3 minute read

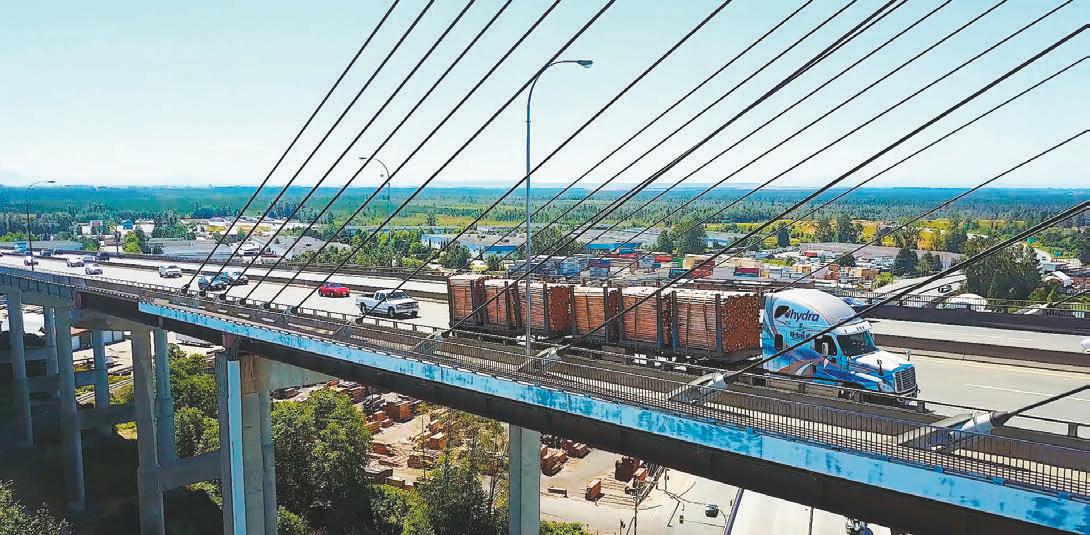

On the fastest path to hydrogen-based trucking

gen since the easy truck conversions ensure immediate off-takers for that fuel. Additional licensee announcements are expected in early 2023 as well as this licensing model ensures the fastest path to hydrogen-based trucking in North America and beyond.

From page 29

Big Rigs: Hydra also provides hydrogen fuelling infrastructure at no cost? What’s the catch?

Verhagen: As noted, Hydra’s conversion kits are free for fleet owners in exchange for a long-term, low-carbon hydrogen fuel contract. Hydra is targeting licensees who will produce or distribute clean hydrogen. By be- ing one of the few hydrogen off-take technologies ready to be deployed en masse with attractive economics to fleets, Hydra enables these HaaS licensees to bring large hydrogen volumes to market profitably. For fleets in their supply locations, it will be up to them whether they want to charge any fees for truck conversions. However, if they want immediate offtakers for their hydrogen supply, it’s in their best in- terest to get trucks converted in their station regions as quickly as possible.

Big Rigs: In the case of Australia, you say Hydra is offering a licensing model for organisations looking to quickly monetise available hydrogen they might have, whether for their own fleets or fleets around them. How will this work exactly? Why would a fleet sign up for this?

Verhagen: Hydra is about to announce a demo truck trial period and follow-on agreement with its first HaaS licensee which is a leading fossil fuel distributor in Canada looking to expand its low-carbon alternative fuel offerings to its customers across Canada. Hydra will first convert two of their tube trailers and then upon completion of this trial period, Hydra will provide this organization with their hydrogen conversion kits, ongoing software updates, data portal access, technical support, and sales materials in exchange for a monthly license fee per converted truck they do in any of the regions they’re offering their clean hydrogen to fleets. So, the licensing option is more about providing an immediate, profitable way for organisations to monetise their available clean hydro-

As for why do fleets sign up for this, Hydra has found that fleets like working Hydra’s offering because its technology has been proven in real-world conditions since 2016, there’s no range anxiety as it seamlessly switches back to diesel if the hydrogen runs out, there’s no impact on payload, the Hydra conversion kit is free, and the price of hydrogen Hydra charges is on par with diesel. Fleets are motivated to work with Hydra because Hydra can save them money by:

1. Keeping them at a fixed hydrogen price when diesel goes higher (fleets get that upside)

2. Improving fuel economy (the dual-fuel mix goes further than diesel alone)

3. Reducing maintenance cots (a cleaner burn means less DPF use extending its life)

4. Attracting new drivers (less downtime)

As you can see, Hydra’s unique approach is a viable option even for the smallest operator.

Big Rigs: You do know that there is no infrastructure in place here and from the smaller operator’s point of view, which accounts for 95 per cent of the trucks on the roads here, a great deal of scepticism about the viability of this technology, particularly given the vast distances that they drive between cities. You really have your work cut out getting uptake on this.

Verhagen: You got it. Once again, Hydra has developed a way to make clean trucking a reality for even the smallest operator as part of the transition to Net Zero. It’s about leveraging existing trucks (like the 5 million registered in North America), providing a green option that makes sense for heavy-duty trucking at no cost, and finding the best and fastest way to make clean hydrogen available to converted fleets everywhere.

Hydra’s HaaS model is the secret to success since it doesn’t wait for technology and infrastructure down the road. It leverages what exists today to make an immediate dent in emissions.

Big Rigs: Given all the obstacles, why the interest here? What have you seen that our readers are not?

Verhagen: Hydra’s HaaS model can apply to any region with clean hydrogen to leverage and Class 8 trucks looking to reduce their impact on the environment without sacrificing performance or paying more for new technology. Hydra is continuously approached by Australian fleet owners and fuel suppliers every time the company announces another milestone so more than anything, Australia has come to Hydra. The Australian government has also shown some commitment to hydrogen hubs and to decarbonising commercial fleets specifically. And Hydra is also seeing the progress Hyzon has had in the New South Wales region, a great market where 7000 trucks are traveling between there and Sydney each day.

Big Rigs: What do you think of the current hydrogen sector in Australia at present and how does it compare with Canada’s? The federal and state governments here are making a lot of noise about investing, yes, but are light years behind North America.

Verhagen: Adoption of Hydra’s innovation really comes down to availability, desire, and government support to utilise clean hydrogen. Australia continues to show interest in hydrogen (as well as electric solutions) but like any government – including Canada – it’s about having viable, affordable solutions that leverage it. Otherwise, hydrogen-based transportation will continue to be talked about rather than implemented. Hydra has shown how real hydrogen is possible right now and that when it comes to heavy-duty trucking, hydrogen makes the most sense. This has government bodies around the world taking notice, including Australia. The secret is realising that clean trucking takes baby steps like what Hydra is uniquely providing today.