4 minute read

Finance Q&A

by mdmemphis

Financial Q&A

Protecting your investment portfolio

Advertisement

QFinancial Q&A

Q. My investment and retirement portfolios are going down in value and my anxiety level is going up. Some of my colleagues are getting out of the stock market now before the market declines further, and other colleagues say to stay invested no matter the circumstances. I’m confused as to the best course of action. Please advise.

A. Before taking any action, you should examine your current goals and objectives. What goals are important to you? What are your savings goals? What is your time horizon? The objectives of your investment and retirement portfolios will help dictate the asset classes and security types needed to accomplish the goals of your plan.

So far, 2022 has been a difficult year for the financial markets. Losses have been significant and widespread, but a short-term portfolio decline should not be the reason to abandon your goals and objectives. Over time, history shows that stocks consistently provide higher returns than cash and bonds, and higher returns in stocks help accomplish investment goals faster. Unfortunately, positive stock market outcomes are not always the result, and long-term investors in stocks must accept the possibility of greater risk (market swings) for the possibility of greater returns as the market’s price of admission.

The downside of selling during market declines to protect against future losses means you probably won’t be able to take advantage of future gains. Gains after significant declines are unpredictable and often come in bursts. While the appeal of market timing is obvious (improving portfolio returns by avoiding periods of poor performance), timing the market consistently is extremely difficult, and investors that wait for the right time to invest often find themselves missing out on the best performing days the market has to offer. A simple example of this can be found by looking at an investor that stayed fully invested in the S&P 500 stock index from the beginning of 1997 through June 2022. Over this period, the investor with an initial $1,000 investment would have been rewarded as the investment grew to $3,452. The investor who missed out on the best 40 performing days (during the same period) experienced a loss as their initial investment of $1,000 declined to $399.

My advice is to stay the course, but you must be aware of your investment timeline. Longer timelines dictate a greater ability to tolerate market swings of risker assets. Conversely, shorter timelines dictate the need for safety and protection of investment principal. Combining assets with less risk (cash and bonds) with riskier assets (stocks) helps to reduce overall portfolio volatility and establish the foundation of a diversified asset allocation strategy. I would also advise you to seek further guidance from a qualified financial professional to review your risk tolerance and portfolio composition for the appropriate allocation.

William B. Howard, Jr., ChFC, CFP

International Place II 6410 Poplar Ave., Suite 330 Memphis, TN 38119 901-761-5068 Fax: 901-761-2217 whoward@whcfa.com

Physician Wellness

Three easy ways for you to receive up to six, free and confidential visits with a licensed psychologist

Call, text or fill out a short form. Burnout is normal, and we can help you get back on track.

1 2 3

CALL

This hotline is answered 24 hours a day, 7 days a week.

901-286-3110

TEXT

Our confidential hotline also accepts text messages.

901-286-3110

FILL OUT A FORM

Our form is HIPPAcompliant. Use your smartphone's camera to scan this code.

Give your finances

the same care as you do your patients.

In today’s uncertain markets, having a bank that tends to your financial health is vital. First Horizon Medical Private Banking can help with today’s needs and tomorrow’s goals. Our Relationship Managers offer guidance and solutions tailored to medical professionals. So you can focus on your priority: your patients.

To make an appointment, please contact:

Margaret Yancey

Senior Vice President Medical Private Banking ph: 901-681-2526 myancey@firsthorizon.com

