6 minute read

Happenings

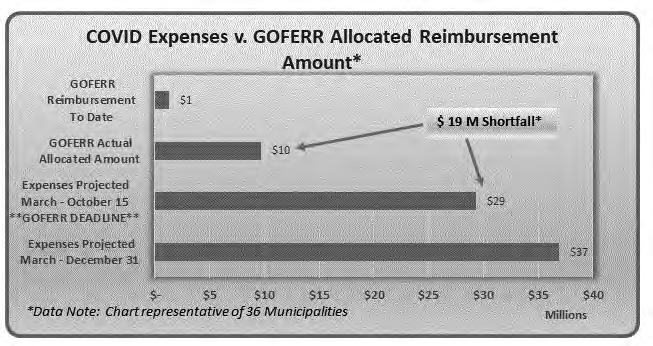

The results of NHMA’s Follow-up

COVID Financial Impact Survey

are in. The report will be used to provide state and federal officials with an update of actual and projected expenses, revenue shortfalls, and delinquencies causing cash flow issues and budgetary impacts among New Hampshire municipalities. Revenue losses are projected through December for all revenue types, with the greatest impact in planning, building and other permit fees, recreation, parking and solid waste disposal. On a positive note, motor vehicle revenue, the second largest revenue source for most municipalities, is reported as having the smallest percentage decrease thus far. Tax delinquencies in January

and thereafter remain a significant concern should we experience a second wave of the pandemic impacting the re-opening process causing a further economic downturn.

This survey was issued July 27 and was due August 11, 2020 in followup to the initial membership survey completed on April 20 when 127 municipalities responded. The results represent the responses of 52 of the total 234 New Hampshire towns and cities. The data is reported as of period ending: July 31, 2020. The survey also looked at numerous categories of COVID-related expenses incurred during the first 5 months of the pandemic March 1 to July 31, as well as their projected expenses for the next 5 months through the December 31 federal deadline of CARES Act funds. We also requested GOFERR reimbursement data projected through the GOFERR reimbursement deadline of October 15, 2020. The expenses an-

ticipated to be incurred through October 15 by those who reported will greatly exceed the GOFERR MRF allocated grant amount by approximately $19 million dollars. In addition, total expenses anticipated to be incurred through December 30, 2020, would exceed the GOFERR allocated grant amount by more than $26 million dollars.

Download Your 2021 Calendar Today!

Go to the Legal Services section on NHMA’s website (www.nhmunicipal. org) to download your 2021 Important Date Calendars which detail important dates and deadlines for March and May traditional meetings and March, April and May SB2 meetings, as well as a general calendar. 2020 General Calendar 2021 General Calendar 2021 Traditional (March) Town Meeting Calendar 2021 Traditional (May) Town Meeting Calendar 2021 SB2/Official (March) Town Meeting Calendar 2021 SB2/Official (April) Town Meeting Calendar 2021 SB2/Official (May) Town Meeting Calendar

HAPPENINGS from page 5

NHMA MEMBERS ONLY: Download Your 2020-2021 Municipal Officials Directory Today!

The 2020-2021 New Hampshire Municipal Officials Directory is in and ready for you to download for free (but only if you are a municipal official from a member municipality). The Directory is a comprehensive resource (in convenient, searchable and clickable PDF format) for cities and towns and other local governments in New Hampshire. The 2020-2021 Directory is updated to provide a current listing of municipal officials in each of the 13 cities and 221 towns throughout the state.

The success of this publication relies upon the information provided by city and town officials to NHMA each April and May. The assistance of these individuals is greatly appreciated. While every effort is made to ensure accuracy, it is important to note that some information unfortunately may have changed since publication.

This publication is made possible through the support of advertisers. NHMA wishes to thank our advertisers for their tremendous support.

