FEBRUARY 2024

Equipping the Actuaries of Tomorrow

The LSESU Actuarial Society is the largest actuarial student society in London. Throughout the years, our society has built upon its successes and advanced our mission to educate the actuaries of tomorrow. Education and connection are the key value proposition that the LSESU Actuarial Society brings to its members. As part of our broader strategy of looking into the future, we strive towards providing more professional development resources, opportunities, and actuarial insights for our members. Additionally, we seek to expand our coverage on emerging actuarial trends by hosting diversified events to further extend our reach on topics outside of the traditional Actuarial professions.

We organise talks and workshops to raise commercial awareness among our members about pensions and insurance while exploring the way actuaries respond to challenges in this ever-evolving world with endless possibilities. There are various opportunities to ask seniors and alumni about their experiences working in actuarial placements, and providing members with advice about internships is also one of the great services our society can offer.

Additionally, we host networking events that connect students directly with industry professionals, providing them with the opportunity to foster relationships that are essential for career development. We are committed to providing our members with memorable experiences and insights about Actuarial Science, and most importantly, ‘Equipping the Actuaries of Tomorrow’.

To highlight some key successes from the 2023-2024 academic year, we proudly hosted our 11th annual Actuarial Conference at LSE, featuring the President of the Institute and Faculty of Actuaries (IFoA) as a distinguished guest. Additionally, we successfully organised our 2nd Actuarial Case Competition, supported by our sponsors and partners.

This academic year, the research division will be responsible for releasing a newsletter to members and nonmembers of the society. Our members will get exclusive access to the newsletter a few days before public release and access to exclusive stories.

Keep readers up to date with changes in the industry

Update readers on actuarial roles and opportunities they can get into

Update readers on what we are doing as a society

Our newsletter is mainly targeted towards Undergraduates and Postgraduates looking to join the actuarial field but even if you don’t fall into those that category feel free to give our newsletter a read.

In simple terms, 'risk' is the possibility that something bad might happen. In most cases, the occurrence of these bad events is uncertain, meaning the mathematical probability is neither 1 nor 0. Psychologists have discovered that humans tend to fear and stress over uncertainties. Therefore, people are willing to sacrifice their current resources for a more secure future. This behaviour is known as risk aversion. In the world of finance, particularly where actuaries work, 'bad things' typically refer to financial losses, such as the inability to work or damage caused to your property Avoiding or mitigating such financial risks can be achieved through financial security systems like insurance and retirement plans. This system involves transferring economic risk from an individual to a group of individuals, this is known as pooling. The psychological impact of these financial security systems is significant. They reduce anxiety and worries by reminding people that they are being protected, providing not just financial safety but also emotional and psychological stability.

This method of resource management allowed communities to withstand periods of poor harvests due to extreme weather conditions, providing a safety net for all members of the community. These ancient practices laid the foundation for modern financial security systems. The concept of pooling resources to mitigate risk and provide support during difficult times is still relevant today.

The Industrial Revolution marked a significant period of development for financial security systems, due to the growth of financial institutions. The first modern government bonds, known as "prestiti," were issued in Venice in the 12th century to fund wars The establishment of the Bank of England on 27 July 1694 was a pivotal moment that introduced systematic public debt instruments to finance wars and infrastructure. While government bond issuance required careful planning to account for future fluctuations such as inflation and interest rates, this work was typically undertaken by financial analysts and investment professionals. In contrast, actuaries played a key role in the expanding insurance industry during this period. They developed mathematical models to quantify risks and ensure the financial stability of insurance companies to assist them to meet growing consumer demand for protection. In early societies, pooling resources within a community was a common practice aimed at providing collective benefits. For instance, surplus harvests were stored and distributed during times of shortage.

To illustrate risk aversion, consider a person who faces a 1% chance of losing $500 tomorrow. If another party offers a trade where the person can pay $10 to completely avoid this risk (essentially, the party will cover the loss if it occurs) should the person accept the trade? Theoretically, this is a poor trade because the expected loss is only $5, which is less than the $10 payment However, in practice, the decision depends on the individual's circumstances. For instance, a millionaire who earns more than $490 a minute might easily afford the potential loss. Conversely, a father who needs $490 for his ill daughter's surgery the next day might find the trade worthwhile to ensure he has the necessary funds This example This highlights how risk aversion is shaped by an individual's unique financial situation. In the real world, actuaries assist insurance companies by predicting probabilities and assessing potential losses, then calculating premium prices This allows companies to mitigate risks for their clients while ensuring long-term profitability.

