7 minute read

DIY Container Shipping?

Is the door opening to DIY container shipping, are steps in this direction a passing phenomenon or are there solid grounds to pursue this course of action? Mike Mundy examines the proposition

Can you envisage an alliance style liner shipping consortium made up of high street retailers? Too far-fetched?

Well up until recently who would have thought Home Depot or Walmart would have entered the cut and thrust arena of liner operations by chartering their own vessels? The extent of their involvement has not really become clear yet but is it really a surprise that they have entered the sector?

Admittedly, it hasn’t happened before in the container sector to any significant degree, but isn’t it a natural step for those seeking control of their own destiny in circumstances where they are hard pressed to achieve this via common carrier service providers?

In August Brett Biggs, Executive Vice president and Chief Financial Officer, Walmart, highlighted the reality that supply chain issues were not just an operational problem but represented a threat to the company’s growth. Hence the decision to charter vessels to carry its own goods. The belief is there that much improved reliability of supply can be achieved and presumably against a background of upward spiralling container freight rates the cost parameters are also competitive.

Home Depot’s motivation is in the same ball-park – achieving integrity of supply. Ted Decker, President and Chief Operating Officer, Home Depot, confirmed this back in June when he talked about a vessel shuttling back and forth 100 per cent dedicated to meet Home Depot requirements.

THE LESSONS OF HISTORY

History also tells us not to be too surprised. When scale and the need for certainty builds – subscribers to the Do-ItYourself approach do emerge.

Air cargo has seen the advent of dedicated players such as DHL, Fed-Ex, UPS and Amazon Air. Fed-Ex is in fact today the largest carrier in the cargo sector overall with a fleet of over 400 aircraft and approaching 300 contracted feeder aircraft. Amazon Air’s fleet has grown in leaps and bounds since the advent of the pandemic. By the end of 2022 it is estimated that the company will have over 85 planes in service.

The bulk shipping sector tells a similar story. Vale is a prominent example in the dry bulk sector, running its own , purpose-built, high-capacity vessels carrying iron ore from Brazil to Asia – the so-called Valemax design which offers a capacity of 2.3 times a Capesize vessel. A second-generation design has been introduced since 2018, a 400,000-ton configuration which Vale claims reduces greenhouse gas emissions by 41 per cent compared to a 2011 built Capesize vessel. These are the top-ofthe range vessels in Vale’s fleet but overall the fleet will typically

8 Maersk has

warned that if the shipping sector does not provide satisfactory services to customers like Amazon they could become competitors

comprise in excess of 250 vessels of various capacities with the mix matched to the varying requirements of different customers.

Pursuit of sustainability and operating arrangements where emission reduction can be properly measured is of course another growing incentive to go the DIY route.

The wet sector of bulk shipping also has serious proponents of dedicated shipping capacity. The energy majors are prime examples – Chevron operates vessels for the carriage of LNG and Very Large Crude Carriers (VLCC) for the carriage of crude oil. Shell operates six oil/chemical tankers, 40 LNG carriers and a specialist LNG bunker vessel.

FURTHER EVIDENCE

The logistics sector provides further evidence of parties seeking alternatives to the traditional liner shipping market.

In December last year Denmark-based DSV chartered three multi-purpose vessels to run a one-off service from China to Denmark and in May this year it chartered an 1800TEU capacity vessel to run another one-off service from Asia to North Europe.

The forwarder Geodis has also pursued a similar course of action. Earlier this year it chartered a 1000TEU vessel to run from Shanghai to Hamburg stating at the time the move was necessary to “deliver certainty amid chaos.”

DKT Allseas Cargo, the ship agency arm of the Allseas Cargo group, is similarly reported to be developing plans to launch a regular China-UK container shipping service.

WHAT ARE THE DYNAMICS?

So, what breathes life into the proposition of do-it-yourself container shipping?

The short answer is, perhaps, the chaos all around. The things we now hear about on a more or less daily basis – the nonavailability of liner shipping capacity in the right place at the right time, spiralling freight rates, port and terminal congestion, port shut-downs due to COVID-19, growing incidences of cargo being rolled, labour and equipment shortages etc. etc.

If we step back a bit we can also see the key factors underpinning the cocktail of chaos symptoms. Back in the second quarter of 2020, with COVID-19 getting a serious grip worldwide, there was a comprehensive scaling back on the part of major retailers and business generally. No one knew what lay ahead and understandably the typical response was to exercise caution, cut costs and reduce orders from Chinese and other producers. Many factories in China and elsewhere were also compelled to close due to COVID-19 and resulting lockdowns.

