11 minute read

Appendix L: Budget and Funding Analysis ..................................................A.167 - A

Table 6: Cost Model Framework (continued)

Model Section/Tab

Advertisement

Revenues

Expenses Description Reflects the actual reported revenue for FY 2019. Reflects the actual budget expenditures for FY 2019, including personnel and operating costs.

Indirect Allocations Reflects calculation of Department indirect personnel. Citywide support provided to the Department such as the City Council, City Manager/City Clerk, Finance Office, City Attorney, and internal Administrative Services allocations were not identified.

Assignable Productive Hours Reflects the assumed productive personnel hours for this study. This metric can be adjusted as needed.

UPDATES TO THE COST MODEL

Some cities choose to update their fees on an annual basis. The cost model has the built-in capability for City staff to make changes to inputs in order to assess the impact of fee adjustment in the future, even after the cost of service study is complete, based on changes to revenues, expenditures, or the CPI.

Table 7 describes how the City can maintain the cost model if it chooses to update fees and charges intermittently or on an annual basis.

Table 7: Cost Model - Inputs to Update

Name/Role Role Description

Revenues Budgeted or actual revenues related to fees and charges for programs and services. Direct Expenses Budgeted or actual personnel and operating expenses related to directly providing City services. Indirect Expenses Budgeted or actual personnel and operating expenses related to the internal support of providing City services.

Specific Fee Levels

Specific dollar amounts to be charged for individual services provided. Annual Service Volumes Annual total counts for the number of programs and / or services provided per service category.

The fees and charges cost model developed for the City is a separate MS Excel file.

Appendix M

COST RECOVERY ASSESSMENT

THIS PAGE INTENTIONALLY LEFT BLANK

INTRODUCTION

An agency built upon sound business principles requires the adoption of defensible financial management policy and continuously justifying how tax dollars are spent and invested. Adopting a methodology encourages productivity and the pursuit of opportunities for efficiency and revenue growth knowing that these efforts can help strengthen systems for the long term. By creating fiscal policy that aligns with fiscal reality, organizations enhance their chances of being financially resilient in the long term.

A cost recovery philosophy embodies a decision to generate revenues by charging fees for programs and services in relation to the total operational costs to provide them. In most cases, undertaking cost recovery as part of business practice does not imply that the goal is 100% recovery of the cost; however, a target cost recovery goal is established according to a variety of organizational and community values. Typical cost recovery goals may range from 0% to more than 100% of costs and are often associated with a community’s service delivery mission and values. Adoption of conventional, industry benchmarks are often the choice of many organizations, but it is generally not the most effective way to establish cost recovery goals. Given that each community’s economic conditions and communal make-up including demographics are vastly different, benchmarking solely against other communities can create inaccurate comparisons.

The Lynchburg Parks and Recreation Department (the Department) currently has a broad-based cost recovery plan that could be used as a guideline for setting fees and systematic resource allocation. Leadership expressed a desire to adopt a more comprehensive department wide cost recovery philosophy, and to build upon their current model which can provide guidance to staff and management for prioritizing core program areas, setting fees and charges, identifying tax subsidy levels, and to allocate resources effectively within the Department.

COST RECOVERY ASSESSMENT

COST RECOVERY MODEL PROGRAM GROUPINGS AND MODEL

The Department currently groups programs and services by perceived benefit to the individual, group, and community. However, to better define cost recovery, it is recommended that the Department also create groupings of programs and services that are alike in some ways, in addition to continuing to assess programs based on benefit received. This two-pronged method groups services according to level or likeness of activity (e.g., introductory, intermediate, etc., community events, merchandise for resale) and also allows for differentiation of value to the individual and/or the community. A sample of possible groupings of services and descriptions has been developed and included for reference and/or consideration in the table below:

Table 1: Sample Service Groups and Descriptions

Service Group Open Access Description Open, unsupervised access to parks, open spaces, and public access outdoor areas. No staff/volunteer supervision or oversight.

