6 minute read

Housing Watch

JUNE HOUSING WATCH

Second Quarter Home Sales Drop, but June is a Bright Spot

The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown. This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.” Lawrence Yun, chief economist of the National Association of Realtors ®

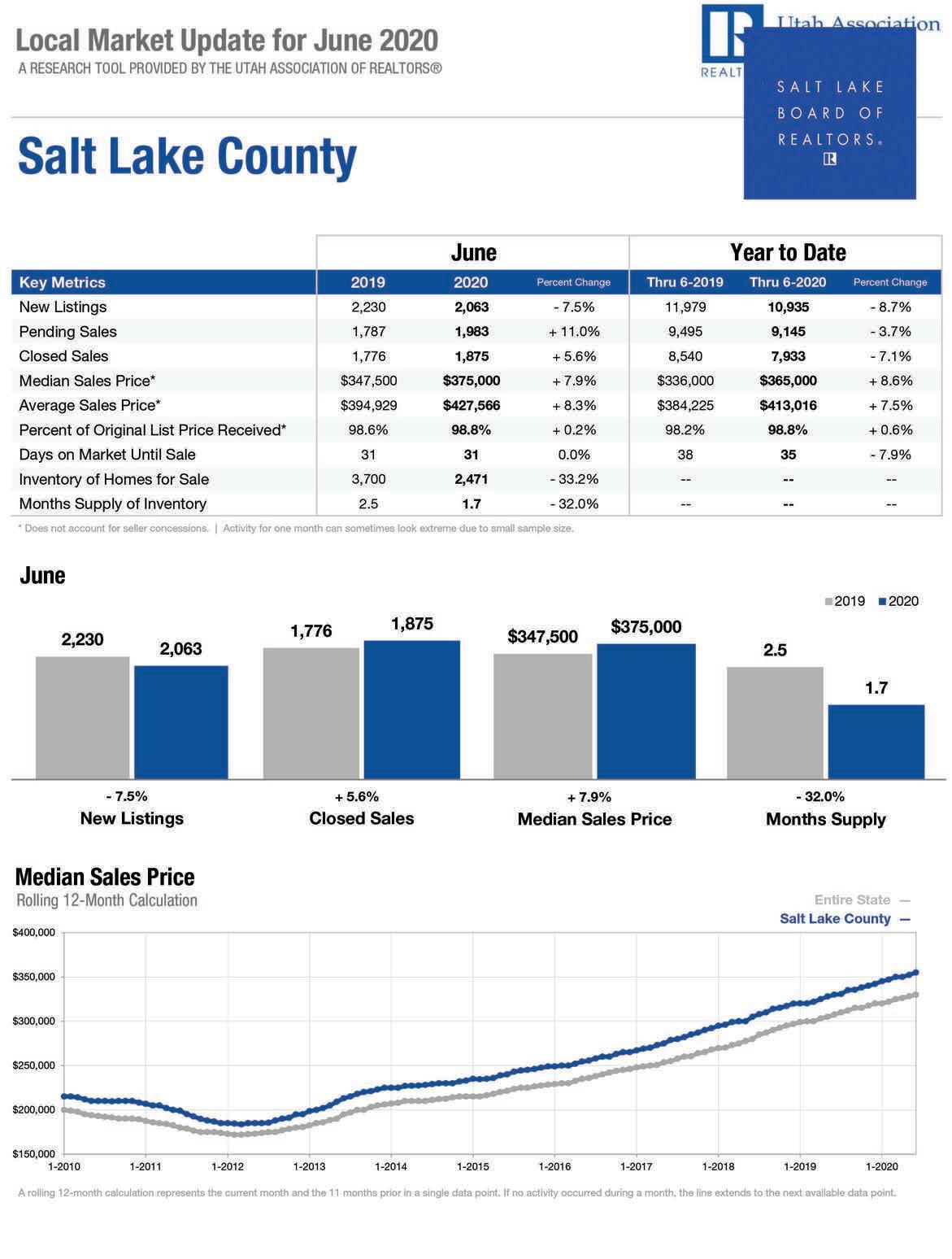

The coronavirus pandemic and subsequent business shutdowns affected home sales across the Wasatch Front. Single-family home sales in the second quarter in Salt Lake County dropped to 3,274 units sold, a 14-percent decline from a year earlier and a seven-year low for overall second quarter sales. One bright spot in the second quarter was the rise in single-family home sales in the month of June, which increased 5 percent compared to sales in June 2019. Lawrence Yun, chief economist of the National Association of Realtors ® , said that if the virus shutdown was less than three months, there would be a quick, robust rebound to the housing market. In Salt Lake County, that is proving to be the case as the spring home buying season has been pushed to summer months.

