17 minute read

attack of the SUVs

Often derided as the sick man of Pakistan’s industrial base, the automobile sector seems to be experiencing a renaissance period. This is attributable to the crossover SUV (CUV) bonanza that’s currently in full swing. The sector is so dynamic that within three years of its inception it is now the stage for the automotive industry’s grand chess game. In this game, you have the progenitor still consolidating its gains, the Sino-Franco-Malay-Korean up starts, and a resurgent Big 3. The CUV segment is the poster child for the success of the Automotive Development Policy (ADP) 2016-21. It was a market that did not exist prior to the KIA Sportage and has now grown from 5% to 20% over the past three years. It was actually not a market that existed at all. It was carved out at the expense of the Big 3 of Toyota Indus Motor Company (IMC), Honda Atlas Cars Pakistan and Pak-Suzuki Motor Company (PSMC). Writers note: SUV is used interchangeably with CUVs in Pakistan and in many other countries where CUVs are described as small to medium size SUVs. We will use a liberal interpretation of the term for the sake of math, and club all of them together. At least, until we get completely-knocked-down (CKD) Prados for proper market differentiation.

Advertisement

Not only has the CUV/SUV segment achieved significant success, but it is also poised for further growth. Its market share is expected to increase from 20% to 37% by 2030 according to Shabbir Uddin, Director Sales and Marketing at Master Changan Motors. This will come at the expense of the sedan and hatchbacks segments.

Disregarding the industry’s protectionism, capital allocation of this sort would probably make Adam Smith proud.

All of this, at some level if not all, is attributable to the KIA Sportage. However, before the Sportage could consolidate its gains, it had competitors, and it’s half-sibling (we’ll get to this) at the gates armed with its blueprints for CUV success.

The Sportage may have found itself to become the first incumbent in the segment. However, all the entrants born from the ADP that sought to challenge the Sportage have now become incumbents as the Big 3 are now mounting their own entry to the CUV market with their CKD lineups.

To explain how everything got to this point. Let’s first begin with where it started and that is the KIA Sportage.

Amir Nazir, General Manager of Sales and Marketing at Honda Cars Pakistan Limited

Suffering from Success

DJ Khalid’s album titled Suffering from Success may not have drawn inspiration from the KIA Sportage but it is the most apt description of the situation. The KIA Sportage is the undisputed leader in the CUV market. It’s also probably in the same league as the Suzuki Mehran and Toyota Corolla in terms of cars that hit the ground running. Possibly even in terms of cult status. Its success is immeasurable. Quite literally, as Lucky Motors does not publish sales figures. Lucky Motors is not a part of the Pakistan Automotive Manufacturers Association’s (PAMA) and is thus not bound to release sales figures. When asked about this, Lucky Motors told Profit that it is their company policy to not disclose sales figures. It is because of this that we have to employ creativity to ascertain the success of the KIA Sportage.

The Sportage celebrated its 25,000 sales anniversary in March 2021, 20 months after being released in August 2020. Now 25,000 sales over the course of 20 months may or not sound like an impressive figure, depending upon who you ask.

Looking at figures provided by PAMA for context, the Toyota Corolla, arguably Pakistan’s most famous car, recorded 33,413 sales over the same time period. The Toyota Fortuner in comparison, Pakistan’s most expensive completely knocked down (ckd) car, recorded 3,538 sales.

Recording seven times the sales of the Fortuner and nearly as many as the Corolla is, perhaps, exactly where the Sportage wanted to be when Lucky Motors first conceived the thought of it. Doing so with a new vehicle, launched by a new company, in a non-existent category, and then achieving those figures is probably over and above what Lucky Motors expected.

It has continued to make strides (possibly). Looking at Lucky Motors’ financial statements, their turnover from their automotive

It’s not like we do not understand this. The Sportage created space for not only itself but also chartered a path for others to follow. We are mindful of the fact that you need to bring change at an appropriate time. The new Sportage is more expensive in every market it has been launched. If the price exceeds a certain point then volumes come down

division grew 25% from PKR 77 Billion to PKR 96 Billion between 31st March 2021 to 31st March 2022. Profit is led to believe that most of this increase is from the Sportage.

