17 minute read

MULCH

WRITTEN BY: DAVID ROBINSON, FIRST COAST MULCH

Landscaping mulch

Mulch is an integral component of any Florida-Friendly landscape Not only does it provide an aesthetically pleasing enhancement to common areas, but it also delivers several advantages to the landscape It can hide problem areas that may be difficult to irrigate or otherwise maintain. It is also effective in controlling weeds, aiding in soil moisture retention, regulating soil temperature, improving soil fertility, and inhibiting erosion. As mulch decomposes, it adds organic matter to the soil, which may aid in reducing the need to fertilize.

There are many types of mulch, which include:

Pine bark

Red, gold, & brown colored wood mulch

Playground chips

How to mulch –

Apply at a depth of 2-3”

Replenish mulch as needed to maintain a 2-3” depth

Avoid “volcano mulching” where mulch is piled against the tree trunk

Leave a 12-18” distance from the base of trees

Mulch 1-2” from shrubs

Playground chips

Not all mulches are created equally Mulches bearing the IPEMA label are certified as being safe for children. The IPEMA (International Play Equipment Manufacturer’s Association) sets the standards regarding not only play equipment but also the mulch in which children play on This ensures the mulch meets certain requirements regarding mulch size, purity, & consistency.

The mulch must be manufactured following a specific process to ensure the chips are uniform in size and without splintered ends This process is inspected, which allows the chip manufacturer to become certified & display the IPEMA seal. Also, IPEMA mulch is free of foreign objects like metal, stones, or large wooden pieces that could injure a child if they fall on the playground. IPEMA does not allow mulch made from treated wood to be used in playgrounds, so you know the mulch is free of hazardous chemicals Finally, the IPEMA certification ensures the mulch meets the required fall height testing, making the mulch safe for children to play and, at times, fall on. According to the IPEMA website, critical fall height is defined as “ a measure of the impact attenuation performance of a playground surface or surface or surfacing materials, defined at the highest theoretical drop height from which a surface meets the impact attenuation performance criterion specified by this Specification.”

While it is important to preserve an aesthetically pleasing landscape for your community, it is more critical to ensure the mulch used within your playgrounds are safe for your children and meet the IPEMA standards.

Imagine driving down a new street and noticing the most beautiful house you ’ ve ever seen Its bright paint, glistening windows, and clean, welcoming porch show that it’s well cared for But you find yourself distracted by something – a neglected lawn. It’s overrun with weeds, debris, and uprooted trees. It has dusty bare spots and deep channels where water flows anytime it rains. How can the owners take pride in their home when the yard looks like this?

This is a similar problem aquatic experts see with lakes and ponds

No matter how much a community association prioritizes water quality, it will never reach its full potential without a healthy shoreline And just as a neglected lawn can lead to complaints from neighbors, cause home values to plummet, and even citations by the city, so can a deteriorated shoreline.

Most shoreline damage doesn’t occur overnight, it slowly develops over the course of several years. If you assumed responsibility of a waterbody when it was in good condition, it can be easy to overlook the signs of deterioration – and forget that it's much more than an aesthetic problem Shorelines with deep grooves, cracks, exposed pipes, and steep, jagged peninsulas can lead to constant gripes from homeowners and cause serious safety issues for residents, guests, employees, landscapers, and other vendors working around the property. If someone falls or is injured as a result of a neglected shoreline, the association could be held liable.

Waterbodies with degraded shorelines also tend to experience flooding problems Most of the ponds we see in HOAs, POAs, CDDs, and urban areas are man-made to collect stormwater when it rains. Eroded sediment can fill them with muck, reducing depth and volume. Dangerous flooding is more likely to occur if the stormwater facility cannot function properly In addition to the liabilities this can cause, flooding expedites the rate of erosion and may cause waterfront properties – and their estimated value – to “shrink” over time.

In addition to the obvious signs of erosion, property managers may notice that maintaining healthy water quality is becoming more challenging. Lakes and ponds filled with muck are more likely to have dissolved oxygen (DO) deficiencies and elevated nutrient levels These imbalances often manifest as nuisance aquatic weeds and toxic algae blooms, fish kills, bad odors, and cloudiness–resulting in an unsightly lake and an influx of complaints from residents.