Community Events Special Events

Open access events with broad community appeal and larger attendance. Events that target specific groups and may or may not require a fee. Permits and Rentals Facility, field, and amenity rentals, which provide for private and exclusive use of Lynchburg Parks and Recreation space and/or property. Skill Based - Introductory Programs for participants that are being introduced to a new skill and do not require any experience to participate. Skill-Based - Intermediate Programs for participants that have prior experience in a similar program and are looking to further improve their skill level. Skill-Based - Advanced Programs for participants who wish to master a specific skill, are competitive in nature, or are private (one-on-one) or small group instruction. Community Education/Life Skills Staff-supervised or instructed programs focusing on education, socialization, life skills development, and personal enrichment. These programs may or may not require pre-registration or require a fee.

Retail Merchandise Service areas that provide individual benefits and are commercial in nature and similar to offerings made by the private sector.

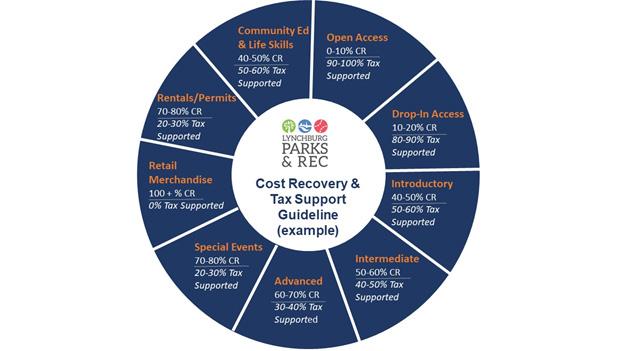

In many agencies, activities are subsidized to greater and lesser levels based on priorities directly or indirectly identified by the codifying body. For example, activities for youth, teens, and seniors have been traditionally subsidized to a greater level than adult activities. Services targeted to low-income residents have traditionally been subsidized to a greater level than those targeted to middle- and higher-income residents. Using newly developed groupings instead of traditional categories, and after establishing a cost of service for each one of the programs and services offered, a cost of service model can be developed. (The model in this case has been developed and has been provided as part of a different phase of this project, but has been completed nonetheless.) Using the cost of service model developed to estimate the full cost of providing specific programs and services will assist staff with setting fees to desired levels, forecasting the revenue potential at specific fee levels, and will also allow staff to assess the subsidy levels for each program and service to better reflect the mission of the agency and the community values so that subsidy can be allocated to provide a greater degree of equity in service delivery. A sample of possible subsidy levels for specific service and program groupings has been developed and included for reference and/or consideration in the graphic below:

Figure 1: Sample of Possible Subsidy Levels

Establishing a cost recovery policy and implementing the practice into routine fiscal exercises can provide the Department with a number of opportunities to improve service delivery and to align fees with the mission and priorities of the community as a whole. Establishing a formal cost recovery policy for the Lynchburg Parks and Recreation Department may:

• Enhance accuracy in identifying the cost of providing each park and recreation service to the

Department; • Identify and categorize both direct and indirect costs; • Define the amount of tax subsidy allocated to each service; • Establish a basis of fees and rationale for the pricing structure; • Demonstrate consistency, structure, and uniformity throughout the Department; • Promote transparency for the public, stakeholders, and staff; • Provide justification for future price increases; • Articulate consistency and responsibility with the use of tax dollars and user fees; and, • Create a financial management framework to sustain in varying economic climates.

COST OF SERVICE/FEES AND CHARGES

As the Department seeks to efficiently manage limited resources and effectively respond to increased service demands, a formal fee study is a way to align fee levels with the total cost of services, as well as identify potential fee deficiencies. This important undertaking will help the Department better align fee levels with its true costs of providing services and serve as a basis for making informed policy decisions regarding the most appropriate fees, if any, to collect from individuals and organizations. The analysis should determine (or update) the full cost of providing services, including direct salaries and benefits of staff, direct departmental costs, and indirect costs applied by way of the City of Lynchburg internal service support. Once the analysis is complete (or updated), providing the full cost estimation for each service, fees can be set at the Department’s discretion, using the cost recovery policy as a guiding light.

