9 minute read

A BREWERY IN HAMBURG IS FINANCED BY SECURITY TOKENS

AN INNOVATIVE PROJECT USING BLOCKCHAIN TECHNOLOGY

The innovative Hamburg brewery “JoyBräu” relies on a new type of financing model. It is the first food company to collect two million euros from the public via a blockchain-based financing model. Black Manta Capital Partners, whose Co-Founder & Managing Partner gave an in-depth interview to PANGAEA on the function, value, security and future of cryptocurrencies and other block chain-based financial instruments, is handling the transaction.

Advertisement

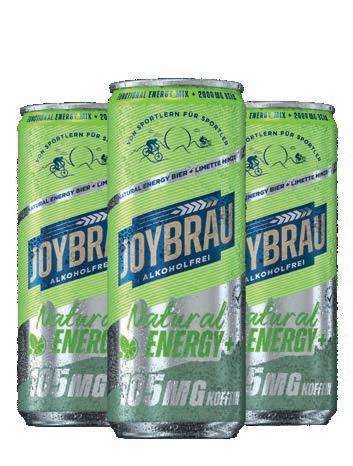

„JoyBräu“ launches the world’s first non-alcoholic sports beers.

© www.joybraeu.de

But first, let’s talk about the innovative crowdfunding of the Hamburg-based start-up JoyBräu. “Over the remainder of the campaign period (until December 31 2022), investors with a total investment of up to two million euros can acquire a two percent share of the total revenues of the ‘Well-Beering Company’ until 2029,” Erik Dimmer founder and managing director of “JoyBräu GmbH” said in a press release:

“With the Well-Beering Token, we at JoyBräu also want to set new standards in the area of financing. There has never been a security token offering in the food industry and we are proud to take crowdfunding for startups to a new level.”

With a starting investment of only 500 euros investors can purchase “Well-Beering Tokens” with a value of one euro per token. Each token transaction is digitally documented on the Ethereum blockchain. Investors can access the tokens via common crypto wallets and view the token value on a daily basis. Thanks to the innovative technology, the well-beering tokens can be traded on the secondary market similar to shares or bonds. Security Token Offerings (STO) have been popular in the real estate market for years. JoyBräu is now the first company to bring the innovative financing tool to the consumer goods market.

Due to the similarity of STOs to conventional financial instruments, the financing form is regulated by the local financial market authority (in this case BaFin in Germany) –an additional security for investors. With Black Manta Capital Partners from Munich, JoyBräu has an experienced issuing partner at its side.

We are delighted to be able to be involved in such an exciting, unique project and to finally be able to launch the offering after a long and intensive period of preparation, comments Rapatz on the deal.

What kind of company is Black Manta Capital Partners? Founded in 2018, the company is now represented through its offices in Luxembourg, Munich, Vienna and Cork. Their German entity, BMCP GmbH, is a regulated and BaFin-supervised financial services institute for the entire European market. The company is registered in all member states of the EU.

With the business model of TokenizationTM as a Service™, the company positions itself as a one-stop agency for digital and tokenised assets and offers clients (i.e. issuers) a complete package from the structuring of an issuance, through the technical implementation of an STO, to the placement on the capital market. In addition to tokenisation, Black Manta also works on several corporate finance & private placement projects, both for funds, corporations, and real-estate projects.

Alexander Rapatz, a trained lawyer who was drawn to the world of finance, is one of the proven experts when it comes to cryptocurrencies and blockchain-based financial instruments. The co-founder of Black Manta Capital answered PANGAEA magazine’s questions in Vienna. In particular, he described in detail the advantages of investing in cryptocurrencies compared to other financial products.

Alexander Rapatz (left) and Christian Platzer, both co-founders and managing partners of Black Manta Capital Partners, in front of their company logo.

© Black Manta Capital

PANGAEA: In short, what are cryptocurrencies and how do you get into them?

Alexander Rapatz: “Cryptocurrencies are digital or virtual currencies that are decentralized and anonymous based on cryptographic tools (such as blockchain). Digital assets, i.e. digital securities, are those applications that also represent an asset or rights and obligations attached to it. Bitcoin was the first cryptocurrency and the first application on the blockchain. This represents nothing at all, is in reality just an arithmetic unit. Newer cryptocurrencies often have a purpose, they have a protocol behind them or so-called smart contracts, which also have functions. Cryptocurrencies can be purchased and traded on the common crypto exchanges. There are now more than 10,000 cryptocurrencies, some of which are very well known - such as Bitcoin or Ethereum. However, the majority are neither known nor tradable on the common crypto exchanges. ”

PANGAEA: How do cryptocurrencies differ?