Financial security systems often require individuals to delay immediate rewards for long-term benefits, such as retirement savings. However, there exists a psychological challenge, as people are usually willing to gain instant gratification at the expense of longer-term positive outcomes. Hyperbolic discounting models this tendency, describing how individuals make choices that are inconsistent over time, that is they make choices today that they would not prefer in the future, despite knowing the same information. Overcoming this ‘present-biased’ is crucial for effective retirement planning, as it involves promoting a mindset that prioritises long-term financial stability over short-term pleasures. Actuaries help mitigate this psychological barrier by designing pension systems and retirement plans that encourage long-term saving. They create models to calculate sustainable contribution rates and determine optimal payout schedules, ensuring that individuals have sufficient funds to support themselves throughout retirement, factoring in life expectancy and inflation.

The future of financial security systems is being shaped by transformative technologies. If Cryptocurrencies can achieve stability and safety, they have the potential to revolutionise financial security by reducing reliance on centralised currencies and enhancing the efficiency and transparency of transactions. Human behaviours (such as pursuing efficiency), independence from traditional banking systems and optimistic embrace of technological solutions suggest that cryptocurrencies have a chance to replace traditional transactional methods in the coming years. As systems evolve, there will be more ways to improve and mitigate cyber risks, but there will also be new forms of cyber risks Quantum computing has the potential to effectively enhance the strength of cybersecurity, including the development of cyber insurance. Actuaries are already working on new insurance products designed to protect digital assets, mitigate blockchainrelated risks, and offer coverage for cyberattacks, data breaches, and theft of digital assets. With advances in quantum computing, actuaries are expected to improve their models by conducting more detailed scenario analyses to better capture the complexities of cryptocurrencies and blockchain. In addition to technological trends, climate change is influencing the insurance sector, with the introduction of parametric insurance to cover natural disasters and environmental risks. Demographic shifts such as population aging is also a factor that could alter the future of both insurance and pension sectors significantly

Financial security systems act as vital shields against unforeseen circumstances by providing financial cushions during emergencies, thereby ensuring long-term stability. Despite having these benefits, the aforementioned human psychological behaviours still deter individuals from investing in such systems. To address this issue, many public and private sectors are working to improve and sustain society's welfare over the long term. Most countries had implemented mandatory pension schemes or systems as a key part of their social security framework. Meanwhile, influencers on TikTok are starting to educate people about life insurance and promoting financial awareness.

The challenges facing defined benefit pension schemes and the importance of bulk purchase annuities as a solution for these pension schemes.

Pensions are long-term savings plans that help people save money for retirement. Defined benefit (DB) pension schemes are a type of workplace pension which guarantees an individual a specific income throughout their retirement life. The company takes responsibility for the investment and distribution of funds to the retiree. The amount paid out to the individual depends on factors like the individual’s final salary (final salary pensions) or average salary (career average pensions) and how long the individual has been a part of their employer’s scheme.

The main advantage of DB pensions is the security it provides to the retiree. DB pensions guarantee the retiree a retirement income which will not be affected by changes in the market or the performance of investments.

The biggest disadvantage of DB pensions is its lack of flexibility. The income from a DB pension scheme rises with inflation (general price increases over time) but is otherwise fixed by the rules of the schemes, DB pensions pay you a set amount of income every month. An individual cannot decide how much income they would like to draw down each month and how frequently to do so. Hence, they cannot take out large lump sums, nor leave the savings invested for growth. This makes it harder to address any changes to an individual’s financial needs or goals

One challenge currently faced by DB pension schemes is the uncertainty surrounding the volatility of pension liabilities on corporate balance sheets. Financial market volatility, driven by fluctuating interest rates and inflation, can lead to fluctuations in the asset values of investments made by the company. These fluctuations can affect the ability of DB schemes to meet their future liabilities (i.e., pension payouts to retired employees). For instance, prolonged periods of low interest rates can increase the present value of pension liabilities, putting additional pressure on funding levels.

Another challenge is funding constraints, particularly when companies seek to achieve funding levels that are both affordable and aligned with the sponsor’s financial capacity and covenant strength Companies may face significant strain in meeting the DB scheme liabilities, particularly during economic downturns or in times of rising business costs. Companies have an obligation to allocate resources to DB pension schemes, resources that might otherwise have been used to grow the business. These pressures are worsened when the investments of the company underperform. As a result, companies often struggle to balance the competing demands of meeting DB pension obligations while ensuring the ongoing performance and sustainability of the business.

A bulk purchase annuity (BPA) is a transfer of pension obligations from a pension fund to an insurer. BPAs play an important role in helping to tackle the challenges faced by companies regarding DB pension schemes. There are two types of BPAs: a buy-in and a buyout

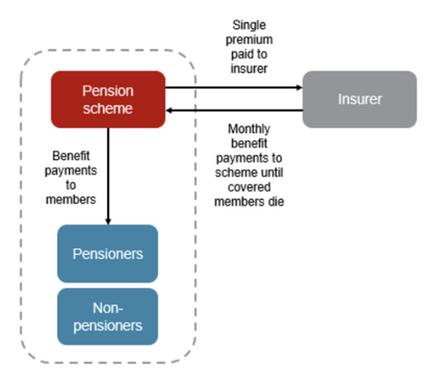

Under a buy-in, the pension scheme buys an insurance policy to secure all or part of all future pensions and benefits due to be paid to members.