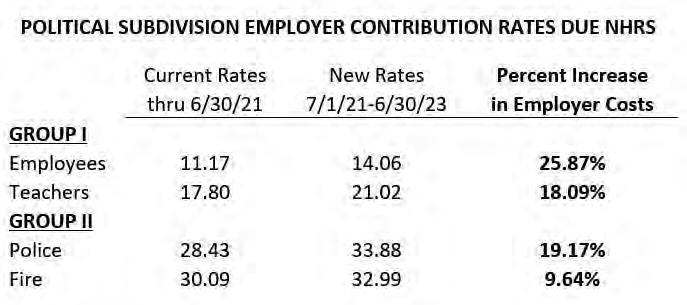

If you are a municipal official from a member municipality, please download your free digital Directory today! As mandated by state statute, the New Hampshire Retirement System (NHRS) Board of Trustees certified the employer contribution rates for fiscal years 2022 and 2023 at its meeting on September 8, 2020, formalizing the draft rates reported last month. The new rates must be implemented for Earnable Compensation paid on or after July 1, 2021, effective through June 30, 2023. The most significant factor in the new rate increase was a reduction in the assumed rate of investment return from 7.25% to 6.75%. Other rate factors cited by NHRS were the adoption of updated post-retirement mortality assumptions and a reduction in the payroll growth factor. NHRS has posted a FAQ: 2019 Actuarial Experience Study document which provides answers to some common questions regarding the revised actuarial assumptions and the impact these assumptions will have on future employer contribution rates.

NHMA Offers Customized “On-Demand” Training Services During Times of COVID-19 for Only $350!

Thanks to COVID-19, we’re doing things a little differently with our “On-Demands” training. Instead of having a legal services attorney travel to your city or town, we’re now offering “On-Demands” as virtual presentations via the GoToWebinar platform.

Attendees would log in to the training proONDEMAND gram from the comfort of their home or office and attend virtually, with the ability to ask live questions of the presenting attorney. Please contact us at legalinquiries@nhmunicipal.org for more information!

NHMA will offer this alternative method of training on a date and time that would be suitable for your board and staff, and you could always invite surrounding member municipalities to participate and contribute to the total cost. The cost is only $350.00.

If interested, please Download Fillable PDF On-Demand Order form on NHMA’s website (www.nhmunicipal.org) and follow instructions.

Evergreen Farm Offers 30 Foot-tall Balsam Fir as Holiday Tree to Interested City or Town

Evergreen Farm in Kingston, New Hampshire has been growing choose-and-cut Christmas Trees since 1985. This 30+ foot-tall Balsam Fir was never chosen as a Christmas Tree and is now much too tall for any residential application. It is time for this beautiful tree to make room for new trees in the plantation, so Evergreen Farm is offering to donate it to a New Hampshire city of town that can give it a good home this holiday season. The chosen municipality will be responsible for cutting the tree and removing it from the Farm.

If interested, please give Glenn Coppelman of Evergreen Farm a call at 603.772.5355 (land), or 603.770.5355 (cell). Glenn can also be reached via email at gcoppelman@gmail.com.

State Releases 2020 Forest Action Plan

According to the introduction of the New Hampshire Forest Action Plan – 2020, for over 60 years New Hampshire has been evaluating and assessing the needs of the state’s forests. The first New Hampshire Forest Resources Plan was written by a committee appointed by Gov. Sherman Adams in 1952. In 1981, the state codified this tradition by passing the “Forest Resources Planning Act,” RSA 220 (recodified in 1996 to RSA 227-I) req

The 2020 New Hampshire Forest Action Plan is the state’s sixth stateis a revision of the New Hampshire Statewide Forest Resources Assessment and The New Hampshire Forest Resources Strategies, both published in 2010. The 2020 plan reflects the input provided by individuals and groups within the New Hampshire natural resource community and from the public, and review of existing plans and assessments.

The Plan is a comprehensive assessment of forest-related resources and a suite of 42 recommended strategies and 159 associated actions to address issues, opportunities and program priorities, regardless of ownership. The 2020 plan combines the two separate 2010 Assesswide forest assessment and plan. It

ment and Strategies documents into a single document.

The 235-page Plan was prepared by the Department of Natural and Cultural Resources, Division of Forests and Lands protects and promotes the values provided by the state’s trees, forests, and natural communities.

One may view the full report here: https://www.nh.gov/nhdfl/documents/nh-draft-sfap-sept-2020.pdf