9 minute read

PAkIstAN PlANs to quAdruPle doMestIc coAl - fIred Power, Move AwAy froM gAs

DESPITE INCREASING POWER DEMAND IN 2022, PAKISTAN'S ANNUAL LNG IMPORTS profIt ReuteRS

PAKISTANplans to quadruple its domestic coal-fired capacity to reduce power generation costs and will not build new gas-fired plants in the coming years, its energy minister told Reuters on Monday, as it seeks to ease a crippling foreign-exchange crisis.

Advertisement

A shortage of natural gas, which accounts for over a third of the country’s power output, plunged large areas into hours of darkness last year. A surge in global prices of liquefied natural gas (LNG) after Russia’s invasion of Ukraine and an onerous economic crisis had made LNG unaffordable for Pakistan.

“LNG is no longer part of the long-term plan,” Pakistan Energy Minister Khurram Dastgir Khan told Reuters, adding that the country plans to increase domestic coal-fired power capacity to 10 gigawatts (GW) in the medium-term, from 2.31 GW currently.

Pakistan’s plan to switch to coal to provide its citizens reliable electricity underscores challenges in drafting effective decarbonization strategies, at a time when

FELL TO LOWEST IN FIVE some developing countries are struggling to keep lights on.

Despite power demand increasing in 2022, Pakistan’s annual LNG imports fell to the lowest levels in five years as European buyers elbowed out price-sensitive consumers. “We have some of the world’s most efficient regasified LNG-based power plants. But we don’t have the gas to run them,” Dastgir said in an interview.

The South Asian nation, which is battling a wrenching economic crisis and is in dire need of funds, is seeking to reduce the value of its fuel imports and protect itself

Years

from geopolitical shocks, he said.

Pakistan’s foreign exchange reserves held by the central bank have fallen to $2.9 billion, barely enough to cover three weeks of imports. “It’s this question of not just being able to generate energy cheaply, but also with domestic sources, that is very important,” Dastgir said.

The Shanghai Electric Thar plant, a 1.32 GW capacity plant that runs on domestic coal and is funded under the China-Pakistan Economic Corridor (CPEC), started producing power last week. The CPEC is a part of Beijing’s global Belt and Road

Car prices continue to soar as Toyota, Chery hike prices simultaneously

profIt report

Daniyal ahmaD

Toyota and Chery have introduced price hikes for their entire lineups.

The most likely explanation for the price increases are the increases in the cost of production due to the Rupee’s depreciation, the global commodity supercycle, and the general rise in the domestic cost of production.

These new prices are likely, and hopefully, also reflective of the companies factoring in further dips by the Rupee, and potential increases in taxes levied on vehicles. The latter is potentially a consequence of the rumours across industries of new rounds of taxation across industries due to negotiations with the IMF.

Playing Devil’s aDvocate: toyota

This price increase amounts to Toyota’s third price increase within the span of a month.Toyota’s rationale is clear. It has made operating losses for two consecutive quarters. It recorded an operating loss of Rs 3.3 billion in Q1FY23, and Rs 1.483 billion in Q2FY23 taking its HFY23 operating loss to Rs 4.78 billion. Its HFY23 loss is a 150% Year-onYear contraction, for a staggering reduction of Rs 15 billion.

Furthermore, Toyota has been unable to meet demand due to inventory shortfalls. This has led to it announcing non-production days from February 1 to February 14, and its intent to shift to a single shift work day from February 15 until stated otherwise. Toyota seems to be so crippled by these shortfalls that it

TOYOTA JACKS UP PRICES BY RS890,000 WITH CHERY’S PRICES GO UP BY RS1.1M is the most likely explanation for why Toyota has also reduced its shift; it is expecting demand to fall, and therefore aims to reduce its fixed costs whilst bolstering its margins.

Playing Devil’s aDvocate Part Deux: chery Chery cannot be faulted for its price increase. The company has withheld its prices from September till now, and its decision is a likely consequence of the aforementioned macroeconomic reasons plaguing the entire industry. Ghandhara Nissan introduced the Chery Tiggo 8 Pro and 4 Pro almost a year ago, however, the reception has not been lacklustre to say the least.

Initiative.

In addition to the coal-fired plants, Pakistan also plans to boost its solar, hydro and nuclear power fleet, Dastgir said, without elaborating.

If the proposed plants are constructed, it could also widen the gap between Pakistan’s power demand and installed power generation capacity, potentially forcing the country to idle plants.

The maximum power demand met by Pakistan during the year ended June 2022 was 28.25 GW, more than 35% lower than power generation capacity of 43.77 GW.

