17 minute read

No, the stock market is not an accurate indicator of the economy

No,

Advertisement

Profit answers your questions and lists out the reasons why the stock market isn’t an indicator of the economy

By Ariba Shahid

The stock market is not an accurate indicator of the economy. If you’re on twitter you’ve probably read this scribe tweet about it often enough - at times ad nauseam even. Whether you agree or disagree to the statement widely depends on a number of reasons.

Before we get into details and talk about whether or not the stock market is an indicator of the economy, let’s talk about what politicians say. It’s simple. If you’re in government and the stock market index goes up taking credit for it seems like the best thing to do because optics. If you’re in opposition and the market goes down, you could say that the government is doing a terrible job at managing the economy and it is reflected in the index’s performance.

Our argument, which also happens to be true by the way, is that whether the stock market goes up or down it says absolutely nothing about how the economy is doing. It does say how people think the economy is doing, but that is a pretty big and pretty significant detail. However, before we debate on this concept, let’s get some concepts straight, and to do that let us answer some important questions.

How do you define an economy?

Atextbook definition is that an economy is the state of a country or region in terms of the production and consumption of goods and services and the supply of money. In order to understand how the economy is performing we use a number of indicators. These indicators are pieces of economic data. They are usually macroeconomic and not microeconomic.

Macroeconomic data is basically data for the aggregate economy. This means large scale data such as the total number of cars produced in an economy in a year. Microeconomics, in contrast, is on a smaller level - as the name suggests. For instance, the number of cars produced by a single manufacturer in a year. Another example to understand this better could be the total money spent by the government in a year is concerned with macroeconomics; while the total money spent by your family in a year is concerned with microeconomics.

What do we mean by economic indicators?

There are a number of economic indicators. Essentially investors or analysts can use any indicator they deem relevant to the research they are undertaking. However, some indicators are widely used as they are released by the government or dedicated organizations. For instance, the consumer price index, gross domestic product, unemployment rates, debt, exchange rate, risk premiums, budgets, current accounts, interest rates, gold and oil prices, and stock market indices.

Some of these indicators work hand in hand with the economy without lag, some have impacts on the economy in a lag, and some are impacted by the economy with a lag. For instance, the GDP is an indicator of the economy. When the GDP grows, in crude terms the economy has grown too. To refine this, we look at real GDP instead which is inflation adjusted GDP.

Similarly, interest rates have an impact on the economy. When interest rates are higher, output growth slows down as investment slows down. In contrast, the stock market as an indicator is debatable and also depends on a variety of factors.

What is a stock market?

The stock market can also be called a stock exchange. Essentially, when you’re buying a share on the stock market you’re buying the ownership of shares in a corporation. Similarly, when you’re selling shares, you’re selling your rights to ownership. Incorporated companies list on the stock exchange to raise money.

What this means is that the stock market is composed of buyers and sellers of shares. This does not represent all businesses, employees and households. People use indices to understand how the market is performing.

What is a stock market index?

Astock market index is an index that measures a stock market. It helps investors compare current price levels to the past as a gauge of market performance.

In Pakistan we have the KSE 100 index, KSE 30 Index, KSE All index, KMI 30 Index, and KMI All index. The KSE 100 index is a stock index that is used as a benchmark. 100 companies with the highest market capitalization are chosen. In order to make it a greater representative, the company with the highest market capitalization from each sector is also included. Approximately 90% of market capitalization is represented by these companies.

The KSE 30 index on the other hand only represents the free float of shares rather than using paid up capital as a determinant. Top 30 companies participate in it.The KSE All Index is an index used to show changes in all the stocks listed on the PSX.

The KMI 30 index is called the KSE Meezan Index. These companies listed in this index are Islamic Shariah Compliant. It was introduced in 2009. At the time, the Karachi Stock Exchange (now PSX) and Al Meezan Investment Bank (now Meezan Bank Limited) created the index. It is calculated on the basis of free float market capitalization. The index reflects the free float market value of selected Shariah-compliant shares in comparison with the base period. KMI-30 is recomposed semi-annually. Some day we’ll write an ELI5 on the KMI index and the criteria.