The development of a comprehensive cost model should calculate, identify, total, and distribute allowable direct and indirect costs to all programs and services

for the fiscal year chosen, and include any future assumptions and/or indicators to forecast in the out years. Creation of the cost model would identify the allocation methods used for distribution to all services, on the basis of relative benefits received. In order to accurately and reasonably do so, the model would calculate and identify:

• Total Expenditures: Determine total costs, regardless of source applicable to Department programs and services.

• Unallowable and Excluded Costs: Determine all unallowable costs, excluded costs, and any other distorting items and remove them from the model’s calculations.

• Direct Costs: Determine all costs that can be tied specifically to a Department program or service, and therefore may be assigned as an expense. Common examples of direct costs include personnel expenses related to staff providing direct services, contracted services and supplies used, equipment purchased, and any other expense incurred to provide services.

• Indirect Costs: Determine all costs incurred for a common or joint purpose benefiting more than one program or service. Common examples of indirect costs include internal accounting and finance support, personnel or human resources support, information technology support, purchasing support, legal support, and City executive management support.

Using the calculated cost recovery percentage as a starting point, the Department would then work to identify cost recovery targets and define a plan to implement appropriate fees for programs and services.

PRICING STRATEGIES

The following factors are common pricing factors and could be considered by Department staff and management in developing proposed fees:

• Cost to offer the program (limited direct costs only) • History of fees charged • Perceived ability and willingness to pay • Number of participants per class/activity • Affordability for target audience • Ability to attract participants

Establishing a price for a program can be based upon a variety of strategies. Arbitrary pricing is not encouraged as it is difficult to justify and does not articulate use of tax subsidy in a way that ties to the Lynchburg Parks and Recreation Department’s organizational or community mission. It is recommended that the Department follow a cost recovery pricing approach, which is based on cost recovery goals within cost recovery goal percentage ranges. This method uses cost recovery goals as a primary pricing strategy, followed by either market pricing (for services with low alternative coverage – few, if any, alternative providers) or competitive pricing (for services with high alternative coverage – other alternative providers offer similar or like services).

Other strategies to consider after cost of service and fee analysis is undertaken include:

• Market Pricing: a fee based on demand for a service or facility or what the Department thinks a participant is willing to pay for a service.

Private sector businesses commonly use this strategy. One consideration for establishing a market rate fee is determined by identifying all similar providers (i.e., private sector providers, municipalities, non-profit sector providers, etc.), and if it has been determined that the service has excellent position in the market, establishing a fee that is higher than other similar providers.

• Competitive Pricing: a fee based on what similar service providers are charging. One consideration for establishing a competitive fee is determined by identifying all providers of an identical service (i.e., private sector providers, municipalities, non-profit sector providers, etc.), and establishing a fee that is at mid-point or lower.

• Differential Pricing: fees that are grounded in the idea that different prices are charged for the same service when there is no real difference in the cost of providing the service. The same service may be offered at a more desirable time, location, or have other factors that attract a following, which may drive a higher price point. Alternatively, there may be services that are offered that are struggling to maintain a minimum and need a boost to stimulate more interest, driving a lower initial cost. The

Department may wish to expand use of this pricing strategy:

• To stimulate demand for a service during a specified time; • To reach underserved populations; or, • To shift demand to another place, date, or time.

COST RECOVERY RECOMMENDATIONS

SUMMARY OF RECOMMENDATIONS

• Develop and adopt a more comprehensive cost recovery policy, which would build upon the current model and will provide guidance to staff and management for prioritizing core program areas, setting fees and charges, identifying tax subsidy levels, and to allocate resources effectively within the Department.

• Align pricing strategies to assist with the development of new fees for programs and services as well as to help guide methodologies for adjusting current fee levels according to desired outcomes.

• Review select fee levels annually and adjust in accordance with budgetary requirements and/or macroeconomic indicators such as the

Consumer Price Index (CPI). • Undertake a basic cost of service update biennially and conduct a formal fee study every three to five years; when the City experiences a significant change in demand for services, organizational structure, or key business processes; or when it identifies budgetary issues.

• Utilize the electronic registration system,

ReCPro, to the greatest extent possible to allow for detailed tracking and analysis of revenues and annual volumes per activity, program, and service-type to help assess which fee adjustments may have the greatest fiscal impact.