It was not immediately clear how Pakistan will finance the proposed coal fleet, but Dastgir said setting up new plants will depend on “investor interest,” which he expects to increase when newly commissioned coal-fired plants are proved viable.

Financial institutions in China and Japan, which are among the biggest financiers of coal units in developing countries, have been backing out of funding fossil-fuel projects in recent years amid pressure from activists and Western governments.

Imran ‘super corrupt’, filed false cases against rivals via ‘pressure tactics’: Marriyum

ISLAMABAD Staff RepoRt Minister for Information and Broadcasting Marriyum reintroduced its refund policy, from July, last month.

Thus, Toyota’s decision comes down to a confluence of two things: It can only produce a limited number of vehicles, and it needs to increase the profit margins for its vehicles. The price increases, therefore, are a means for Toyota to achieve this. There is no doubt that Toyota’s sales volume has fallen as a result of these. Its 7MFY23 sales volume stands at 21,877 units. This is a 51% contraction from the 44,869 units it sold over the same period last year. However, there seems to be a method to the madness.

Toyota gross profit, and gross profit margin both improved Quarter-on-Quarter from Q1FY23 to Q2FY23. This was despite Toyota selling fewer vehicles within that time span. This is likely in part due to the change in the composition of vehicles Toyota sold over the period.

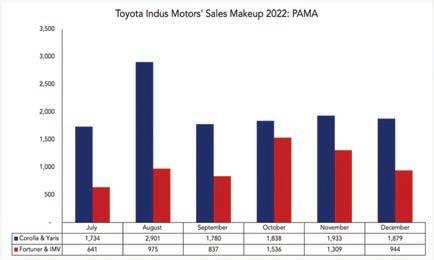

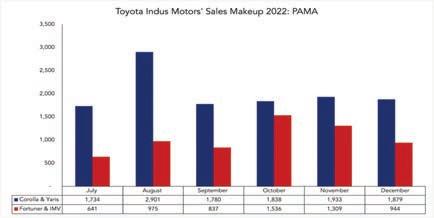

Q1FY23 saw the Toyota Yaris and Corolla constitute 72% of total sales, with the remainder being attributed to the Toyota Fortuner and its IMV line of vehicles. Q2FY23, in contrast, saw the Yaris and Corolla’s share dip to 60% with the shares of the Fortuner and the IMV line of vehicles rising to 40%.

Based on past precedent, the higher prices are likely to dissuade customers from the more affordable options across Toyota’s portfolio, whilst encouraging sales across Toyota’s more expensive lineup. Such a dynamic would therefore lead to Toyota only producing those cars which it has higher profit margins for. This

Ghandhara Nissan started Q1FY23 with a Rs 78 million loss. Now, the company did not provide disaggregated segment wise data to extrapolate which of its automotive brands was failing. However, the fact that it made a loss overall, is indicative of Chery also struggling.

This is despite the fact that Chery International outlined its eagerness and plans to expand across the Pakistani market in 2023, earlier this year. Chery’s Tiggo Pro 4 might serendipitously be a beneficiary of Toyota’s price increase as Chery’s SUV enjoys an even more considerable price advantage compared to Toyota’s sedans. The Tiggo Pro 8, however, now operates in a very competitive price market with the majority of the newer entrants who entered the market having their premium offerings either within that price range or on the boundaries of it.

Toyota records lowest half-yearly earnings since 2019

profIt report Daniyal ahmaD

Toyota Indus Motors has released its quarterly financials for Q2FY23 on the Pakistan Stock Exchange. The financials reveal that Toyota was able to record a Quarter-on-Quarter (QoQ) increase of 2.59%, however, its half year financials stand at Rs 2.67 billion. This amounts to the lowest half-yearly earnings Toyota has recorded since December 2019, with this also being the second lowest half-yearly earnings in the past five years.

Toyota’s sales revenue grew by 33% QoQ to Rs 49.5 billion. The whopping 33% is significant given that Toyota only saw a 6% increase in the number of units sold QoQ based on the sales data provided by the Pakistan Automotive Manufacturers Association (PAMA). The increase is likely a result of the composition of vehicles Toyota sold over the period. Q1FY23 saw the Toyota Yaris and Corolla constitute 72% of total sales, with the remainder being attributed to the Toyota Fortuner and its IMV line of vehicles. Q2FY23, in contrast, saw the Yaris and Corolla’s share dip to 60% with the shares of the Fortuner and the IMV line of vehicles rising to 40%.

On a Year-on-Year (YoY) basis, Toyota’s revenue is down 29% from the Rs 69.6 billion it earned over the same period last year.