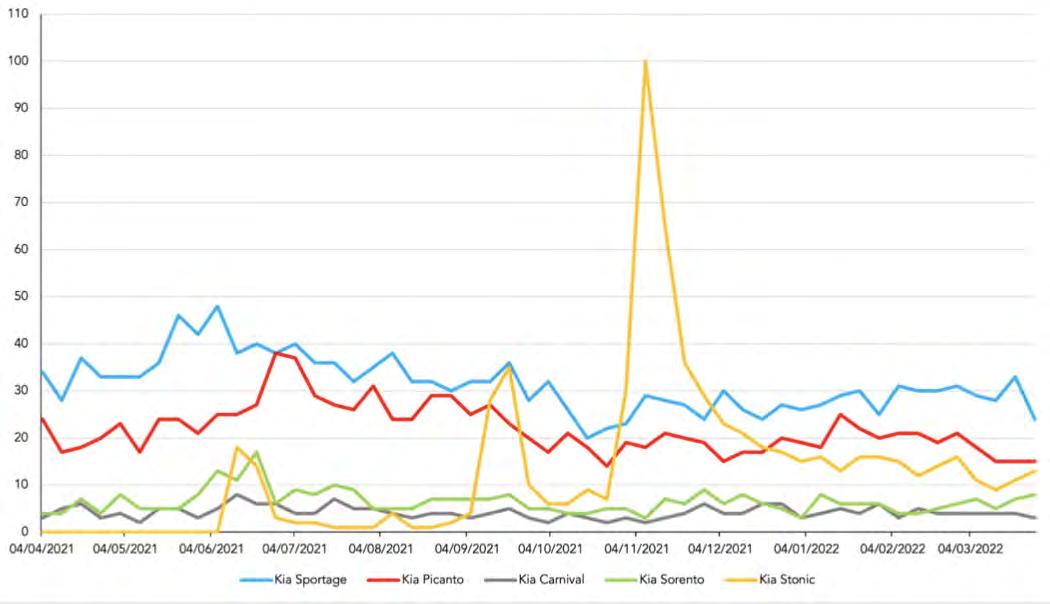

Simply looking at Google Trends one can see which of Lucky Motors’ cars from its KIA portfolio garnered the most interest.

However, it would be premature to make any assumption based on just Google Trends alone.

“The Sportage was our most popular car. We were averaging sales of 250-300 Sportages a month before the import issue arose.” said a member of the sales team at a local KIA dealership in Lahore. “If we sold 10 cars a day then seven of them would be Sportages,” he said when asked about the popularity across their vehicle portfolio.

However, Profit is still not going to risk upsetting the competitors. Estimating a range of 40-70% of total sales, Profit did the maths as to how many KIA Sportages, Lucky Motors may have sold to get the turnover figures that they did. Let’s just say we arrived at a lot of Sportages sold across all our possible estimates.

Competitors are free to arrive at their own conclusions from these figures. These figures are keeping in mind that Lucky Motors’ Q1 2022 figures include the Peugeot 2008. The 40% to 70% range is given to adjust for this.

However, this is where the problem starts and our ode to DJ Khaled begins.

The Sportage has changed the Pakistani car buyers preferences for better or worse, depending upon who you ask. However, in doing so it now risks its own demise as it may have subsidised the success of all the new entrants.

Pakistani customers are now not only open to the idea of trying new companies, but are also acutely aware that they too are deserving of purchasing the latest models of any car like their international consumer counterparts.

The importance of having the latest model available may not seem important at first glance, particularly given how Pakistani customers have become accustomed to purchasing globally outdated vehicles courtesy of the Big 3.

Releasing the globally prevalent model was one of the main reasons for the Sportage’s success. To put the importance of this in context, Lucky Motors has already been punished by the market for releasing an outdated model of their KIA Sorento. Customers would have been shocked in 2016 if you told them they would become automotive connoisseurs within a decade.