The scheme pays a fixed premium to an insurer, and in return, the insurer takes on responsibility for meeting the insured benefits, along with the interest rate, inflation, longevity and demographic risks associated with those benefits

The insurer would generally make the payments to the scheme which, in turn, pays the members. As a result, the pension scheme holds the bulk annuity policy as an asset and retains the ultimate responsibility for interacting with members and making sure their pensions can be paid.

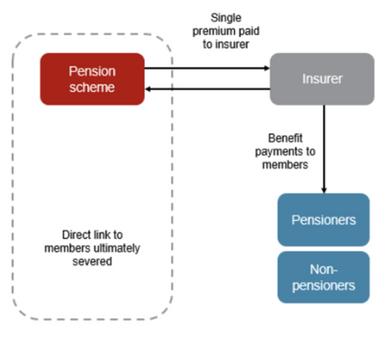

Under a buyout, the pension scheme pays a fixed premium to fully secure all future pensions and benefits due to be paid to members. In most scenarios, this will cover all members of a pension scheme. An insurer assumes responsibility for fulfilling the liabilities, including managing the associated risks of interest rates, inflation, longevity, and demographics. The insurer directly manages the benefits for the scheme members, who become its policyholders. As a result, the pension scheme is fully relieved of its obligations to the members. Where a buyout covers all members of a scheme, the scheme can be wound up as it now has no assets, no liabilities, and has transferred responsibility to the insurer for paying the benefits.

The BPA market has seen a rise in deal volume, with major transactions taking place in the United Kingdom. For example, the Atradius UK Pension Scheme has completed a £190m buy-in with the Pension Insurance Corporation (PIC). The transaction secured the pensions of 344 deferred and pensioner scheme members, along with benefits accrued to date for 66 current active members Another example is the Halma Group Pension Plan and the Apollo Pension and Life Assurance Plan securing £250m of buy-ins with Standard Life, securing retirement benefits for 2,200 pension scheme members Additionally, according to a survey report by WTW, 55% of the schemes surveyed reported that buyout represents the long-term target for the DB scheme and 59% of these (i.e. 32% of all schemes) are looking to buyout their liabilities in the next five years and are accelerating their preparations for buyout now. This growth in the BPA market is due to pension de-risking solutions becoming more affordable now due to higher funding levels and rising interest rates, which have resulted in more favourable pricing from insurers.

Furthermore, the average time to buyout for FTSE350 DB pension schemes has fallen from 5 7 years at the end of September to 5 2 years as of 31 October 2024. This is due to rises in gilt yields from 4.45% at the end of September to 4.80% as of the 31 October 2024, post Budget.

The rise in gilt yields reflected concerns of fiscal rule changes and increased government expenditure, borne out during the Chancellor’s delivery of Labour’s borrowing plans. This has contributed to a decrease in the DB End Gauge index* of 6 months (the biggest monthly drop seen since February) despite an offsetting impact of a rise in expectations for future inflation and poor asset returns over the month.

*The DB End Gauge Index is a measure used to track the funding position of defined benefit (DB) pension schemes in the UK, reflecting the gap between the schemes' assets and liabilities. It provides an indication of the health of these pension schemes, with a higher index value suggesting better funding levels and a lower risk of underfunding.

In recent years, the complex relationships of different categories of financial systems have revealed vulnerabilities that once seemed impractical, leading to crises such as insurance insolvencies and insurance death spirals. For example, The Affordable Care Act, known as “Obamacare,” failed its promises in 2010 to reduce the costs of healthcare, as premiums increased by 80% in 14 years. However, to counter this outflow and attract higher-income families to return to the market, Congress created new subsidies for poverty in the American Rescue Plan Act. However, the media claimed that these subsidies were not only regressive but were also very wasteful since many people were already insured elsewhere. Actuaries play a critical role by looking to identify, manage and mitigate the risks associated with financial systems, ideally by accurately analysing and pricing insurance products to deal with regulators, in order to meet solvency requirements

A death spiral occurs when premiums rapidly increase due to changes in the insured population This happens when a significant number of lower-risk policyholders drop their coverage, leaving a higher proportion of riskier policyholders behind. As a result, the expected payout by the insurance company will increase, due to the skyrocketed risk from the remaining policyholders.

If premiums are overpriced, they will be unattractive to healthy people, which harms the risk pool. Conversely, if underpriced, it will attract more unhealthy people, increasing the total claims.