These problems aren’t just surface level, they can have disastrous, lasting consequences for residential communities. According to a 35-year study of 2,000 lake homes, Bemidji State University in Minnesota found that a 3 ft decrease in lake clarity caused a $700 decrease in the sale price per foot of shoreline For example, this calculates to a $28,000 decline in the value of a 40 ft waterfront lot. We know the effects of erosion can be stressful, but when you fully understand how it occurs, you can implement strategies that will help preserve property values and make your job easier over time

Poor shoreline management can also accelerate the timeline for more substantial maintenance services like dredging, which is one of the largest expenses a community may ever face. Though all waterbodies will need to be reset at some point by digging out all accumulated sediment, communities usually have 20-30 years to plan and budget for a major dredging project In cases of severe erosion, this could drop to less than 10 years, leaving community leaders in a very difficult position – divert funds from other important maintenance projects or increase dues and suffer the blowback?

Once erosion occurs, it can be difficult to halt future damage. When partnering with a professional, they will work with you to evaluate the level of deterioration and muck development, and design a restoration plan that’s customized to the unique qualities of your waterbody Often, these involve the use of tools that allow aquatic experts to bioengineer a new shoreline that is incredibly stable and aesthetically pleasing. They may recommend pairing these efforts with mechanical hydro-raking to scoop out bottom muck in target areas, which will then be shaped and sodded over to reestablish several feet of land back to the property.

Shoreline erosion is a slow burn; it’s easy to ignore, but it’s also easy to intervene Professionals recommend integrating several proactive solutions into the ongoing maintenance practices on your property:

Cultivate a beneficial buffer of tall native plants around the perimeter of your waterbody to slow stormwater runoff and help hold the soil in place.

Monitor wildlife populations – species like muskrats and invasive armored catfish (found primarily in Florida) are known to burrow and destablize banks

Introduce docks or special paths for visitors to safely fish, kayak, or enjoy the view without trampling vulnerable areas.

Partner with a professional to regularly survey the area for invasive weeds that can quickly take over sensitive shorelines

Properly dispose of yard waste, pet droppings, trash, and other debris so it doesn’t decay and contribute to muck build up in your waterbody.

Reduce the use of lawn and garden fertilizers, which fuel the growth of aquatic weeds and algae

Break down muck by introducing nutrient remediation products, biological bacteria, and aerators that increase DO, which is essential to the digestion process.

While erosion is a natural part of pond ownership, property managers have a lot of control over how quickly it occurs Responsible management practices not only help enhance aesthetics and recreational opportunities, but also safeguard the value and reputation of a community

Become the most desirable community in your region with beautiful, healthy lakes and ponds. With proactive shoreline solutions in place, you can be at ease knowing your water, residents, and assets are protected from future erosion damage.

Managing a successful homeowners' association is no easy task There are many responsibilities that come along with being an association member. From dealing with finances to finding vendors, it is safe to say handling a self-managed community can be quite stressful and time consuming.

The hiring of an HOA management company can help relieve much of the stress associated with managing a community In this article, we will discuss the major the benefits of using a management company and why they should be utilized

Increased Resident Support

As an HOA member, duties include answering residents’ questions and providing residents with support. There are bound to be times when board members won’t have all the answers. However, hiring a management company alleviates that issue Not only do they have more expertise on all things regarding association management, but their hiring also allows for board members to gain more time back for themselves

Vendor Oversight

A significant benefit of HOA management is their professional expertise in vendor management. Without a management company, it is far easier for the board to become overwhelmed when it comes to managing vendors Management companies will bring years of experience of handling vendors and possess the software to help the process move along smoothly By only using professional and dependable vendors, management companies also allow the community to look more appealing overall.

Community living offers a great amount of benefits to all residents within Nonetheless, sometimes residents miss out on a lot of these great opportunities for mere lack of involvement. As a board member, you want to carry out your job and represent the needs of all your residents, but how can this be achieved, when most of them are (sometimes through no fault of their own) uninvolved?

Many strategies have been tried (ranging from incentives to stricter regulations) to boost this resident involvement, yet many of these just lead to animosity or generate control groups With this in mind, what could be the best way to simplify engagement for those who may simply “not have enough time to get involved”?