“In function. Some have no function at all. Bitcoin, for example, is a purely digital value. A unit of account that is limited to 21 million euros and is therefore often compared to gold. I can buy Bitcoins and sell them again, that’s all what I can do with it.

Black Manta (in the picture Alexander Rapatz and Christian Platzer brainstorming in down town Vienna) takes the anonymity out of cryptocurrencies and creates financial products.

© Black Manta Capital

The second largest cryptocurrency is Ethereum - and it already has functionality. Here, I can program so-called smart contracts, which means: I make the cryptocurrency intelligent. This is also the use case when it comes to tokenization, where I can tokenize real assets, for example, a property, and represent them on Ethereum and trade with them.”

PANGAEA: Similar to cash, do cryptocurrencies offer a form of anonymity?

“Yes, cryptocurrencies are decentralized and can - but do not have to - be anonymous. This is also what is most criticized by the regulators. Initially, cryptocurrencies were often associated with money laundering or other criminal activities, since transactions could be processed completely anonymously - like cash, only in this case globally, in a matter of seconds and regardless of the amount of the transaction. As an example: I have a wallet with Bitcoins that cannot be assigned to me because it is not registered anywhere. If I transfer my wallet to you, no one will know about this transaction. What we’re doing now at Black Manta Capital, we’re taking out the anonymity to create regulated financial products. This means that every one who invests in products with us must go through an identification process (so-called Know Your Customer – KYC). The issuer as well as the investor must be identifiable at all times. And the transfer can only be made to someone who has gone through this identification process. We are creating regulated financial instruments using blockchain technology.”

PANGAEA: Why would anyone invest in cryptocurrency instead of cash?

“Of course, you can also invest with cash. The hypothesis we had when founding Black Manta was that at a certain point in time, someone would also want to get their cryptocurrency profits back into the “real world” and use them to buy a tokenised property, for example. The advantage: the transactions would be based on the same technology and could be processed in real time. But why am I tokenizing at all? Let’s say I can’t afford to own an apartment but still want to in vest in real estate: by fractionalizing ownership via the blockchain, I can buy a square meter of real estate for a few thousand euros. This means I can, for example, participate in the increase in value and in the rental income, even with small investment amounts. The advantage lies in particular in the instant settlement and tradability in the secondary market, peer-to-peer. This means that if you want to buy a token from me, I can transfer it to you from wallet to wallet immediately. Real time. I no longer need a bank, depot or other intermediary. As a counterexample: if I want to sell my Apple shares to you today, I can’t do that at all. I have to sell the stock back to my custody account - and you can then buy the stock from your bank or custody account somewhere. A peer-to-peer business is usually not possible.”

Black Manta’s Alexander Rapatz is a popular speaker when it comes to cryptocurrencies.

© Black Manta Capital

PANGAEA: How safe are cryptocurrencies?

“That is a difficult question. In my opinion, security is very much based on custody, i.e. the custody system behind it. There are differences whether I have my coins on an exchange, such as BitPanda in Austria, or whether they are physically on a cold wallet (such as a telephone, check card, etc.). Normally, only the respective owner can access the wallet. It should be noted in this context that there are always hacks on exchanges. This is where the disadvantage of anonymity comes into play, because when the coins are gone, they are gone. However, if you have bitcoins on your phone and lose the phone, the bitcoins are gone too.”

PANGAEA: How stable in value can cryptocurrencies be, maybe even more stable than regular FIAT currencies?

“There are so-called stablecoins, which are cryptocurrencies that are tied to a currency like the US dollar. Since this summer there has also been a euro stablecoin that is 100 percent backed by euro monetary assets such as government bonds. However, in order to be considered a real digital euro, they would have to be issued by a central bank. China has come a long way in this regard, in Europe the discussions are still going on. Otherwise, the value of the cryptocurrency depends on supply and demand and we see a very high volatility - but this is also the attraction for certain investors.”

We all know the success stories of people who have invested money in cryptocurrencies and whose investments have since ballooned to incredible amounts. But there’s always a risk that they fall drastically, leaving investors with a deep hole in their pockets.

“The cryptocurrency Terra/Luna has fallen to almost zero within 24 hours. I personally know people who have lost a tremendous amount of money. There are also plenty of success stories as well. But you also have to highlight that things can go up or down very quickly. With smaller cryptocurrencies, it is important that the protocol can be trusted. We therefore recommend every investor not to invest blindly, but to either do their own research or seek appropriate advice.”

Perfect after an extensive workout to enjoy your sports beer with friends.

© www.joybraeu.de