Understandably, insurance companies price their premiums based on historical data. However, if an insurance company analyses merely average data from a group of aggregate individuals, without considering any classifying factors, then the risk of an insurance death spiral is high. Therefore, a fair and regulated classifying system is crucial for both parties. The common classifying factors are gender, smoking and drinking habits, medical history and occupation.

If the insurance death spiral becomes uncontrollable, i.e. healthier people continue to opt-out (flee), creating a risk pool that consists of unhealthier individuals, then the premium could rise to unaffordable levels. In such cases, the government might need to intervene by subsidising coverage for the people who need insurance protection, which could impact the country’s economic and public welfare significantly.

To reduce the risk of insolvency during a death spiral, insurance companies often purchase reinsurance. This is a strategy where an insurer buys insurance from another company (the reinsurer) to protect itself from large claims events. By transferring some of their risks to reinsurers, primary insurers can support their financial stability and reassure policyholders.

Reinsurance acts as a buffer when a major claims event occurs, absorbing a portion of the claims burden. Therefore, insurance companies that are reinsured do not need to increase their premiums at the early stage of a death spiral. Hence, the healthier policyholders would not decide to opt out which potentially prevents the death spiral from worsening.

Actuaries constantly assess and adjust for adverse selection risks, by assessing each policyholder’s risk accurately. While regulations prevent insurers from reunderwriting a subscriber once a claim is filed, actuaries can adjust premiums following strict guidelines. Additionally, effective management of the risk pool by the insurance underwriter is crucial, particularly in keeping the pool open to new and healthier members. Insurers may offer wellness programs or incentives to reduce policyholder risks or attract new lower-risk customers. This helps create a healthier environment for society at large.

The insurance death spiral poses a significant threat to market stability, but actuaries play a crucial role in mitigating this risk through accurate risk assessments, effective management of risk pools, and tools like reinsurance By balancing premiums and risk classifications, insurers can prevent spiralling costs and maintain financial health. While government intervention may be needed in extreme cases, the expertise of actuaries ensures that the system remains sustainable and fair for both insurers and policyholders.

Collective Defined Contribution (CDC) schemes were introduced in the UK through The Pension Schemes Act 2021. Officially known as Collective Money Purchase, CDC is a pooled risk (or target pension) plan, where employer and employee contributions are pooled into a single fund CDC schemes offer a middle ground between Defined Benefit (DB) and Defined Contribution (DC) plans. They spread risk and smooth the effects of market volatility to provide a more predictable pension income based on collective investment performance while removing the complex financial decisions that savers must make under DC schemes.

According to research by Hymans Robertson, 41% of companies with DC schemes are ‘very likely’ to introduce a CDC pension scheme. The growing interest in CDCs is mainly due to the following reasons:

1.

CDC pensions lead to better retirement outcomes as risk-sharing results in more stable incomes compared to DC schemes.

Research conducted by Hymans Robertson revealed that 29% said that 'protection against members exhausting their pension pot in retirement' was an appealing feature of CDC, while 25% said the attractiveness comes from CDC schemes providing higher pensions for members from the same contribution amount 23% of respondents said another significant advantage of CDC was the reduced burden of decision-making for members at and throughout retirement. According to Paul Waters, Hymans Robertson's head of DC markets, this growth of CDC “illuminates the rising popularity of DC risk sharing in the industry, with attention growing after the Royal Mail unveiled the UK's first CDC scheme in October and the multi-employer CDC draft regulations were published.”

3.

CDC pensions reduce long-term financial responsibility for employers compared to traditional DB pensions.

2. CDC pensions result in better investment efficiency since collective pooling allows for more robust investment strategies.

Current legislation means members of a CDC scheme can only be that of a single employer or connected employer (e.g. a group can set up a scheme consisting of the group’s employees and the subsidiary’s employees). A consultation by the Department for Work and Pensions (DWP) on legislation that would allow the creation of unconnected multi-employer CDC schemes was concluded in November.

Aon head of collective DC and partner, Chintan Gandhi, said that opening up to multi-employer whole-life CDC schemes would meet the needs of employers and the self-employed, arguing that these schemes have the potential to help over 30 million UK workers build up a pension.

The main criticisms of CDC plans are regarding scale, communications and future flexibility. To ensure a stable and predictable benefit from a CDC plan, the participant pool needs to be sufficiently diversified to reduce the impact of fluctuations in the plan’s experience (e.g., investment performance, life expectancy) Ideally, there should be a large number of participants, and the participant group should be diversified across the age range covered by the plan. For example, the U.K.’s Actuarial Research Centre concluded that benefit payment volatility could be significantly reduced by increasing plan participant numbers and ensuring that a steady stream of new younger participants join the plan. Careful consideration should be given to what happens when the number of participants falls or the average age of the participant group increases If most of the employees in the plan retire in and around the same time, there could be significant strain on the fund’s resources.

