13 minute read

Bybit Review In-Depth 2025: Pros, Cons, Potential & More

Based in the vibrant hub of Dubai, UAE, Bybit has rapidly ascended to become a leading global cryptocurrency and derivatives exchange. In 2024, Bybit continues its mission to reshape the financial landscape, offering a comprehensive suite of trading services alongside cutting-edge security measures and innovative tools designed for both beginners and experienced traders. The platform's impressive growth and resilience stem from a commitment to meeting the ever-evolving needs of crypto traders, all while prioritizing user experience and the safety of their assets.

Prioritizing Security: Keeping Your Funds Safe

Bybit understands that security is paramount in the crypto world. To safeguard user funds, the exchange employs a robust system of cold and hot wallets. This means the vast majority of assets are stored offline in cold storage, significantly minimizing the risk of large-scale hacks.

Getting Started with Bybit: A Quick Guide

(We'll get into the specifics of using Bybit's features in a moment. First, let's take a closer look at what Bybit is and what it offers.)

What Exactly is Bybit?

Founded in March 2018, Bybit is a cryptocurrency exchange that has quickly become a go-to platform for traders, particularly those interested in derivatives. While headquartered in Dubai, Bybit serves a global clientele. The exchange specializes in derivative products within the cryptocurrency market, providing services such as futures trading, perpetual contracts, and options. One of the key draws for many traders is the ability to use leverage, with options up to 100x. With a listing of over 800 different cryptocurrencies, Bybit offers a wide array of trading opportunities.

TOP CRYPTO EXCHANGE ON THE MARKET UP TO $30,000 BONUS REWARDS

REDEEM NOW

Bybit's Core Offerings: More Than Just Derivative

Bybit's appeal lies in its diverse range of features, catering to a wide spectrum of trading styles and investment goals. Here's a breakdown of some key features:

Derivatives Trading: Trade perpetual contracts and futures contracts, leveraging your positions up to 100x for potentially amplified returns (and risks).

Spot Trading: Access a wide selection of cryptocurrency trading pairs, including popular options like BTC/USDT, ETH/USDT, and a host of altcoins.

Earn & Staking: Put your crypto holdings to work. Bybit offers savings and staking products that allow you to earn interest on your deposited cryptocurrencies.

Launchpad & Launchpool: Get in on the ground floor of promising new cryptocurrency projects. These platforms provide opportunities to participate in early-stage investments.

Copy Trading: New to trading or short on time? Copy the strategies of experienced, professional traders, mirroring their trades automatically.

BOT & API Trading: For advanced users, Bybit supports automated trading through bots and API integration, enabling you to execute complex strategies.

Bybit's Global Reach Bybit is registered in British Virgin Islands, and its main office is located in Singapore. Bybit is a global company. Its offices are located in places such as Hong Kong and Taiwan. The exchange platform is available worldwide.

Understanding How Bybit Operates: A Simple Breakdow

Bybit, like other centralized cryptocurrency exchanges (CEXs), operates on a fundamental cycle. Think of it as a flywheel that keeps spinning:

1. Initial Launch: Bybit started with a selection of initial markets and crypto assets.

2. User Incentivization: To attract traders, Bybit uses various strategies like advertising, marketing campaigns, and incentive programs.

3. Growth in Users and Volume: These efforts lead to an increase in the number of users and the overall trading volume on the platform.

4. Increased Revenue: Higher trading volume translates directly into more revenue for Bybit.

5. Expansion and Further Growth: With increased revenue, Bybit can expand its offerings by adding more markets and assets, attracting even more users and boosting trading volume – and the cycle continues.Bybit, like other centralized cryptocurrency exchanges (CEXs), operates on a fundamental cycle. Think of it as a flywheel that keeps spinning:

👉Visit Bybit Exchange Offcial Link bybit.com

Bybit Review: Weighing the Pros and Cons

Before diving into the specifics, let's examine the key advantages and disadvantages of using Bybit:

Pros

Rapid Growth: Bybit is one of the fastest-growing crypto exchanges in the market, indicating its popularity and innovation.

Derivatives Expertise: Bybit excels in futures trading, offering leverage up to 100x, which can amplify both potential profits and risks.

Competitive Fees: The exchange boasts competitive trading fees, making it an attractive option for cost-conscious traders.

High Liquidity: Bybit offers high liquidity, ensuring that trades can be executed quickly and efficiently, even for large orders.

Streamlined Registration: The sign-up process is quick and simple, allowing you to get started trading quickly.

Robust Security: Bybit prioritizes security, employing multiple protection and insurance methods to safeguard user funds.