“It’s not like we do not understand this. The Sportage created space for not only itself but also chartered a path for others to follow. We are mindful of the fact that you need to bring change at an appropriate time. The new Sportage is more expensive in every market it has been launched. If the price exceeds a certain point then volumes come down. From Pakistan’s perspective, you need to justify your volumes to be viable,” said Muhammad Faisal, President Automotive Division at KIA Motors, when asked about the entire matter.

So what could be the price of the new KIA Sportage in Pakistan? Well, Profit decided to do some creative mathematics and figure out what it could be.

Firstly, Profit looked at the LX and X-Line AWD variants of the Sportage across a range of possible estimates for what the Rupee will settle on against the US Dollar. A 15% profit margin was then utilised to find that the new Sportage CBU could retail for anywhere between PKR 15 million to PKR 23 million.

The importance of looking at the CBU price of the Sportage is because Lucky Motors sells the CBU and CKD variant of the Stonic, at least, in its Lahore KIA dealership. The price difference between the CKD and CBU variants is 10% for the EX and 15% for the EX+.

Utilising the 10-15% difference between the CKD and CBU units, Profit estimates that if the new KIA Sportage achieved the levels of localisation of the KIA Stonic then its price could range from PKR 14 million to PKR 21.5 million. This range includes the application of the 10-15% discounts. Even with all the current price increases, these prices are steep.

Lucky Motors seems very self-aware of the conundrum they are in. However, so are the new entrants. They saw Lucky Motors dislodge the Big 3 due to their lethargy. They now smell more blood, coming from the current incumbent this time, and are going for the jugular.

The Floodgates are Open

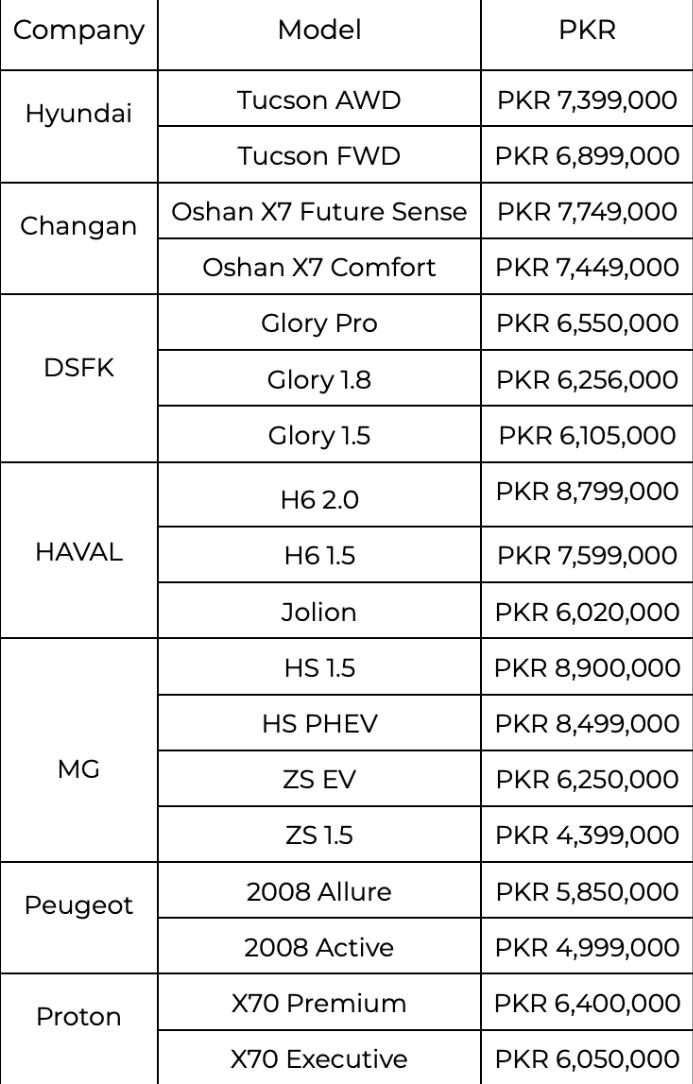

Kharbozay ko dekh kar kharboza rung pakarta hai aur Pakistani auto manufacturers doosray ki gaari ko dekh kar apni gaari launch kartay hain. The number of CUVs on offer across the new entrants is astounding. It would be remiss to highlight that one may forget how many CUVs are available in the market. So let’s do a count. To strike when the iron is hot would be an understatement. Just looking at the aforementioned sheer variety, within a range of PKR 4.5 million, customers can choose between 18 different CUVs apart from the Sportage and the Corolla Cross (we’ll get to the latter in particular, later on). The new entrants have not only provided customers with choice but are also a breath of fresh air in terms of features. The CUV category already has the title of being the parent category of Pakistan’s first automotive export, and also potentially the first CKD hybrid vehicle.

