4 minute read

Eye on the Housing Housing Share of GDP Lower in

HOUSING SHARE OF GDP LOWER

in the Second Quarter of 2022

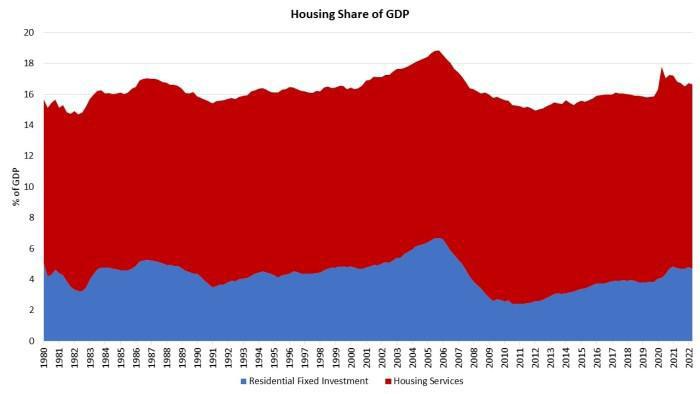

Housing's share of the economy edged lower at the end of the first half of 2022. For the second quarter of 2022, overall GDP declined at a 0.9% annual rate, following a 1.6% decrease in the first quarter. Housing’s share of GDP decreased to 16.6%, slightly below the first quarter share of 16.7%. In the second quarter, the more cyclical home building and remodeling component – residential fixed investment (RFI) – decreased to 4.7% of GDP. Home construction will face growing challenges as higher interest rates due to tightening monetary policy increase housing affordability challenges. RFI subtracted 71 basis points from the headline GDP growth rate in the second quarter of 2022.

Housing-related activities contribute to GDP in two basic ways. The first is through residential fixed investment (RFI). RFI is effectively the measure of the home building, multifamily development, and remodeling contributions to GDP. It includes construction of new singlefamily and multifamily structures, residential remodeling, production of manufactured homes and brokers’ fees. For the second quarter, RFI was 4.7% of the economy, recording a $1.2 trillion seasonally adjusted annual pace. The second impact of housing on GDP is the measure of housing services, which includes gross rents (including utilities) paid by renters, and owners’ imputed rent (an estimate of how much it would cost to rent owner-occupied units) and utility payments. The inclusion of owners’ imputed rent is necessary from a national income accounting approach, because without this measure, increases in homeownership would result in declines for GDP. For the second quarter, housing services represented 11.9% of the economy or $3.0 trillion on seasonally adjusted annual basis. Taken together, housing’s share of GDP was 16.6% for the quarter. Historically, RFI has averaged roughly 5% of GDP while housing services have averaged between 12% and 13%, for a combined 17% to 18% of GDP. These shares tend to vary over the business cycle. However, the housing share of GDP lagged during the post-Great Recession period due to underbuilding, particularly for the single-family sector. The recent expansion in housing activity has increased these shares to near historic norms.

BY: DANUSHKA NANAYAKKARA-SKILLINGTON

BANKS REPORT UNCHANGED

Home Lending Standards

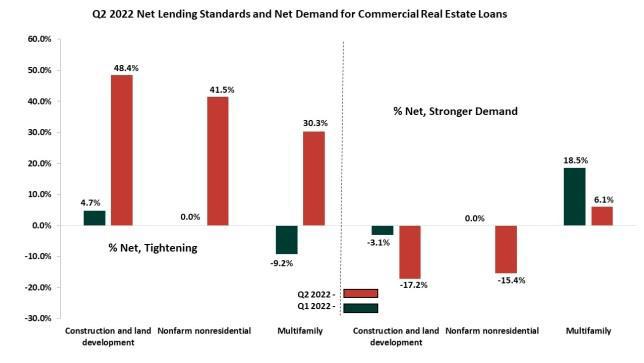

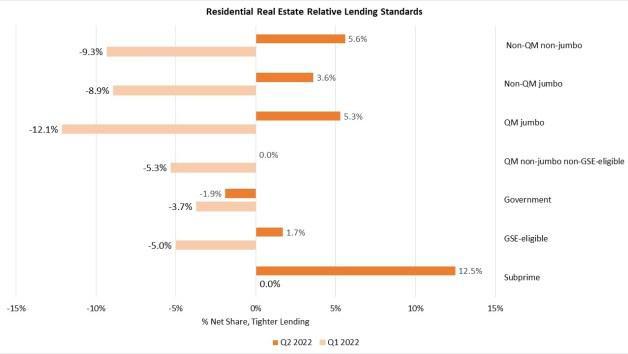

In the second quarter iteration of the Federal Reserve Board’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices, banks reported largely unchanged lending standards across all residential real estate (RRE) loans. Major net shares of banks reported weaker demand for most RRE loans except for home equity lines of credit, for which a significant net share of banks reported stronger demand. The second quarter also saw tighter credit standards for Commercial Real Estate (CRE) loans and Commercial and Industrial (C&I) loans. The below figure derived from the SLOOS shows that RRE credit standards relative to the first quarter of 2022, tightened by no more than 5.6 percent, except for subprime mortgages for which banks tightened standards by 12.5 percent. Government-issued mortgages, such as FHA and VA loans, were the only category of RRE loans that showed a loosening of credit standards, that too, by a negligible amount of -1.9 percent.

BY: LITIC MURALI

Although major net shares of most banks reported weaker demand for RRE loans, a small fraction of banks reported moderately to substantially stronger demand across all loan categories except subprime residential mortgages. For loans extended to homeowners based on their homes’ market values, a positive net share of 41.1 percent of banks surveyed reported moderately stronger demand for home equity lines of credit and 5.4 percent of banks reported substantially stronger demand. Meanwhile, banks reported tighter lending standards for all Commercial Real Estate (CRE) loan categories and weaker demand in construction and land development loans and nonfarm nonresidential loans. A modest net share of banks, 6.1 percent, reported stronger demand for loans secured by multifamily residential properties. In Q1 2022, multifamily loans’ demand, on net, was 18.5 percent stronger. In the following quarter’s survey, 4.5 percent of banks reported substantially stronger demand, 18.2 percent indicated moderately stronger, and 60.6 percent of banks reported unchanged demand. The questions were subdivided between large commercial banks and other commercial banks. In SLOOS’s last category, Commercial and Industrial (C&I) loans, banks reported a tightening of lending standards across all firm sizes, citing unfavorable economic conditions for the tightening. Thirty-three percent of banks reported moderately stronger demand for C&I loans made to large and middle-market firms while 29 percent of banks reported moderately stronger demand for loans made to small firms. Interestingly, the survey asks banks to use only funds disbursed to measure C&I loan demand.