“The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown,” Yun said. “This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.” June’s sales increase suggests the worst might be over, as record-low mortgage interest rates drive buyers to purchase homes. Prior to June, single-family home sales had fallen three consecutive months: March sales were down 3 percent; April sales dropped 25 percent; and May sales were down 22 percent year over year. Other Wasatch Front counties saw similar declines in the second quarter: Davis County sales were down 7 percent; Tooele County saw sales drop 17 percent; Utah County sales were down 6 percent. Weber County sales were flat, falling just 0.2 percent. The top 5 ZIP codes with the highest number of single-family home sales in the second quarter were (percent change year over year): Lehi (84043) 314 sales, down 6 percent Eagle Mountain (84005) 300 sales, up 13 percent Tooele (84074) 290 sales, down 19 percent Herriman (84096) 285 sales, up 2 percent Clearfield (84015) 278 sales, down 6 percent Salt Lake County’s median home price in the second quarter climbed to $404,193, up 6 percent from a year earlier. Weber County posted the lowest median home price at $300,000, up 8 percent year over year. In the second quarter, the typical Salt Lake home was on the market 31 days before it sold, down from 36 days on the market in the second quarter of 2019.

7 Client Behaviors (continued from page 26) 2. Wish lists are shifting. Home shoppers are changing some of their priorities for home features. For example, NAR research shows that the top feature desired by buyers is a home office. Many households may need more than one. Also, more home buyers are sizing up outdoor space, showing an increasing desire for a pool, garden, or just more space to enjoy the outdoors.

3. Buyers are less concerned about

commutes. As remote work grows, 22 percent of about 2,300 Realtors ® surveyed by NAR said their buyers are becoming less concerned about commute time when shopping for a home. Freedom from the bounds of the commute has allowed some buyers to expand their searches beyond city centers to the suburbs and exurbs— which may also offer more affordable housing. A quarter of Realtors ® report their buyers are looking away from the city center and toward to the suburbs or smaller towns. “If workplaces keep changing and there’s this greater acceptance of remote working, this trend could stick around longer,” Lautz said. Also, second homes may be in greater demand. “If they can work from any place, we could see more buyers embrace second homes in rural areas,” Lautz said.

4. Multigenerational households may

grow more common. One in six Generation Xers and younger baby boomers purchased a multigenerational home pre-COVID. Lautz suggested that trend could increase as more generations, including aging parents and adult children, all come under the same roof during the pandemic. “Moving forward, that could mean your buyers will be looking for larger singlefamily homes,” Lautz said. “They also may want to make sure they have a sizable living space on the first level” for an aging parent. Also, recent surveys show a growing desire of buyers— particularly younger buyers—wanting to live closer to their family. The top reasons to move before the pandemic were a new job, marriage, or baby. But now most moves are being driven by young millennials—twenty-somethings— who want to be near their family or friends. “The family unit appears to be becoming more important, and I think COVID could increase this trend,” Lautz said.

5. Pets could drive purchase decisions.

The pandemic has sparked a surge in households that want a pet. NAR surveys have shown that pets can influence when and where people buy. Forty-three percent of households say they’d be willing to move to better accommodate their pet, according to NAR’s 2020 pets in real estate study, “Animal House: Pets in the Home Buying and Selling Process.” “We see consumers actually want to buy a property because of a pet, and then they may want a fenced-in yard and extra space for their animals,” Lautz said.

6. A first-time buyer wave could emerge.

Consumers may show more commitment to their home than to long-term relationships. In the 1980s, 75 percent of first-time buyers were married. In 2019, that dropped to 53 percent. Young adults are waiting longer to get married. Meanwhile, unmarried couples are buying homes at the highest levels ever recorded by NAR: 17 percent. Also, NAR research has seen a rise in roommates pooling their incomes to purchase a home together. NAR’s research shows that percentage at a mere 4 percent, but Lautz noted it’s the highest share that NAR has ever recorded. Overall, in 2019, first-time buyers comprised 33 percent of the housing market, still a low number by historical standards. “But there could be an uptick, particularly in affordable places further out,” Lautz said. “If young professionals become less tied to a metro area for work—in metros where it can be difficult to afford a property—they may increase their purchases.” 7. Housing tenure could fall. Over recent years, homeowners have stayed put in their homes longer than they have in past—an average of 10 years, which is longer than the traditional six-year average. Americans are not moving longer distances like they did in the 1980s. As cities urged stay-at-home restrictions during the pandemic, consumers may start to question whether their home fits their current needs. “Interest rates are at all-time lows; [consumers] may want to move and find a home where they can work from and the kids can too, and they want more yard space to relax,” Lautz noted. “This change in homeowner tenure could be one we see coming soon.”

Our agents are all in. Are you?

Our Hub App keeps you connected to information and resources like our Safe Showing Center and exclusive education events

Weekly economic videos by our Chief Economist Matthew Gardner and automated drip emails Safety kits and supplies help keep you ready to show homes on the fl y

Partnered with Distillery36 to create branded hand sanitizer

Love making people’s dreams come true? Text Monica at 435 313 7905