6 minute read

3.1 Mediobanca Group

from CNFS22

by Mediobanca

20

3. Identity

3.1 Mediobanca Group

[GRI 102-1], [GRI 102-2], [GRI 102-4], [GRI 102-5], [GRI 102-6]

Mediobanca was founded in 1946 to support the reconstruction and development of the post-war Italian economy. In the course of this activity, the Bank forged strong links with the most important industrial families in Italy, promoting growth by taking equity investments in the companies itself. Although its original mission was to large corporates, activities were soon launched in the retail and mid-corporate segments too, with a view to diversification: with companies operating in consumer credit (Compass, 1960), leasing (Selma, 1970), mortgage lending (Micos, 1992) and private banking (Banca Esperia, 2001 and CMB, 2003).

Starting from 2003, the Bank embarked on a major transformation process, in a market and regulatory scenario that required change to be accelerated in view of the financial crises that marked the last decade. With the aim of strengthening its capital and earnings profile, and positioning itself as an operator geared towards creating value in the long term, the Mediobanca thus transformed itself from a holding company to a banking group performing highly specialist activities. This led to more active management of the equity investment portfolio, thus moving away from the system of cross-shareholdings, withdrawing from the various shareholder agreements entered into and selling investments not considered to be strategic, but also growing the banking activities in which the Bank had specialized, prioritizing capital light and fee-generating businesses in particular.

The 2016-19 business plan accelerated this process further, with a Wealth Management division being set up to leverage growth opportunities more effectively. Developing this division has become central to the Group’s growth strategies.

In continuity with the previous business plan, the 2019-23 Strategic Plan intends to make the Group’s business model even more effective, with the aim of definitively establishing Mediobanca as a distinctive player in the European financial panorama in terms of growth, quality and sustainability. The guidelines contained in the Strategic Plan target balanced growth in all business segments, by leveraging on:

Focus and positioning in highly specialized, highly profitable market segments driven by long-term trends;

Strong capital resources;

Ongoing investment in talent, innovation and distribution.

An ESG strategy has also been integrated into the business plan and top management’s long-term remuneration for the first time, so as to combine growth in business and financial solidity with social and environmental sustainability, thus creating value over the long term for all stakeholders.

Solidity and stability, along with the ability to innovate, professionalism and proper conduct, attention to and respect for our clients and partners are the values that have guided Mediobanca from the outset and which have driven our recent, sound growth.

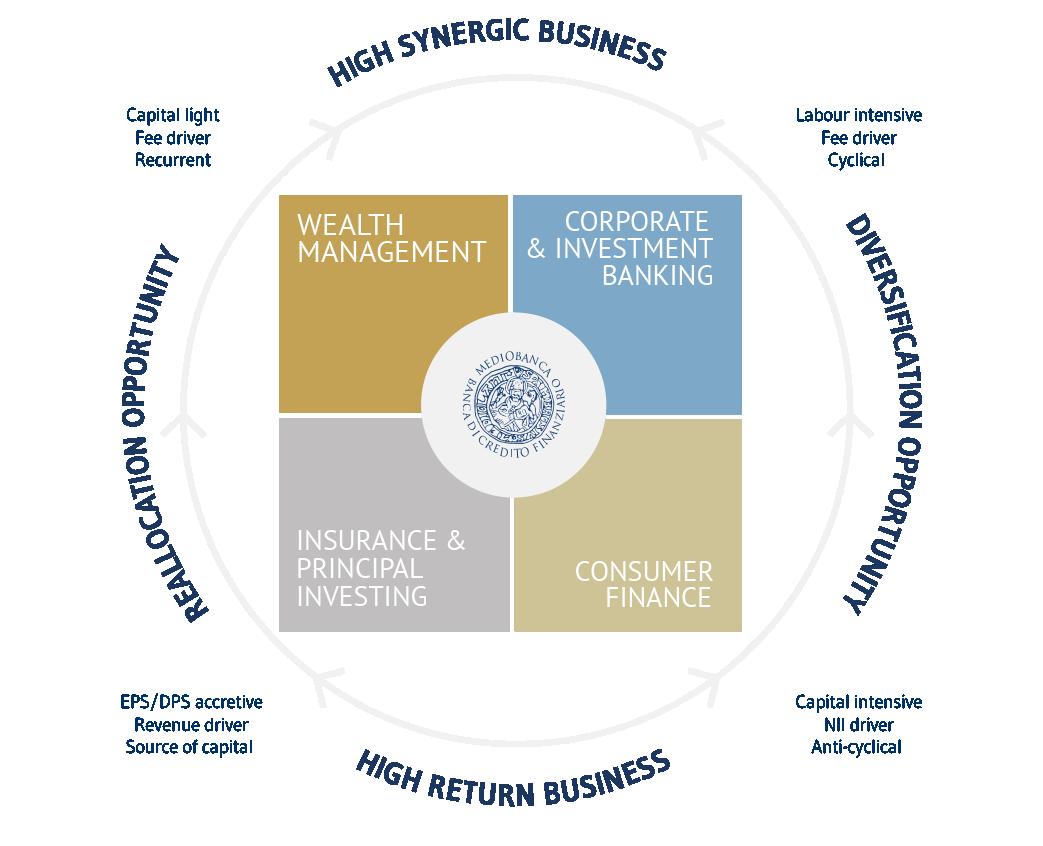

Tradition and innovation combine in the areas which go to make up the Group and contribute equally to its performance: Wealth Management, Consumer Finance, Corporate & Investment Banking, and Insurance & Principal Investing.

