11 minute read

NAHB Monthly Update

NAHB

Monthly Update

Here are the latest news and developments affecting the housing industry. The Senior Officers’ travel schedule is also provided for your reference, followed by NAHB’s positions on key policies.

Note: This information is for use by NAHB members and HBA staff to explain our priorities and should not be widely circulated outside of the NAHB Federation.

Prepared by NAHB Communications July 2, 2021.

New For June

• Commerce secretary tells NAHB leadership administration is committed to tackling material costs issues. • NAHB chair credits grassroots for congressional spotlight on lumber. • Building costs skyrocket over the past 12 months. • Record number of builders report material shortages. • Commerce Secretary pledges to make lumber a priority. • A win for NAHB on OSHA’s temporary emergency standard. • EPA seeks to revise definition of waters of the United States. • CDC extends eviction moratorium through July 31 • Housing prices likely to remain high as supply stays low. • HUD to reinstate Affirmatively Furthering Fair Housing rule. • Podcast: NAHB chief economist’s midyear report and forecast. • Single-family starts steady in May. • Rising material challenges, declining builder sentiment. • New home sales drop in May as housing costs continue to rise.

Subscribe to the NAHBNow blog to get alerts when new posts are added.

Lumber and other Building Material Prices

(updated July 21)

• NAHB’s tireless efforts to encourage the White House to convene a home building materials supply chain summit has borne fruit. • I am pleased to report that the White House has heard our concerns and recognizes the importance of finding solutions that will end production bottlenecks that have resulted in soaring material prices. • At NAHB’s urging, a White House summit on building materials was held on July 16 with a diverse group of stakeholders.

Representing the administration were Commerce Secretary Gina

Raimondo, HUD Secretary Marcia Fudge and Director of the

National Economic Council Brian Deese. • NAHB stressed at this meeting that it is imperative that lumber mill

producers boost production in order to meet rising demand. • Home inventories are lean and the U.S. housing market is more than 1 million single-family homes short of what is needed to meet the country’s demand. • The summit was an important step forward. All the participants recognized the need to resolve supply chain bottlenecks and the issue of rising material prices and supply shortages has been brought front and center to the Biden administration.

A Year-Long Effort

• I want to stress that this White House summit on building materials was the culmination of a year-long effort where NAHB has been in the forefront in educating the public and policymakers about how rising lumber and building material prices are harming home builders, home buyers and the economic recovery. • NAHB leaders have appeared on CBS This Morning and numerous times on Fox Business News. We have also been featured in Bloomberg, CNN Business, Fortune, CNBC and scores of local media outlets across the nation calling for action to address rising prices and supply shortages. • Overall on the media front, we have earned more than $50 million in media coverage, with over 11,000 stories featured in national and local news. Effectively, we got $50 million in national publicity for free rather than having to pay for it. • In the policy arena, we have reached out to virtually every member of Congress on this issue and held talks with top White House officials and Commerce Secretary Raimondo. • Thanks to the outreach of NAHB and our grassroots membership, several House and Senate leaders have openly raised the issue of soaring lumber prices, housing affordability and tariffs with

Secretary Raimondo and U.S. Trade Representative Katherine

Tai. • In fact, Secretary Raimondo addressed the NAHB Leadership

Council on June 28 and said that “supply chain disruptions are at the top of my mind.” • And we are also seeking swift action on the trade front. Tariffs on

Canadian lumber shipments into the U.S. are exacerbating price volatility and increasing housing costs.

Not Out of the Woods Yet

• On the lumber price front, many of you may have seen media reports about the recent sharp drop in prices. • While this is good news, the lumber crisis is far from over. Since

April 2020, the price of softwood plywood has increased by more than 200 percent and the price of oriented strand board (OSB) has skyrocketed by nearly 500 percent. • The bottom line is that the OSB-led changes in softwood lumber

prices that occurred between April 2020 and July 2021 have added $29,833 to the price of an average new single-family home and raised the rental price of a new apartment unit by $92. • Moreover, most builders have not been able to take advantage of the recent drop in framing lumber prices because producers are still selling off lumber that they purchased from mills when prices were at their peak. • So, when buyers read that lumber prices are coming down, builders need to educate them about this price lag.