But then with the introduction of national stimulant programmes demand came roaring back – this funding, in turn, played a massive part in the huge uplift of activity focused on ordering goods on-line. Even without government stimulant led programmes this activity continues today.

Net result: massive demand, supply pipelines bursting at the seams and freight rates riding an escalator into uncharted territory. Interestingly, there have been recent moves to cap spot rates on the part of leading lines – is this recognition that they are heading into dangerous territory, might be providing an incentive to the DIY concept?

WHAT NEXT?

The influence of on-line sales is a big factor in what happens next or rather longer term.

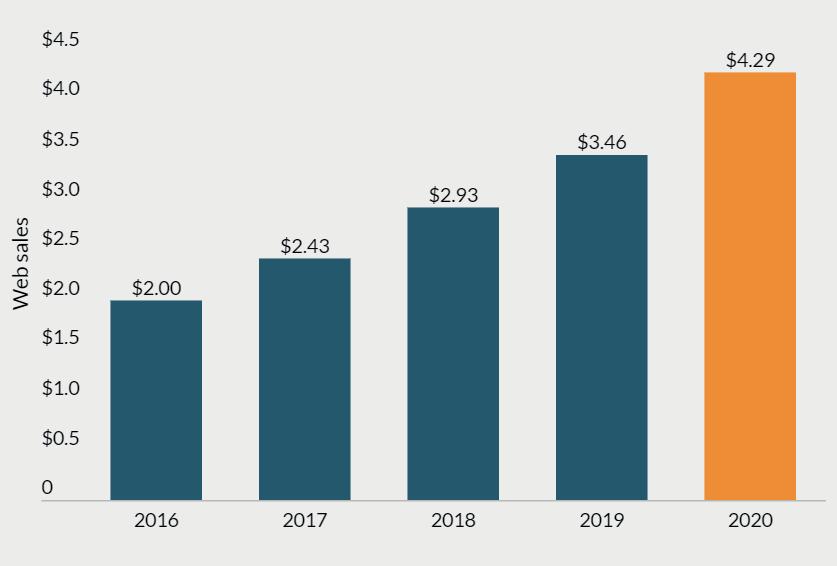

Digital Commerce 360, the research and media organisation, estimates that globally in 2020 more than US$1 in every US$5 went towards the purchase of consumer goods on the web. Online penetration, it says, hit 20.2%, up from 16.4% in 2019 and 14.4% in 2018.

In revenue terms, as Figure 1 demonstrates, Web-based global consumer sales have more than doubled in the period 2016-20.

There is not the time or space to delve deeper into these positive trend lines but suffice it to say there are many growth characteristics – the consolidation of position in established markets such as the USA and China continues and new growth markets in countries such as Canada, the UK and Mexico are rapidly emerging. The latter three countries saw e-commerce activity grow by 71.2, 36 and 81 per cent respectively in 2020 compared to the previous year.

Overall, online sales drove nearly three-quarters—or 74.6%—of the gains in total retail in 2020 - the highest share of overall annual growth ecommerce has ever represented.

Plus, B2B e-commerce is also on an upswing – said to account for USD 7.72 trillion in 2021 and expected to achieve revenue of USD 25.65 trillion in 2028.

All this ultimately spells changing supply chains. Place an order with Amazon or Alibaba and it goes through directly generating a logistics requirement and what such platforms want is a seamless supply chain from beginning to end where there are not concerns over matching different components. In other words, control and dedicated capacity.

This is evidenced in Amazon’s ownership of freight forwarder Beijing Joyo Courier Service, a Chinese subsidiary, which runs its operations between China and the US.

Alibaba has taken a different but also direct route to logistics. It has ‘One Touch’ which automatically links with Maersk and with CMA CGM providing ‘non clunky’ logistics.

Significantly, Maersk has publicly voiced the thought that if such large customers are not provided with a five star service then ultimately they will represent a threat – they will come to think that they can do it better themselves.

Are we about to arrive at this watershed moment?

Sceptics will say when things get back to normal the incentives will disappear.

Will they?

Dedicated shipping services are a good fit with the automated, digitally driven, supply chains that the really big platforms and retailers are progressively basing their operations on. The proposition that dedicated retailer shipping services could emerge in key trade lanes is a serious one and cannot be discounted. Indeed, some contend it has gained impetus as a result of recent problems in traditional supply networks.

There may yet emerge a new category of shipping line client for ports and terminals to have as a customer. Now that would be interesting!

8 Figure 1: