9 minute read

Cocomos and IPO frenzy - this week in Pakistan’s business and economics Twitterverse

Cocomos and IPO frenzy

this week in Pakistan’s business and economics twitterverse

Advertisement

In this week’s social media round up, Ariba Shahid walks us through the falling number of cocomos per packet, Karachi’s complex relationship with Tabish Gauhar, Waqar Zaka’s war on Elon Musk, as well as what to do if your boss sees your tweet about them. All this and more in this week’s social media roundup.

For the love of genres Conclusion

Not so impressive records

While we agree with Asra on how the population finds it cool to hate on Pakistani content, we can’t help but mention the fact that Hollywood comes out with hundreds of movies each year. A majority of those movies have nothing to do with the army. Pakistan comes out with a handful of movies in a year out of which more than half of them are either by the ISPR or about the army in some way. We even got a navy movie believe it or not. A romcom here or a comedy there that does not involve patriotism might be nice. Minahil sums up what it’s like to be on twitter in a tweet. It’s crazy and we live for crazy

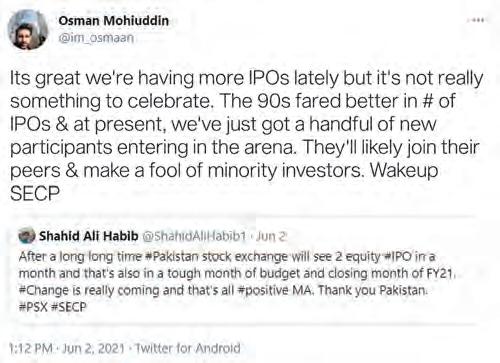

If you do something specific enough, you will no doubt manage to create a world record, most probably because it just hasn’t been done before. The way there is a Guiness World Record for most soda cans opened with a parrot’s beak, or there is a record in cricket for fastest century in the first session of a test match (in terms of minutes). It really is a case of inventing records for yourself. In the same way, when it comes to financial news, it is always “First IPO of the year” this, and “IPO after x years” that, or “First (insert industry) IPO in x years”, and now “Two equity IPOs in a month”. What we’re trying to say is, you will always find a way to make an IPO sound special – but do we really need to celebrate IPOs? I mean after all, when are we going to normalize IPOs? Osman Mohiuddin, ex banker and startup founder rightly points out how the SECP needs to do more for minority investors, especially in light of more IPOs.

Isn’t the whole point of crypto currencies to free oneself from the shackles of regulations and fiat? Well if that is the case, why is Zaka complaining now about the lack of regulation? Also, is he serious about getting twitter to ban Elon Musk (of course it is possible, remember what twitter did to Trump?). Would be cool if Musk files a lawsuit about Zaka and his allegations about Elon being a pumper and dumper. Then again, any attention from Musk would probably be incredible for Zaka.

Beware the bosses

Honestly, can’t say this enough but twitter seems more useful for work than linkedin is. It’s more informative if you follow the right people and better for networking. You can tell it’s better by the fact that we’ve completely stopped referring to linkedin posts in this roundup. However, twitter is risky. Sometimes your tweets about your annoying bosses and coworkers go viral and end up reaching them. For that we suggest alt accounts. Maybe someday you’ll bump into mine.

