8 minute read

Housing Watch

SEPTEMBER HOUSING WATCH

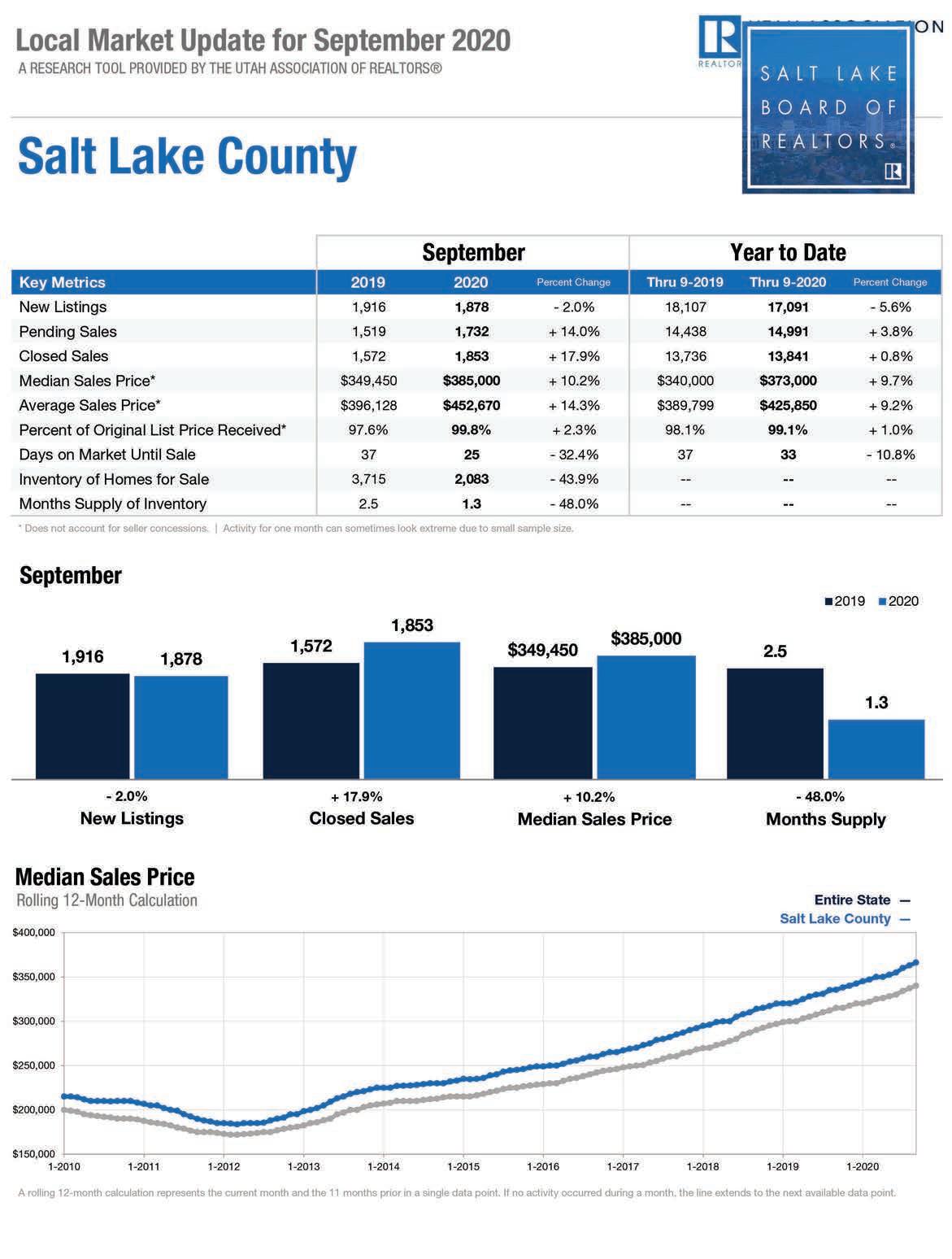

Home sales in Salt Lake County climbed 18 percent in September, the fourth consecutive month of rising sales year over year. The recent sales increases have now erased the downturns experienced earlier this year tied to the Covid-19 pandemic. Sales in the county from January through September climbed to 13,841 sales, up 1 percent compared to sales in the same nine-month period in 2019.

In neighboring Davis County, sales in September were up 3 percent. Year-to-date sales increased to 3,696 closings, up 2 percent compared to the same January through September period in 2019.

Nationally, total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 20.9 percent from a year ago (5.41 million in September 2019), according to the National Association of Realtors® .

“Home sales traditionally taper off toward the end of the year, but in September they surged beyond what we normally see during this season,” said Lawrence Yun, NAR’s chief economist. “I would attribute this jump to record-low interest rates and an abundance of buyers in the marketplace, including buyers of vacation homes given the greater flexibility to work from home.”

The median home price for all housing types sold in Salt Lake County in September increased to $385,000, up 10 percent from $349,450 a year earlier. In Davis County, the median price reached $380,000, up 13 percent from last year’s median of $336,000. The U.S. median home price in September was $311,800, up 15 percent from September 2019.

