1 minute read

Protect Our Lagoon..............................................................28

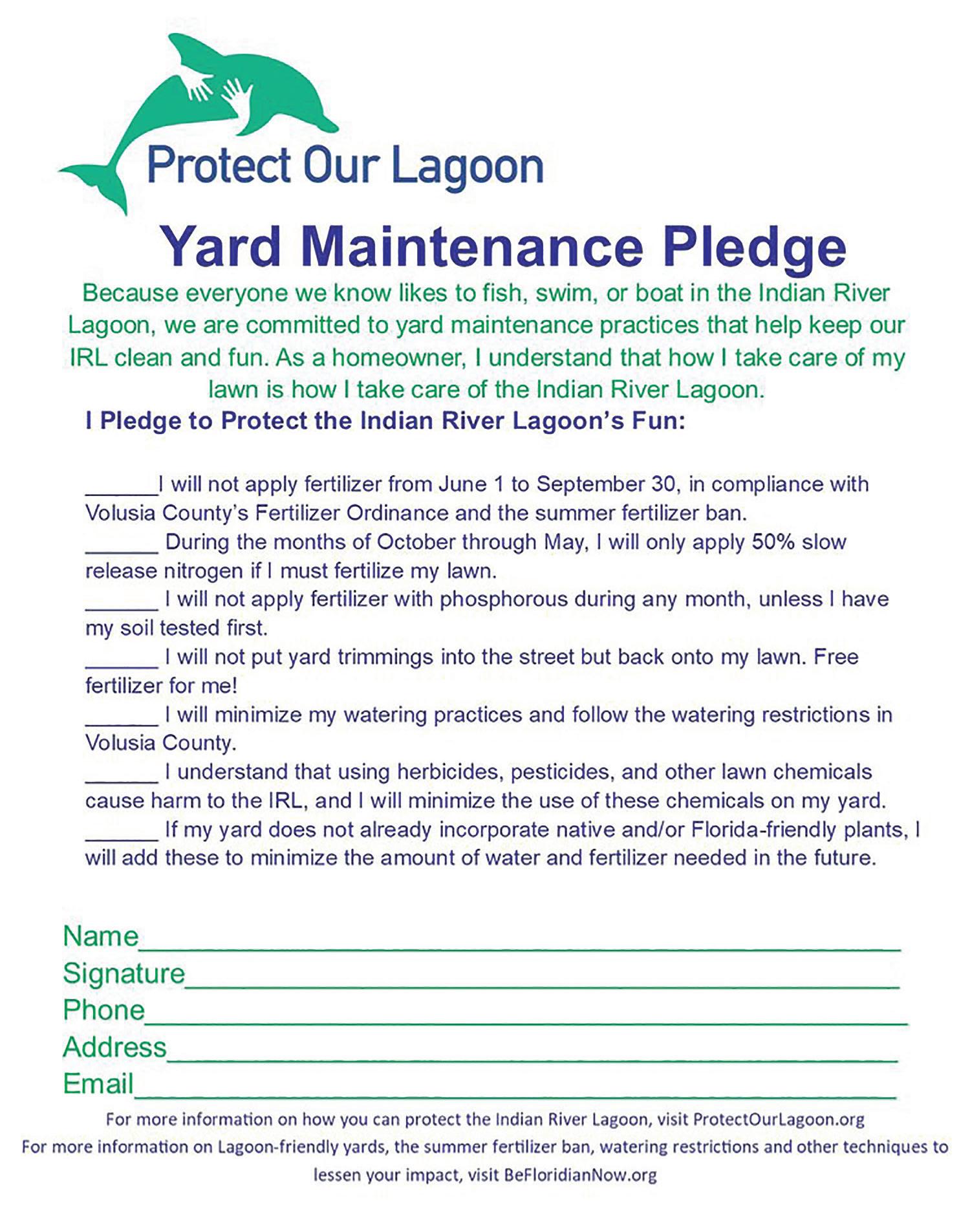

Want to be a part of the solution? Take the pledge now and get your very own Protect Our Lagoon yard sign!

Advertisement

1) Current Trends in Marine Insurance:

We are presently in a tough market for marine insurance, especially on vessels over 30 feet and over 15 years of age. South Florida is considered to be a higher risk area with theft issues, coastal hurricane exposure, a litigious environment, among other factors. Within the last few months, a couple of yacht insurance carriers have begun non-renewing policies and have pulled out of the State of Florida entirely, pushing some vessels into the surplus lines market (known as non-admitted carriers). A non-admitted carrier is less regulated by the State insurance department, not financially backed by the Florida Insurance Guarantee Association “FIGA”, and can raise and lower rates and make policy changes (at renewal---not mid-term of a policy period) more easily as the market dicatates. In general, it is better to obtain insurance with an “Admitted” carrier, but often this is not possible. Another current trend is for some insurance providers to require vessels not be kept on a lift during a hurricane. It may seem like a lift is a safe place to secure a vessel, BUT loss experience has shown that lifts are not designed to handle the torque and wind load of a powerful storm. Another issue with securing a vessel to a lift is storm surge, where the water raises up and over or into the vessel.

2) Tips on getting the lowest rate:

There are a few things that help boaters obtain the lowest rate possible. Completing a boating