecoloft Indonesia, also certified EDGE Zero Carbon by the IFC in 2023—the country’s first such project. “Sustainability has become a differentiator for investors and occupiers alike,” CBRE noted. The figures show that verifiable ESG performance, once viewed as an expense, is fast becoming a prerequisite for premium capital and tenancy.

RATES IN KEY REGIONAL MARKETS

That same idea—designing around existing patterns of life rather than replacing them—animates work elsewhere in the region.

In the Philippines, where malls often stand in for public squares, Robinsons Land has leaned into that role. Robinsons Starmills Pampanga hosts the Giant Lantern Festival; retail centres in Bacolod and Pagadian coprogramme markets and small-business fairs.

Elsewhere, connection is built through continuity. In Thailand, AP Thailand keeps open channels with neighbours before and after construction, including consultations, education, and follow-ups. Its 2024 audit logged 96,000 people engaged and no registered complaints—modest, but rare consistency in a volume market.

Verification is becoming the next frontier. Standards that once focused narrowly on carbon and energy are beginning to expand into areas such as wellbeing, accessibility, and local employment.

As Thanadon of BDF puts it, real change will depend on incentives that “align social standards with business and human-rights principles,” reframing housing from counting units delivered to improving lives. In short, social responsibility must be designed into the system, not added at the end.

Back in Thailand, the same construction camps that once exposed the industry’s deepest inequities are beginning to change. Developers, NGOs, and regulators are testing ways to make them safer, healthier, and more permanent.

The Ministry of Labour’s new e-permit system, introduced in late 2025 as part of Thailand’s digital migrant-labour registry, is one such step, formalising employment and widening access to welfare and insurance. Several major contractors have also begun adopting Baan Dek Foundation’s co-design model, adding shaded communal areas, proper drainage, and childcare support across sites in Bangkok and Chiang Mai. A 2025

GOVERNMENTS, INVESTORS, AND DEVELOPERS ARE WORKING TO ADDRESS HOUSING INEQUALITIES

IN ASIA’S FAST-GROWING CITIES

“These are small shifts,” says Thanadon. “But when workers feel secure—physically and socially connected— they invest back in their surroundings. That’s how real communities start to form.”

The change is gradual but real. What began as isolated pilot projects is slowly becoming standard practice, reinforced by regulation and investor pressure.

Asia’s skylines will keep rising. But if these shifts hold, more of those who build them may finally share in their promise.

REJUVENATING CITIES, CITIZEN BY CITIZEN

A 2024 Asian Development Bank study, Rejuvenating the City, stresses that participatory planning is essential to sustainable urban renewal. Reviewing projects from Cebu to Ho Chi Minh City, the report found that redevelopment succeeds when residents co-design outcomes.

“Engaging citizens in a highly technocratic urban-redevelopment planning process has traditionally been ineffective. These processes must be simplified, and dedicated citizen-engagement models developed,” the paper concludes. Case studies show that inclusive design not only improves resettlement outcomes but also strengthens civic trust—a key ingredient in lasting urban transformation.