Toyota, however, still recorded a gross loss of Rs 490 million. This is an 80% QoQ reduction on the Rs 2.3 billion gross loss it incurred in the previous quarter. The change in Toyota’s sales composition is also the likely reason for its gross profit margin (GPM) improving from -6.33% last quarter to -0.99% this quarter. Its current GPM still stands significantly lower than the 7.56% it recorded last year over the same period.

Toyota’s operating expenses have increased by 4.86% QoQ to Rs 954 million. This is also a 2.27% YoY increase. Similar to last quarter, Toyota was able to record sizable income from its other earnings to bolster its overall earnings, and thereby prevent a cumulative loss.

Toyota’s quarterly financials do not reveal the make-up of its other income. However, its other income elucidates upon how these are the gains that Toyota makes from engaging in investment activities.

Toyota’s other income, similar to last quarter, exceeds its operating income which, again, indicates that Toyota made more money from being a bank or investment institution than a car company. Its other income stands at Rs 3.45 billion, and is Rs 4.89 billion in excess of its operating loss of Rs 1.4 billion. Toyota’s other income has experienced a 33.09%

QoQ decrease, but it is still 38.07% higher on a YoY basis.

Toyota ended the Q2FY23 with a net income of Rs 1.3 billion. This amounts to a 2.59% QoQ increase but a 72% YoY decrease. Looking at the quarter ahead, it is likely that Toyota will do similarly, if not worse. By similarly, we mean that it will record a sluggish QoQ increase if it does at all. Toyota has not only undergone three upward price revisions across January and February, but it has also observed non-production days from February 1 to February 14. Toyota has announced that it will operate a single shift going forward from February 15 due to its inability to maintain its inventory levels which in turn are a consequence of the country’s forex, and the subsequent import situation.

Toyota has also reinstated its refund policy earlier this month. The refund did not lead to a significant dip in sales according to Asghar Ali Jamali, CEO Toyota Indus Motors, however, it remains to be seen whether a similar outcome will happen this time.

Toyota’s biggest challenge, beyond its supply-chain quagmire, will be the waves of inflation that will erode customers’ purchasing power in the months to come. January has already recorded the highest inflation in the past five decades, with most expecting February and March to exceed this.

Aurangzeb said on Tuesday that if General (Retd) Bajwa was a “super king”, Imran Khan was a “super corrupt” person who filed false cases through threats and pressure tactics against the then-opposition leaders in front of “selected judges”. Addressing a press conference here she said, “Not a single evidence has been presented against Prime Minister Shehbaz Sharif in any court inside and outside the country to prove the allegation of corruption. The then opposition leadership appeared in every court and never made any excuse like Imran Khan, wearing a plaster on the leg.” She said that the leadership of the Pakistan Muslim League (Nawaz) including Nawaz Sharif, and Shehbaz Sharif become victorious and Imran Khan got “exposed every day”. She said the political victimization of Nawaz Sharif and Shehbaz Sharif by Imran Khan damaged the county. The minister said that “Imran Khan had destroyed the economy, and foreign policy and deprived the youth of employment and pushed the country into a storm of inflation”. She asked the Supreme Court of Pakistan to “summon Imran Khan in the fake narrative of cypher and foreign conspiracy against his government as this was a national and public interest issue at present”. She said that during Imran Khan’s rule, baseless cases were filed against Shehbaz Sharif. The minister said that Shahzad Akbar the head of the Asset Recovery Unit and his team were hired for filing of false cases against Shehbaz Sharif and Imran’s other political opponents.

PPP decides against contesting NA by-elections

ISLAMABAD Staff RepoRt

Accepting the proposal tabled by Pakistan Democratic Movement (PDM), the Pakistan People’s Party (PPP) on Tuesday decided against contesting the upcoming by-elections to 33 seats of the National Assembly (NA).

According to details, the decision to boycott the upcoming by-elections was taken during PPP’s parliamentary board meeting held with PPP Chairman Bilawal Bhutto Zardari in the chair. The PPP’s parliamentary board meeting was attended by Yousuf Raza Gilani, Raja Pervez Ashraf, Nair Bukhari, Farhatullah Babar, Makhdoom Ahmed Mehmood, Faryal Talpur and candidates of the by-elections. The participants of the meeting were divided over the Pakistan Democratic Movement’s (PDM) proposal, sources claimed. During the meeting, the party’s senior leaders opined against contesting the elections. However, sources claimed, the meeting decided in principle to boycott the by-polls and let the Pakistan Tehreek-e-Insaf (PTI) fight against no one. The candidates – who were nominated to contest the polls – were taken into confidence. It is pertinent to mention here that by-polls on 33 NA seats would be held on March 16.