4 minute read

How to build a resilient investment portfolio

By John Sim, CFP®

Introduction

Advertisement

We are in unprecedented times! 2020 will remain a year that most of us will not forget any time soon. If not for anything else, it will be remembered for how the COVID-19 virus wreaked havoc on the financial system and our investment portfolios. We’ve seen:

• All major economies of the world are continuing to print money to support their economies • Despite how the virus has decimated the real economy, equity markets around the world have been reaching record highs • Inflation is seen less so in goods and services, but more in financial assets • Even bankrupt companies like Hertz can quadruple in price

So how do we position ourselves during these financially crazy times? I present 4 steps we can take now to ride through this storm and come out stronger from it.

STEP 1

Broad Diversification

If we can take away anything from this pandemic, it is this: no one can predict the next crisis and how markets will react to it. As such, diversification is key.

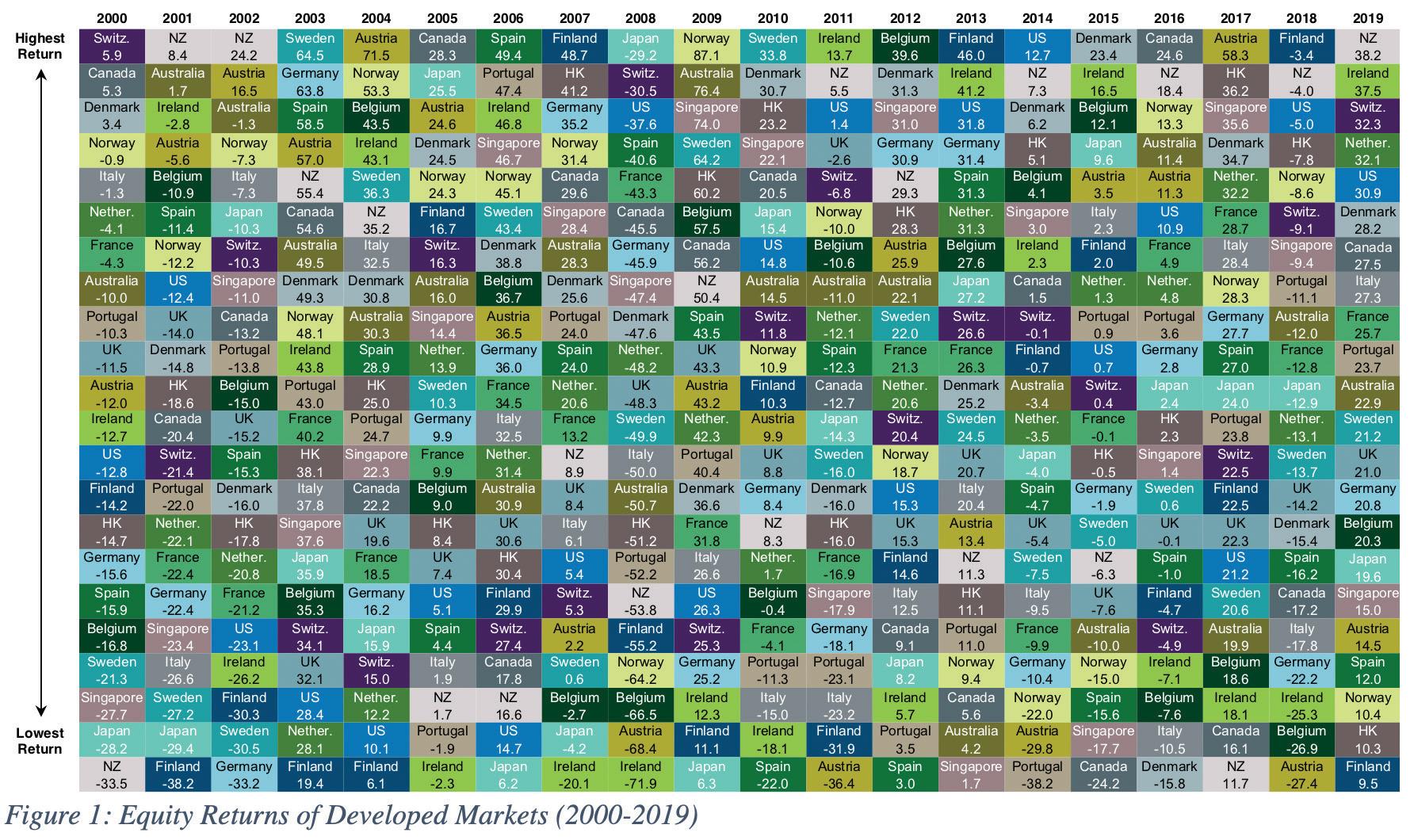

From the above table, we cannot discern any pattern to tell us beforehand which developed market will do well in the following year. We see similar randomness of returns when we look at emerging markets.