High-Performance Trading Engine: The platform's trading engine is top-tier, capable of handling up to 100,000 transactions per second, ensuring smooth operation even during periods of high activity.

Cons

Limited Spot Market Variety: While Bybit shines in derivatives, its spot trading offerings are more limited compared to some other exchanges.

Fiat Currency Restrictions: Currently, Bybit only supports deposits in three fiat currencies: RUB (Russian Ruble), BRL (Brazilian Real), and ARS (Argentine Peso).

US Availability: Bybit is not available to users in the United States.

The 2025 Bybit Security Incident: A Look Back

In February 2025, Bybit experienced a significant security breach, reportedly linked to North Korean hackers, resulting in the theft of approximately $1.5 billion. Here's a summary of how the exploit occurred, based on reports from Chainalysis:

Phishing Attacks: The attackers used phishing tactics to target individuals responsible for signing transactions from Bybit's cold wallets. They tricked these signers into approving malicious transactions.

Compromised Multi-Signature Wallet: This allowed the hackers to replace Bybit's legitimate multi-signature wallet contract with a compromised version.

ETH Diversion: Disguised as a routine transfer, the attackers redirected roughly 401,000 ETH to their own wallets.

Money Laundering: The stolen funds were moved through a complex network of wallets to make tracking difficult. The hackers used decentralized exchanges (DEXs), cross-chain bridges, and services that don't require KYC (Know Your Customer) verification to convert ETH into BTC and DAI, further obscuring the trail.

Dormant Funds: A considerable portion of the stolen assets remains untouched. This is a common tactic used by North Korean-linked cybercriminals, who often wait for the initial attention to die down before attempting to move the funds.

It's important to note that Bybit replenished its reserves within 72 hours of the hack.

Joining Bybit: A Step-by-Step Guide to Signing Up

Ready to get started with Bybit? Here's a simple guide to creating an account:

1. Visit the Website: Go to the Bybit official website

2. Enter Your Details: Provide your email address and create a strong password. If you have a referral code, enter it here. Password Tip: Make sure your password is at least 8 characters long and includes at least one uppercase letter, one lowercase letter, and one number.

3. Human Verification: Complete the simple puzzle presented by Bybit to prove you're not a bot. This usually involves sliding a puzzle piece into place.

4. Email Verification: Check your email inbox for a verification message from Bybit. It will contain a one-time code.

5. Enter the Code: Go back to the Bybit sign-up page and paste the code you received.

That's it! You're now officially registered with Bybit.

UP TO $30,000 BONUS =>

Verifying Your Identity on Bybit (KYC): A Mobile-Focused Approach

Before you can start trading, you'll need to complete at least Level 1 KYC (Know Your Customer) verification. While you can initiate this process on the website, it ultimately involves linking your phone. For a smoother experience, it's recommended to complete the verification using the Bybit mobile app.

1. Download the App: Download the Bybit app from the Google Play Store (for Android devices) or the App Store (for iOS devices).

2. Log In: Open the app and log in using the email and password you created during registration. Navigate to your profile section.

3. Start Verification: Tap the "Verify" button to begin the Level 1 identity verification process.

4. Choose Document Type: Select the country that issued your identification document and choose the document type (passport, driver's license, residence permit, or ID card). Ensure the country you select is one where Bybit operates.

5. Review Requirements: Carefully read the requirements for document submission. The key is to ensure your document is clear and easily readable.

6. Photograph Your Document: Take a clear photo of the front side of your document. If the image is satisfactory, click "Upload." Repeat this step for the back side of your document.

7. Face Verification (Video): Finally, you'll need to record a short video of yourself to confirm you are the person on the document. Follow the on-screen instructions, which typically involve slowly moving your head from right to left and then left to right. The green bars on the screen will guide you.

Bybit states that verification can take up to 24 hours, but in most cases, approval is granted within minutes. You'll receive an email notification once your verification is complete, and you can then begin trading.

👉Sign Up for Bybit

Bybit's Standout Features: What Makes it a Top Choice?

Bybit has earned its reputation as a leading cryptocurrency exchange, particularly for derivatives and margin trading. Let's explore some of the features that make it a favorite among traders.

1. Derivatives and Margin Trading: Power and Flexibility

Bybit is a global leader in derivatives and margin trading volume, and a key reason is its support for high liquidity across perpetual, futures, and options contracts. These contracts are typically collateralized with stablecoins pegged to the US dollar, primarily USD Coin (USDC) and Tether (USDT). With over 220 contracts available, traders have a vast array of options.

