4 minute read

Casa Grande Subdivisions

Casa Grande is growing like wildfl owers in the spring, and homebuilders are busy trying to keep up. In the last couple of years, the City has experienced a resurgence in residential construction after 10 slow years following the Great Recession. The City issued 1,107 building permits for singlefamily homes in 2020, 562 in 2019, 256 in 2018 and 114 in 2017. From 2010-17, the City issued fewer than 200 each year, including just 52 in 2012. During the lean years, two companies were building in Casa Grande. Now, 18 companies are building here. When the housing market collapsed during the last half of the 2000 to 2010 decade, builders abandoned plans to construct homes on thousands of lots in Casa Grande. In many cases, the work had already begun. Some developments had water lines, sewer lines and paved streets, but no houses. Dubbed “ghost” or “zombie” subdivisions, they blighted the City and sat idle for years. As late as 2017, the City had 6,000 vacant lots. “Most of the subdivisions listed on our current builder activity list were subdivisions that were started in the 2004-06 time frame and never fully completed,” City Planning and Development Director Paul Tice said. However, today builders have fl ooded back into Casa Grande and have started buying up these subdivisions and building homes. They have returned for several reasons. Casa Grande’s location between Phoenix and Tucson and at the junction of I-10 and I-8 is ideal. Industry is here, and more is coming. Casa Grande is also attractive to home buyers for its low cost of living. “Looking at the cost of housing in Casa Grande vs. Chandler,” said Renée Louzon-Benn, president of the Greater Casa Grande Chamber of Commerce. “Get more house for your money.” The City made the permitting process easier, reduced development impact fees and changed requirements for fi nancial assurances from builders that they will complete infrastructure. “City leadership and City management worked with builders and developers to fi nd out what needed to be done to make Casa Grande attractive to growth again,” Mayor Craig McFarland said. The Census Bureau estimates Casa Grande’s population was 58,632 in 2019. The City projects a population of 75,049 in 2030. To get there, the City is counting on 4,485 new single-family homes, 961 apartment units and 961 manufactured homes, Tice said. The City issued 11 building permits for multi-family housing in 2020. No such permits were issued from 20132019. Casa Grande Crossings on Camino Mercado, a 284-unit apartment complex, will soon be under construction, Tice said. The City issued 63 permits for manufactured homes in 2020.

NEWCOMERS AND NEIGHBORS CLUB

Advertisement

Meets second Thursday of each month Central Event Hall, 408 N. Sacaton St., Casa Grande AZ For more information, please visit www.cgnnc.com

