7 minute read

💰JustMarkets Minimum Deposit 2026 – Start Trading JustMarkets with Affordable Capital

from Pepperstone review

by Jone Eva

What is the JustMarkets Minimum Deposit in 2026? ->The JustMarkets Minimum Deposit starts from just $1 for Cent Accounts, while Standard and Pro Accounts may require $5–$100 depending on the account type.

Are you looking to start trading with JustMarkets, but wondering how much you need to begin? The good news is that JustMarkets Minimum Deposit is designed for traders who want flexibility, affordability, and instant access to global markets. Whether you’re a beginner learning the ropes or an experienced investor expanding your portfolio, this broker allows you to start trading with small capital while still enjoying professional-grade features.

➡️ Open your JustMarkets account today and experience seamless trading across forex, indices, metals, and more — all with a low minimum deposit requirement.

🌐 Why the JustMarkets Minimum Deposit Matters in 2026

In 2026, the trading landscape continues to favor brokers that make investing accessible for all levels of traders. The JustMarkets Minimum Deposit policy reflects this trend perfectly. It ensures that traders don’t need a large upfront investment to enter the forex market.

By lowering the barrier to entry, JustMarkets empowers retail traders to:

Test real market conditions with smaller funds.

Manage risk more effectively while learning.

Scale up gradually as confidence and skills grow.

💬 For new traders, this model is ideal because it allows you to get a feel for live trading environments without exposing too much capital early on.

➡️ Visit JustMarkets official website to explore all account types and find one that fits your goals.

🌐 What Is the Minimum Deposit in JustMarkets?

When it comes to JustMarkets Minimum Deposit, flexibility is the key. The broker offers several account types — each tailored to different experience levels and trading strategies.

💰 Cent Account – Ideal for beginners who want to start small, this account requires as little as $1 to begin trading. It’s perfect for learning without taking big risks.

💰 Standard Account – This account type is suitable for more active traders, requiring a minimum deposit of $5–10 depending on your region or payment method.

💰 Pro and Raw Spread Accounts – For experienced traders, these accounts provide tight spreads and higher leverage, typically requiring $100 or more as the JustMarkets Minimum Deposit.

This tiered deposit structure ensures every trader — regardless of budget or experience — can participate in global markets efficiently.

Remember, the JustMarkets Minimum Deposit may vary depending on the currency, platform, and country you register from. Always verify on your JustMarkets dashboard before funding.

🌐 JustMarkets Deposit Methods – Simple, Fast, and Reliable

One of the strongest advantages of trading with JustMarkets is the wide variety of deposit methods. The broker understands that traders worldwide need secure, quick, and low-cost ways to fund their accounts.

Here are the most common JustMarkets deposit methods in 2026:

💰 Bank Transfers – Traditional yet secure. Processing time may take 1–3 business days depending on your country.

💰 Credit/Debit Cards (Visa, MasterCard) – A popular and instant funding method with minimal fees.

💰 E-Wallets – Methods like Skrill, Neteller, Perfect Money, and Sticpay allow fast deposits with near-instant confirmations.

💰 Cryptocurrency Payments – Bitcoin, Ethereum, and Tether (USDT) deposits are supported, offering decentralized and borderless funding options.

💰 Local Payment Systems – Depending on your region, JustMarkets also supports local bank networks and fintech payment gateways for smoother transactions.

All these options reflect JustMarkets’ commitment to convenience — letting traders focus more on strategy and less on funding issues.

➡️ Deposit now and start trading with your preferred payment method.

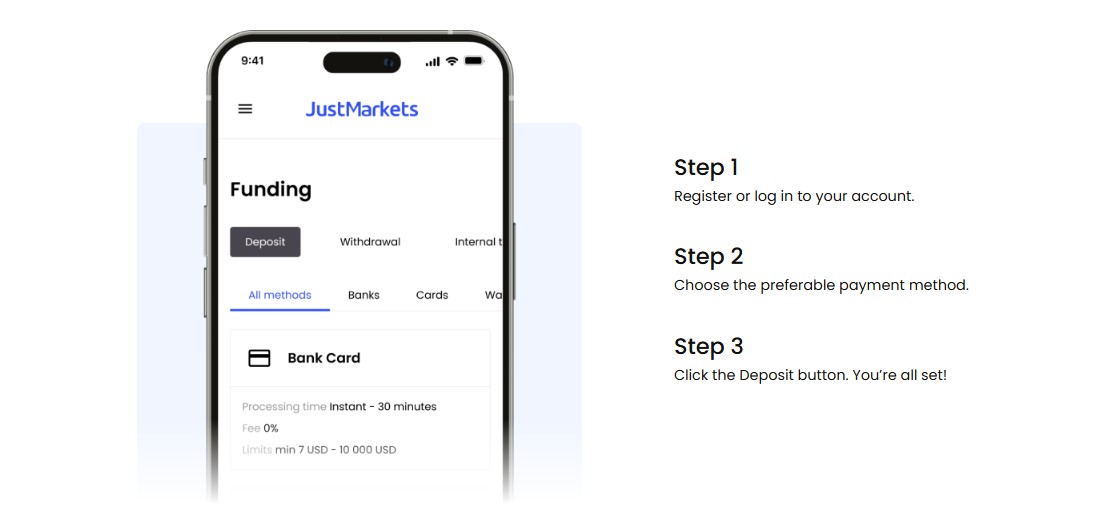

🌐 JustMarkets Deposit Guide – Step-by-Step for 2026

Setting up your JustMarkets Minimum Deposit is easy and takes just a few minutes. Here’s how to get started:

1️⃣ Register an Account:➡️ Go to the JustMarkets sign-up page and create your trading profile.