Execution Tip: Ensure that our portfolios are diversified on a global scale. We need to steer clear from home biases, where we allocate an oversized proportion of our investments into our home market, Singapore.

STEP 2

Asset Allocation

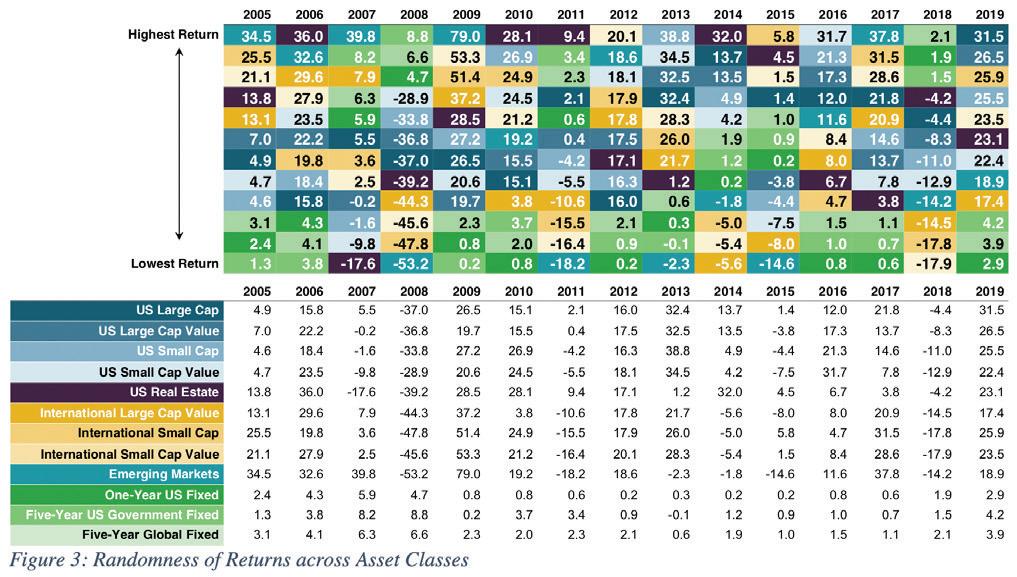

Even different asset classes perform almost randomly, as seen in the next chart. In a traditional equities and fixed income (bonds) portfolio, we can observe that different types of equities (and bonds) deliver different returns in different years.

STEP 4

Secret Sauce – Factors of Returns

Execution Tip: void picking and choosing the “flavour of the month or year” asset classes, because it is near impossible to forecast beforehand which asset class will perform well at the end of the year. Many “talking heads on financial TV” will be able to give many very convincing reasons why markets performed as they did AFTER the fact. As they say, hindsight is 20/20. But none of them will be able to consistently give an accurate prediction before things happen. And the key phrase here is “consistently before things happen”. STEP 3

Secret Sauce – Factors of Returns

Next step is to make sure that we are maximising our returns in both our equities and fixed income portfolios. The way we can do this is to “tilt” our portfolio from the traditional market capitalisation weighted approach to one that overweights factors that produces higher returns. Some call these factors “Smart Beta”. While many factors have been identified by the academic community, few have been found to persist and withstand the test of real-life execution. Here is the list: (high profitability tends to out low profitability companies)