The CUV market is actually so enticing that Lucky Motors’ new Peugeot brand only has CUVs right now. This is probably the Sportage’s Brutus moment with the Peugeot 2008. However, it’s also the finest example of pragmatism.

Pragmatism is probably the best word to describe the entrants. “Customers prefer vehicles with greater height because of the safety and status it provides,” said Amir Nazir, General Manager of Sales and Marketing at HACPL, when asked about why CUVs appeal to customers.

Profit identified the allure of being a Chaudhry Sb on a budget as one of the reasons for the Sportage’s success. Newer entrants were likely cognisant of this when they all doubled down on the CUV market.

“The global giants are large ships and MG is a speed boat. Our turning radius is much better so we can respond to the needs of customers more quickly,” said Syed Asif Ahmed, General Manager of Sales and Marketing at MG Motors, when asked about the CUV segment. Though these are his words, we can assume that all automotive top brass across the new entrants are similarly buoyant.

However, their buoyancy may be all there is to it.

The competitors, though numerous, have not significantly dented the Sportage’s success. Profit would like to have substantiated this claim with data, but we assume the new players believed not releasing sales data was part of Lucky Motors’ recipe for success because none of them have posted it.

The Hyundai Tucson is the only outlier with publically available sales figures. Brownie points for their confidence.

The Tucson was poised to be the main rival to the Sportage largely on account of the Sportage and the Tucson sharing the same frame because Hyundai and KIA are sister companies globally. However, the similarities between the two end about there.

The Tucson has only recorded 8,643 sales since its launch in August 2020. The other main competitor, and arguably the loudest, the MG HS, made initial strides but has since been encumbered in a tax and legal quagmire.

It would be incorrect to paint the entire industry with the strokes of MG and Hyundai. The new entrants will likely mount a challenge like no other in the CUV market. All whilst claiming to be the best two syllable company from their country of origin.

All of this was the assumption till the Pakistani Auto Show 2022 took place. This is because it’s no longer the new entrants compet-

ing with one another in a market they largely created and occupy. This is because the Big 3 are back, well maybe.

The Empire Strikes Back

“It does not make much sense for any player to bring a newer generation model in this economic situation,” said Faisal when asked about the state of competition. The Big 3, however, probably did not get the memo. The Pakistan Auto Show 2022 marked nearly three years since the Big 3 were left reeling by the rise of the Sportage. Another two years since they were subsequently made to feel like boomers by the new entrants. The event showed that the Big 3 had not been licking their wounds idly. Imitation may be the best form of flattery and that could not be truer than with IMC, HACPL, and PSMC all using the event to highlight their own CUV offerings. “All cars have a replacement cycle of three to four years and the current cycle for CUVs is coming to an end,” said Nazir. Early adopters of the Sportage will now be in their third year of owning the vehicle so the timing is ideal for the Big 3. “We will be introducing the latest edition of the HR-V. We expect customers to be attracted by its design and fuel average,” explained Nazir when asked about what will entice customers to the HR-V. The Cross and the HR-V were launched globally in 2020 and 2021 respectively. Releasing the latest globally prevailing model in Pakistan relatively so soon breaks with the Big 3’s norm. It not only highlights how far Pakistan’s automotive landscape has come but is also rather ominous for a certain KIA Sportage.

However, the return of the Big 3 for now at least is more like the Storm Troopers and less like Darth Vader. This is because, for starters, we do not have any release date as of yet.

IMC and HACPL have given tentative dates for 2023 but it would not be impossible for them to just extend the timeline to 2024. They could easily do this and cite the current economic situation and their preoccupation with a certain import conundrum that’s led them to take very unexpected decisions. We don’t think anyone expected the IMC refund at all.

