4 minute read

Australian economy

In March 2021, RBA Governor Philip Lowe made his now infamous speech where he forecast the cash rate, which was a record low of 0.10% at the time, “is very likely to remain at its current level until at least 2024” Since then, the cash rate has risen 12 out of the last 13 months to 4.10%.

Governor Lowe justified the latest increase on several grounds, noting12 that services inflation remained high and with unemployment near 50-year lows in June, the labour market remained too tight, increasing the risk of further wage price inflation. In hindsight, this non-consensus rate rise should not have come as such a great surprise. Documents released in early May13, under freedom of information laws, showed that the RBA’s own internal modelling (conducted in February 2023) forecasted that the cash rate needed to rise to 4.8% to reduce inflation back to within the 2%-3% target range by 2025.

Despite the RBA’s hawkish sentiment, we remain firmly of the view that the RBA has already done enough to suppress inflation. Indeed, we have a high conviction that the Australian economy remains on the cusp of a more concerted slowdown over the next 12 months, which should ease inflationary pressures, for numerous reasons.

First, although the May labour force survey14 was surprisingly resilient and showed a fall in unemployment to 3.6% in seasonally adjusted terms, there were some statistical anomalies given that April is a month where hiring is interrupted by school holidays, Easter and Anzac Day. Some signs of weakness were buried in the detail, including a pick-up in the underemployment rate and a 1.8%15 decline in monthly hours worked. This could suggest that employers experiencing a slowdown in activity are cutting back hours but holding onto staff longer rather than retrenching, perhaps scarred by the well documented difficulties in re-hiring staff after the pandemic lockdowns. The modest rise in the participation rate also suggests that cost of living pressures are becoming more pervasive, with more people returning to the workforce by necessity.

ABS Labour Force report, key statistics as at May 2023

Source: Australian Bureau of Statistics16

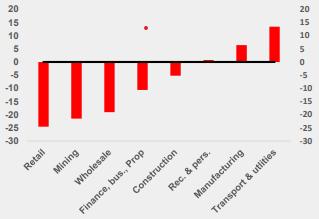

Second, the May NAB Monthly Business Survey released on 13 June showed a decline in business confidence to levels well below the long run average. A broad-based slump in forward orders, with the exception of manufacturing and transport & utilities, foretell a looming contraction in activity.

12 Monetary Policy Statement, Reserve Bank of Australia (RBA), 2 May 2023, https://www.rba.gov.au/media-releases/2023/mr-23-10.html

13 RBA modelling reveals huge cost of lifting rates more aggressively, Sydney Morning Herald, 11 May 2023, https://www.smh.com.au/politics/federal/rba-modelling-reveals-huge-cost-of-lifting-rates-more-aggressively-20230511-p5d7pu.html

14 Labour Force, Australia - May 2023, Australian Bureau of Statistics, 15 June 2023, https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release

15 Labour Force, Australia - May 2023, Australian Bureau of Statistics, 15 June 2023, https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release

16 Labour Force, Australia - May 2023, Australian Bureau of Statistics, 15 June 2023, https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release

Source: NAB Monthly Business Survey17

Third, retailers are already bearing the brunt of the cost-of-living crisis, with a raft of earnings downgrades18 over the recent quarter coming from the likes of Baby Bunting, Adairs, Best & Less and Super Retail Group. Fourth, the latest Westpac Melbourne Institute Consumer Sentiment survey19 released on 13 June remains deeply negative at levels that would normally only be expected during a recession. Inflation was noted as more of a concern among survey participants than interest rates. Similarly, the Institute’s Leading Index survey conducted in May, which indicates the likely pace of economic activity relative to trend three to nine months into the future, remains in negative territory.

Consumer Sentiment Index (Jun-93 to May-23)

Source: Westpac - MI Consumer Sentiment

Fifth, the tidal wave of mortgages rolling off fixed rates over the next 12 months has only just begun. According to the Australian Bankers Association, over 222,000 fixed rate mortgages rolled off ultra-low rates (2-3%) in the June quarter alone to reset on much higher rates (6%+) A further 590,000 more are due to reset over the next 12 months. Although only one third of households have a mortgage, the impact on disposable incomes for this cohort will be significant, likely contributing to a sharp reduction in discretionary spending.

17 NAB Monthly Business Survey, National Australia Bank, May 2023, https://business.nab.com.au/wp-content/uploads/2023/06/NABMonthly-Business-Survey-May-2023.pdf

18 Best & Less reveals Australia’s spending pain, and there’s more to come, Australian Financial Review, 20 June 2023, https://www.afr.com/chanticleer/best-and-less-reveals-australia-s-spending-pain-and-there-s-more-to-come-20230620-p5dhvd

19 Consumer Sentiment steadies near recession lows, Westpac-Melbourne Institute, 13 June 2023, https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/economics-research/er20230613BullConsumerSentiment.pdf

Source: MacroBusiness20

Sixth, growth in Australia’s largest trading partner, China, has weakened after the initial rebound in activity following the end of the COVID-19 lockdowns. Although Authorities have eased financing restrictions in the ailing property sector, following the clampdown on debt that triggered a wave of high-profile defaults by property developers, the sector remains challenged by high levels of debt and a large stock of unfinished apartments. As the property sector contributes about a quarter of China’s GDP, these challenges have spilled over into weaker consumer sentiment and economic growth more generally. This, combined with emerging weakness in the United States and the global economy does not augur well for Australian export demand over coming quarters.

Conclusion

The impact of rising interest rates on economic activity typically acts with a lag of 6-12 months on economic activity. The impacts are now obvious. Global inflation has been in retreat and inflation in Australia is also well past its peak and should continue to gradually subside over coming quarters as growth continues to slow. Services inflation has remained more persistent, as labour input costs remain stubbornly high. This too however should start to recede as wage price pressures gradually moderate. There is a fine line between reducing inflation and avoiding a recession. In our view, the risk of a hard landing has increased considerably following the RBA’s latest hike. This means there is now considerable downside risks to the RBA’s own forecasts where economic growth (GDP) in Australia is expected to slow to 1.5% and 2%21 respectively for the years ending 30 June 2024 and 2025.

20 The fixed rate mortgage cliff is here, Macrobusiness, 8 April 2023, https://www.macrobusiness.com.au/2023/04/the-fixed-ratemortgage-cliff-is-here/

21 Statement on Monetary Policy – Economic Outlook, RBA, May 2023, https://www.rba.gov.au/publications/smp/2023/may/economicoutlook.html