2 minute read

Are you aware of the changes to business rates for holiday lets?

The changes

From 1 April 2023, new business rates eligibility rules will be applied to self-catering properties in England and, if you fail to meet these requirements, your holiday let will be required to pay council tax. According to the Government website, to be eligible for the new April business rates your property must be:

Advertisement

•available to be let commercially for short periods that total 140 days or more in the previous and current year.

•actually let commercially for 70 days or more in the previous 12 months. (gov.uk)

To establish whether your property was let on a certain day, the government’s Valuation Office Agency (VOA) will check whether your holiday let was occupied immediately before midnight. In other words, if you let your property out from, say, Friday evening to Sunday morning, this would be classed as a two-day let under the new self-catering criteria.

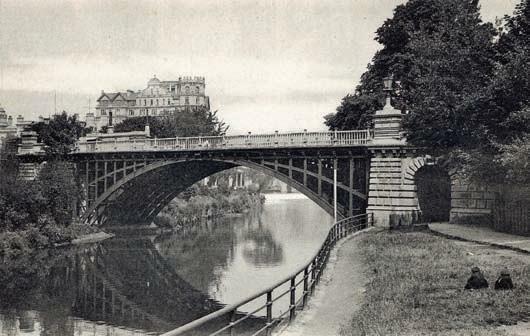

With all its grandeur and historical importance, the Roman city of Bath has long been a destination to visit. In years gone by it was for the ancient Roman baths, though now many tourists prefer the Thermae Bath Spa as a modern alternative, where you can bathe in the only natural thermal hot springs in Britain. Tourists bring millions of pounds to the local economy each year, which is why it’s no surprise that the area is filled with holiday lets. Many of these are privately owned – if you are such an owner, are you aware of the changes to business rates happening this year?

Business rates

Properties that are let for commercial gain are taxed, with the funds used to help finance local services. Similar to the council tax paid for domestic homes, business rates are paid to local authorities and are charged on self-catering holiday lets and most non-domestic properties. Some changes to these business rates have been announced and will be coming into force in April this year.

The current rules on business rates for holiday lets, which apply until 31 March 2023, mean that if your English property is available for let over short periods (at least 140 days) for 20 weeks per year, it is classed as self-catering and thus valued for business rates.

These new rules only apply to those properties classed by the VOA as self-catering holiday lets and not to other kinds of holiday accommodation, such as guest houses, hostels, and hotels. It is worth noting that there are no exceptions within the new eligibility rules – they apply equally to all self-catering accommodation within England and Wales.

The changes have been designed with the intent to protect those genuine holiday let businesses that benefit Bath. It is aimed at preventing second-home owners from leaving their properties empty for most of the year but still benefitting from the preferential business rates instead of paying council tax.

Valuation officers from the VOA will be conducting a rolling audit programme of all properties listed as self-catering to ensure that they meet the new eligibility rules. The information that is required must be provided on a Request for Information’ form, which the government state they will send out at a later date. Penalties will be issued for any forms not returned on time.

At The Apartment Company, we have a number of second-home owners; if you are unsure of how the changes to the business rates affect your property, do get in touch with our lettings team on 01225 303870.