So does the PSX accurately represent the economy?

If you don’t want to read ahead, let’s make it simple for you. No. it doesn’t. While there have been many papers written about the relationship between the stock market in general with the economy, and the PSX and Pakistani economy specifically, we’re going to list a few simplistic reasons. There are, of course, more. In case you don’t buy it, here are the major reasons why the PSX cannot be taken as an accurate indicator of the economy.

Reason 1:

The PSX market capitalization to GDP stands at 17.39% in FY21. It was around 43% in 2007. What this means is that the country’s output has grown while the PSX’s contribution to the output has shrunk.

Reason 2:

The stock market does not represent all the companies that make up the Pakistani economy, especially considering the size of the informal sector. The market is largely made up of corporations that are larger and have access to broad capital markets which not all small companies do. If we talk about Pakistan, agriculture remains a huge source of employment, most of which is in the informal sector and is not listed on the market. However, spillover effects happen, such as employment generation through the demand created by the companies listed on the PSX.

Reason 3:

The money invested in the PSX is somewhat concentrated in a few hands. For instance, big conglomerates have multiple companies listed on the PSX. Top 12 groups in Pakistan own around 41% of the total value of the PSX. That is how concentrated the market is.

Reason 4:

Investors do not always rely on fundamentals to invest in the PSX. They may be driven by emotions or speculation. Their behavior may not always go line in line with the economy’s performance and current affairs. The market isn’t really the most rational place in the world. Had it been rational, we wouldn’t have seen market crashes or markets rallying for no apparent reason.

Reason 5:

Bubbles exist. Individuals, institutions and the government should stay weary of speculative bubbles, especially when there are no other strong economic indicators to back this.

A recent example of this is from 26 May 2021 when the PSX saw an all time high daily trading volume. The government was quick to take credit and make it seem like the economy was booming. However, a deeper look into the trading showed that it was indeed not the economy that was pumping up volumes. Out of a volume of 1560 million shares, 707 million were added by Worldcall Telecom Limited making up almost half of the total intraday volume. Volume was witnessed in WTL considering the recent news of an acquisition or an alleged pump and dump. Now tell me dear reader, does that mean the PSX and the economy are highly integrated?

Reason 6:

There are a handful of investors. There are only 252,322 unique investors on the PSX as per data by NCCPL. 12,356 are foreign accounts. How can the PSX be an indicator of the economy when it doesn’t even engage a significant proportion of individuals?

What does all of this mean?

We’re not saying that the PSX has nothing to do with the economy. Ofcourse, when the economy is performing better there is usually more activity on the PSX. However, we’d like to say that the PSX is better at explaining or representing what investors expect in the future or how they feel about the present. It could be used as an indicator of expectations or sentiments. However, even with that the indices may not be a true representative.

The good thing is that in economics, there is always room for proxy variables in the absence of true indicators n

