7 minute read

Trial Information

Sowing Date

Various: see relevant trials.

Sowing Details

Seed was direct drilled inter-row with narrow points and press wheels into standing stubble with a four-row cone air seeder (38 cm row spacing). All trials were inoculated with appropriate granular inoculants.

Fertilizer

80 kg/ha MAP + 2.5% Zn

Herbicides Lentil

Chickpea

Pre-sowing: Glyphosate 450 @ 2000ml/ha + Trifluralin 480 @ 1000ml/ha + Terbuthylazine 875 @ 860g/ha + Isoxaflutole 750 @ 70g/ha

Faba Bean

Field Pea

Vetch

Whole site

Post emergent: Clethodim 240 @ 600ml/ha + Haloxyfop 520 @ 50ml/ha + Paraffinic oil 582 and Alkoxylated alcohol non-ionic surfactant 240 @ 0.5% w/v

This trial investigates the effects of row spacing, row direction and stubble height on plant growth, grain yield and pod drop of lentil varieties differing in architecture and tolerance to pod drop.

Treatments

Varieties/ Breeding Lines Spreading architecture - PBA Jumbo2, GIA1703L, PBA Ace, Aldinga Erect architecture - CIPAL1821, PBA Hurricane XT, PBA Bolt, PBA Hallmark XT

Row Spacing

38 cm 19 cm

Row Directions

North-South East-West

Stubble height

Standing Slashed

Other Details

Sowing Rate 120 plants/m2

Sowing Date 06th May

Curyo 2020 Results

Spreading varieties = no response to direction or row space. Erect varieties = 6% less sown N/S cf E/W, 9% higher in 18cm vs 36cm rows.

This trial investigates the implications of novel herbicide tolerance traits in lentil on the management of vetch.

Treatments

Varieties PBA Jumbo2, PBA Hallmark XT, PBA Kelpie XT, GIA2004L, GIA1703L, *Timok Vetch *Timok vetch was pre sown 1-2 cm deep in weedy plots at 40 plants/m2

Herbicides

Treatments

IBS Time of application1

SimRes 3N 5N

Nil - - - -

Conventional Terbyne® 860g/ha Sakura® 118g/ha

Brodal® 150ml/ha Broadstrike® 25g/ha Group B Terbyne® 860g/ha Sakura® 118g/ha Ally® (5g/ha) Brodal® 150ml/ha Intercept® 750g/ha Group C Intercept® 750g/ha Sakura® 118g/ha Ally® (5g/ha) Brodal® 150ml/ha Metribuzin® 280g/ha

Group I Terbyne® 860g/ha Sakura® 118g/ha Ally® (5g/ha) + Clopyralid (600g/L) @ 75ml/ha Brodal® 150ml/ha Intercept® 750g/ha 1IBS – Incorporated by sowing, SimRes - Simulated Residue, 3N – 3rd node growth stage of lentil, 5N - 5th node growth stage of lentil. Glyphosate and Trifluralin were applied pre-sowing.

Other Details

Sowing Rate 120 plants/m2

Sowing Date 06th May

GERMPLASM X SOIL TYPES – LENTIL, FABA BEAN, CHICKPEA, FIELD PEA AND VETCH

These trials investigate the growth and grain yield of range of cultivars and breeding lines that differ growth habit, flowering date and maturity, and adaptability in sandy and sandy loam duplex soils in the medium rainfall zone.

Crop Varieties and breeding lines

Lentil PBA Bolt, PBA Ace, PBA Hurricane XT, PBA Jumbo2, PBA Hallmark XT, PBA Highland XT, PBA Kelpie XT, Nipper, GIA Leader, CIPAL2121, CIPAL2122, GIA2001, GIA2003, GIA2002L, GIA1703L, GIA2004L Faba bean PBA Bendoc, Farah, PBA Zahra, PBA Samira, PBA Marne, PBA Amberley, PBA Nasma, AF12025, AF14092, AF14075, AF15283, AF15278, Field pea PBA Pearl, PBA Noosa, PBA Gunyah, PBA Percy, PBA Taylor, PBA Butler, PBA Wharton, PBA Oura, Sturt, Kaspa, GIA KaStar, GIA OurStar, OZP1901, OZP1903, OZP2103, OZP2105 Chickpea Genesis090, PBA Royal, PBA Magnus, Kalkee, Kaniva, PBA Striker, CBA Captain, CICA1735, CICA1944, D14017>15F2TMWR2SS013, D14133>16F3TMWR2AB015, D11057>14F3TMWR2AB017

Vetch Rasina, Studenica, SA37714, RM4, Popany, Morava, Timok, Benetas

Other Details

Sowing Rate

Lentil: 120 plants/m2 Faba bean: 20 plants/m2 Field pea: 40 plants/m2 Chickpea: 35 plants/m2 Vetch: 70 plants/m2

Sowing Date

06th May

PBA Hurricane PBA Bolt

Varietal frost tolerance

These trials are led by Liz Farquharson and Ross Ballard of SARDI. The work is part of GRDC Project UOA1805-017RTX (9176500), 2018-2022: Increasing nitrogen fixation in pulse crops through the development of improved rhizobia strains, inoculation, and crop management practices.