2️⃣ Verify Your Profile:Complete KYC verification by uploading your ID and proof of residence — ensuring secure financial transactions.

3️⃣ Log in to Your Dashboard:Once verified, access your account dashboard to view all deposit options available in your country.

4️⃣ Choose Your Deposit Method:Select your preferred payment method — such as card, e-wallet, or crypto — then enter the desired amount.

5️⃣ Confirm and Fund Your Account:Follow the on-screen instructions to complete the process. Most deposits are credited instantly, allowing you to start trading right away.

💡 Pro Tip: Always check if there are any deposit fees applied by your payment provider. JustMarkets itself charges zero deposit fees for most methods, maximizing your capital efficiency.

🌐 Why Traders Prefer Low Minimum Deposit at JustMarkets

The JustMarkets Minimum Deposit model gives traders freedom and flexibility. Here’s why it stands out:

✅ Low Barrier to Entry: Start trading with as little as $1. Perfect for newcomers.✅ Risk Management: Smaller deposits allow safer learning.✅ Diverse Account Options: Choose from Cent, Standard, or Pro accounts based on your strategy.✅ Global Accessibility: Accepts payments from multiple currencies and regions.✅ Zero Deposit Fees: Keep your capital intact and trade more effectively.

By lowering the JustMarkets Minimum Deposit, the broker fosters a more inclusive trading ecosystem where everyone — from small-scale retail investors to high-volume professionals — can thrive.

➡️ Open your JustMarkets account now and take the first step toward smarter trading.

🌐 How JustMarkets Low Deposit Benefits New Traders

For beginners, the JustMarkets low deposit feature provides a unique advantage. It allows you to:

Learn live trading mechanics with minimal risk.

Develop real-world trading psychology.

Test strategies before committing larger funds.

Access real-time spreads and leverage conditions identical to larger accounts.

This hands-on experience with small capital builds confidence and sharpens decision-making skills — both critical for long-term success in forex trading.

Remember: it’s not about how much you start with, but how effectively you manage your funds.

🌐 Tips to Maximize Your Deposit Efficiency

Even with a JustMarkets Minimum Deposit, there are smart ways to stretch your capital further:

💡 Use leverage wisely – Don’t overextend your positions. Leverage can amplify both profits and losses.💡 Monitor spreads – Opt for tighter spreads in volatile markets.💡 Avoid emotional trading – Stick to your trading plan.💡 Withdraw profits periodically – Protect your gains and maintain discipline.

These principles, combined with JustMarkets’ low deposit and reliable execution, help traders create sustainable growth over time.

🌐 Start Trading Smart with JustMarkets in 2026

As the global forex market evolves, JustMarkets Minimum Deposit continues to attract thousands of new traders every month. With low-cost entry, flexible funding, and transparent conditions, this broker stands out as one of the best choices for anyone looking to start trading confidently.

If you’re ready to take control of your financial future:➡️ Join JustMarkets now and start trading smarter, not harder.

🌐 FAQ – JustMarkets Minimum Deposit

❓ What is the JustMarkets Minimum Deposit in 2026?✍️ The JustMarkets Minimum Deposit starts from just $1 for Cent Accounts, while Standard and Pro Accounts may require $5–$100 depending on the account type.

❓ Can I start trading with $1 on JustMarkets?✍️ Yes, you can! The JustMarkets Cent Account allows you to begin trading with only $1, making it perfect for beginners and budget-conscious traders.

❓ Does JustMarkets charge deposit fees?✍️ No, JustMarkets does not charge internal deposit fees. However, third-party payment providers might apply minor transaction costs.

❓ What are the available JustMarkets deposit methods?✍️ Traders can fund their accounts via bank transfers, cards, e-wallets, cryptocurrencies, and local payment gateways — ensuring global convenience.

❓ Is the JustMarkets Minimum Deposit suitable for professional traders?✍️ Absolutely. Even though it’s low, the JustMarkets Minimum Deposit doesn’t limit access to high-end trading features such as tight spreads, fast execution, and advanced analytics tools.

⭐ Final Thought: JustMarkets Minimum Deposit Starting your trading journey in 2026 doesn’t require huge capital. The JustMarkets Minimum Deposit gives you the freedom to begin small, learn effectively, and scale sustainably. Whether you invest $1 or $1,000, JustMarkets ensures your path to financial success starts with accessibility, transparency, and trust.

➡️ Create your JustMarkets account today and step confidently into the world of professional trading.