Business model based on highly specialized activities

WEALTH MANAGEMENT

Business with highly specialized content

Recurrent fee-based and low capital-absorption

Position in the Affluent & Premier segment continuing to strengthen

Unique product offering in Italy as Private& Investment Bank, with special focus on illiquid products for UHNWI clients3

CONSUMER FINANCE

Historical business launched in the 1960s

Specialist domestic business with high entry barriers addressed to families

Stable revenue source, driver of net interest income for the Group, highly profitable

Credit risk highly fragmented

CORPORATE & INVESTMENT BANKING

Business historically part of Mediobanca’s identity addressed to companies

Client-driven, highly specialized business

Fee-generating business, profitable and cyclical

Business well diversified by source, product and by geography

INSURANCE & PRINCIPAL INVESTING

Division which includes the Group’s main investments

The substantial legacy portfolio has been gradually unwound

Division consists almost exclusively of the Group’s holding in Assicurazioni Generali, an investment which delivers positive returns and helps stabilizes revenues and earnings, particularly in recessive market cycles

Wealth Management: this division brings together all asset management services offered to the various client segments:

Affluent & Premier: (CheBanca!);

Private Banking (Mediobanca Private Banking and CMB Monaco). This division also comprises the Asset Management companies (Mediobanca SGR, Cairn Capital, RAM Active Investments and

Mediobanca Management Company) in addition to Spafid, Spafid Family Office SIM and Spafid

Trust fiduciary activity. Consumer Finance: this division provides retail clients with the full range of consumer credit products: personal and special-purpose loans, and salary-backed finance. The division also includes Compass RE, which reinsures risks linked to insurance policies sold to clients, and Compass Rent, which operates in the second-hand car and vehicle hire segment.

Corporate & Investment Banking: this division brings together all services provided to corporate clients in the following areas:

Wholesale Banking: (lending, capital market activities and advisory services, and trading – client and proprietary – performed by Mediobanca, Mediobanca International, Mediobanca Securities and Messier et Associés);

Specialty Finance: factoring and credit management activities performed by MBFACTA and MBCredit Solutions and MBContact Solutions. During the year under review, after the calendar provisioning rules were extended to include NPL portfolios acquired, the Group decided to separate the activities of MBCredit Solutions, choosing instead to leverage third-party NPL management, and commencing a gradual and orderly disposal process of the NPL portfolios acquired, which will be transferred to Revalea, a new company set up by Compass, once the relevant authorizations have been received.

Insurance & Principal Investing: this division manages the Group’s equity investments, in particular the stake in Assicurazioni Generali.

Holding Functions: this division includes SelmaBipiemme Leasing, MIS and other minor companies, plus Group Treasury and ALM (with the aim of minimizing the cost of funding and optimizing the liquidity management on a consolidated basis, including the securities held as part of the banking book4), all costs relating to central Group functions including operations, support units (Planning and Control, Corporate Affairs, Investor Relations, etc.), senior management and the control units (Risk Management, Group Audit and Compliance) for the part not allocated to the business lines.

The Mediobanca Group’s strategy continues to focus on growth in all divisions, to be realized prudently and progressively by leveraging on its strong capital position, reputation and the market opportunities on offer, i.e. both through organic growth and by M&A. Priority will continue to be given to growth opportunities in the wealth management area, and more generally to fee-based and capital-light activities.

The Group maintains an extensive international network through companies set up in the various countries where it has operations.

NEW YORK

LONDRA

PARIGI LUSSEMBURGO

GINEVRA

MADRID ROMA MILANO

MATERIAL ISSUES

Capital solidity and profitability

Risk management

RISKS IDENTIFIED BY MEDIOBANCA

Wrong or inadequate consideration of scenario variables (e.g. economic, geopolitical and environmental scenario), of sustainability priorities and stakeholder expectations, with possible adverse impacts on strategic planning, decision-making and operating processes, and on the Group’s performances

Lack of and/or inadequate business continuity models sufficient to tackle the crisis

MITIGATION ACTIONS

Board CSR Committee

Management Sustainability Committee, Group Sustainability unit, and ESG working groups

Group Sustainability taking part as guest in the Wealth Management division’s Investment Committee meetings

Group Sustainability Policy

Specific stress testing methodologies defined for credit, liquidity, market and operational risk, to ensure a fully-integrated approach can be taken to management of risks relating to climate change as part of the Group’s strategy

Revision of the Mediobanca Group materiality matrix, supported by specific stakeholder engagement activity

Regular meetings with the Italian Banking Association (ABI)

Signatory to PRB (Principles for Responsible Banking)

Business Continuity Plans updated regularly (Risk Assessment and Business Impact Analysis performed at least once a year)

Crisis Unit

IT Regulation, IT Compliance & Business Continuity unit which acts as BCM Office at Group level and co-ordinates and manages the local BCM offices

Federal organization of Business Continuity, with specific local teams at each of the Group Legal Entities which have defined roles and responsibilities

Internal regulations on business continuity updated with the introduction of a new scenario for pandemic events

Training and awareness activities

IT infrastructure and multichannel offering enhanced