17 minute read

How Five Community-Owned Businesses Were Bolstered with Cares Act Money

The grandly titled Coronavirus Aid, Relief and Economic Security (CARES) Act came quickly out of Congress and was signed into law after the namesake disease clamped down on both public and private life in March of 2020. A key provision was a $367 billion loan and grant program for small businesses.

Sometime later, the city of Peachtree Corners was allocated $4.5 million meant to aid those enterprises and divvied it up among each qualifying applicant. This is a story about five Peachtree Corners enterprises forced to weigh a number of considerations, from how to balance safety for customers and staff with a driving need for revenue — and about the help they got to stay afloat.

Advertisement

By Mark Woolsey

Anderby Brewing

Anderby launched in 2019 with owner Preston Smelt and spouse Michell, along with a small cadre of employees, brewing a variety of IPAs, stouts, fruited sours and other favorites. They built buzz through their taproom and by supplying kegs of beer to restaurants. Then came COVID, and the whole enterprise, well, went flat.

They got a COVID-19 grant through the Cares Act plus help through other government programs that, lumped together, was in the low six figures. It was badly needed as their taproom shut down until June. With restaurants closed, as well and many later limiting to pickup and delivery once open, that part of the business dried up as well.

Smelt said some stark numbers told the tale. He said a good month prior to COVID meant $35,000 to $40,000 in total revenue rolling in from product distribution and their taproom. After the onset of the epidemic, that shrank to $3,500 or $4,000.

“And it wasn’t like we were a long-established business where we could go to a bank and say ‘we need a $100,000 loan and we’ll be good for it as soon as we get out of this,’” he pointed out.

Smelt said, “The money got us to the point where we were able to make some reinvestment in product and stocking raw materials.” He said it also helped to fund the acquisition of capital equipment for a canning opera-

Opposite page, clockwise: Preston and

Michell Smelt

The bar area serving individual brew Clockwise, this page: Preston and assistant brewer Dana Reppel Anderby expansive interior Wall art Anderby’s original brew canned on site.

tion “because that was one of the few ways to move beer during this period.”

That canning equipment took until October to arrive. In the meantime, they resorted to a hand bottler, filling exactly two bottles at once and selling finished six-packs out the front of their digs. Ultimately the endeavor was a money-loser, but Smelt said it did provide some revenue, got their product into the hands of their boosters and gave them visibility.

It also kept them from pouring even more beer down the drain than they had already had to do.

Another factor in play, he said, was a “fantastic landlord” who worked with them on their rental obligations. “We would not have survived without those two things,” he said bluntly.

Smelt said he and his wife had just started talking about revamping their product lineup when the epidemic descended. The federal help helped enable them to settle on a core of three or four beers they think will help them expand throughout the region.

The couple is cheering the growing vaccination numbers and drooping COVID caseloads. With more companies reopening in the surrounding Technology Park and their workers beginning to stop in, and restaurants starting to clamor again for kegs, prospects are improving.

Another positive factor, he said, was that three new breweries have opened in the immediate area since they debuted. He said having several in close proximity will create a “brewing scene” that could become a destination choice.

At their own destination, they had cut taproom seating by 30-40% before reopening last summer and took other cleaning and sanitizing steps. “What we’re wanting to do is create an environment where you can come in and spread out and feel comfortable,” Smelt said.

In line with the push toward distancing has been a reluctance to re-start larger themed events. He said that if a bigger crowd shows up in conjunction with daily operations, they’re OK with that, but a large blowout is not in the cards.

In another case of altered plans, Smelt said earlier plans to do a capital expansion have been put on hold. All the juggling of procedures, products and profitand-loss numbers has taken a toll.

“There hasn’t been a lot of sleep,” he said. “There’s still not. While things are improving, we’re not back to normal yet.” ■

continued on page 16

MY SALON Suite— BeautifulLea Hair Salon

Businesswoman Lea Harwell said her business has been subject to ebb and flow since the onset of the pandemic some 16 months ago. Although she prides herself on having an “always prepared” mentality, being shut down for five weeks and then having to make operational concessions to COVID took a considerable financial toll.

The thousands of dollars in COVID grant money she received helped compensate for the weeks of no income, she said. The veteran cosmetologist dipped into her own finances for business expenses during that time, then used some of the grant money to replenish her rainy-day stash.

She also utilized the help to get masks and additional safety supplies and institute cleaning measures. Then there were operational and scheduling changes that chewed away at her former income level.

“I work longer hours to do the same number of people because I’m not seeing two people at the same time,” Harwell said. She occupies a one-room suite with three chairs at the MY SALON Suite and said in pre-COVID times she could have a client in one chair undergoing a color processing while simultaneously giving a haircut in the other. That’s not possible now.

On the other hand, she allows that having an individual room instead of working as part of a larger open salon has been a plus.

In addition to the limitation on people, additional costs have come with completely sanitizing her room between clients and keeping mask and cleaning supplies on hand for her and for customers who want to feel more comfortable.