In terms of scale, Pooled Employer Plans (PEPs) could be allowed to protect smaller employers from the uneven experience of their workforce. A PEP plan is a type of retirement savings plan that allows multiple unrelated employers to join together and pool their employees’ retirement savings into a single plan. PEP providers would be required to achieve a certain minimum size to provide experience pooling.

Secondly, in CDC plans, participants bear the investment and group longevity risks of the benefits to be provided and the benefit levels will fluctuate. Therefore, it is important that participants know that their benefits may change over time. Any benefit amounts communicated to participants should be considered carefully to ensure that undue expectations of a right to those benefits are avoided. The communication of any benefit cuts may be complex and may generate emotionfilled responses from participants.

To address this concern, an annual, mathematical, systematic adjustment mechanism could be applied. It has the advantage of being impartial and objective. On the other hand, it has the disadvantage of potentially being overly responsive to shortterm experience deviations from long-term expectations. Approaches that smooth out short-term fluctuations have the advantage of stability but will be more complicated to communicate and less transparent to the average participant. A combination of some smoothing mechanisms coupled with objective adjustment formulas is likely to achieve the best balance of transparency and stability

Lastly, CDC plans require a long-term commitment and function most effectively when sustained over many years. For example, it may be difficult for a plan sponsor to reduce or suspend contributions to a CDC plan, as doing so could create inequities A December 2021 report from Brookings highlights that, compared to DC plans, one key disadvantage of CDCs for employers is the inability to reduce or suspend contributions during adverse economic conditions. For employees, the main drawback is that benefit levels are not guaranteed; they bear the investment risk, which could result in reduced benefits or higher employee contributions if the plan’s performance falters."

The Netherlands also makes use of CDC pension schemes which differ from the CDC schemes implemented in the UK. The Netherlands has a long history of collective pension schemes, with CDCs evolving from traditional DB plans to address financial sustainability concerns. In contrast, the UK has primarily relied on DC schemes, where individuals bear investment risks. Hence, the transition to CDCs has been easier for the Netherlands compared to the UK. This has resulted in differences in the implementation of CDC schemes between the Netherlands and the UK.

• Better retirement outcomes because of risk-sharing

• Efficiency in investment due to better investment strategies

• Removes long-term liabilities of employers

• Requires coverage of a diverse group of participants

• Participants bear the risks

• Lack of flexibility due to long-term commitment

Risk-sharing

Regulatory framework

• CDCs were a natural evolution from DB schemes This means that employers, employees, and regulators were already familiar with collective risk-sharing.

• Established legal and governance structures for collective schemes, ensuring smooth operation

Governance

Employer/ Employee trust

• Experienced pension boards and governance models ensure effective CDC management

• Shifting from an individual-based DC system, where members bear full investment risk. Unfamiliar with collective risk-sharing.

• Trust in collective pension models is well-established.

In the Netherlands, a new pension arrangement has recently been introduced in the new pension law, the Solidary Pension Arrangement (SPR). The SPR represents a new novel approach to CDC pension fund design, allowing pension funds to maintain collective investments but allocating the total capital and returns to individual member pension pots.

However, there are still concerns regarding the implementation of CDCs in the UK Apart from the disadvantages of using CDCs as mentioned above, there is also a lack of pension knowledge amongst employees working in the UK.

• Still developing its regulatory framework (Pension Schemes Act 2021). Ongoing policy development may cause uncertainty and slow adoption.

• UK employers and trustees lack experience with collective models which may lead to implementation delays and governance challenges.

• Scepticism due to the history of individual DC schemes. Employers and employees may hesitate to adopt CDCs without strong assurances.

Royal Mail Group director of pensions, Angela Gough, emphasised the importance of ongoing communication and education to help members understand CDCs. Adding to this, Communication Workers Union postal assistant secretary, Andy Furey, said “We have a lot more work… to raise the knowledge and awareness of what it all means to people and how they can benefit in the future”

In conclusion, the introduction of CDC schemes in the UK marks a big change in the pension industry in the UK. While there are advantages to CDCs, there are also cons to it and the success of CDC schemes depends on careful implementation, strong governance, and building trust among employers and employees.

Matthew Bryne is the Head of Actuarial Function at NFU Mutual. University of Cambridge Master of Arts - MA, Mathematics. An experienced actuary and senior manager with 25 years in financial services, primarily general insurance Matthew has worked in pricing, reserving and capital modelling.

What failures in our pension system won't be corrected by just replacing DCs with CDCs?