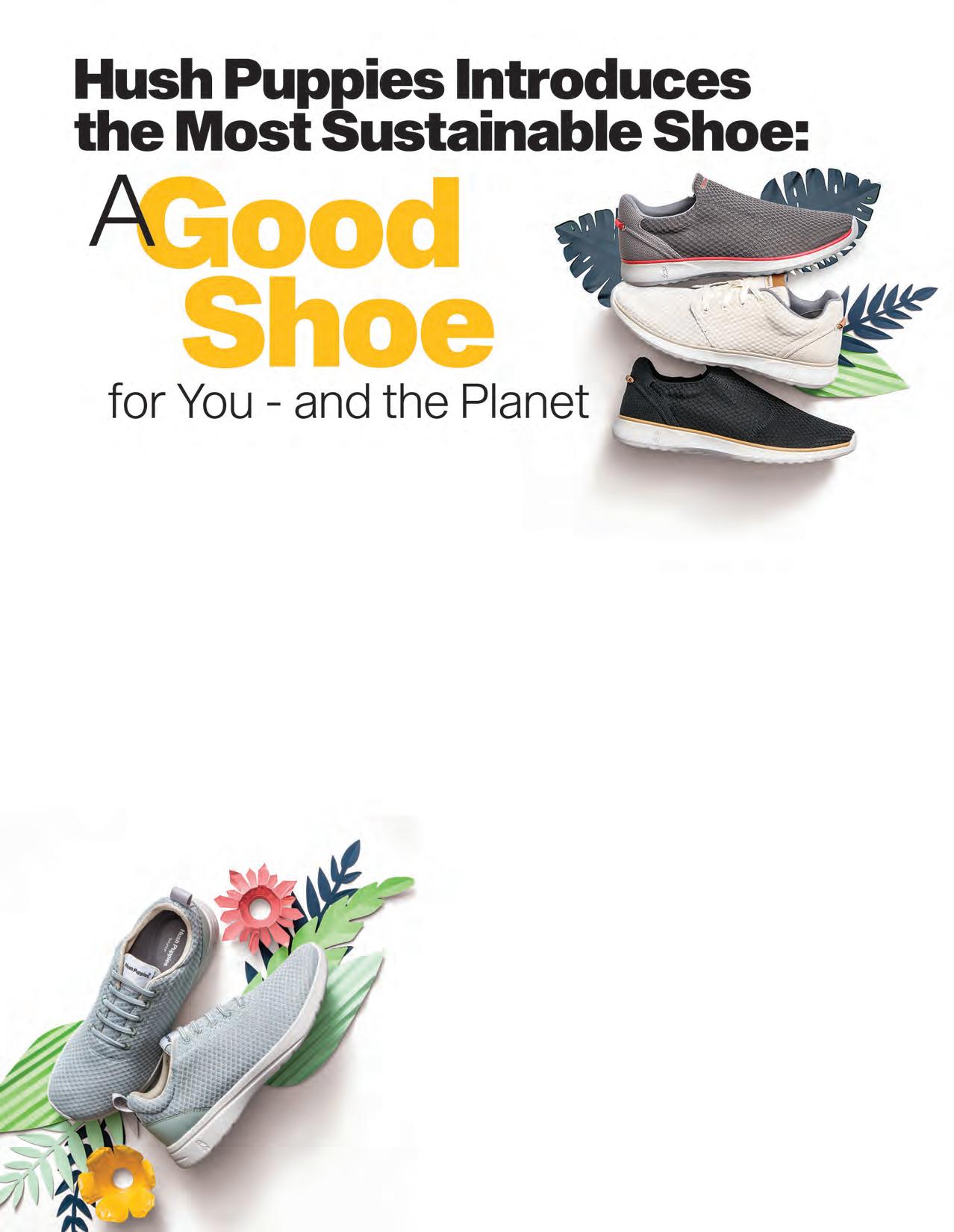

Hush Puppies is renowned for its casual footwear catering to men, women and children. Their focus has always been about making a positive difference and inspiring their customers to “help shape a brighter world.” Today, that means a world where the pressing matter of climate change is addressed. According to German watch, Pakistan ranks 5th in the list of countries most vulnerable to the adverse impacts of climate change. Hush Puppies wants to help bolster our government’s efforts to mitigate this change through Vision 2025. In line with this belief, they have introduced the first ever “Good Shoe” in their range – an eco-friendly, stylish shoe that doesn’t compromise on comfort. “The Good Shoe” uses bounce technology in the sole which helps one stay comfortable with sustained cushioning even up to 250,000 steps. The shoe is made from algae harvested from water bodies where it is causing harm, and has 100% recycled uppers made from ocean landfills plastic (from approximately 500,000 plastic bottles) helping improve the environment by giving a second life to those plastics and reducing trash in our landfills. All round, it is their most sustainable shoe. Their mission is to innovate their core Body Shoe category (which is also made from Bounce footbed technology, with bio-Dewix and bio-Derix, the antimicrobial inner and upper being made of these natural and sustainable dry fabrics which are good for moisture management, among many other benefits) and provide the wearer with unmatched comfort. And that isn’t all: Hush Puppies is planning to plant a tree for every Good Shoe sold, meaning each pair is a direct step towards climate resilience.