That has made her more adaptable, she inferred. “You can’t cut hair very well around a mask,” she said, although if clients insist on a covering, she can find a workaround.

She’s gone the extra mile on Zoom to help clients who are even more ultra-cautious. Harwell said several who have feared venturing out have asked her to jump on a video call with her so they can trim a friend’s or partner’s bangs or clean up a bit around their ears.

She’s willing to do that, but couples it with a cautionary note. “I tell them I will try to help, but I can’t take any responsibility for what you do with your untrained hands.” As she noted, “I have doing this for 40 years.”

Providing what could be termed “tele-haircuts” is a second manner in which she’s had to be nimble since COVID reached pandemic levels last year. Harwell said there are other examples as well.

Take what happened at the end of the five-week shutdown, for example. “I remember the day the governor was doing his press conference. He made the announcement at 4:00, and at 4:01 my phone started blowing up. That day was a scramble, and everyone wanted to be back,” Harwell recalled.

She said that after initial rush, business tapered off. A couple of roller-coaster cycles followed, including a drop-off last July and August. Now her business has settled into a groove that’s about 80% of the pre-pandemic level.

A couple of ancillary factors have brightened the picture. “Our owners were very generous to us,” she said. Although they had to keep up with payments to their landlords, lease payments from individual salon tenants were waived during the time that they were not able to be open, she explained.

Harwell also cited working for

Left to right, Lea Harwell; Her salon suite Harwell’s styling

a number of years in sales and marketing, which she pursued until coming back to the haircutting business some 13 years ago. “I can get out there and find business,” she said confidently. “If business falls off, I just don’t wait for something to happen. I need to work, and I want to work.”

For now, she’s playing it conservatively, using her much-appreciated help to rebuild her savings while keeping her fingers crossed that cases don’t spike again to the point that another shutdown is required. She’s still in recovery mode, financially.

Harwell said she thinks Governor Brian Kemp has done what he can to keep small businesses going during the pandemic and added that she’s eternally grateful that Georgia is not in the same boat as California, where she said stylists weren’t allowed to work for a year. ■

Mojitos

“I don’t want to say it was a drop in the bucket, it was very helpful,” said Luis Fernandez of the thousands in federal money his business got under the Paycheck Protection Program, a later COVID-19 grant and from elsewhere.

“But one rent check, one liquor license renewal and a couple of utility check payments and you just blew $50,000,” said the owner of Mojitos as he recounted well over a year of struggle in his Peachtree Corners restaurant and other locations. He said without the money from the paycheck program, they wouldn’t have made it until December of this past year, when they got the grant.

As the pandemic flickered to life in the spring of 2020, he said, the dining room was closed for more than a month, then open for takeout only, and when the dining area finally reopened, 80% of their square footage disappeared due to social distancing.

Thinking initially that the crisis would peak and begin to subside in 15 days, Fernandez said he gathered staff and told them that he was going to pay them as if all and sundry were going on a couple-week vacation.

When that span came and went with no sign of recovery, “that’s when the body aches and the grey hairs came. I feel like I aged 30 years in ten months,” he lamented.

Efforts to stay afloat included them cashing in life savings and maxing out a home equity line of credit. Not so good.

But much better: Fernandez credits both the city of Peachtree Corners and ordinary citizens with being a huge help. The grant money that he had applied for in late November-early December came through a couple of weeks before Christmas — a very timely holiday gift, if you will.

As with Harwell, Fernandez said since reopening and easing back toward “normal,” business has been a roller coaster ride. “We saw some amazing weeks of sales come in late May and early June (of 2020) and we said, ‘Hey, baby, we’re coming back.’ And then the whole riots and everything started happening with spikes in cases and (business) went back down again.”

He credits the city with helping to stem the bleeding in a couple of ways. Fernandez said when they decided to reopen the dining room, he procured a large banner announcing the reopening. Unbeknownst to him, he

