8 minute read

Benefits Bulletin

On-site Mobile Mammography

OCPS and Cigna have teamed up to bring the Women’s Center for Radiology’s Mobile Breast Center on location to offer screening mammograms in April (appointments at all locations start at 8 a.m.).

Advertisement

• Lake Nona Transportation Compound: Monday, April 25 • Pine Hills Transportation Compound: Tuesday, April 26 • Ronald Blocker Educational Leadership Center: Thursday, April 28

To make an appointment, call 407.841.0822, option 2.

Please note: • Appointments are required and patients must meet the eligibility requirements in order to participate.

Visit http://insurance.ocps.net and go to the Employee Wellness page for more information and instructions. • Walk-ins cannot be safely accommodated. • Patients must wear a mask at all times while on the mammography vehicle; no exceptions. • Only two patients are allowed on the mammography vehicle at a time (one in the screening room and one in the waiting area). • If you or any member of your household has COVID-19 symptoms, are awaiting COVID-19 test results or tested positive for COVID-19, do not attend the mobile mammography event. • Per guidance from the CDC, if you have recently been vaccinated for COVID-19, ask your health care provider how long you should wait to get a mammogram as some experts recommend waiting four-to-six weeks after getting your shot due to the possibility of swelling in the lymph nodes in the underarm. https://www.cdc.gov/coronavirus/2019-ncov/vaccines/expect/other-procedures.html

Insurance Benefits Update

As a result of ratification of the 2021-22 CTA and OESPA contracts, insurance benefit plan changes will be pushed to the 2022-23 plan year and the district will cover the costs associated with continuing the 2020-21 plan design for the current plan year. There are no premium increases associated with the proposed plan design changes. Watch for details of the proposed plans and annual enrollment dates in upcoming issues of the Benefits Bulletin, via email and posted on the Insurance Benefits intranet page, Enrollment Information.

Annual enrollment is the only time to add benefits or change your current plans without an approved family status change.

Plan Ahead for Optional Benefits

Take a look at these optional benefits and be ready when annual enrollment is announced.

Life Insurance

While OCPS pays for term life insurance equal to your annual salary, with a minimum of $7,500, there are two optional life insurance plans you can purchase. • Dependent Term Life Insurance — You may purchase additional life insurance for your spouse/domestic partner in an amount up to $10,000 and for each eligible child up to $5,000, depending on your annual salary. • Group Universal Life Insurance — You may apply for additional life insurance coverage in amounts from one to five times your annual salary and also have the ability to make contributions to a cash accumulation fund.

Your spouse/domestic partner may apply for coverage up to three times your annual salary with the availability of a cash accumulation fund. If you or your spouse/ domestic partner elect coverage, you may purchase a $5,000 or $10,000 policy for eligible dependent children. Evidence of insurability may be required for some elections.

Dental Insurance

• DeltaCare Basic Dental Plan (HMO type) — This plan is designed for individuals who currently have healthy teeth and gums, and focuses on preventive dental maintenance. There are benefits for other more complex dental work is offered as well. You must use a participating general dentist to receive benefits. • DeltaCare Comprehensive Dental Plan (HMO type) – This plan offers a broader range of benefits, including some restorative dental procedures (fillings) at no charge after a $5 office visit copayment. It also offers a wide range of benefits for specialty referrals when you are referred by your participating general dentist. • Delta Dental PPO Dental Plan — With this plan, you have the freedom to select any dentist you wish. If you choose to see a participating PPO dentist, you will receive a higher level of payment for your dental work. You may decide at the time you receive services whether or not to use a participating provider.

Vision Insurance

The Humana Specialty Benefits Vision Plan provides benefits for eye examinations, lenses or frames through participating doctors. You can receive services from an out-of-network doctor and be reimbursed according to plan allowances.

Disability Insurance

The disability plan helps you to cover your expenses if you are not able to work due to an accident or illness. You select the benefits from $200 to $7,500 that will replace your monthly income up to 66 2/3% of your salary. You also choose the waiting period so that benefits will begin after day 14, 30, 60 or 180. No health questions will be required for this year’s annual enrollment. The pre-existing limitation applies. The duration of benefits is based on your age when the disability occurs.

Flexible Spending Accounts

Flexible Spending Accounts allow you to make payroll deductions on a pre-tax basis to pay for certain eligible health and/or dependent care expenses. There are two types of FSAs: • Medical – Used for health care expenses like deductibles, copayments, dental expenses, eyeglasses • Dependent Care – Used for expenses like day care, before- and after-school care programs, nanny expenses. A dependent is any person who either: (1) may be claimed as a dependent on the employee’s tax return and who is under 13 years of age or requires full-time care because of physical or mental incapacity; or (2) is the spouse of the employee and is physically or mentally incapable of caring for himself or herself

The accounts are treated separately. You may participate in either or both accounts but may not transfer funds between accounts. When you enroll, you designate how much you want to put into your account for the plan year. The accounts are “use it or lose it” — that is, if you haven’t used all of the money in an FSA by the end of the plan year, you cannot carry over that money to the next year.

Stretch Your Tax Savings with a Flexible Spending Account

If you are eligible for health benefits, consider the following options to enroll in a Medical FSA and Dependent Care FSA (you can enroll in one or both):

Enrollment

Enrollment is yearly. If you have an FSA and want to continue it for the next plan year, you MUST re-enroll during annual enrollment.