Electronic Voting could be the answer to your troubles! If your community is like (the vast majority) of communities around the country, it will often struggle to even get a quorum for annual meetings

The impact of this can go beyond just low participation. Votes to approve budgets, document amendments or updating memberships on important capital projects can all be impacted. In our ever-changing, modernized world, many communities are looking to the internet to help grow member participation through electronic voting.

Mind you, electronic voting is not a new concept by any means. Whether you realize it or not, we ’ ve all used electronic voting when we partake on reality shows like The Voice or America’s Got Talent Of course, the stakes in each of these voting scenarios are different, but it just goes to show that we are more familiar with this concept than we perhaps realize.

The Deterrents (And Their Respective Solutions)

The most common argument used against

Financial Support

Keeping track of HOA financials is not typically a job for one person, let alone someone with little experience dealing with finances A major benefit of hiring an HOA management company is financial assistance. Most companies will have a Certified Public Accountant (CPA) or accounting specialist dedicated to their community to help take some of the financial weight off the board members' shoulders

Legal Aid

There are many laws in place that are important for board members need to be aware of. Through having an HOA management company, communities gain a significant amount of legal expertise that they otherwise may not have If legal problems arise, the company ’ s legal team will be there to help.

The benefits of hiring an HOA management company go on and on. To learn more about Vesta Property Services and our commitment to our customers, check out our brochure here: vestaps com/brochure

Electronic Voting is of course, antiquated laws A lot of communities have rules and regulations that require in person voting (because at the time of foundation, these were the norms state and nationwide). However, in the past few years a number of states have amended HOA and Condo laws to allow electronic voting, making it easier than ever to adopt the new technology and alleviate the woes. Today residents in over 20 states can use electronic voting for HOA or condominium matters.

Security and transparency are also an issue for implementing electronic voting These concerns particularly grew in the early 2000s with the famous Diebold touch screen voting machines during the Presidential election. Needless to say, though, nearly all electronic voting vendors have processes in place to ensure the security and integrity of the voting process as they have learned from these past situations.

As with any change, residents may be a little hesitant to adopt electronic voting due to lack of understanding of the process or technology Before implementing such a process, it would go a long way to host an educational session to explain the process to residents.

Even though there is no absolute solution to reduced engagement, electronic voting makes matters so simple, that the busiest of residents can partake in the decision-making aspects of their community, all within conditions that favor whatever situation they may be in. Electronic voting holds promise, especially in larger communities, to bring down costs and facilitate member engagement

W R I T T E N B Y : T R U I S T

Aging buildings and systems along with rising maintenance costs to support them present a sizable challenge for property managers and associations. One quarter of Americans are part of a community association, and collectively, these properties are worth $9.2 trillion.1 Preserving that immense value and protecting it from loss hinges on carefully planned maintenance and upkeep Association leaders recognize the critical need to set aside money for maintenance and repair to protect their member’s investments. In 2020, they oversaw approximately $25.8 billion in reserve funds for repairs, replacements, and enhancements to common property This touched on everything from replacing roofs and fixing swimming pools and elevators, to resurfacing streets, upgrading to meet environmental standards, and making changes to help communities become more energy efficient.1

Association leaders recognize the critical need to set aside money for maintenance and repair to protect their member’s investments. In 2020, they oversaw approximately $25 8 billion in reserve funds for repairs, replacements, and enhancements to common property. This touched on everything from replacing roofs and fixing swimming pools and elevators, to resurfacing streets, upgrading to meet environmental standards, and making changes to help communities become more energy efficient 1

Unexpected and unfunded maintenance

Reserve funds aren’t always enough to handle problems that arise, and maintenance surprises even for the best prepared are common. A 2020 survey by the Foundation for Community Association Research found that four out of five respondents faced unanticipated infrastructure needs in the previous three years.2

Thirty-six percent of survey respondents reported problems with plumbing or electrical systems, and nearly a third said they’d experienced issues with one of the following, none of which had been uncovered during the association’s most recent reserve study:2

Roofs or roof sheathings

Building envelopes or structures

Recreational facilities

Too often, unexpected structural problems and system failures lead to short-term superficial or temporary repairs that don’t adequately address the need for restoration or replacement. Then, the damage grows, along the safety risks and the potential costs for remediation.2

But while 80% of respondents said adequate maintenance reserves were a critical need, only half thought their association had enough funds to handle an unanticipated repair or replacement of a major system or building component.2

Assessing conditions and funding reserves

Four key steps can help your association board or property management company get ahead of unexpected problems and underfunded reserves to keep your association in good shape physically and financially.