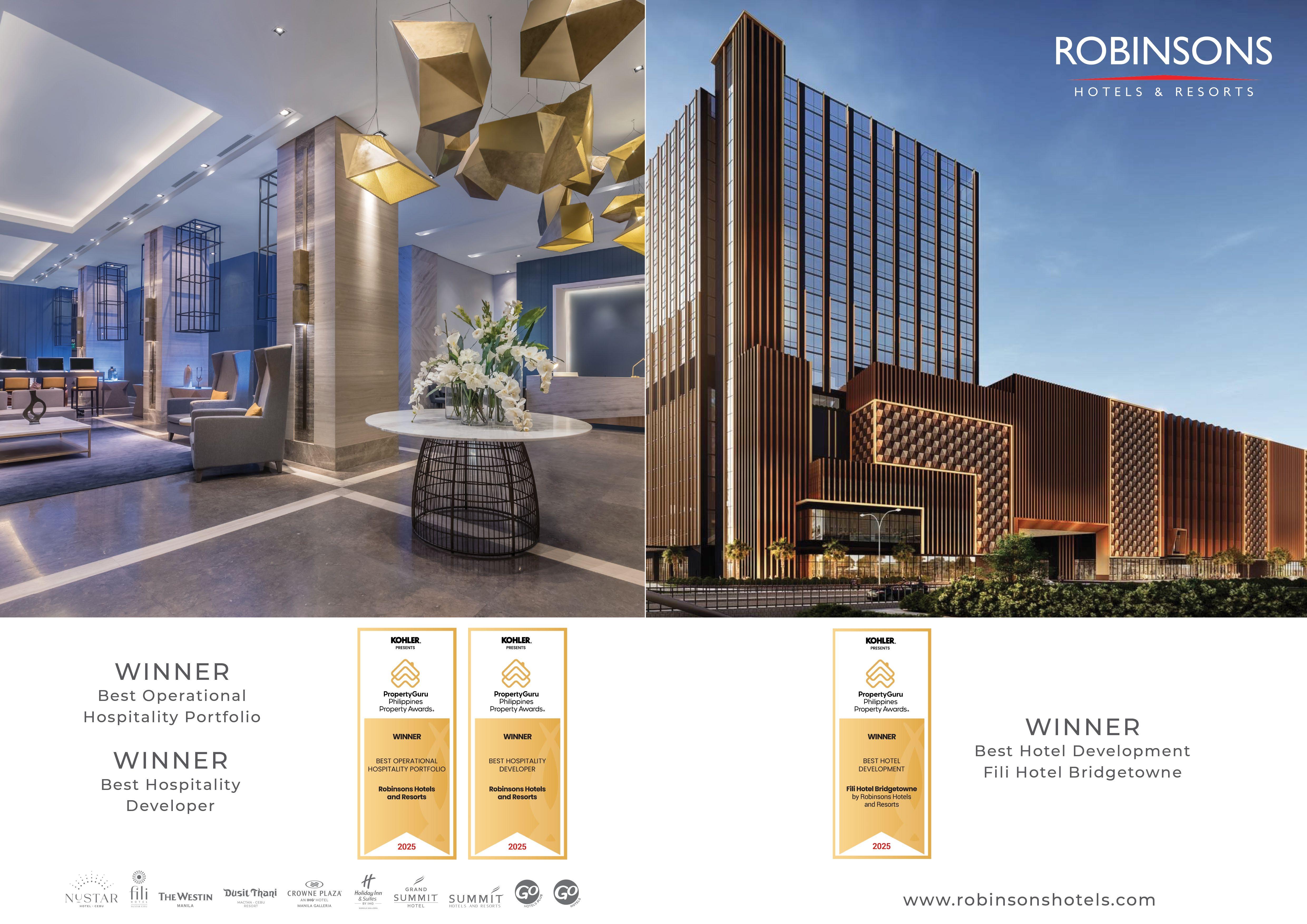

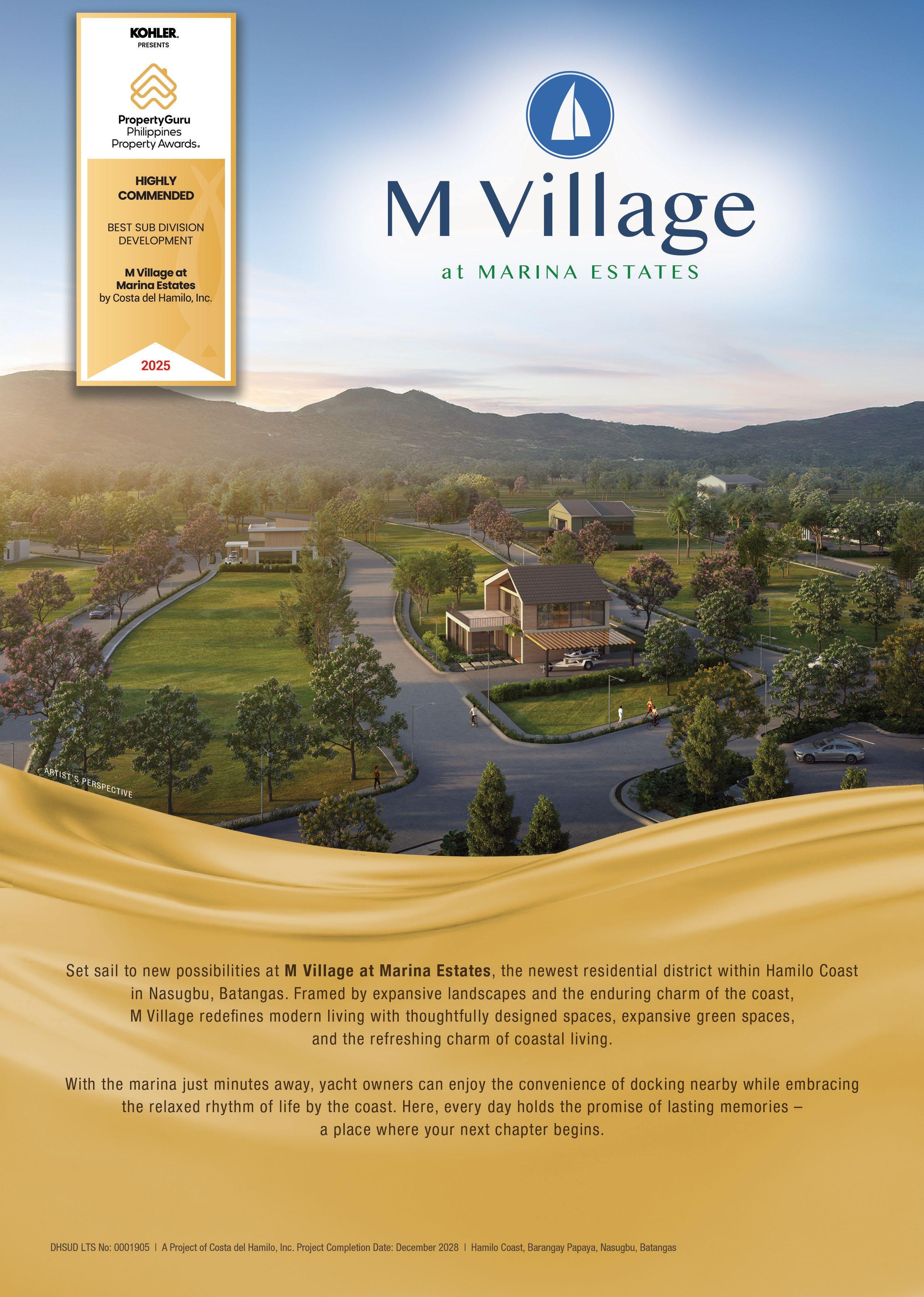

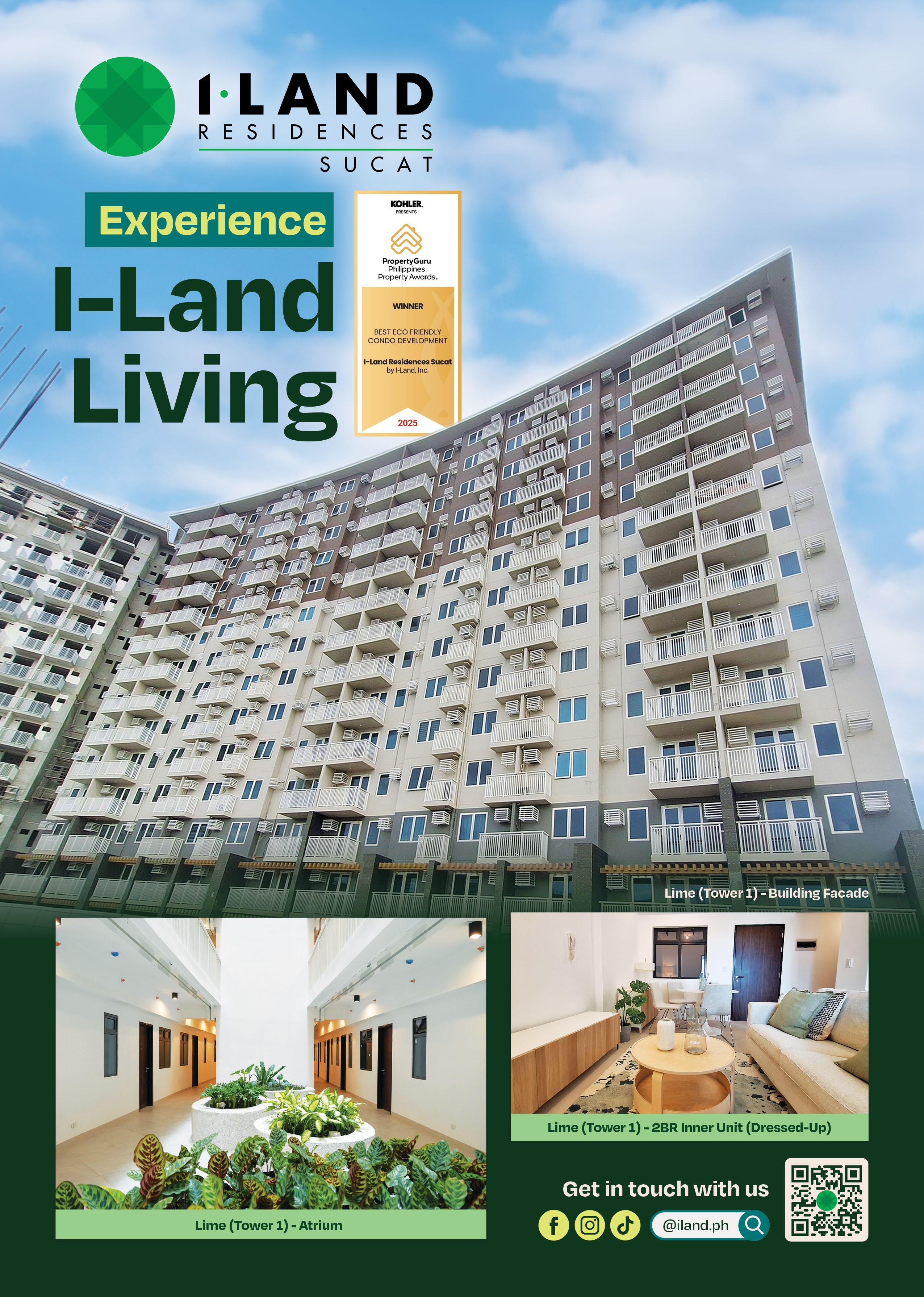

The 13th PropertyGuru Philippines Property Awards honoured the nation’s premier real estate in a festive gala dinner and ceremony on 15 August 2025 at Shangri-La The Fort, Manila.

Around 70 statuettes recognised outstanding, sustainabilitydriven developers from across the archipelago.

Robinsons Land claimed Best Developer for the fourth consecutive year, with chairman Lance Y. Gokongwei receiving the inaugural Life Achievement Award. The company also won Best Developer (Luzon), Best Luxury Developer, and Best Sustainable Developer.

The awards celebrated portfolios and projects nationwide, as well as strong ESG performance. Cebu Landmasters, Inc. was recognised as Visayas and Mindanao’s finest developer while Aboitiz InfraCapital Economic Estates won Best Industrial Developer, with head Rafael Fernandez de Mesa named Real Estate Personality of the Year. Jessica Bianca T. Sy of SM Prime & SMDC shone as the year’s Rising Star.