I came across an article suggesting that actuaries were the original data scientists, having used generalised linear modelling (GLM) since the 1970s. In the pricing space, actuaries have predominantly used GLMs for decades. In the reserving space, various chain ladder methods have been employed, while actuaries in capital modelling have used dynamic financial analysis.

When data science took off, there were other algorithms actuaries could try, apart from GLMs, such as gradient boosting models or neural networks However, early on, challenges arose, such as: Are actuaries familiar with these new tools and techniques? Do they have access to the right data? And do they have the necessary computing power within their organisation, especially given that many rely on bespoke actuarial software from industry suppliers?

For example, if you want to use GLM for pricing, instead of building your own, you'd typically buy software to do the modelling.

There was a time when the software available wouldn't allow actuaries to experiment with new methods.

Before COVID, actuaries were encouraged to build their own models, which was a challenging and time-consuming task. However, as the industry progresses, I've noticed that software suppliers are catching up, making these techniques more accessible to actuaries. This means actuaries can now experiment with new methods without having to build everything from scratch.

Machine learning and AI offer the ability to test various predictive algorithms These are primarily used in pricing, where even slight improvements in accuracy can boost profits.

The reserving space has been slower to adopt new techniques, partly because it is more tightly regulated. Changes to reserves, which are audited, require the auditor’s approval. Additionally, some of these new methods might be more predictive but less transparent compared to existing methods In the capital modelling space, it’s less clear how to use these methods.

I have seen machine learning applied in risk analysis, such as using principal component analysis (PCA) to model interest rates. PCA helps identify the key factors that drive fluctuations in interest rates and assess market risk.

The IFOA is keen to help encourage actuaries to upskill themselves, which is why they have added R to the exams.

in our pension

For several years, process automation has been a key focus, with teams across businesses looking to speed up processes by implementing automation wherever possible. For actuaries, it requires dedicating time to consider how processes can be improved. This will vary depending on the actuary, their company, and the specific task. For example, tasks involving manual aggregation of datasets, such as copying and pasting, can likely be automated with AI or machine learning tools.

In the actuarial profession, we have long used tools such as macros within spreadsheets to improve efficiency. One of my first jobs involved moving work from Lotus 1-2-3 to Excel. To do this, I had to learn VBA and write programs to pull in data and update formulas.

For the actuarial profession to gain the full benefit from AI, actuaries will need to learn more about the automation processes available and engage with colleagues in other areas who may already be exploring wider business process automation.

NFU Mutual, like many other organisations, has already invested in process automation. I often speak with colleagues about the automations they are using and reflect on how my team can make use of them.

Recently, Microsoft has introduced tools like Power Automate, which give everyone the opportunity to perform smaller-scale automations. For example, one of the automations I have set up takes meeting notes and emails them to me

What specific actuarial tasks do you think are most at risk of automation through AI?

A lot of people in the industry are saying actuaries won’t be replaced by AI, but an actuary who doesn’t use AI might be replaced by one who does, becoming more efficient and productive in the role. AI will enable actuaries to automate and speed up the more repetitive aspects of tasks, such as gathering data and crunching numbers However, actuaries have always done more than just crunch numbers. They carefully consider past data and the current situation to anticipate how things might change in the future. When changes occur, the challenge is figuring out how to make allowance for them. Actuaries make a lot of expert judgment, which makes it difficult for AI to replicate all aspects of the role.

Do you think specialised actuarial roles in AI will emerge in the future, such as an ‘AI Actuary’ or an ‘Actuarial Machine Learning Specialist’?

It is likely that a data science specialism for actuaries could emerge, similar to the existing specialisms of general insurance, life insurance, investments, and pensions. As part of the AI work I’ve been doing with my employer, I’m working with people from other professions more than ever before There’s a broader set of skills required for businesses to embrace AI, which creates new opportunities for actuaries to get involved in wider business projects.

I’ve spent a lot of time helping people around the business where I work understand AI As an actuary who is comfortable with using AI, I feel confident in my ability to explain how AI works, as well as its limitations and the risks of using it. To stay updated on developments, I have to keep learning. I often share posts on LinkedIn about how large language models (LLMs) aren’t as clever as people think. While they may evolve over the next few years, LLMs are far from flawless and can often produce errors, so they’re not perfect

What are the common regulatory requirements that must be met by actuaries while using AI models, and what challenges do actuaries face when trying to meet these requirements?

There is increasing awareness of discrimination and bias in machine learning and AI models, which is an important issue for actuaries to understand. It’s essential that actuaries learn about this to help themselves and their companies deploy AI and machine learning tools successfully.

In the main working group I’m involved in, I lead an AI ethics workstream. We focus on how actuaries using AI and machine learning can comply with professionalism, regulation, and ethics.

In terms of transparency and fairness, AI might produce biased decisions. What can actuaries do to deal with that?