Step 1 – Start with a healthy board. Boards have a responsibility to decide what’s necessary and clearly communicate maintenance requirements to residents. A strong, well-led board can boost your association’s chances of success in assessing property conditions and financing as well as in implementing remediation plans. Community managers need to recruit volunteers to sit on the association’s board who have clout in the community, are willing to face pushback that often accompanies unpopular decisions and are able to work with residents who are delinquent in paying assessments.

Step 2 – Conduct a full reserve study to inform the community’s reserve financial analysis and funding plan. Make sure the reserve analysis is up to date and use less extensive periodic examinations to revise remaining useful life estimates and replacement costs for major components.

Step 3 – Set priorities with the association board or appropriate committee. Structural safety is an absolute necessity, but issues that could lead to water damage, electrical problems, pest infestation, or other problems can reduce property value and impact residents’ quality of life. Things like inoperable lighting systems, peeling paint, and deteriorating fences may not seem as urgent, but they can affect safety as well as marketability

Step 4 – Engage leaders and prepare to communicate with boards and homeowners. Homeowners and association governing boards sometimes resist efforts to resolve maintenance needs, avoiding the financial cost and the community confrontations that can emerge from expensive projects.

From assessment to outcome

Resolving long-neglected maintenance issues often requires significant assessments to ensure repairs are made safely and completely. Working with a lender that understands the unique borrowing needs of associations can be crucial in obtaining the necessary funds for repairs Funding preventative maintenance reduces the risk of unexpected failures that require expensive repairs that can disrupt the community or even endanger residents.

In some cases, more assessments may not be the answer Many older buildings lack a reserve to handle even basic repairs and don’t have residents willing to pay for major repairs. Property managers and association boards could be called upon to guide the community through the choice between repairs or replacement.

For communities that choose to repair or replace, hiring independent construction experts, engineers, and architects can offer a useful perspective on how to best address the problem. And though it may be painful, dealing with unexpected maintenance concerns can help educate community homeowners on the importance of preventative maintenance. After issues arising from aging infrastructure, communities frequently increase reserves, and many hire a reserve specialist to help prevent future problems.2

Whatever your community’s age and maintenance needs, formulating an effective plan is essential to fulfilling the association’s legal obligations, fiduciary responsibilities, and lender requirements while enabling financial planning for a sustainable future.

Sources

1 U S National and State Statistical Review, Community Association Fact Book 2020, Foundation for Community Association Research, 2020

2 Breaking Point: Examining Aging Infrastructure in Community Associations, Foundation for Community Association Research, 2020.

Truist Bank, Member FDIC. © 2023 Truist Financial Corporation. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation.

As we all know by now, inflation has moved into our lives and isn’t estimated to move out for about a year or more. While some industries are already seeing some relief, this is not and will not be the case for many other industries for the foreseeable future, including those that community associations rely on for capital projects. Because the primary purpose of reserve studies is to provide associations with a comprehensive short and longterm capital plan, we work diligently to account for these economic changes in our studies and reports

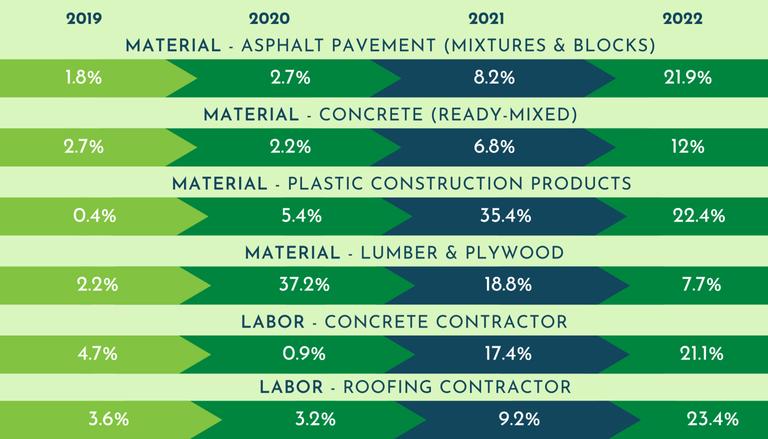

Generally taking 3% inflation into account in our reports, we are now incorporating higher rates in the near term when/as applicable. There are three primary ways in which inflation is affecting capital planning efforts within associations, including the cost of goods, the cost of materials, and the cost of labor.

