5 minute read

INVESTMENT COMMENTARY

from ASSET NOVEMBER 2020

by ASSET

Interest rates going to near zero for … many years

David van Schaardenburg asks: what’s the implications for investors and how does this affect retirement strategies?

BY DAVID VAN SCHAARDENBURG

I’ve been investing or advising on client funds for over 35 years. In that time I’ve seen a lot of financial records set; be it sharemarket highs, falls, extreme volatility, etc.

The new financial record set in 2020 is the trend for interest rates on bank deposits and Government bonds falling towards zero.

I have never seen such low returns on offer for low risk assets. At the time of writing, the top five NZ high street banks are now offering on average under 1.0% for one-year TDs.

And with the Reserve Bank’s new “Funding for Lending” programme (low cost “helicopter money” for the banks to lend) soon to start, interest rates are set to go further lower.

Interest rates in NZ have been trending down gradually over the last 10 years. However like many things, the pace of change has been accelerated by the economic recession triggered by Covid-19 and the resultant relaxation of monetary policy plus introduction of “unconventional” monetary policy tools. Not only do we believe 2020 is the year of record low interest rates but based on overseas experience near nil interest rates may be around for many years.

Take the US. After bank rates fell dramatically in the GFC between 2007 and 2009 (3.7% to 0.8%), the average US one-year bank CD rates have ranged between 0.2 to 1.0% over the last decade. This is despite a good rate of economic growth between 2010 and 2020.

Similarly, in the UK their central bank base rate, which was 5.75% at the start of the GFC (late 2007), has ranged between 0.1 to 0.75% since 2010.

In each instance, general inflation has remained suppressed despite reasonable to good economic growth. So no requirement to raise interest rates.

Given the present weak medium-term economic outlook for New Zealand I see no reason the same will not occur in New Zealand for much of the next decade.

What does this mean for investors?

Between August 2019 resident household deposits with banks rose from $182 billion to $197 billion. So despite returns declining, with all the uncertainties of Covid households were prepared to squirrel away more of their savings into a secure investment (the bank) but one which would increasingly return less.

Makes sense in an uncertain world and over the short term the opportunity cost will usually not be too high.

However this cost can rise to become a material gap over medium to longer periods.

To highlight the cost over the medium to long term I provide clients a simple example of a 50-year-old couple who have invested $500,000 for their retirement and are highly concerned about the Covid recession so they’ve stuck it all in the bank for short-term capital security.

This is compared to another couple who are at the same age and stage, that choose to invest for retirement via a balanced portfolio as they presume they won’t be touching it for a long time – ie when they retire.

Each are hoping to draw $50,000 a year on their savings for retirement income needs from the age of 65.

End of year one1 – versus the balanced portfolio couple, the bank couple are only $20,000 behind in their portfolio value. Not great but not a disaster.

End of year five – the difference is starting to get painful. The opportunity cost between the two accounts has risen to $110,000 or 21% of original capital.

End of year 10 – the difference in accumulated wealth between the bank couple and their balanced portfolio friends has risen to $251,000 or 48%.

How does this affect their respective retirement lifestyles?

Assuming they stick to the same investment strategy in retirement, each couple can anticipate the following retirement lifestyles.