It’s also interesting that PSMC revealed their XL7 as a sample vehicle and as an MPV. The general belief seems to be that it’s a Trojan Horse because PSMC may have thought no one would Google it and see that Suzuki advertises the XL7 as a CUV/SUV in other markets such as Indonesia and Thailand. The decision to market it as a sample vehicle may very well be on account of the economic situation as PSMC, like IMC, is currently subject to a production crisis.

Maybe not the best move to expand your production portfolio when you can’t produce existing orders? PSMC may be thinking along those lines and may have kept the XL7 as a sample vehicle so that they can introduce it on their own timeline, whilst also being able to reject all questions about it from the media. IMC and HACPL may not have thought that through.

Furthermore, apart from release dates, there is no expected price for any of the models either. IMC has hinted at a price of PKR 10 million with Nazir confirming that the HR-V will be priced competitively. The HR-V and Corolla Cross are both cheaper than the new KIA Sportage, however, PKR 10 million may be a stretch today.

Assuming a one- to two-year horizon, the PKR 10 million figure may be a reality given that IMC and HACPL are likely to be ahead of Lucky Motors in localisation solely due to the

number of years they have been in business. However, given the Big 3’s track record with localisation, we cannot be too optimistic.

IMC and HACPL would benefit from the reduced import duties on the import of parts for hybrid vehicles outlined in the Auto Industry Development and Export Policy (AIDEP) 2021-26. However, the cost savings are debatable given that hybrids are generally more expensive in terms of their upfront costs. Honestly, a Daronomics-backed Rupee might be the only way IMC, HACPL, and KIA are able to launch affordable CUVs. However, this may not be the hill to die on for the three as the Civic warps perception of what is considered affordable.

This is also just another moment to appreciate how right the new entrants got their prices in terms of the larger players. PSMC’s XL7 will not be subject to this problem. It competes directly with the B-Segment Sedans and might just undercut everyone.

Irrespective of the problems with the Big 3, their decision now puts all existing CUV players under a crunch.

Hyundai, for example, faces a very comparable problem to the KIA Sportage due to it too having an outdated design. The only difference in the situation is that the Tucson has a fraction of the Sportage sales numbers. Do you cut your losses and come back to fight another day with a newer model or do you persist? That is a question Hyundai-NIshat will ask themselves. Thankfully, they now have the productive capacity to undertake any overhaul as Profit was able to confirm from a source at the company who preferred to not be named.

MG and HAVAL are still in the midst of setting up their local assembly plants and, therefore, will likely face capacity constraints comparable to what Hyundai-Nishat faced last year.

By the process of elimination this just leaves DSKF, Changan, Peugeot, and Proton in the ideal position to benefit from any disruption at the top.

Will they benefit from more customers wanting CUVs courtesy the Sportage, more features courtesy the Big 3, at low prices, and all whilst MG and HAVAL face production issues?

Maybe.

It’s a lot of assumptions. The Sportage may dwarf the cumulative CUV sales of everyone listed in this based on information available. Or rather, the lack thereof.

Assuming the Sportage to have come to the end of its journey may be a bit premature. It may just have inadvertently benefited from the global and domestic supply shocks that hinder production of these latest iterations of CUVs. An older model might just be beneficial in this situation.

“Not a lot of time has passed since the Sportage was launched. It still has the potential to continue further and we think its current price point still provides value for money from a customer point of view,” said Faisal.

The coming year will test the resolve of the KIA Sportage to retain its position at the very top of the CUV market. It is faced with the dilemma of whether or not to introduce the latest model of their best selling car. If they do not then they risk becoming the Big 3 and if they do then they risk low sales volume.

Whilst Lucky Motors ponders over the matter, it is likely new entrants will be out for a pound of flesh.

The original Big 3 will finally be getting their opportunity for revenge against everyone. Now whether their return is more akin to Godfather 2 or Godfather 3, we will find out once they release their CUVs.

The certainty that we do have is that the wild west of the CUV market may be coming towards its final destination. It is just ironic that the Big 3 may utilise the same tactics to return that were used to dislodge them. n