This trial was designed to: 1. Validate the results of pre-sowing soil tests using the new DNA based test from SARDI, Predicta rNod for E & F rhizobia, which measures the number of rhizobia in soils that can nodulate pea, bean, lentil and vetch. A second test under development for chickpea rhizobia is also being validated.

Pre-sowing rhizobia numbers: For vetch- predicted as low-moderate for Group E/F (900 rhizobia/g), so there is a moderate chance of an inoculation response at this site. For Chickpea –not detected, so there is a high chance of an inoculation response.

2. Validate if increasing the rate of peat inoculant applied to seed above the standard rate or applying novel “helper” bacteria with standard rates of inoculant can increase nodulation and Nitrogen Fixation of vetch and chickpea.

Treatments

Peat Slurry Inoculant applied to seed at different rates; Uninoculated, half standard, standard, double, four-times the standard rate and standard rate + Chickpea helper bacteria or Vetch helper bacteria.

Other Details

Sowing Rate

Chickpea: 35 plants/m2 Vetch: 70 plants/m2

Sowing Date

06th May

Inoculation requirement for legumes in the E and F inoculation groups (faba bean, lentil, field pea and vetch) can be measured using PREDICTA rNod provided by SARDI through PREDICTA® B accredited agronomists. Tests for Group G and S, and N are under development.

While Canada bakes, Australia glows.

2021 has been another very strong season for for most of our pulse crops, with lentils being the standout in terms of prices and grower returns. While not wanting to gloat over someone else’s misery, the dire climatic situation across North America has provided Australian lentil growers with an unexpected bonus and impacted global trade flows across all pulses. The shortage of peas and lentils from Canada has also impacted supply lines in India and has led to price inflation in the Indian pulse market. As a result, the Indian Government has eased some of the tariff constraints applied to Australian lentils to encourage trade and reduce supply constraints. However, while this move by the Indian Government does encourage the supply of stored lentils from last year’s harvest, there is no indication from the Indian Government that the tariff reduction will extend to enable new crop lentils to benefit.

The extremely dry conditions in North America have also pushed global canola prices to unprecedented levels, with global supply chains for both lentils and canola unlikely to be completely restored in 2022. Consequently, prices for both these commodities can be expected to remain firm coming into the 2022 season, creating some important rotation and disease pressure considerations for growers next year.

Shipping constraints providing an unwanted handbrake.

Despite the generally good season for Australian pulses, and firm global demand, the challenge for this harvest will be securing sufficient affordable shipping, particularly for container trade. Exporters have struggled all year to meet export orders due to the extreme shortage of shipping containers and unprecedented vessel and stevedoring charges. It seems apparent that shipping lines withdrew capacity at the start COVID last year as global shipping trade, especially ex China, shrank, and despite global commerce essentially returning to normal levels, shipping lines have not, or will not, restore shipping capacity.

This has created a significant challenge for the Australian pulse industry in matching the balance between meeting the market prices and channelling these prices to growers, yet with great uncertainty that the export demand can be satisfied. The industry has seen a shift towards bulk shipments for pulses that might otherwise have been exported in containers, which has created its own logistical challenges.

The pulse future remains bright.

Despite these challenges, the pulse industry prospects continue to grow and look very favourable into the future. Coming out of successive years of drought from 2017-2019 and now with two solid and profitable years now under our belt, the industry is well placed to continue to grow. Pleasingly, the industry is continuing to attract investment into on-shore valueadding, with Unigrain recently announcing its plan to build a pulse fractionation plant at Smeaton, expected to utilise 40,000 tonnes of field peas and faba beans sourced from growers in the Mallee, Wimmera and South Australia. This investment builds on the ongoing investment by Australian Plant Proteins in their pulse fractionation plant in Horsham. The establishment and growth of plant-based food ingredient suppliers such as these, combined with plant-based food manufacturers such as V2foods serves to develop thriving domestic pulse processing industry and beginning to reduce Australia’s reliance on the variabilities associated with many of our export markets.

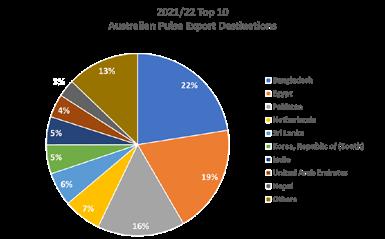

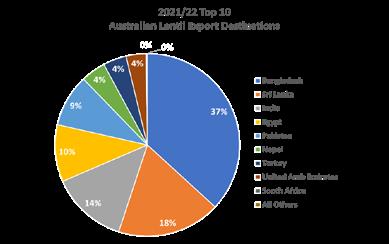

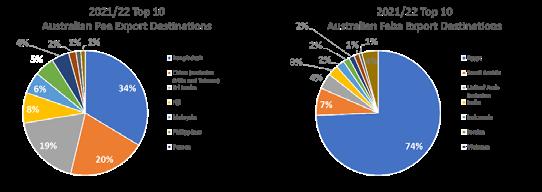

Major Australian Export Destinations