There isn’t an easy answer, unfortunately The first thing actuaries should do is be aware that this is a problem and take it seriously. The second thing is to keep up to date with the latest and continuously emerging industry practices.

In terms of explainability and transparency, actuaries can review the decision-making process of an AI model to understand how it reached its conclusions While this process has limitations, it is better than taking no action at all.

In terms of bias and discrimination, there are a couple of things I’m aware of. One is that actuaries should be testing their outputs as a minimum. Traditionally, in the actuarial world, a lot of time is spent setting assumptions and then pressing "go", believing that the result must be correct because the assumptions were well thought out In the AI and machine learning world, there needs to be more emphasis on checking whether the answers make sense or if they are biased or discriminatory in any way.

In the actuarial research space, Ronald Richman has published influential papers on using machine learning techniques to detect signs of bias in models. While I’m not aware of any firms currently using his methods, this is an area of active research, and as actuaries, we need to stay updated on developments to understand the options available to us.

Surety bonds are financial guarantees designed to protect against potential losses or breaches of contract. They are commonly used in industries such as construction and government contracting, where performance is crucial. Surety bonds are a three-party agreement between the principal, surety, and obligee. The principal is the party responsible for fulfilling an obligation, often a contractor or business owner. The obligee is the party that would be paid if the contract was unfulfilled. The surety, often an insurance company, is the party that issues the bond and guarantees the performance of the principal by ensuring that the obligee is paid the agreed amount in the event that the principal does not fulfil their obligation.

The two most common types of surety bonds are contract surety bonds and commercial surety bonds.

Contract surety bonds are primarily used in construction projects. If the contractor (the principal) defaults, the surety company is responsible for ensuring the contract is completed, either by finding another contractor or compensating the project owner for financial losses

Types of contract surety bonds

• Bid bonds

• Performance bonds

• Payment bonds

• Warranty bonds

Commercial surety bonds safeguard the public (consumers) from fraud, misrepresentation, and financial risk. These bonds are often required by federal courts, government agencies, financial institutions, and private corporations as part of a company's licensing and regulatory requirements.

Examples of commercial surety bonds

• License and permit bonds

• Court bonds

Surety bonds are important for several reasons:

Surety bonds protect the project owner from the overall risks of using contract workers, from work not being completed to the right standard and from the construction firm becoming insolvent. Surety bonds help mitigate financial risk by ensuring that the obligations of one party (obligee) are fulfilled, reducing the risk of default or non-performance by the principal and protecting the obligee Surety bonds also enhance the credibility and trustworthiness of the business (principal). It signals to clients, partners, and customers that the bonded party is financially stable and committed to fulfilling their obligations.

To maximise profits, the project owner (contractor) may opt for lower-bidding subcontractors, who are often less reliable. However, by purchasing a surety bond, the contractor mitigates this unreliability, as the bond provides a financial guarantee that the subcontractor will perform according to the contract terms, or the surety will step in to complete the project or compensate the project owner in the event of a default. Some industries and professions in the UK require surety bonds as a regulatory or legal requirement, such as working for a regulatory or statutory body. Obtaining a surety bond ensures that businesses comply with relevant laws and regulations

Surety bonds provide payment protection for subcontractors. Subcontractors may benefit from bonds, which ensure they receive payment for their services and materials, even if the contractor defaults on payment.

Surety bonds facilitate a smoother resolution process in the event of a dispute or default as the surety company may step in to mediate or fulfil the financial obligations as specified in the bond.

Actuaries are involved in determining the risk associated with surety bonds. Actuaries specialising in surety bonds use statistical models to assess the likelihood of a claim being made. This analysis helps determine the premium charged for the bond, similar to how risk is priced in insurance. Surety bonds usually cover a percentage of a contract’s overall value (often around 10%). This provides the obligee with the funds required to find a new contractor or to rectify mistakes.

However, several factors can affect the cost of a surety bond These include:

Creditworthiness of the principal: a principal with a higher credit score and a more stable financial situation is generally considered less risky and therefore may be able to secure a bond at a lower cost

Type of bond: different types of bonds come with different levels of risk, and therefore may be priced differently (a less risky bond is priced lower)

Amount of bond: as the bond amount increases, the bond premium may increase as well

Length of bond: the longer the bond, the more time there is for something to go wrong, and therefore the higher the risk, hence higher pricing

Operating state or country: different countries have different financial situations and stabilities which will affect the risk of the bond, for example:

Inflation or increase in wages will both result in higher costs hence a construction company is more likely to bail on a project, hence higher risks associated with this bond. Due to economic downturns, a construction company may lose contracts forcing it to go into liquidation The company is unable to carry out the project and the surety will have to compensate the project owner.