Moving Forward

• Looking ahead, we will remain laser-focused on not only lowering lumber prices and increasing supply, but also keeping pressure on policymakers to improve supply chains for all building materials in order to protect housing affordability. • The NAHB advocacy team – Government Affairs,

Communications, Economics and Legal – continues to work doggedly on all fronts to find solutions that will ensure a lasting and stable supply of lumber and other building materials for the home building industry at competitive prices. • Learn more about what NAHB is doing to resolve the lumber crisis at nahb.org

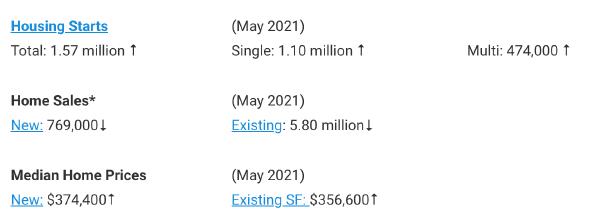

Housing Market Snapshot

*Seasonally Adjusted Annual Rate; Arrows indicate direction from previous month for starts and sales and year for prices.

NAHB/Wells Fargo Housing Market Index: The index, which measures builder confidence in the market for newly built single-family homes, fell two points to 81 in June from a reading of 83 in May. Any number over 50 indicates that more builders view sales conditions as good than poor.

NAHB Chief Economist Robert Dietz’s analysis: “Builder confidence in the market remains strong due to a lack of resale inventory, low mortgage interest rates and a growing demographic of prospective home buyers. However, first-time and first-generation home buyers are particularly at risk for losing a purchase due to cost hikes associated with increasingly scarce material availability. Policymakers must find ways to increase production of domestic building materials, including lumber and steel, and suspend tariffs on imports of construction materials. This action is sorely needed to help builders supply the additional inventory the housing market so desperately needs.”

• In an important example of the value of membership, NAHB has scored a major legal victory that sets aside the federal CDC eviction moratorium for all NAHB members nationwide. • On March 10, the U.S. District Court for the Northern District of Ohio ruled that, by issuing an eviction moratorium, the CDC exceeded the authority granted to it by Congress. NAHB brought

the lawsuit as a plaintiff on behalf of its members and we were the only association to do so. • As a result of this ruling, the CDC eviction moratorium is currently set aside with respect to all NAHB members nationwide who were members of the association as of Oct. 23, 2020 when the case was filed. • However, the eviction moratorium may still apply to landlords who are not NAHB members and those who became new members of

NAHB after Oct. 23, 2020. Moreover, NAHB members must still comply with state or local eviction restrictions. • The reason the decision was set aside for all NAHB members across the nation and not all landlords is because NAHB was a plaintiff in the case and we had “representational standing.” • This means NAHB was acting as a representative of its members who have been impacted by the moratorium. When an association wins a case like this, the decision applies to all its members. • This victory for all NAHB members shows how our association is working on behalf of our entire federation and producing concrete results to help your businesses and our industry. • And while this is an important win, NAHB continues to urge members to seek access to the $46.5 billion of rental funding through the Emergency Rental Assistance Program via your local government and housing authorities. NAHB has always stated that the best way to help all parties is through emergency funding and not moratorium mandates. • Finally, with the CDC eviction moratorium set to expire on March 31, the agency moved to extend the eviction freeze through

June 30, 2021. In late June, the CDC said it would extend the moratorium one final time through July 31, 2021. Given the district court’s ruling on March 10, this eviction moratorium extension should not apply to NAHB members. • For more information, view NAHB’s FAQ on the CDC eviction moratorium.