In order to get more people to play their part in creating a greener and cleaner future through small steps, the brand has also taken to social media with their initiative, creating the viral #smallstepschallenge. The company is firm in their belief that each positive action towards protecting the environment, no matter how small, is significant in the fight against climate change. Further, Hush Puppies has partnered with Waste Busters for a tree plantation drive, the first leg of which is complete. In honor of Independence Day, they plant 500 trees in Raiwind, Lahore.

Firhaj Footwear (Pvt.) Ltd subsidiary of Umer Group of Companies introduced the brand in Pakistan, where the growth rate of their shoes has been recognized and appreciated by Hush Puppies® USA as being the second largest in the world. The Umer Group of Companies has always been conscious of environmentally-positive measures. Another project undertaken as part of this environment protection initiative is the deployment of a large-scale solar power unit producing 50kV of clean electricity. This unit will significantly reduce the company’s carbon footprint. This switch towards using renewable and sustainable energy resources is a huge win for environmental health.

In addition to this, Hush Puppies is one of the only local companies to have integrated their Point of Sale system online. This avoids production of paper waste through printing invoices. The company actively educates customers about the importance of SMS or Email based invoices to eliminate the need for paper entirely.

Mohammad Qasim, Managing Director of the company, is focused on leading the change: “at Hush Puppies, we try to take every step we can to ensure a sustainable future. From our products all the way down to the hand sanitizers we use, we try to emphasize on eco-friendliness.”

Hush puppies has clearly renewed their focus on sustainability and is making exhaustive efforts to ensure they not only reduce their carbon footprint with their green investments and sustainable products, but also encourage others to play their part in improving the environment. Their socially responsible and future-focused approach is inspiring and other companies should follow their lead in taking action in every capacity to combat the pressing matter of climate change.

The valuation has implications beyond just Airlift as a company

By Taimoor Hassan and Meriyum Ali

According to that year’s annual report, it was not actually the pandemic that affected the company - after all, sales only dipped 6%, because of government lockdowns. Rather, it was the devaluation of rupee against the dollar which increased the cost of the company’s inputs.

It’s not every day that the head of a country decides to comment on the ‘tech valuation space’. This is especially true in Pakistan, where you would think the collapse of our western neighbour to armed terrorists, or the imminent climate change disaster on our hands, would take up headspace, rather than the musings of tech bros on twitter. Not so here: it speaks to the complete paucity of decent news in recent times that Prime Minister Imran Khan found time to tweet the following: “We welcome the recent investment of $85 million by leading VCs of the world in Airlift, a company led by young Pakistanis. Pakistan has huge potential and we are open for business. My government {sic} is fully committed to creating opportunities.”

Unless you are living under a rock, you will have by now found that Airlift (a startup that this writer has used exactly once, to order potatoes (make of that what you will)), is now one of the highest valued tech companies in Pakistan, with a higher valuation than actual listed tech companies on the Pakistan Stock Exchange. Again, it speaks to the rarity of this news, that even mainstream news channels struggled to figure out how to broadcast this information - valuation? investment? VCs? But this appears to be a good sign: Pakistan is (finally, finally) now entering a brand new world, where technology takes paramount importance over agriculture or construction,

and where increasingly this jargon will become more commonplace (and not just limited to the realm of a small few). And that is also what Shahrukh Saleem, analyst at AKD Securities, also highlighted in a report sent to clients on August 20.

Airlift has only claimed to raise $85 million in Series B funding, which potentially takes the total amount of funding raised by the company to $109.2 million. As earlier reported by Profit, Airlift has managed to secure only $30-40 million, out of the claimed $85 million investment in Series B1 and Series B2 rounds. Whereas for the remaining $45-55 million, the startup plans to go for a Series B3 round in the fourth quarter of this year and Airlift is only riding the hype with the tweets on claims of $85 million funding, which it has yet to raise completely.

