9 minute read

Demand boosts steel prices

the decades before, this still means that the penetration of tractors in Pakistan is only 0.9 horsepower per hectare of cultivable land. Compare that to the required power of 1.4 horsepower per acre, meaning there is a shortfall of 0.5 horsepower per hectare. Now, from July 2018 to March 2019, the total tractors’ production in the country stood at 37,399. Of that, a substantial 64% was produced by one company alone: Millat Tractors.

Still, tractors account for 7% of largescale manufacturing in Pakistan. The actual structure of the tractor market is somewhat oligopolistic. Millat Tractors has a 70% market share, and a production capacity of 40,000; while Al Ghazi Tractors has a 29% market share, and a production capacity of 30,000.

Advertisement

Millat has always had a bit of a headstart when it came to tractors. Started in 1964 in Lahore, it is the authorized manufacturer of the American Massey Ferguson tractor in Pakistan. The company was nationalized in 1972, and made a part of the Pakistan Tractor Corporation (PTC).

The PTC started an indigenisation programme in 1980, and got Millat Tractors on board to set up engine assembly plants in Pakistan. To this day, that programme has been successful: the tractor industry has achieved 95% of localisation in production.

As a result, this has led to cheap tractors when compared to tractors around the world, but is still unaffordable for the majority of farmers in Pakistan. As has been previously locally reported, most farmers find it difficult to invest in a tractor given that the average size of their farm is quite small for the purchase of a tractor to make sense. In addition, rates on loans from banks have not been generous in previous years, thus deterring more farmers from owning their own tractor.

And yet, that was not the case in 2021. According to the Pakistan Economic Survey of 2020-2021, total tractor production jumped 57.5% from 23,266 in 2020, to 36,653 in 2021. “The production increase was largely due to an improved liquidity position of farmers,” the survey said.

And the numbers were reflected in Millat Tractors as well. In fiscal year 2021, the company sold 35,527 tractors, depicting a growth of 70% year-on-year. And in the first four months of fiscal year 2022, the company sold more than 10,700 tractors, growing by 5% year-on-year. Among the total sold volumes, around 45% of the contribution was from bigger tractors (more than 60HP) while around 55% of the contribution was from smaller tractors (less than 60HP).

In a recent analyst briefing meeting, Millat Tractors said the affordability of the farmers this year is higher than previous years due to bumper yields in crops. This in turn may ignite another wave of tractor sales in upcoming months. To capitalize on the growing market, the company plans to increase its product range by introducing 100HP tractors for bigger farm sizes.

Still, the picture is not all rosy. For instance, the company expects export sales to remain under pressure in fiscal year 2022 as trade activities with Afghanistan are currently under a halt. Then, the tractor industry is currently being charged a GST of 5% which may increase to 17% in the near future to meet the conditions of IMF. This may adversely impact the volumes of Millat. A hike in interest rates is also expected to slow down the demand for tractors in the coming months.

And while the localization level of Millat currently stands at 92%, the company is still exposed to foreign exchange risk since the base raw materials of the localized parts are mostly imported.

Still, Millat is banking on its early investment in Hyundai Nishat Motors. The company currently has an 18% stake in Hyundai, with an investment of Rs1.3 billion. The company’s management said it expected fruitful results from this strategic investment when the Hyundai brand matures in Pakistan. The global shortage of semiconductor chips, however, is currently hindering the growth of the company. n

How important is agriculture to Pakistan? The sector contributes 18.5% to the country’s gross domestic product (GDP) and employs 38.5% of the national labour force. Even our state emblem is made up of four crops: jute, cotton, wheat, and tea. Yet for a country that prides itself on its agricultural base, we do not have enough of the one machine one really needs: a tractor

Mughal Steel in particular seeks to benefit

Its a great time to be in the steel and copper sector: prices are rising at ridiculous rates. In a note sent to clients on November 26, investment analyst Mohsin Ali noted that increased demand was having repercussions, both internationally and locally. International scrap and copper prices increased by 11% since October 2021 to currently hover around $488 per ton and $9,932 per ton respectively compared to the fiscal year to date average of $473 per ton and $9,485 per ton. Much of this increase is because of a power shortage and supply concerns which caused smelters to go offline from Chile to China. However, there are concerns over future metal supply cuts may still linger where uncertainty on new recycling restrictions in Malaysia have caused the scrap market to tighten considerably, increasing dependence on refined metal as global demand started to pick up ahead of the winter season. Still, Ali also noted that impressive Chinese export growth in October had counterbalanced some of the pressure mounting on Chinese local manufacturers because of the enormous power shortage, supply-side disruptions and reappearance of Covid-19 cases in China.

“Moving forward, strong Chinese exports in October 21 and booming global demand ahead of winter holiday season could keep industrial metal prices upward in the short run,” said Ali. He also said that the $1 trillion infrastructural bill had been passed by US Congress in November 2021 which was bound to keep copper and other metal prices on a upward trajectory in the medium term.

Meanwhile, closer to home, local rebar prices increased by 9.7% month-on-month to Rs195-197,000 per ton in November 2021. There are three reasons for this: strong retail demand in the construction sector, in both north and south; higher freight cost; and the rupee’s devaluation of 2% since October 2021.