Specifically pertaining to goods and materials, we have found that materials related to waterproofing are most commonly increasing in price This can include flat roofing, shingle roofing, traffic coatings in garages, and more Additionally, due to increases in oil costs, petroleum-based products like asphalt are also rising in cost Along with rising material costs comes rising labor costs. We have compiled some data detailing annualized inflation rates of various materials and labor costs as seen below:

PPI Rates Source: U.S. Bureau of Labor Statistics, AGC The Construction Association

So, what are the implications of the current economic environment on capital planning for associations? First and foremost, the current climate has lent itself to capital planning issues within community associations. Because of this financial turbulence, an association’s existing reserve fund or reserve funding plan may be prematurely outdated and in need of updates This is especially true in cases where there are projects due soon or projects already in progress that are capital-intensive.

Understandably, this information may seem intimidating However, with years of experience and having conducted many reserve studies during previous periods of inflation and financial uncertainty, Reserve Advisors is able to take current inflationary circumstances into account when creating our studies and capital plans.

First and foremost, we take into account the fact that the market will eventually correct itself, as it historically has. When it comes to short-term adjustments, particularly current-year expenditures, it’s important to bring in an expert on each project to guide you through the scope of the projects, the need for the project, and related costs These can be incorporated into the reserve study, even after the report has been received. Because we are always available to make changes to the capital plan we ’ ve laid out based on current conditions, the report is not truly “finalized” and can be adjusted to take inflation into account for up to six months after the date of report publication

Currently, when we conduct reserve studies, we are typically increasing near-term project costs extending through 2023. To account for supply chain issues, inflation, and pandemic-related pricing, we rely on real-world costs which our engineers collect as part of their information gathering at a community, along with published sources including construction cost estimating guides. Because these numbers may vary by market, we also rely on a proprietary database of recent projects in each market When we weigh these sources of information, we find that client vendor contracts are priority, followed by the database of recent projects by market and published sources of information.

One important thing to examine during times of economic uncertainty is the prioritization of all upcoming projects. If an association is unable to complete all capital projects as planned, priority should be placed on projects that, if deferred, would cause additional damage to the component, later leading to higher project costs to remediate excess damage For example, if deferring a roof replacement would increase water infiltration, replacement costs down the road would increase due to continued deterioration of the roof and any other component affected by this water infiltration Next, associations can weigh the importance of discretionary projects, and decide to defer noncritical projects until inflation subsides or evens out. Again, your reserve study consultant will always be available to your board to help inform and solidify the updated trajectory of capital project timelines

Of course, periods of inflation require associations to re-evaluate their current funding plans, specifically near-term. With the guidance of a reserve study consultant, two questions associations will work through are: 1.

If we are facing significant increases in contributions, can the increases be phased in over a number of years?

Could a loan scenario be used to minimize reserve contributions near-term?

These questions allow associations to consider not only their current and future financial situation, but to consider the financial situation of their residents. While it’s important for boards to consider how inflation is affecting their community as a whole, it’s also important to consider the financial status of those who make the community what it is.

If an association is running low on funds and project timelines are being disrupted, it’s inevitable that residents may be individually suffering financially as well If you can expand the number of phases of increased reserve contributions, residents will not experience as dramatic a financial burden. Additionally, minimizing contributions near-term through a loan can help associations complete crucial projects on time, while also giving residents time to recoup from any financial strain they are experiencing before having to comply with higher dues

If your association has a recent reserve study in hand, there are some best practices we recommend to weather this storm. If your latest reserve study is only a year or two old, a reserve study update without a site visit is a costeffective option to consider if your association needs insight into the following:

1.

2

Have capital-intensive projects been recently completed?

Can previously planned on projects be safely deferred until the market evens out?

We know that making these decisions on your own can be stressful, but Reserve Advisors is here to help you navigate the unknown with expert experience and advice. If you have any questions regarding inflation within your community or would like to inquire about tweaking your current study, please do not hesitate to reach out.