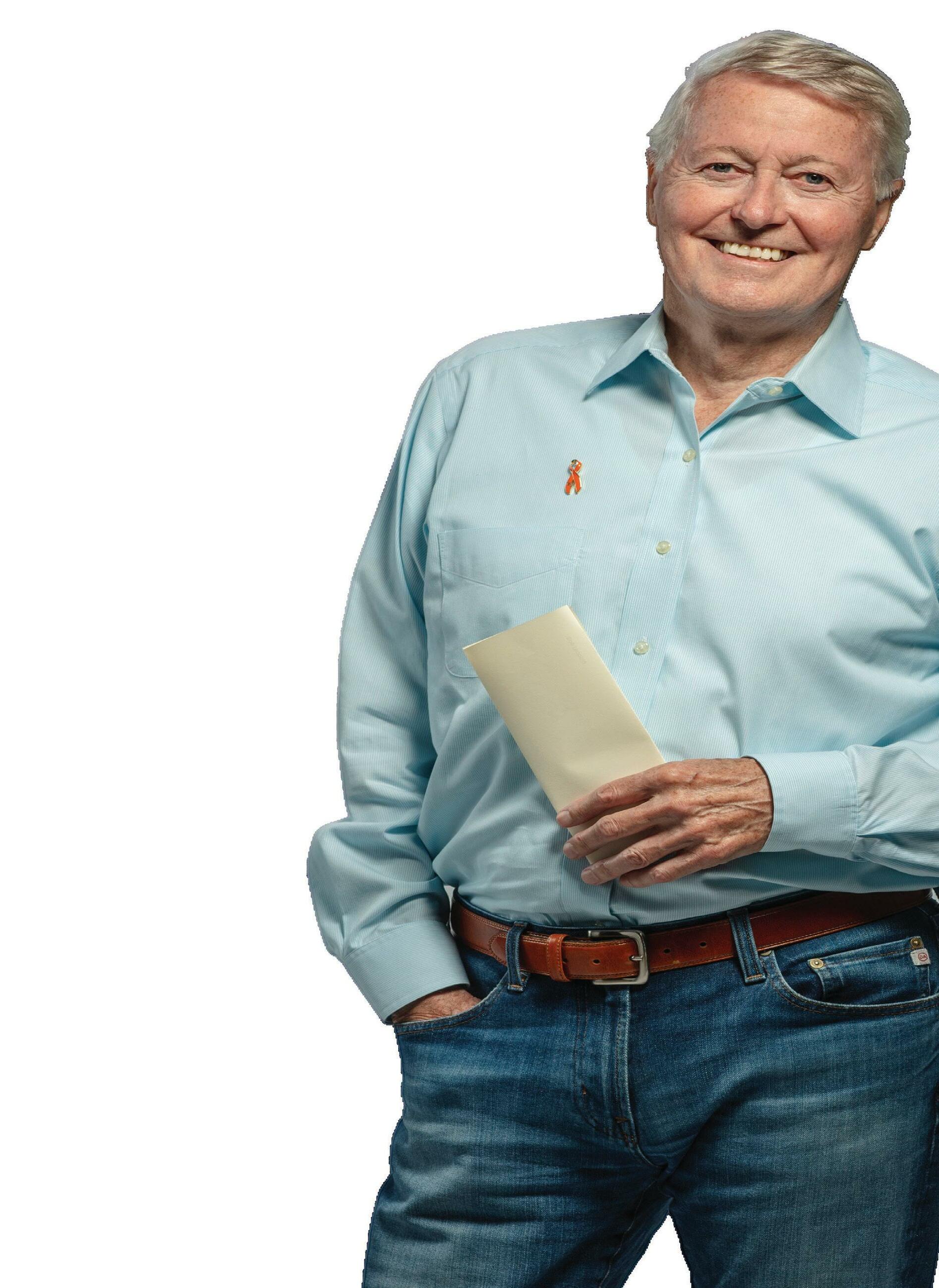

My health issues are a lot smaller and I’m a lot happier.

BOB LEOPOLD Thankful Bone Marrow Transplant Recipient

When Bob Leopold required a bone marrow transplant to treat leukemia, he needed a specialized team with proven clinical quality and safety. He got that and so much more. Our dedicated oncology experts and surgeons pushed the boundaries of stem cell research and exceeded every single one of Bob’s expectations. In a letter, he writes, “My surgery was successful because of the commitment, skills and positive energy of my team. They were always willing to go the extra mile. I am so grateful for the care you gave me.”

Hear Bob’s full story of thanks at methodisthealth.org/bob.