6 minute read

Keaney Financial Services

Need More Coupons - MyLivingMedia.comMARKET MINUTE Emmelis Keaney RFC®, Executive Vice President | September 23, 2022 BEAR MARKETS: A TRAP FOR THE HOPEFUL

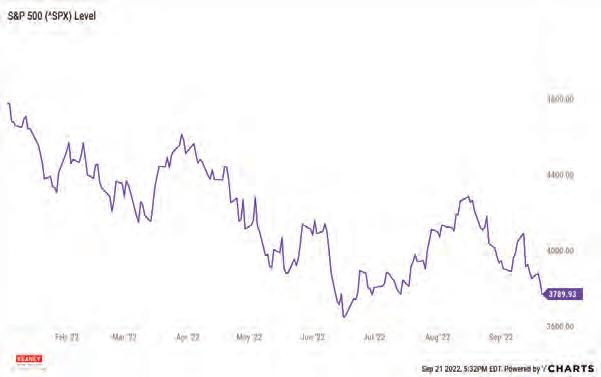

Though not an exact measure, a 20% stock market drop from the most recent high is what we call a “bear market”. It consists of lows, followed by lower lows, with minor highs that don’t reach the previous high.

March 23rd, 2020 was the lowest point of the S&P 500 closing at 2,304.92. In January 3rd, 2022 the S&P 500 reached an all-time high, closing at 4,796.56. The index hasn’t reached January levels again. But remains over 1,500 points higher as we get ready to enter the 4th Qtr. of 2022. These are not alarming fluctuations. Nonetheless, it’s a call to proceed with caution.

The red line on the chart helps visualize the decline, while “tuning out noise” or temporary rallies. These rallies typically result from speculation that doesn't always affect stock markets in a fundamental manner.

In a bear market, investors normally have a small window of opportunity to be proactive and make necessary adjustments to their portfolios. Recent market volatility and the Federal Reserve’s remarks on continued rate hikes, hint the possibility of a prolonged bear market. But changes in economic policy are reactionary measures, not anticipatory. The Federal Reserve works slow and now their attempt to stabilize prices might be too little and too late. People normally panic in times of turmoil, challenging their ability to make rational investment decisions. The most common emotional reactions are herding behavior, recency bias and knee-jerk reactions. While I don’t have the right to tell you not to panic, I have, however, the training and education to tell you there’s no need to panic, yet. These are economic concerning times, but we’ve been expecting a big stock market crash for quite some time now. A cycle shift from unprecedented growth due to easy money is long overdue. These cycles happened in the past, all over the world, and the only reason we may not recognize them immediately is because they haven’t happened in our lifetime. We didn’t live through the “Roaring 20s”, or The Great Depression; we read about it. We remember high interest rates of the early 1980s but were starting to or in the middle of saving for the future. You probably can’t identify if they impacted you in a significant way. We remember most vividly the last 20-25 years.

If you proceed with caution, seek financial literacy and professional advice (with a focus on risk management), there’s a higher probability the current economic pressures will not lead to financially devastating decisions, as you will be better prepared and more conscious of what’s happening. Beware of bear market traps. Chasing after short-lived market returns, listening and reacting to noise, even procrastination, may not yield you the desired outcome.

March 23rd, 2020 was the lowest point of the S&P 500 closing at 2,304.92. In January 3rd, 2022 the S&P 500 reached an all-time high, closing at 4,796.56. The index hasn’t reached January levels again. But remains over 1,500 points higher as we get ready to enter the 4th Qtr. of 2022. These are not alarming fluctuations. Nonetheless, it’s a call to proceed with caution. The red line on the chart helps visualize the decline, while “tuning out noise” or temporary rallies. These rallies typically result from speculation that doesn't always affect stock markets in a fundamental manner. In a bear market, investors normally have a small window of opportunity to be proactive and make necessary adjustments to their portfolios. Recent market volatility and the Federal Reserve’s remarks on continued rate hikes, hint the possibility of a prolonged bear market. But changes in economic policy are reactionary measures, not anticipatory. The Federal Reserve works slow and now their attempt to stabilize prices might be too little and too late. People normally panic in times of turmoil, challenging their ability to make rational investment decisions. The most common emotional reactions are herding behavior, recency bias and knee-jerk reactions. While I don’t have the right to tell you not to panic, I have, however, the training and education to tell you there’s no need to panic, yet. These are economic concerning times, but we’ve been expecting a big stock market crash for quite some time now. A cycle shift from unprecedented growth due to easy money is long overdue. These cycles happened in the past, all over the world, and the only reason we may not recognize them immediately is because they haven’t happened in our lifetime. We didn’t live through the “Roaring 20s”, or The Great Depression; we read about it. We remember high interest rates of the early 1980s but were starting to or in the middle of saving for the future. You probably can’t identify if they impacted you in a significant way. We remember most vividly the last 20-25 years. If you proceed with caution, seek financial literacy and professional advice (with a focus on risk management), there’s a higher probability the current economic pressures will not lead to financially devastating decisions, as you will be better prepared and more conscious of what’s happening. Beware of bear market traps. Chasing after short-lived market returns, listening and reacting to noise, even procrastination, may not yield you the desired outcome.

by Emmelis Keaney, RFC®

-20.99%

"WE BELIEVE THE BEST WAY TO BUILD WEALTH IS BY ADDRESSING WHAT CAN LEAD YOU TO LOSE IT IN THE FIRST PLACE" -Ernesto Keaney

FINANCIAL SERVICES CORP Of ce: 772-287-8089 Toll-Free: 877-287-8089 keaney nancialservices.com

759 SW Federal Highway Suite 326 Stuart Florida Representatives offer products and services using the following business names: Keaney Financial Services Corp.– insurance and nancial services | Ameritas Investment Company, LLC (AIC), Member FINRA/SIPC – securities and investments Ameritas Representatives offer products and services using the following business names: Keaney Financial Services – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member Advisory Services (AAS) – investment advisory services. AIC and FINRA/SIPC – securities and investments | Ameritas Advisory Services (AAS) – investment advisory services. AIC and AAS are not affiliated with Keaney Financial Services or any other entity mentioned herein. AAS are not af liated with Keaney Financial Services Corp. or any other entity mentioned herein. Products and services are limited to residents of states where the representative is registered. This is not an offer of securities in any jurisdiction, nor is it specifically directed to a resident of any Products and services are limited to residents of states where the representative is registered. This is not an offer of securities in jurisdiction. As with any security, request a prospectus from your representative. Read it carefully before you invest or send money. A representative will contact you to provide requested information. Representatives of AIC and AAS do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your situation. any jurisdiction, nor is it speci cally directed to a resident of any jurisdiction. As with any security, request a prospectus from your representative. Read it carefully before you invest or send money. A representative will contact you to provide requested information. Representatives of AIC and AAS do not provide tax or legal advice. This article is for informational purposes only, you should not construe any such information or other material as investment advice. You should Please consult your tax advisor or attorney regarding your situation. not make any decision, nancial, investment, trading or otherwise, based on any of the information presented in this article without undertaking independent due diligence and consultation with a professional broker or nancial advisory. Past performance is not indicative of future results.