5 minute read

HOT TOPICS: What is Inventory Turnover?

WHAT IS INVENTORY TURNOVER?

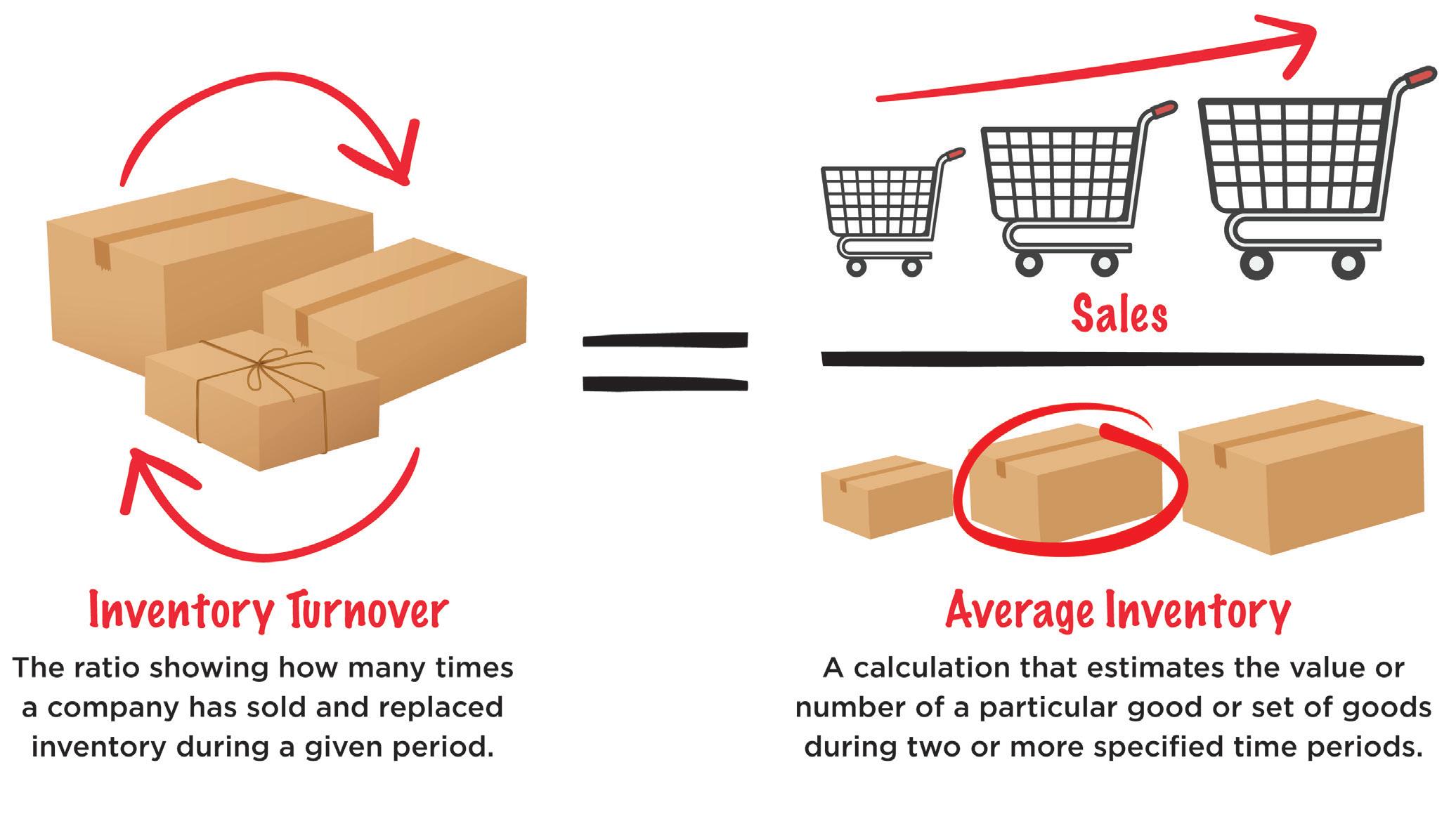

INVENTORY TURNOVER IS A TOPIC THAT’S FREQUENTLY DISCUSSED but often poorly understood by pawnshops. The definition of Inventory Turn originates in a traditional retail store setting. It is a ratio that is calculated to show how many times a company has sold and replaced inventory during a given period. Properly calculating inventory turnover can help pawnbrokers make better decisions on pricing and marketing the items that they have for sale, as well as the amounts and mix of items that they will purchase or allow as collateral for a pawn loan. a moneymaker, but it’s also the primary method of recovering capital from defaulted pawns. Well run retail builds your ability to loan more aggressively,” he says.