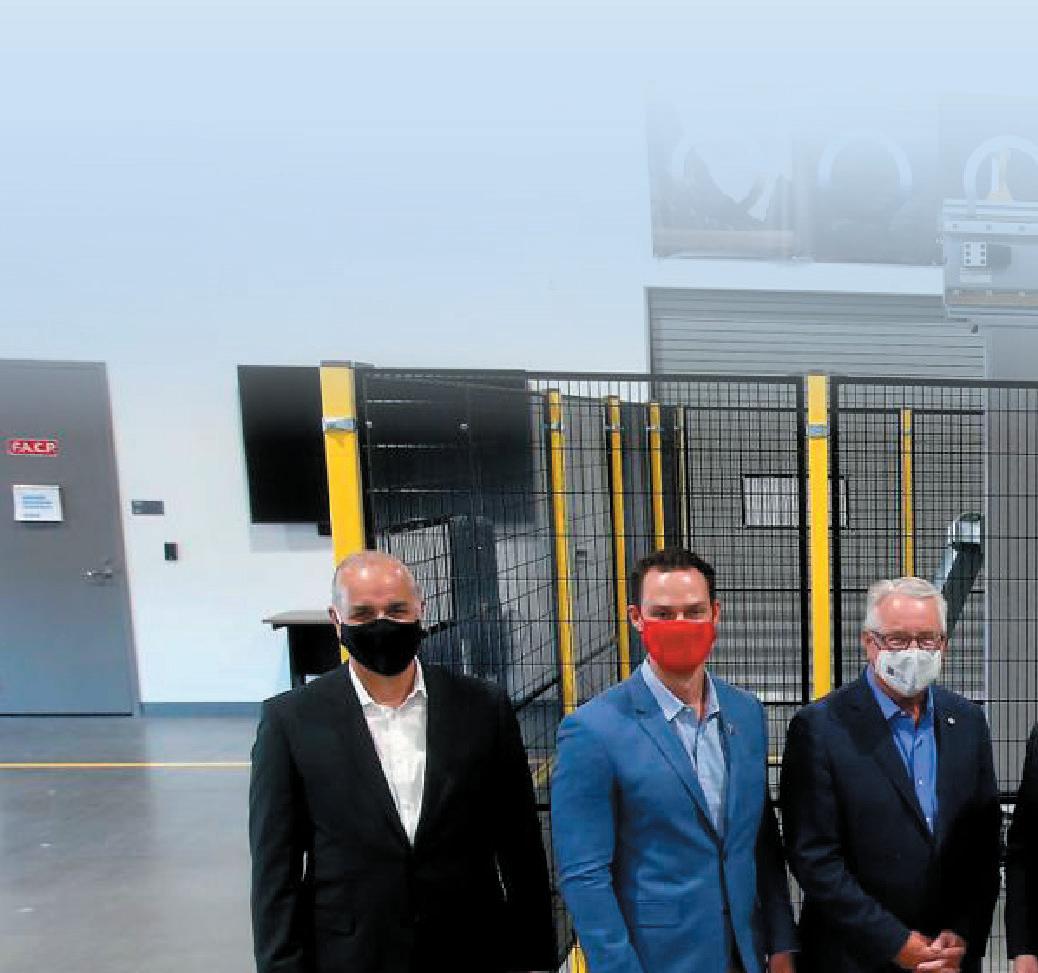

Arizona Innovation & Technology Corridor

Western Pinal County is home to some of the most exciting green-energy development projects in the country, prompting county offi cials to market this area to more 21st-century industries as part of the Arizona Innovation Technology Corridor. The AITC highlights the county’s 21st-century business clusters to promote the area as a place to build and collaborate with similar industries. Electric vehicle manufacturer Lucid Motors has opened its fi rst factory, a $700 million investment that will create in excess of 6,000 jobs by 2029. The Lucid Air, a state-of-the-art luxury sedan, should be rolling off the assembly line by late 2021. Another electric vehicle manufacturer, Nikola Motor Company, recently broke ground on a 1-million-square-foot plant where it will manufacture zero-emission heavy trucks. In the summer of 2020, the county secured contracts with University of Arizona and Arizona State University related to the AITC. The Board of Supervisors approved an agreement between Pinal County and the Arizona Board of Regents for the planning and implementation of the corridor. The agreement gives Pinal County the benefi t of University of Arizona’s research, planning and leadership. “This could be up to a 35-year project … it’ll take that long to develop all the property,” says the UA. “And (we are) talking close to $70 billion worth of high-tech companies we could bring into this corridor.” UA’s study will identify every parcel of land and assess its suitability for the development of high-tech manufacturing. The county also has a contract with Arizona State University for the Seidman Research Institute to assess the economic potential of an inland port in Pinal County. According to ASU’s written proposal, Pinal County’s strategic location has prompted several discussions about an inland port. An inland port, or dry port, is a distribution hub, usually connected by rail to one or more seaports. Infrastructure in the Connecticut-size Pinal County includes Interstates 10 and 8 and Union Pacifi c Railroad, connecting the AITC to numerous major markets. Three international airports within a short drive mean the country’s major cities are a direct fl ight away. The county has a website promoting the AITC at azitc.pinal.gov. The AITC extends down I-10 from Riggs Road, through the Gila River Indian Community, through Casa Grande, on I-8 to Attesa motor sports complex and south to Marana. Approximately 2.8 million people live in a 50-mile radius of where the two interstates meet.