Tax benefit

The money you deposit in your account(s) is automatically deducted from your gross pay prior to calculating federal and Social Security (FICA) taxes. Your account deposits are not considered current taxable income and therefore don’t appear on your W-2 form as taxable income. Since your taxable income is reduced, so are your annual taxes* .

Deductions

YOU choose the annual amount(s) that will be deducted from your gross pay and transferred into your FSA. Deductions are taken over 10 months in 20 paychecks. • Medical FSA minimum contribution: $200; Maximum contribution: $2,850 • Expenses covered must be medically necessary as determined by a doctor. You may not consider premiums paid for any health insurance coverage or expenses for cosmetic surgery — these are not allowed usages of your FSA. Over-the-counter (OTC) medications require a prescription or

Letter of Medical Necessity from your medical practitioner in order to be reimbursed from your

Medical FSA. • Dependent Care FSA maximum contribution: $5,000

Be on the Lookout for Diabetes Information

OCPS, AdventHealth, Cigna and CVS Caremark have joined forces to bring you the Thrive-Diabetes Care Program at no added cost. Those 18 years or older who have a diagnosis of Type 1 or Type 2 diabetes and are covered by an OCPS Cigna health plan are eligible to join this multidisciplinary program.

Participants will receive free quarterly appointments with the AdventHealth Diabetes & Endocrine Center and can possibly lower Tier 2/Preferred Brand costs for covered diabetes medicines.

Packets about the voluntary ThriveDiabetes Care Program will be sent from AdventHealth. Once received, review all of the benefits and set a reminder to enroll beginning April 1. The enrollment period is limited to twice a year – April and October. Don’t miss your chance to take charge of your health.

For questions regarding enrollment, contact AdventHealth at 407-303-2720.

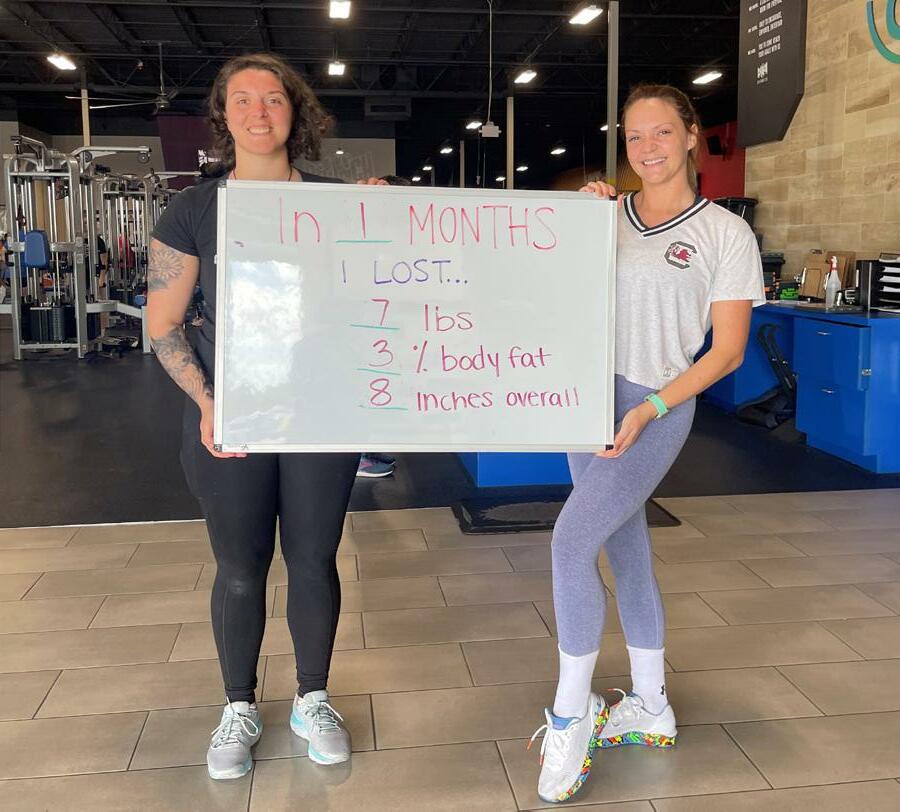

Benefits Bulletin is designed to keep OCPS employees and their families informed about available benefit programs. This information is not intended to replace professional health care. See your health care professional for information relevant to your medical history. From right: Neely Moss is motivated to work out at Crunch Lake Nona with her personal trainer.

April Healthy Hero

Neely Moss, Kindergarten teacher from Lake Gem Elementary, has long been a believer in health and fitness. As a child, she took ballet classes. Now that she does not dance as much, she says that she’s been exploring other avenues of fitness and really enjoys weight training and weekly yoga.

Brandon Hodges, Physical Education teacher at Lake Gem Elementary, nominated Moss and discussed the value of different yoga styles.

“I believe this simple conversation with Moss has saved many teachers from dealing with [the stress of work],” he said.

Moss credits the OCPS Fitness Challenge as a major motivating factor in sharing her journey with coworkers.

“We have a community of people who share fitness as a common interest,” she said. “Regardless of individual motivations, we can support each other by sharing tips and tricks to make the experience more meaningful.”

While Moss has been a valuable source of advice for her coworkers, she does have one piece of advice to share with OCPS employees starting or continuing their health journey: “Do it for yourself and celebrate the successes!,” she said. “Whether it's sharing it on social media or treating yourself to a cheat meal, don't forget to celebrate your achievements — big or small!"

445 W. Amelia St., Orlando, FL 32801 | 407.317.3200 www.ocps.net