The complexity of the project: more complex projects tend to have more risks and therefore priced higher Industry type: bonds for industries such as construction, transportation and service are riskier than bonds for professions such as real estate and finance

In Europe, the surety bond market is projected to grow from $4.13 billion in 2023 to $6.53 billion by 2031, with a compound annual growth rate (CAGR) of 5.9%. The main reason for this growth is due to Basel IV, a package of banking reforms developed in response to the 20082009 financial crisis that began implementation in 2023 and full adoption by 2025. Basel IV aims to enhance the stability and resilience of the financial system by ensuring that institutions hold sufficient capital against potential losses This has resulted in partnerships between banks and surety companies emerging to diversify risks and expand into niche markets to help them manage the stricter capital requirements imposed on financial institutions, Basel IV.

Surety companies, particularly those affiliated with banks or financial institutions, act as underwriters offering expertise in assessing contractor risk and issuing bonds These surety companies will need to hold higher capital reserves, which could affect their liquidity and capacity to underwrite new bonds. Hence this leads to more conservative underwriting policies. The collaboration between banks and surety companies enables banks to share some of their uncertainties with surety companies, which in turn enables the banks to mitigate their risks and meet capital requirements

In addition, digitisation will drive surety growth and remain a major focal point. 73% of surety companies are planning investments in digital and analytical platforms to ensure an improved customer experience. In addition, 68% of surety bond clients have expressed a preference for receiving bonds digitally. As electronic bond demand continues to grow, governments are enacting legislation to ensure principal and obligee safety from acceptance to issuance to recording digital bonds. Furthermore, industry groups, such as The International Credit Insurance & Surety Association, are also forming working groups to help streamline bond issuances, including the online attorney registration and signature verification process.

A blockchain is a digital record-keeping system in which past records are almost impossible to change because transactions are safely saved in "blocks" that are connected in a chain. Everyone can see past records, but no one can change them, making it a secure, transparent, and trustworthy way to store and verify information. Blockchain technology therefore has the potential to revolutionise the surety bond market by providing a more secure system for the sale and purchase of these bonds, particularly for international transactions

Furthermore, with the growing demand for renewable energy, there is an increasing need for the development of new projects around the world. However, there are many obstacles in the way of completing these renewable energy projects, ranging from having adequate funding, to dealing production shortages. Bonds are frequently needed to guarantee the completion of renewable energy projects because investing in them might carry a significant risk Smart contracts are created using blockchain technology. When certain project milestones are completed, smart contracts can trigger payments and offer real-time tracking of bond obligations. Therefore, the integration of blockchain technology into surety bonds could help to reduce uncertainty and build trust among stakeholders, which could make renewable energy investments more financially viable

COMPANY

Gallagher

LCP

PROGRAMME NAME DEADLINE

Cyber Actuary London 2024 Rolling

Insurance Analytics Graduate London 2025 Rolling

Government Actuary's Department Graduate Analyst 31-Dec-24

APR Actuarial Solutions

Lane Clark & Peacock

Secerus Recruitment

Arch Capital Group

NatWest Group

Verisk

RSA

Graduate Actuarial Associate Rolling

Insurance Analytics Graduate Programme - September 2025 Rolling

Global Reinsurance Broker Actuarial Graduate Rolling

Graduate Programme 2025 28-Feb-25

Risk Industrial Placement 2025 Rolling

Catastrophe Modelling Risk Analyst Intern - Placement Year Rolling

Actuarial Internship Rolling

First Actuarial Actuarial Internship Rolling

LCP

LCP

LCP

Legal and General Group

SAGA

STARR

Hannover re

Canada Life Group (UK)

Aviva Grads Campaign

Line Up Aviation

Lockton, Inc

Ernst & Young

Pensions Consulting - Summer Internship 2025 Rolling

Insurance Consulting - Summer Internship 2025 Rolling

DC Investment & GovernanceSummer Internship 2025 Rolling

Actuarial Analyst Graduate 2025 Rolling

Insurance Pricing Graduate Rolling

Actuarial Analyst (Grad Role) Rolling

Actuarial Graduate Programme Rolling

Actuarial Trainee Rolling

Actuarial Graduate Pathway 25 Rolling

Actuarial Analyst/Pensions Analyst Rolling

Reinsurance Actuary - Lockton Re Rolling

Actuarial Life Insurance Graduate ProgrammeSeptember 2025 intake Rolling

LSE Actuarial Society Marketing Division

Ethan Lam

Angelina Letizia Megan Chuadrey

Chia Chian Yung

Nila Jeyaram

LSE Actuarial Society Research Division

Joshua Lufakalyo

Beatrix Quake

Shishir Bhatt

Ze Kai Ng

Zhengxian Yi

lsesuact@gmail.com

www.linkedin/in/lsesuactsoc

www.lsesuactsoc.com

www.facebook.com/LSESUActSoc/

@lsesuactsoc