Other notable winners in the Developer categories included Damosa Land, Inc., FIESTA Communities Incorporated, and Primehomes Real Estate Development, Inc.

For the full list of winners, visit asiapropertyawards.com/en/award/philippines

THE JUDGES

Cyndy Tan Jarabata, President, TAJARA Leisure & Hospitality Group Inc.

Carlo Cordaro, President & CEO, Atelier A

Carlo Rufino, Co-Managing Director, NEO

Jaime A. Cura, PhD, Vice-Chairman, The RGV Group of Companies

Jean Jacquelyn Nathania A. de Castro, CEO, ESCA Incorporated

Kathleen P. Obcemea, Principal Interior Designer, KPO Beyond Designs Co.

Luis Enrique T. Mangosing, CEO, Metro Development Managers, Inc. (MDMI)

Michelle Barretto, Founder & CEO, Vitamin B, Inc.

Philip Mareschal, Head of Property & Asset Management, JLL Philippines

Richard Raymundo, Managing Director, Colliers Philippines

SPONSORS AND PARTNERS

Platinum sponsor Kohler

Gold sponsor Boysen Paints

Official magazine Property Report by PropertyGuru

Official newspaper The Philippine Star

Print and online news partner Inquirer Property

Official publicity partner Ripple8

Media partners

Bridges, BusinessWorld, Manila Bulletin, Philippine Daily Inquirer, PhilStar Property Report PH, and Real Estate News PH

Official supervisor HLB

THE CLASS OF 2025 TAKES A GROUP PHOTO

REAL ESTATE PERSONALITY OF THE YEAR WINNER RAFAEL FERNANDEZ DE MESA

CEBU LANDMASTERS, INC. NAMED VISAYAS AND MINDANAO’S BEST DEVELOPER

FIESTA COMMUNITIES INCORPORATED WINS BEST AFFORDABLE HOUSING DEVELOPER

AS BEST BOUTIQUE DEVELOPER

PRIMEHOMES REAL ESTATE DEVELOPMENT, INC. WINS BEST BREAKTHROUGH DEVELOPER

ROBINSONS LAND RECEIVES ITS FOURTH BEST DEVELOPER AWARD

JESSICA BIANCA T. SY RECEIVES THE RISING STAR AWARD

DAMOSA LAND, INC. HONOURED