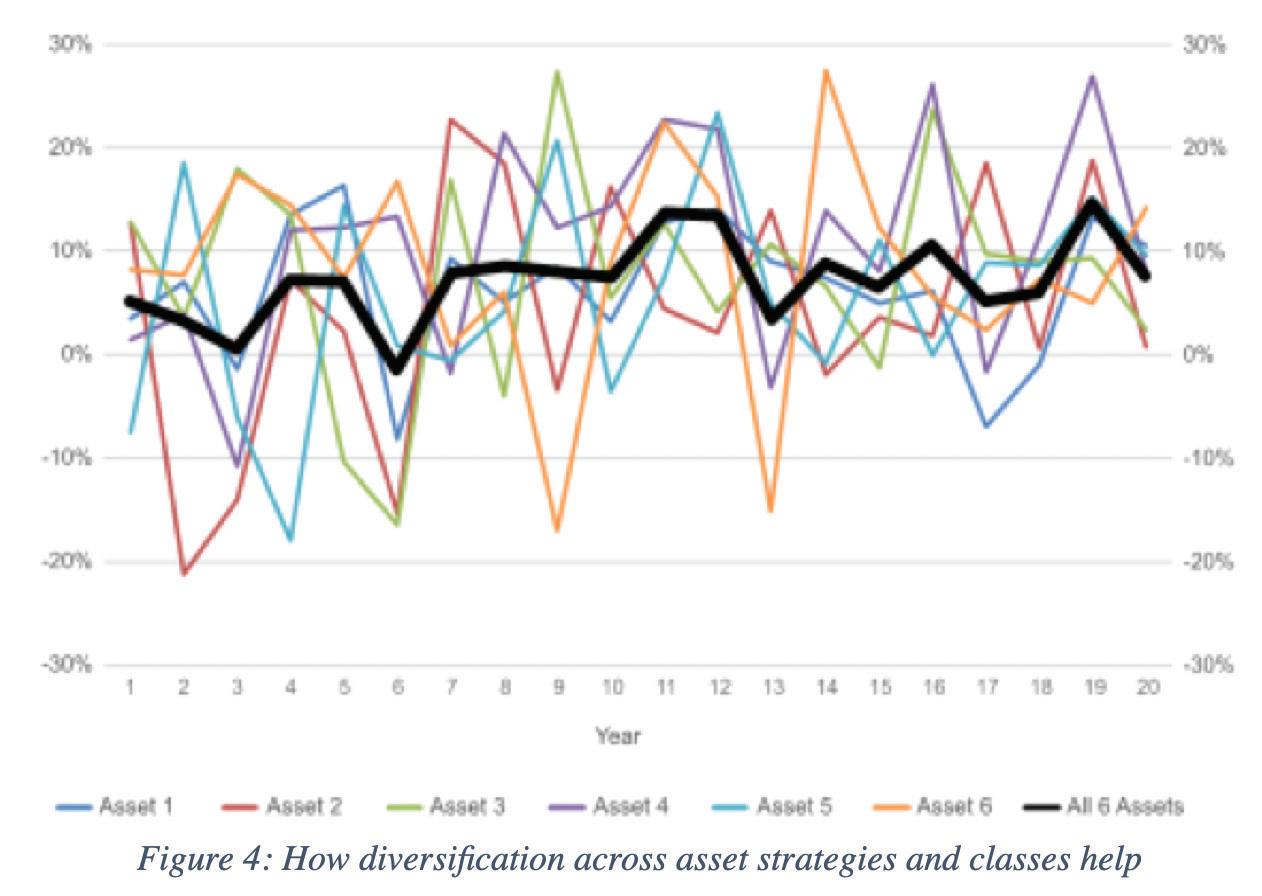

Execution Tip: Instead of going with a traditional market cap weighted index (for either equities or fixed income), you can choose funds / ETFs that are overweighted in the above factors of returns to achieve better returns than the market. Finally, to complete the picture of diversification, we can go beyond the traditional asset classes of equities and fixed income and further diversify into alternative strategies and alternative asset classes. The following diagram illustrates how such diversification helps your portfolio. The important point is that we want to include assets strategies and classes that perform differently from the traditional assets under varying market

Equities

• Market Premium (equities tend to outperform bonds)

• Size Premium (small cap tends to outperform large cap companies)

• Value Premium (value tends to outperform growth companies) • Profitability Premium Fixed Income

• Duration Premium (longer tends to outperform shorter) • Quality Premium (high credit quality tends to outperform low credit qualify bonds)

• Currency Premium (certain issuing currencies tend to outperform other issuing currencies)

conditions. Here are some ideas to include into your portfolio. In addition, we may want to position our portfolio to combat potentially upcoming inflation that has been notoriously missing since quantitative easing (otherwise known as money printing) that began back in 2008.

Alternative Strategies

• Venture capital • Leverage buyouts • Long/short equity • Merger arbitrage • Managed futures Alternative Asset Classes

• REITs • Commodities / Precious metals • Derivatives • Cryptocurrencies

Execution Tip: Look for unit trust funds / ETFs that allow you to gain exposure to the above strategies and asset classes. Such products allow access without requiring large sums of capital to achieve the required safe diversification.