Here's a breakdown of the derivatives offerings:

Future Contracts: Bybit provides perpetual futures contracts with leverage up to 125x. Over 100 trading pairs are supported.

Leveraged Tokens: Currently, Bybit offers 3x leverage for longing or shorting Bitcoin (BTC) and Ethereum (ETH).

Inverse Contracts: These contracts, settled quarterly, use the underlying cryptocurrency (like Bitcoin or Ethereum) as collateral. Support is currently limited to a few major assets.

Crypto Options Trading: Trade USDC-settled option contracts with daily, weekly, monthly, and quarterly expiries.

2. Copy Trading: Learn from the Pros

Bybit's copy trading feature allows users to automatically replicate the trades of experienced "Master Traders." This feature appears to be more popular

and robust on Bybit compared to similar offerings on other exchanges like Phemex and MEXC.

You can browse through hundreds of Master Traders, examining detailed statistics that go beyond what many other platforms offer. Key metrics include ROI (Return on Investment), win rate, maximum drawdown, and the Master Trader's profit and loss. Crucially, Bybit also allows you to view the profit and loss of the Master Trader's followers, providing valuable insight into the real-world results of their strategies.

3. Trading Bots: Automate Your Strategies

Bybit's crypto trading bot feature shares some similarities with Binance's offering. Both platforms let users browse and copy the trading bots used by others, categorizing them into futures, martingale, and spot grids.

However, Bybit goes a step further by enabling users to create their own bots. This is a significant advantage, making bot creation accessible to a wider range of traders due to its simplicity and ease of implementation.

Another differentiating feature is Aurora AI. This powerful tool generates 18 sets of trading bot strategies. These AI-powered parameter suggestions allow users to engage in complex bot trading simply by entering their desired investment amount, effectively lowering the barrier to entry for automated trading.

4. Earning Opportunities: Making Your Crypto Work for You

Bybit provides multiple avenues for users to earn passive income on their crypto holdings:

Bybit Savings Accounts: Earn guaranteed yields by depositing crypto for a specified period. You can withdraw your funds at any time.

ETH 2.0 Staking: Participate in Ethereum 2.0 staking and earn rewards.

Wealth Management: Have your crypto managed and invested by third parties through various portfolios and investment strategies. Bybit maintains custody of the assets at all times.

Liquidity Mining: Deposit your coins into liquidity pools to provide liquidity and generate yields.

The user-friendliness of this feature is exceptional. Simply select the crypto asset you want to deposit, and Bybit will display all available yieldgenerating options for that asset.

The user-friendliness of this feature is exceptional. Simply select the crypto asset you want to deposit, and Bybit will display all available yieldgenerating options for that asset.

How to Trade Derivatives on Bybit: A Step-by-Step Guide

Let's walk through the process of trading derivatives on Bybit:

1. Navigate to the Trade Section: On the Bybit homepage, find the "Trade" button.

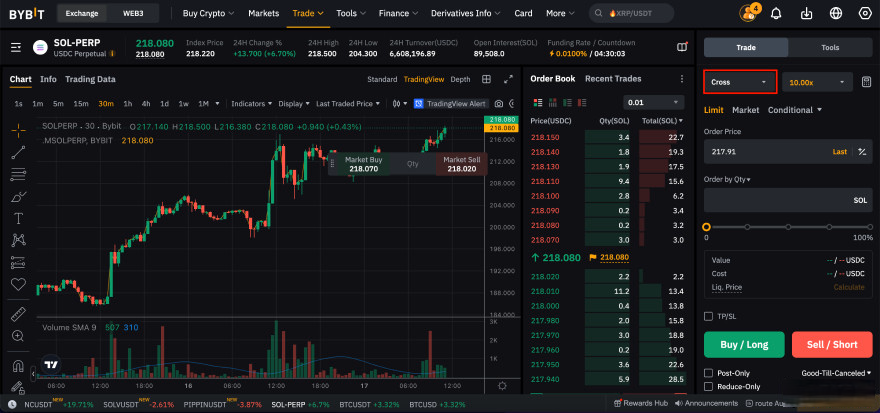

2. Select Your Instrument: Hover over "Trade" to see the available options. Choose "Futures," and then select your preferred type (e.g., USDC Perpetual). For this example, we'll choose the "SOL-PERP" pair from the list of perpetual options.

3. Analyze the Chart: The next screen will display a chart of SOL-PERP's price movements. On the right side, you'll find the key parameters you need to set. Click on "Cross" (under the trading section) to explore other margin types

4. Choose Your Margin Mode: If you're new to perpetual trading, it's generally recommended to start with the default "Cross Margin" or the less risky "Isolated Margin." For this example, we'll stick with Cross Margin.