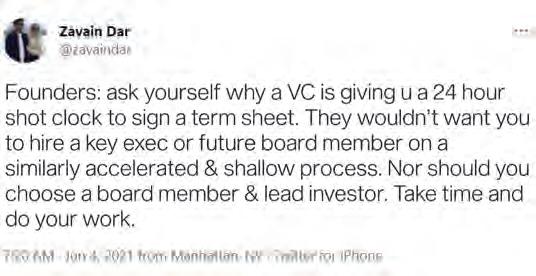

Now or never

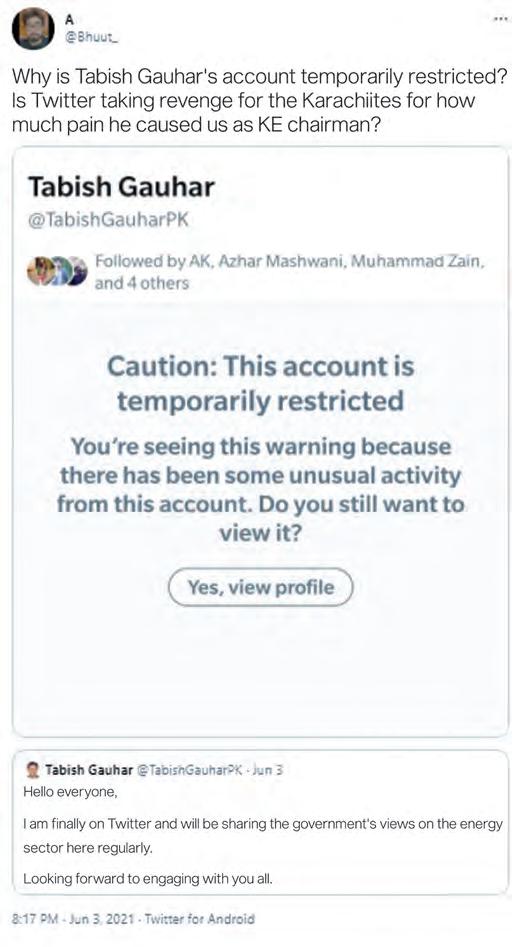

This is the literal translation of it is now or never. However, when you’re talking about your own venture, it’s not that simple and nor should it be. At least that’s what Zavain Dar thinks. Prioritizing the short term over the long term through quick decisions should not be a thing. Tabish Gauhar is the SAPM on power, however we all (Karachites) know him as the man that ran K electric. Because of that one job he held once upon a time, we will associate him to all the hours of load shedding we faced as a result. Tabish may go on to become the best thing for the power sector, but we do not care. All that matters for us is the load shedding we faced.

Same

Hey Preeti, we agree 100% because we relate 100%.

HOW TO CONTACT

facebook.com/Profitpk twitter.com/Profitpk linkedin.com/showcase/13251020 profit.com.pk profit@pakistantoday.com.pk

Readers Say

Given the fact that the writer has fairly limited publicly available information on the topic it was a nice read. However for any meaningful analysis one will need to analyze the retail market in terms of its segments (men/women/children). Apropos: Did Big Textile’s retail pivot work?

Fraaz Jamshed, Website

This very same situation can be found everywhere in Pakistan. It is only when a company is run by professional speculators that a company becomes host to speculation like this. This does not happen in a vacuum. And why focus on making the company better when you can just make big bucks by manipulating the stock market like this? Whatever else happens, it is an incredible shame because employees are suffering from the demise of good management. There are so many that are not even getting their salaries, while the corrupt elite running these companies make money at the expense of honest, hardworking, people. Apropos: WorldCall: An acquisition or another Pump and Dump?

Anonymous, Website

Usually, a pump and dump scheme can only work on the back of some positive news. This could include things like possible acquisition, a fancy joint venture announcement, large expansion plans, etc. To execute such a pump and dump successfully, the most critical aspect is having control of the supply of shares. Given that there is a large free float (the number of shares), it would really have to be an elaborate plan that has the backing of big players. To Keep it going mid-stream, additional news usually comes in to supplement earlier news, possibility of a new buyer in case of acquisition, story as to how company will benefit under different scenarios, etc. Let's see what comes our way. Apropos: WorldCall: An acquisition or another Pump and Dump?

NAK, Twitter

Measure volume in rupees, not number of shares traded. Number of shares is a completely useless number. Always look at the value of shares traded. The PSX measures the exact value of each trade (volume multiplied by actual price of executed trade) for ALL trades that take place in a given trading day and publishes that number every day on its website. Apropos: WorldCall: An acquisition or another Pump and Dump?