President Biden’s Stimulus Plan Will Help Housing

• While the end of the year relief package was a positive development, more needs to be done to help small business owners and keep the economy moving forward. • Millions of Americans remain underemployed or unemployed, millions of small businesses still require economic relief and millions of mom and pop landlords have not been receiving rent payments for months, threatening their economic livelihoods. • The Biden COVID-19 relief bill signed into law on March 11 includes additional funds for small businesses, rental assistance, school reopenings, nationwide coronavirus vaccine delivery, and state and local governments — which are critical to help many of our members and get the economy back on track. • The new law will leverage $35 billion in government funds into $175 billion in low-interest loans for small businesses. It also includes $15 billion in grants for small businesses. An additional $25 billion is targeted to rental assistance to help renters and landlords. • This is why NAHB supports the Biden relief package, though we recognize the COVID relief law is far from perfect. • Regarding aid to state and local governments, this provision is a net plus for members. Without federal aid, critical government services such as planning approvals, building permits and timely inspections are at risk of being curtailed or eliminated, which would result in construction delays and increased costs to home buyers.

Prior COVID-19 Relief Package Signed into Law a Major Win for Housing

• The $900 billion coronavirus relief package approved by Congress and signed into law by President Trump at the end of 2020

includes significant provisions that NAHB championed. Three major builder concerns addressed in the legislation include: - Relief for small businesses from burdensome loan forgiveness requirements. - Rental assistance for struggling renters and landlords. - Access to Paycheck Protection Program loans by state and local HBAs. • NAHB championed several more policies that are also contained in the relief package, including: - A permanent minimum 4% credit floor on low-income housing tax credits that will allow multifamily developers to finance thousands of additional affordable rental units; and - An extension of temporary tax provisions for newly built energy-efficient homes and for home owners who engage in remodeling activities.

View further analysis on the following areas of the $900 billion rescue package that will benefit members: Tax Relief, Rental Assistance and Paycheck Protection Program.

Recruit and Retain ‘ONE in 21’

• NAHB’s “ONE in 21” campaign asks members to help recruit and retain at least one member this year. • Membership matters, and everybody can make an impact. Visit the retention tips and resources web page to get started on your

Retain ONE effort. • You’ll find sample outreach materials and advice from HBAs with top retention rates. • Make a difference – be a part of “ONE in 21.”

Key Issues

NAHB continues to focus on several issues, including:

Housing Affordability. Addressing ongoing housing affordability concerns remains a top issue for home builders. Due to the complexity and nationwide scope of the problem, NAHB is looking to Congress to play a constructive role in helping to craft practical solutions and put them in place.

Regulatory Reform. On average, 23.8 percent of the price of building a typical new single-family home – almost $94,000 – is due to government regulation.

Meanwhile, government regulation accounts for more than 30 percent of the cost of an average multifamily development.

NAHB firmly believes that efforts to further regulate the housing industry must:

• Be subject to greater oversight • Allow for increased public participation in the process • Be based on sound data • Only be undertaken after a careful consideration of the costs and benefits as well as the potential effects on small businesses.

Housing Finance Reform. NAHB is a strong proponent of housing finance reform that would increase the role of private capital in the U.S. housing finance system but maintain a limited federal backstop to the nation’s housing finance system.

Federal support is particularly important in continuing the availability of the affordable 30-year fixed-rate mortgage, which has been a staple of the U.S. housing finance system. • Safeguard our borders; • Establish a fair employment verification system; and • Create a market-based visa system that will allow more immigrants to legally enter the construction workforce as the housing industry gains momentum and the demand for workers increases.

Environment. NAHB supports a common sense, scientific approach to safeguarding the environment that reasonably balances protection of endangered species, clean air and clean water, with the need to allow local communities to grow and thrive.

Trade. The trade war on lumber, steel, aluminum and other imported materials is needlessly pushing up housing costs. NAHB urges Congress to call on the administration to return to the table and negotiate a new Softwood Lumber Agreement with Canada and to resolve the trade dispute with China.