4 minute read

Management News

Essential Properties Realty Trust Inc. Partners with Budderfly Inc.

Essential Properties Realty Trust (EPRT) announced, as part of its Essential Sustainability strategy, a partnership with Budderfly Inc., an Energy-Efficiency-as-a-Service (EEaaS) provider. The company’s first sustainability partnership aims to deliver operating savings to its tenants by deploying sustainability upgrades that are estimated to reduce the carbon footprint of the upgraded properties by up to 30%. Under the program, EPRT plans to invest capital in more efficient technologies and equipment upgrades that Budderfly will install and manage. The sustainability upgrades will include but are not limited to: the installation of LED lighting and lighting controls, higher efficiency HVAC units along with HVAC controls and monitoring, refrigeration controls and monitoring, solar solutions and net metering and controls. Budderfly’s established methodologies as a leading EEaaS provider include identifying the optimum sustainability upgrades to deploy, completing the installation, maintaining the upgrades and monitoring utilization.

Marx Realty Launches the Marx Mobile at 10 Grand Central

Marx Realty (MNPP), a New York City-based owner, developer and manager of office, retail and multifamily property across the United States, unveiled the Marx Mobile, the latest amenity offering at its 10 Grand Central tower in Midtown Manhattan. A 10 Grand Central-branded Porsche Taycan, a state-ofthe-art luxury electric vehicle, will serve as the building’s house car and will be accessible to all the building’s tenants through the company’s proprietary Marx Connect software. The Marx Mobile is available to transport tenants around Manhattan — east/west from the East River to Eighth Avenue and north/south from Central Park to Union Square.

“We are always looking to broaden our already hospitality-rich amenity offerings at 10 Grand Central,” said Craig Deitelzweig, president and CEO of Marx Realty. “Our house car will be available to every tenant on a firstcome first-served basis through the Marx Connect app. The Marx Mobile works as an extension of our signature hospitality-infused approach to office design.”

Planet Home Lending Expands Further into Brooklyn, Long Island and Metro New York

Planet Home Lending, a national mortgage lender and servicer, is expanding its branch in Melville, New York, as part of its continued effort to grow operations across the U.S. Joining the office are mortgage veterans Regional Vice President of Sales Michael Cabales and Brooklyn Branch Manager Mike Titiyevsky. They will lead a new team of experienced loan officers with specific expertise in the New York Metro-area market. Homebuyers can compete with all-cash buyers using Planet Home Lending’s Cash 4 Homes offering, which helps pre-approved homebuyers purchase without financing or appraisal contingencies, as applicable. Homeowners selling and buying a moveup home can purchase before they sell with Planet's bridge loan — ensuring they have a new home under contract before selling their current home.

Photo courtesy of Marx

Regional VP Sales Michael Cabales Photo via PRNewswire

SkySlope Launches Breeze to Speed Nevada Disclosures

SkySlope, a creator of real estate transaction software, has launched Breeze, an all-around, simple and streamlined application making Nevada disclosures easy to complete for agents and sellers in Reno-Sparks and Las Vegas.

SkySlope’s core product, SkySlope Suite, enables brokers, agents, auditors and transaction coordinators to track their deals while remaining compliant. Equipped with forms and a digital signature tool, SkySlope provides a frictionless workflow that saves time for agents. SkySlope is the transaction management platform serving over half of the top 20 largest brokerages in the U.S. and Canada.

With the launch of Breeze, SkySlope gives agents the ability to prepare and send seller disclosures to their clients. Available at no cost, Breeze gives sellers tool tips and legal definitions in accessible language to help prevent critical mistakes that may cause lawsuits against sellers, agents and brokers.

Breeze is also available in California, Washington, Arizona and Oregon.

Groundfloor Launches Its Next Round of Financing on Wefunder

Groundfloor, the wealthtech platform that allows people to build wealth through real estate, opened its annual campaign to raise growth capital for the company through a crowdfunded equity offering in partnership with Wefunder. The proceeds help accelerate customer acquisition and continued product development.

Groundfloor is the first and only company qualified by the SEC to issue paymentdependent real estate notes for non-accredited and accredited investors alike. Groundfloor offers short-term, high-yield real estate debt investments to the general public. Over $800 million has been invested on the platform to date, with the investments averaging a 10% annual return. The platform currently has over 200,000 users and continues to grow rapidly.

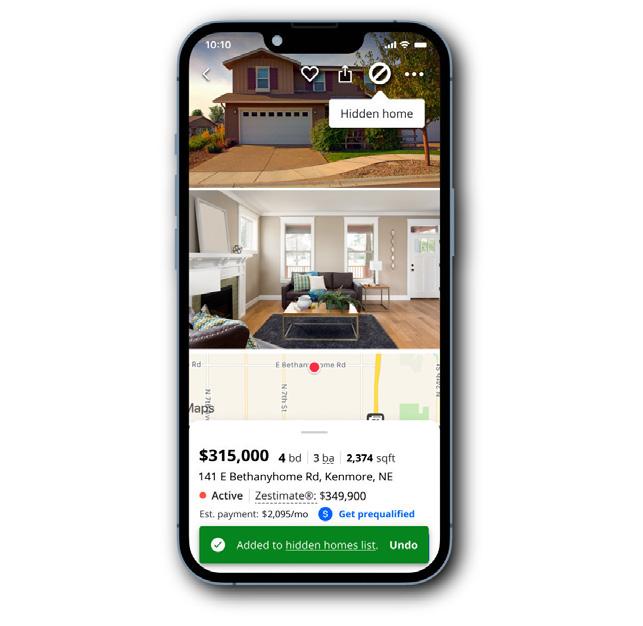

Zillow App Adds Hide Feature: A Top-Requested New Zillow Feature Lets Shoppers Hide Homes They’ve Ruled Out

RealOpen, which helps high-net-worth crypto holders purchase luxury real estate, has launched RealScore, the world’s first crypto purchasing power feature. RealScore provides high-end real estate buyers and sellers with a real-time, credible context to evaluate the asset strength behind a specific offer, the company said. Using the buyer’s cryptocurrency wallet address, patent-pending RealOpen analyzes buyers’ mix of crypto assets and ultimately determines their reliable purchasing power — assuring the seller of sufficient available equity with a cryptographic analysis. Factors used to provide a score include the diversity of the basket of coins used to fund the offer, buyer-held cryptocurrency above the offer price and escrow duration. These factors are then translated into a visual RealScore.

Investors can choose individual renovation projects to invest in based on their interests or use Groundfloor’s automatic investing tools to continuously invest in projects that meet pre-set criteria. Investments repay every nine to 12 months on average, providing liquidity on a secured investment.