What’s of more importance, however, is that like many out there, even perhaps the prime minister is not aware that the present regulations keep investors from coming into Pakistan and the Airlift funding is also going to be channeled to the holding company (HoldCo) in Singapore, which is the parent company and owns Airlift in Pakistan, from where only bits and pieces of this investment will sporadically be invested into Pakistan. As the company, Airlift, has expressed the desire for international expansion, we expect only little will be coming into Pakistan (maybe $10-15 million only) and most will be invested outside the country. Middle-east is one of the regions where Airlift would be investing and is reportedly in the process of setting up an office in Dubai.

We can, therefore, rightly challenge Airlift co-founder and CEO Usman Gul’s statement that the financing will add five per cent to the country’s foreign direct investment (FDI) for the fiscal year 2022. The financing that has been secured so far was co-led by Harry Stebbings from 20VC and Josh Buckley from Buckley Ventures Ltd., with participation from former Y Combinator president Sam Altman. The Lahore-based company started off as a decentralized transport network with an aim to provide affordable mass transit, but because of the pandemic, made an abrupt turn towards last-mile delivery.

The funding that has so far been raised is still a sizable amount. Before Airlift, it had been e-commerce behemoth Daraz that had secured large funding of $55 million in their Series B. Rightly so, it cannot be underestimated how huge of a deal this is: Pakistan startups have raised a cumulative $165 million in 2021 to date. If you take out Daraz’s $55 million, that is larger than the combined proceeds in the past six years. And if Airlift gets the $85 million, it will account for 52% of the amount raised by Pakistani startups during the past

Imran Khan, Prime Minister of Pakistan

six year.

An even bigger deal is the proposed valuation of Airlift, which stands at $275 million. This is for a company that started in March 2019, and pivoted to a brand new business plan in March 2020. Airlift’s higher valuation will enable other startups to claim higher valuation as well. Meanwhile the valuations of PSX Tech bluechips stand at just $547 million for TRG, $518 million for SYS and just $195 million for AVN. These are established companies that have been around for years. Which leads to the question: are these seriously undervalued?

Shahrukh Saleem at AKD Securities seems to think so. As he points out, the latest round of funding by Airlift casts key insights on potential valuation for the listed Tech sector, opening up opportunities of re-rating of multiples where investors have only recently realized the potential of the technology sector. This is especially true considering that the technology sector posted a return of 174.1% in fiscal year 2021, compared to just 35.7% of the market.

“Market cap for SYS/AVN/TRG stands at $518/195/547 with P/S standing at 7.0/6.3/6.9x where market grapevine suggests Airlift’s P/S multiple at 6.0-6.5x,” Saleem notes.

According to him, historically, the re-rating of multiples in the technology sector can be traced back to increased funding in Pakistan’s startup space, mainly by foreign funds, indicating increasing confidence in Pakistan’s growth prospect.

“Consequently, with local startups moving towards Series B and C rounds, increased foreign interest can again lead towards rerating of listed tech companies. Moreover, apart from SYS and AVN, this also bodes well for small cap companies like TELE (Telecard Limited) which is poised for strong future growth,” he says in his report.

And for all the FDI-obsessed warriors out there, what perhaps should make everyone sit up is that technology is quite literally going to save the country. Tech based funding inflow stood at $165 million - which is a completely contrasting picture to foreign interest in Pakistan, with PSX witnessing an outflow of $138.2 million this year. And the listed tech space has attracted $20.9 million of inflow compared to outflow of $63.3 million from traditional blue chip sectors, bank and oil and gas. This clearly indicates changing investor preferences at a global level.

That is what Saleem posits as well: “With Pakistan’s IT based exports reaching $2.1 billion in fiscal year 2021, up 47% year-onyear, we believe the sector is poised to become a pivotal component of the country’s exports and as such, will continue to command investors’ attention.” n