@FarooqTirmizi, Twitter

That's a new idea to me. How come? And— given that they trade at different price points throughout the day—at what price would we be multiplying the total volume by? High, low, open, or close? The most accurate representation would be Σ(v_i • p_i) I presume. If we had the data. Ahhh, that's what I meant by Σ(v_i • p_i), the sum of all prices and their volumes. I should have been clearer. Why is that better though? Apropos: WorldCall: An acquisition or another Pump and Dump?

@amingillani, Twitter

Case with the WTL is of an acquisition this time around. You might even see some official correspondence in the coming days. Not just a case of pump and dump. I have read the article and I know you are not denying acquisition, but I still think that this time around the acquisition business seems a bit more serious. There might be summaries being written to SECP by AKD securities to extend the acquiring date till July even as we speak. I still agree with the unfair advantage bit. Apropos: WorldCall: An acquisition or another Pump and Dump?

@sporrtingnerd, Twitter

While the listed companies are a very tiny bit of the economy, they do reflect the overall business sentiment of the economy. And also they are integrated with a lot of suppliers, vendors, and clients within the economy. Apropos: WorldCall: An acquisition or another Pump and Dump?

@ahmedfayy, Twitter

Worldcall Telecom Limited needs to be kicked out of the Pakistan Stock Exchange. It is famous for its involvement in pump and dump schemes and is a bonafide Double Shah of the stock exchange. It's time they paid a price for that. Apropos: WorldCall: An acquisition or another Pump and Dump?

@SyedHassanAmin, Twitter

WorldCall with the entrepreneurship of the late Salman Taseer has seen days when it surpassed PTCL. In the era before spectrum auction for cellular phones invaded Karachi, Lahore and other big cities, Worldcall was the telecommunication company to envy. But with the tragic demise of the late Mr. Salman Taseer, everything changed. PTCL started expanding with its laid ducts/pipes with Dhobi Ghat cable, the thick aluminised cable with black plastic used for broadband/phone/data services. Then Worldcall also began going off the wagon, and while it tried to revive itself after it was sold off by the Taseer family, its fortunes have only continued to plummet. It is sad to see WTCL become a simple tool for pump and dump schemes in the stock market. Apropos: WorldCall: An acquisition or another Pump and Dump?

Haroon Rashid, Website

IN BRIEF

The Pakistan Stock Exchange (PSX) on Tuesday continued its upward trajectory, with the benchmark KSE-100 index rising by 294.92 points, or 0.62 per cent, and was being traded at 48,212 which is the highest level in the past four years due to the benchmark index adding 316 points.

Prime Minister Imran Khan

Rs20 billion:

The ECC has approved a technical supplementary grant of Rs20 billion for procurement of 10 million doses of the Covid-19 vaccine in June. The meeting was specially called to provide a technical supplementary grant of $130 million to the National Disaster Management Fund (NDMF) to ensure timely procurement of the vaccine.

The National Assembly Standing Committee on Industries and Production expressed concern over the extra money being charged by the dealers and the issues being faced by the general public due to late delivery of cars by Morris & Garage (MG) company. It also claimed that MG was “wrongfully advertising about assembling vehicles in the country.”

$500 million:

Prime Minister Imran Khan on Monday launched the country’s first green Eurobond by WAPDA to meet the financial needs concerning the construction of Diamer-Bhasha and Mohmand dam projects. The bond has been floated for 10 years to raise $500 million at a competitive price of about 7.5 percent interest rate.

The government will form new policy parameters in order to ensure the film industry’s revival and overall growth in the country to announce a substantive package and review of major taxes to spur productions, with all major taxes set to be abolished.

The Transparency International Pakistan (TIP) has asked Finance Minister Shaukat Tarin to take action against the National Bank of Pakistan (NBP) for the violation of PPRA rules in awarding a Rs26 billion contract of scanning and indexing documents to a single bidder.