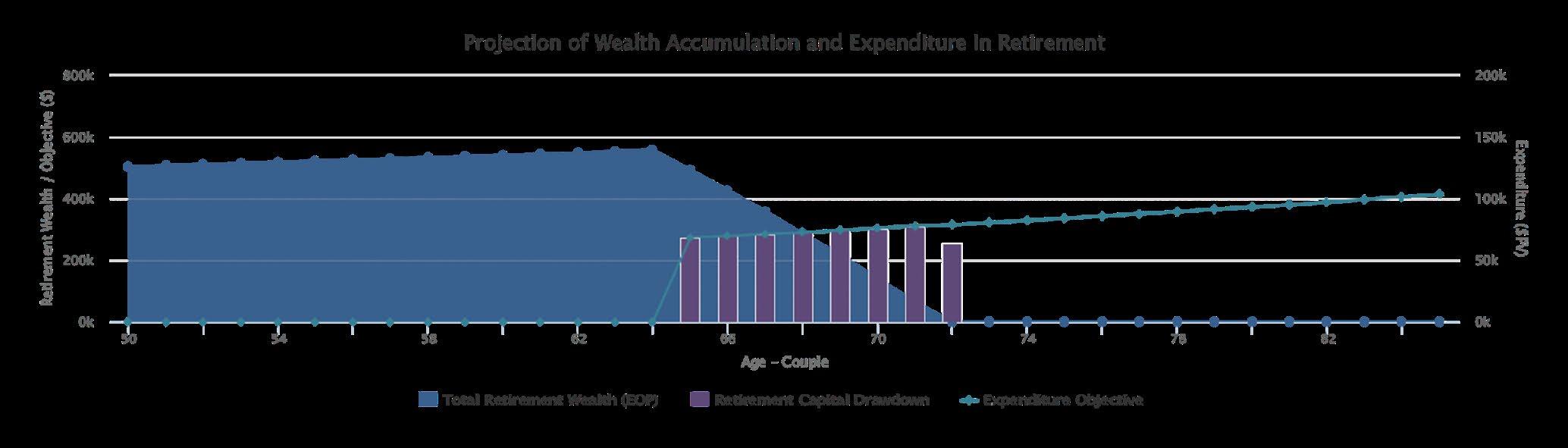

1. Bank deposit based strategy

The safety first couple run out of retirement funds at age 72 and from that time are purely reliant on NZ Super for their lifestyle. Given average longevity for a 50-year-old female today is c.90 years there is guaranteed to be significant income shortfall for this couple for most of their retired life.

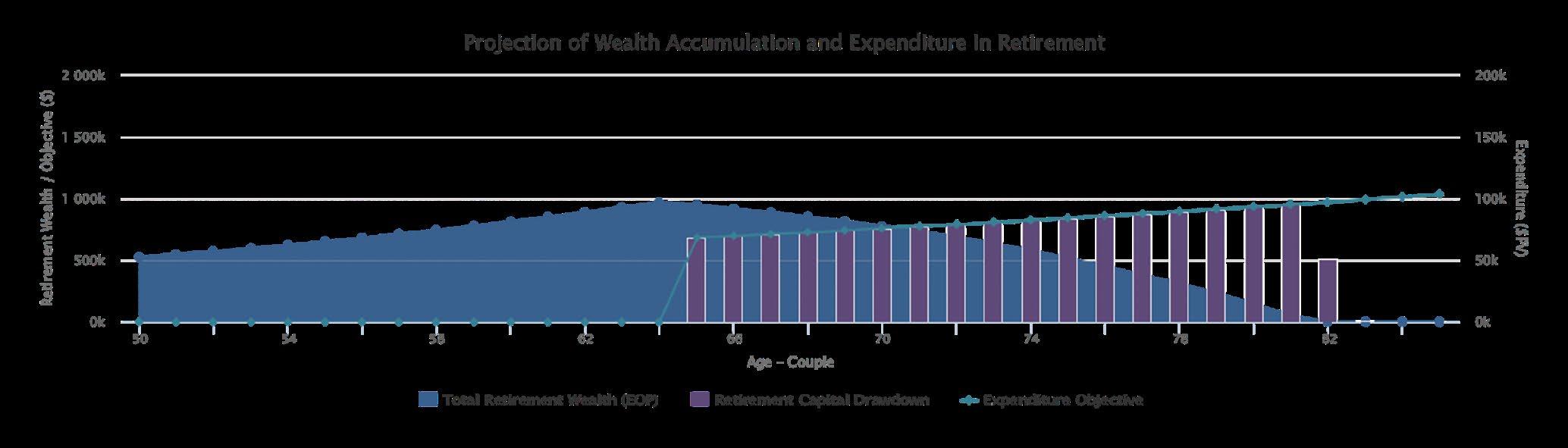

2. Balanced portfolio based strategy

The income needs of this couple in retirement are well met into their 80s when their lifestyle is expected to slow down and expenditure will probably be less. In addition both couples have the capacity to save more between now and retirement plus have reasonable KiwiSaver balances to draw on.

In essence, by taking on more risk couple two are probably going to have the retirement lifestyle they’ve planned for while couple one are going down a problematic path, running out of money too early.

Many New Zealanders have in the past enjoyed the security of bank deposits as a place to get a steady low risk income in the lead up to and in retirement. In the presumption New Zealand follows global trends, a bank based investment approach will no longer achieve the goals of many retirees.

The advice opportunity

For those of your clients who have significant sums in the bank, it’s more important than ever they understand the long-term implications of the lower compounding returns that bank deposits are likely to deliver.

In addition, advisers can really help their clients by taking them through analyses that enable them to better understand how to bridge the trade-off between short-term capital security versus the longer-term greater accumulated wealth achievable from a diversified portfolio.

David van Schaardenburg is a Senior Partner, Wealth Management at Findex. An Adviser Disclosure Statement is available on request and free of charge. www.goodreturns.co.nz/disclaimers

1 In this comparative we have a 4.5% net return for a balanced portfolio vs. 0.75% bank deposit rate less 33% tax as the clients are still working.

2 The projection analyses have an average bank deposit rate of 1% and balanced portfolio return of 4.5%. Tax rate is 17.5%.