Martin Strasser, owner of

Premier Jewellery and Loan

in Kelowna, British Columbia, Canada, explains that for pawnshops, correctly calculating inventory turn and managing the retail side of the business is a crucial component of pawn operations. “Not only can it be

“To understand retail, it’s important to look at two things: sales margin and inventory turn. Margin is how much money a sale generates. Turn is how many times (on average) inventory sells. To retail effectively, you need to optimize both sides of the equation. High margin doesn’t work if people won’t buy because items are overpriced. Likewise, bargain pricing with high volume brings the risks of inventory depletion and ‘selling through’ your client pool.

Beth Annundi, who, alongside her husband Adam, owns Capital Pawn in Oregon, describes their approach to managing inventory. “Having just opened three additional stores within three months, we learned the fast way that you can never stop buying! Always buy as much as you are able and then

price it to move.”

“We determine whether the item is something that sells quickly, takes a bit of time to sell, or is something that will sit forever. Once we have categorized it, we price it accordingly. If it is something we don’t want on our showroom floor, it is priced to move because if it sits there for any length of time, people will think we want to purchase those items from them on a regular basis. Items that we frequently see and items people search for regularly will sell quickly. They’re priced a little higher as they demand a premium,” Annundi explains.

Their four stores in Salem, Beaverton, McMinnville, and Albany use this system that she says they learned from Kevin Prochaska of Lombard Financial Services which operates Insta Cash Pawn Shops of Texas.

“I explain turn and margin as a return on investment,” says Kevin Prochaska, offering the following example:

• Say your inventory averages $100,000, • You get a 30% margin 2 times per year (you sell your average inventory in 6 months)

That means your annual cost of goods is $200,000 ($100,000 x 2 turns), and since you made a 30% margin, you must have sold $285,715. ($285,715 x 30% margin = $85,715 in profit, which is the same as saying $285,715 x .70 Cost = $200,000.

If you were to sell your average inventory of $100,000 three times per year (or in 4 months) and you were able to sell quicker because of a lower price, lets say now that you make 25% profit instead of the 30% you were making by selling every six months.

Now by selling at three times per year with a 25% margin, you are selling $400,000. 25% of $400,000 = $100,000 in profit, with the other 75% being your cost of goods sold of $300,000 (3 x your average $100,000 inventory).

So by selling cheaper and faster, in this example, you made $14,285 more annual profit.

Old way: selling slow for more gross margin = $85,715 annual profit / $100,000 average inventory = 86% return on your investment in inventory.

Best way: selling quick for less gross margin - $100,000 annual profit / $100,000 average inventory = 100% return on your investment in inventory.

“An old saying I have is that I would rather make 5 cents every month, than 50 cents per year. I know which one I would choose,” Prochaska adds.

Jerry Whitehead, Founder of Pawnshop Consulting Group (PCG) finds that most pawnbrokers miss one of the most important aspects of properly navigating good inventory management. “Unfortunately, most traditional pawnbrokers are still fixated on their margins and as a result, place little to no emphasis on what we commonly refer to as their burn rates of the inventory,” he explains.

He uses the term ‘burn rate’ to describe the inventory’s overall turn ratios for any specific period of time being measured. When looking at the measurement per annum, for most pawnshops dealing in general merchandise in high yield markets, “we establish a burn or turn rate of 4 times per year as a minimum threshold,” he says.

“The operator would effectively be turning their entire investment in the inventory 4 X per year. The average shelf life of the inventory, in general, would be 90 days.

This rate, Whitehead explains, is an optimal production level for most medium-sized stores in higher yield markets dealing in general merchandise.

He offers the following example for calculating inventory turns in a one-year period: Average Cost of Goods Sold Level $400,000 divided by (/) AVG InventoryLevel ($100,000) in this example = 4 Turns.

The effective use of data is one of the most important benefits of your pawn software. Len Summa, CEO

of DataAge, makers of Pawnmaster

Software, says that one of the most commonly run reports that their customers run is the Aged Inventory Report, which is useful for knowing what inventory isn’t moving. “Pawnbrokers want to know what they’re sitting on in their warehouse so that they can convert it into cash to loan and get onto the street,” he explains.

But pawnbrokers must take a deeper dive. “It’s important to know how hard your inventory dollars are working for you or how often each inventory dollar is used, per year, to create profit. As a general rule, an efficient pawnshop will have a total average of 3 to 5 turns a year. If your turns are one or less, it is time to take a good hard look at what isn’t moving and why,” he adds.

The bottom line, according to Summa, “Is in the name— pawn. Pawnbrokers’ number one differentiator as a business is their ability to lend. Today’s customer has a lot of options for buying and selling items, but pawnshops have a unique opportunity to serve by focusing on their core business.