3 minute read

Keaney Financial Services

Need More Coupons - MyLivingMedia.comMARKET MINUTE No Signs of a So Landing for U.S. Economy By: Emmelis Keaney

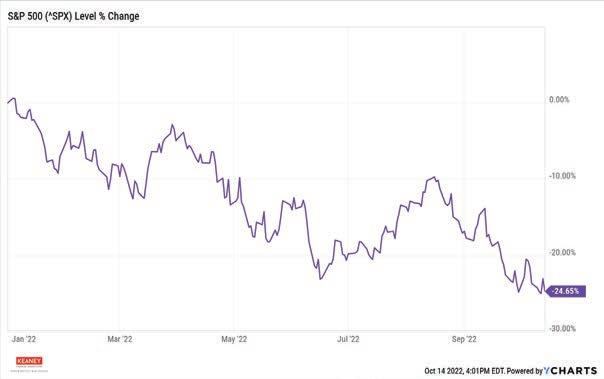

Though not an exact measure, a 20% stock market drop from the most recent high is what we call a “bear market”. It consists of lows, followed by lower lows, with minor highs that don’t reach the previous high.

Let’s not pretend that challenging economic times aren’t becoming obviously visible on the horizon. When the Federal Reserve Chair, Jerome Powell, insists that businesses and households will experience pain resulting from monetary tightening, you better believe him. What happened? When central banks around the world raise interest rates in a fast manner, growth slows down also in a fast manner. e decisive e ort of the Federal Reserve Board to control rapidly increasing in ation is beginning to show signs of declining faith that they will be able to accomplish their goal in the time frame they wish. ere’s a saying in nance that one could accurately predict prices or time frame, but never both. Why anyone would believe the US Central Bank can reverse nearly 40 years of economic damage in a year or two is a discussion for another day…or decade. In any case, we grew accustomed of thinking that in ation is an unwelcomed stranger. e Bank of England made a drastic move last month buying long-term government bonds, with a harsh ripple e ect that caused the pound to plummet and government debt cost to soar. Meanwhile, investors in the USA ercely cross their ngers and use the threat of an economic default in e Motherland to put pressure on the US Central Bank to lean at their mercy. ey’ve pivoted before, so what’s di erent now?

A so landing would avoid a recession. In a perfect economy, Central Banks begin a cycle of raising interest rates to stop the economy from “overheating” and to slow down growth. If done properly, the economy rebounds shortly a er. But economies are not perfect, and ours nearly bursting into ames. e last time the Fed achieved a so landing was in 1994 during Alan Greenspan’s term as Fed Chairman. Fed Funds rate rose from 3% to 6%. In ation stayed at bay, and a year later the economy boomed again. is was the rst successful so landing in close to 50 years. Jerome Powell deploys tactics his mentor Paul Volcker used in the early 1980s. He also uses measures from Alan Greenspan’s intervention in the mid- 1990s. Unlike his predecessors, Powell’s environment is di erent. A lingering postpandemic supply chain crisis, the Russo-Ukrainian war causing surging oil prices, the COVID-19-driven shutdowns of China’s labor force, and now U.K.’s government debt crisis, are all producing a ricochet e ect for our economy. Moreso, it would be unreasonable to conclude that interest rate hikes can control economic strains such as the growing demand for labor and wage increases, or the events discussed above. So landings can be well orchestrated, but history proves they’re very hard to achieve.

by Emmelis Keaney, RFC®

-Ernesto Keaney

FINANCIAL SERVICES CORP

Of ce: 772-287-8089 Toll-Free: 877-287-8089

keaney nancialservices.com

759 SW Federal Highway Suite 326 Stuart Florida

This article is for informational purposes only, you should not construe any such information or other material as investment advice. You should not make any decision, nancial, investment, trading or otherwise, based on any of the information presented in this article without undertaking Copyrighted© My Living Media. 2022 All Rights reserved. To Advertise call 772-247-6849 independent due diligence and consultation with a professional broker or nancial advisory. Past performance is not indicative of future results. Representatives offer products and services using the following business names: Keaney Financial Services Corp.– insurance and nancial services | Ameritas Investment Company, LLC (AIC), Member FINRA/SIPC – securities and investments Ameritas Advisory Services (AAS) – investment advisory services. AIC and AAS are not af liated with Keaney Financial Services Corp. or any other entity mentioned herein.

Products and services are limited to residents of states where the representative is registered. This is not an offer of securities in any jurisdiction, nor is it speci cally directed to a resident of any jurisdiction. As with any security, request a prospectus from your representative. Read it carefully before you invest or send money. A representative will contact you to provide requested information. Representatives of AIC and AAS do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your situation.