The lower price competition in the local market, due to high retail demand, have also provided room for local rebar manufacturers to pass on cost swiftly. This was reflected in the first quarter of 2022 financial results of more steel players. Both Mughal Steel and Amreli Steel performed well, up 4.8% in November 2021, compared the KSE-100 rise of 0.6% in November 2021.

“Likewise, we expect earnings to remain robust in the near term as, higher rebar prices and pricing power benefits local manufacturers in passing through the input cost, translating into better margins,” said Ali.

Out of all the steel players, Mughal Steel in particular stood out. Its topline registered a growth of 81% year-on-year to Rs14 billion in the first quarter of fiscal year 2022. Similarly, its topline grew 65% to Rs44.9 billion in fiscal year 2021. Most of this was because of the 40% year-on-year increase in local rebar prices in the first quarter of fiscal year 2022, and 45% year-on-year increase in copper price in fiscal year 2021.

Mughal Steels re-rolling capacity for rebars increased to 430,000 tons in fiscal year 2021 against 150,000 tons in fiscal year 2020. The company’s billet capacity stood at 419,000 tons in 2021 and increased by 79,000 tons in FY21. In a recent analyst briefing, the company’s management said that the uptick in construction demand is expected to continue which will stimulate long steel demand, which is expected to increase by up to 7% in fiscal year 2022. This would mean the ferrous demand for Mughal would increase by 25% year-on-year in fiscal year 2022. The management also said that international scrap prices has helped graded steel in gaining more market share as compare to ungraded steel because of lower price delta and higher retail demand.

The company is also well placed, since it able to bulk buy its raw material to hedne against rising freight and raw material prices. This will mean its gross margins should be stable.

And when it comes to copper, the company again has an advantage, having established a brand name. It is able to sell its products to a mere 3% discount to the benchmark LME index in contrast to the average discount of 8-10%.

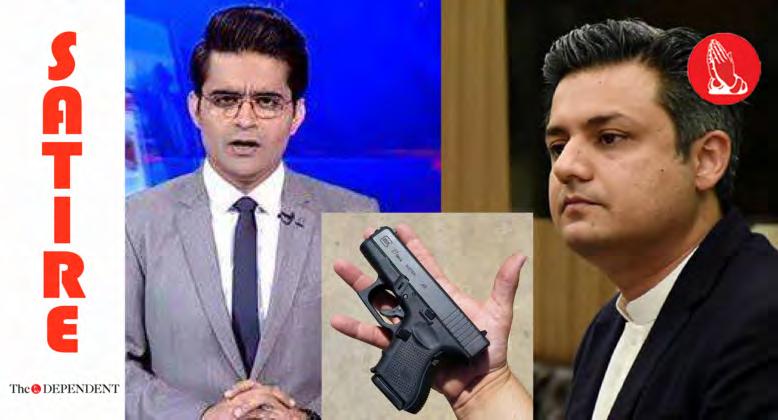

Put me out of my misery once and for all, says Hammad to Shahzeb while handing him Glock

By The Dependent

Federal Minister for Energy Hammad Azhar urged TV news show host Shahzeb Khanzada on Saturday to end the former’s life.

“I can’t bear going on your show again and you-know-who says I must,” he said to Shahzeb, while intercepting him outside his home when he was taking his early evening walk. “Take this, and be careful, it’s loaded,” he said, while handing over a Glock pistol to Khanzada. “Just make it quick.”

“The alternative is something I can’t bear anymore,” he pleaded to Khanzada. “The clips are going to go viral, patwaris are going to stitch those clips with my own statements made on your program. That is, if your own producers don’t do it already.”

“And of late, even the party support base doesn’t defend me anymore,” he said.

“Please, I beg you, finish me,” said a teary-eyed, shivering Azhar.

“No,” said a cold-eyes Khanzada. “You’re coming on my show.”

Youth should be encouraged to take murder blame for employer who will then leave them fortune after killing himself, say personal finance experts

By The Dependent

The youth of the country should be encouraged by the public and private sectors to admit to murder by their employers who will, in turn, leave them their property by signing a legal document before blowing their brains out with a Glock.

These were the views of a panel of personal finance experts that convened at a seminar at a local hotel on Tuesday.

“We know that with rising inflation, it is tough to make ends meet,” said Saleem Hassan, an accountant and personal finance Instagram influencer. “Jobs are hard to come by and if one is lucky enough to even get even a good job, the salaried class isn’t really living it up. Even if you do earn a decent living, forget about savings.”

“Business could be another option, but how to start a business without startup capital. Or even experience?”

“Therefore, the best way to earn a living and, indeed, achieve some savings, is to plead guilty to murder on behalf of your wealthy employer, even though he had not asked the youth to do so and had, in fact, sent over a good lawyer to help the youth out of the police lock-up,” he said. “The indebted employer, of course, will not forget this and will remember to sign over everything to said youth right before bumping themselves off.”

“I agree with this completely,” said Fatima Chaudhry, a Snack video dance/ personal-finance influencer. “That way, when the youth gets out of jail – which is basically nothing worse than reading some Jaun Ailia and Khaled Husseini in a well-lit cell – they can go to the ridiculously large mansion that is now theirs, in a convoy of SUVs.”

“It’s really just about the only viable and believable way for the permanent underclass of this country to punch up.”