2 minute read

Making Cents of Your Money

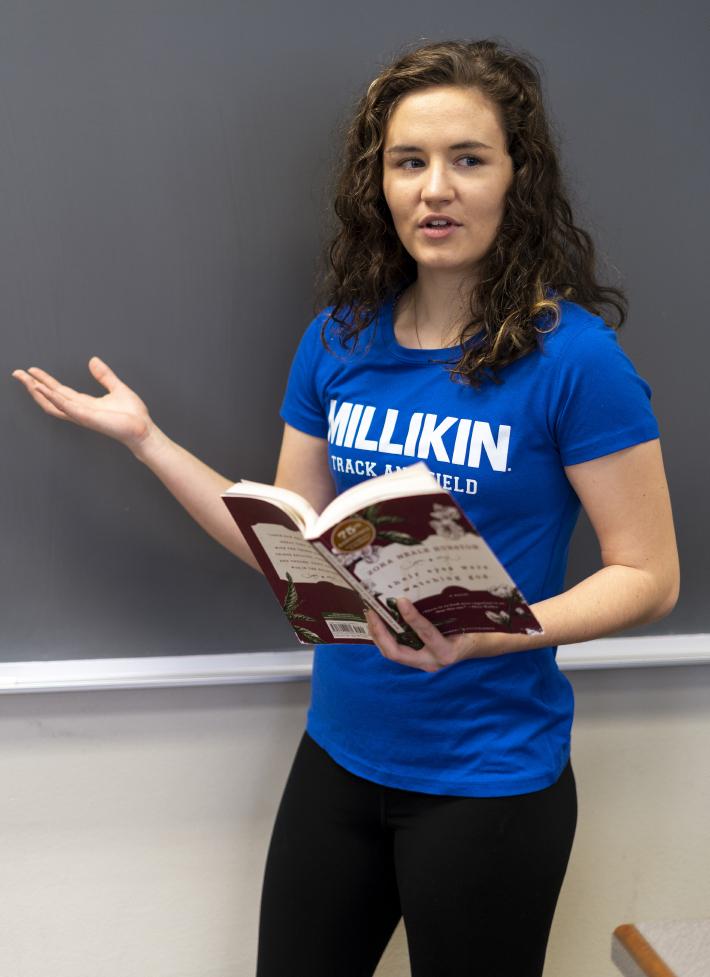

Ashley Brown

Is unexpected spending threatening your peace of mind? Learning these financial keys to success can save you from falling into that trap.

Advertisement

From paying tuition to forking over the last of my cash for ramen noodles, college has demanded every penny I own. If you’re like me, you may feel overwhelmed when life pulls your wallet and savings account in every direction and you’re left wondering: “Where is my money going?”

To answer that question and empower yourself through your finances, try budgeting. Making a budget allows you to see the money you are gaining and losing. This helps you locate any unnecessary spending and find a balance between focusing your money on “needs” and “wants.” Incoming money typically takes the form of career income or allowances, and outgoing money usually refers to expenses. These include everything that requires payment on a monthly basis such as phone and electric bills, tuition, car insurance, and groceries. Using a budget allows you to track your income and manage your expenses. Now that you know the importance of a budget, here are some tips for creating a budget that’s right for you: ¢

2Set financial goals. If you have any goals regarding your finances such as saving money, creating an emergency fund, paying debt, or eliminating unnecessary expenses, write them first. This will set the tone for how you want to focus your budget. List income and expenses. Write the dollar amounts of your monthly incoming money in addition to your outgoing expenses. By subtracting your expenses from your income, you will see how much money remains each month.

Once you have established your budget and started tracking expenses, stick with it.

Before long, your financial goals just may become a reality—and you might not ever have to eat ramen noodles again (unless you want to). 1 4 3 Track your spending. Spend the first month of your budgeting like you normally would to track exactly where you are losing money. Through this process you will discover where your money is really going. Separate needs from wants. You may want to go to Starbucks five times a week, but you probably don’t need to do that. Though you may find it necessary to limit your spending on “wants,” consider maintaining a budget that allows you to enjoy the items and activities that make you happy—but in moderation. BURST 7