“There is no shortage of hopeful, potential buyers, but inventory is historically low,” Yun said. “To their credit, we have seen some homebuilders move to ramp up supply, but a need for even more production still exists.”

Sales in vacation destination counties have seen a strong acceleration since July, with a 34 percent year-over-year gain in September. Additionally, a recent NAR study confirms that many Americans continue to seek new living situations due to the coronavirus pandemic.

In Salt Lake County, properties were on the market for 25 days, down from 37 days a year ago. Across the U.S., properties remained on the market for 21 days in September – an all-time low – seasonally down from 22 days in August and down from 32 days in September 2019. Seventy-one percent of homes sold in September 2020 were on the market for less than a month.

“Home sales flourished this past month, even as we contend with an ongoing and unforgiving pandemic,” said NAR President Vince Malta, broker at Malta & Co., Inc., in San Francisco, Calif. “I couldn’t be prouder of all the brokerages and Realtors® who have helped us navigate these challenging times to ensure our nation’s economy continues moving forward.”

Winter’s Real Estate Market (continued) patio to catch up on emails alone. “With people spending so much time in their homes, including working from home and virtual schooling, there’s a great emphasis on being happy there,” said Matt Curtis, owner of Matt Curtis Real Estate, in Huntsville, AL. Lack of space is a complaint agents hear more often now. And if people are allowed to continue working from home rather than commuting to an office, they might also realize that they can shop for homes farther outside cities—great news for home sellers who live in more remote areas.

Housing inventory is low

Although buyers are plentiful, the number of homes for sale is way lower than usual. According to realtor.com’s Monthly Housing Market Trends Report, in September, national housing inventory declined 39 percent over last year. “Because the number of homes available is currently at a record low, even if we see some improvement, which I expect, there will still be relatively few homes for sale,” Hale said. “That will keep upward pressure on home prices and help ensure that homes continue to sell quickly.” “Inventory is low, so the overall advantage is with the seller,” agreed Yun. Tracy Jones, a real estate agent with Re/Max Platinum Realty in Sarasota, Fla., said buyers have so few homes to choose from these days that they’re feeling forced to make quick decisions about whether to make an offer, or risk losing out on the chance. Nationally, homes spent an average of 54 days on the market in September, 12 fewer days than last year, according to the realtor.com trends report. “The buyers I have worked with this year only had a handful of homes to look at,” Jones said. “They had no time to wait and talk about it, and they had to fight other buyers if they wanted to buy them.”

Sellers can get top dollar for their homes

It’s simple supply and demand: Low supply and high demand are bound to drive up home prices, so sellers stand to make a killing. Across the country, median home listing prices jumped 11.1 percent in September compared with a year ago, to $350,000, according to realtor.com. Price per square foot increased by 13.9 percent. “Sales prices and home values remain strong,” McDaniels said. And since there are so many offers on the table, “sellers can call the shots regarding terms of contract and repairs.” The only challenge sellers face with such low inventory—if you can even call it a challenge—is dealing with too many offers at once, said Curtis. “The challenge they face is navigating multiple offers and not accepting an offer too quickly to help ensure they get the most money for their home,” he said.

Mortgage interest rates are low

Although buyers will face stiff competition, it’s not all bad news for them. For one, despite high home prices, record-low interest rates mean they’ll save a ton of money. Interest rates on a 30-year fixed-rate loan were 2.8% as of Oct. 22, according to Freddie Mac. This “boosts buyer home purchasing power,” Hale said. “In fact, despite double-digit increases in home prices this year compared to last year, today’s home buyers are likely actually paying slightly less on their mortgage each month, thanks to much lower mortgage rates.” The Federal Reserve has continued to lower interest rates this year to keep the economy going during the COVID-19 crisis, said McDaniels. “Even before the COVID-19 pandemic, economists and real estate professionals predicted mortgage interest rates would remain below 4 percent in 2020,” she said. “This means buyers that might have waited will consider entering the market this year.”

Any economic shift likely won’t be felt until spring

Although unemployment continues to rise due to COVID-19 layoffs, Hale said this could affect the real estate market, but the effects likely won’t be felt for a few months. “A worsening unemployment rate would lead to a slowdown in the housing market and home sales, but I don’t expect that to happen immediately, more likely in the spring,” Hale said. This could create a slower start to the spring home-buying season. Plus, if another round of stimulus money appears, this would fuel consumer spending. “This would be a good thing for the housing market and the economy at large,” Hale said.

Erica Sweeney is a writer whose work has appeared in the New York Times, Parade, HuffPost, and other publications. Reprinted from Realtor® Magazine Online, November 2020, with permission of the National Association of Realtors®. Copyright 2020. All rights reserved.

Collaboration over competition.

The Windermere family is tight. We are one of the few real estate agencies in the nation that fosters a culture of collaboration over competition. The result? A happier work environment, deeper relationships with our clients and communities, and sustainable prosperity. During these uncertain times, the one thing that keeps us going is the pleasure we get out of working with each other, not against each other.

COME COLLABORATE WITH US

Call or text Monica

Monica Draper VP of Business Development 435.313.7905

Or learn more online by visiting: winutah.com/joinus