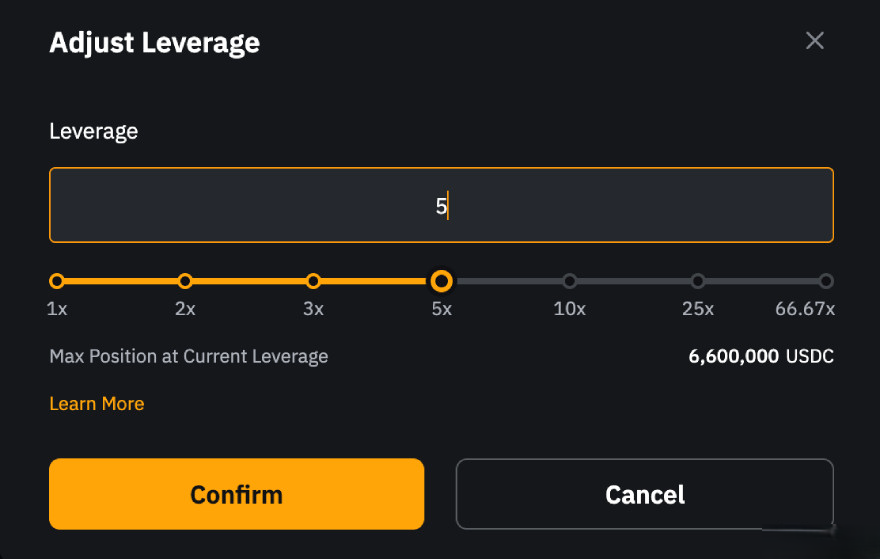

5. Set Your Leverage: Next to the margin mode button, you'll see the default leverage (e.g., 10x). Click on it to adjust. You can enter a specific number or use the slider. Important Reminder: Higher leverage increases both potential profits and losses. Beginners should consider using 5x leverage or lower.

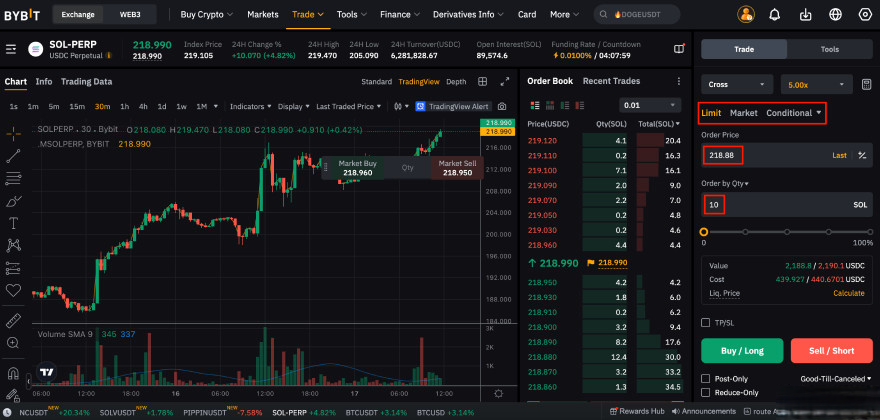

6. Select Your Order Type: Choose from three order types:

Limit Order: You specify the price at which your order will execute.

Market Order: Your order executes immediately at the current market price.

Conditional Order: Your order executes only when a specific price condition is met (useful for stop-loss or breakout strategies).

For greater control, a Limit Order is often a good choice. After selecting your order type, enter the desired "Order Price" and "Quantity."

For greater control, a Limit Order is often a good choice. After selecting your order type, enter the desired "Order Price" and "Quantity."

7. Set Take Profit/Stop Loss (TP/SL): To manage risk, click the "TP/SL" button. Enter the price levels at which you want to take profits or limit potential losses. Double-check all your settings before proceeding.

8. Buy (Long) or Sell (Short): If you anticipate the price will increase, open a "long" position. If you expect the price to decrease, open a "short" position.

And that's it! You've placed a derivatives trade on Bybit.

===> Click Access Bybit Exchange Official Link

Conclusion: Is Bybit Right for You?

Bybit stands out as a user-friendly exchange with robust technology, competitive fees, and an intuitive interface. The presence of an insurance fund to mitigate market risk is also a reassuring feature. Bybit has experienced remarkable growth, constantly adding new products and features, which further fuels its expansion.

Many experienced crypto traders, and even some institutional traders, trust Bybit. The platform has a strong security framework in place. While we encourage you to conduct your own research, Bybit appears to be an excellent exchange that meets many of the criteria for a top-tier trading platform.