continued on page 18

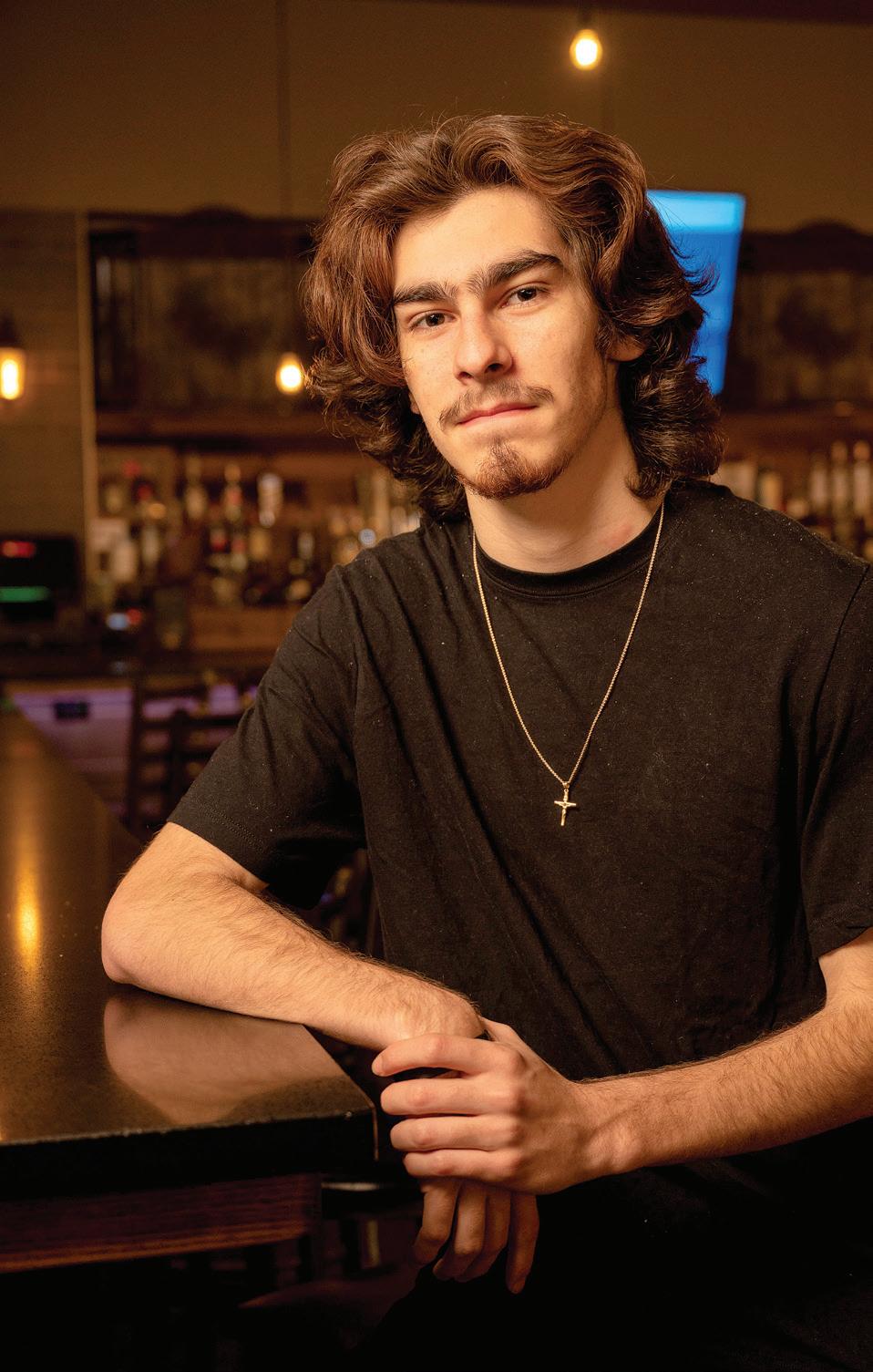

Top, Luis Fernandez Above, the Mojito’s Cuban style dining area Right, Fernandez’ son Julian Fernandez

said, was a provision in the city’s building code limiting the size of such signage. A code enforcement agent drove the point home with a visit.

The Cuban restaurant owner decided to plead his case with city hall, emailing a member of the council and getting a sympathetic hearing. “A week later, the city announced they weren’t enforcing the signage code,” he said, adding, “you’re not thinking about the city code when you’re trying to save your financial life.”

The city also eased up on late fees for paying liquor sales tax, Fernandez said, which alone saved thousands of dollars. The move made sense, he said, given that restaurants, with historically little profit margin, have to closely allocate their money in order to meet such obligations in a timely manner.

The community also rallied, buying gift cards while the restaurants were closed and placing garden-variety-sized orders with a $100 tip attached. “They really did bring tears of joy on more than one occasion, just knowing that we have a community that wants to help small businesses,” he said.

Fernandez said the business is back to about 80% of its former level. He noted that the latest wrinkle involves finding enough staff. “We had an amazing

Mother’s Day weekend at all of our restaurants,” he said. “But we have like 40% of the staff, so it feels a lot harder.” He said the weekend was a mad scramble as a result.

While the trend is in a positive direction, he added, a business model meant to evoke a crowded, hopping 1950s Cuban nightspot faces a tough challenge in an era of social distancing and face masks. ■

Cricket Zone

Mohammed Rashid’s cricket practice, coaching and instructional facility seemed poised to capitalize nicely on the increased popularity of the game in Atlanta. Then came the pandemic.

COVID made its appearance at a tough time for Rashid’s venture — the fledgling enterprise had only been in business for about two years. Suddenly, nobody wanted to show up and take swings in the batting cages or learn more about the fine points of the game.

The federal grant through the city was significant, Rashid said, allowing them to keep current with the rent on their place and helping to cover utilities and the salary of one part-time employee.

On a less positive note, he said, they were invited to apply for an SBA Targeted Economic Injury Advance loan, then told that they didn’t qualify due to being in a high-income area.

“Our business dropped significantly, and we literally had to shut it down; then we opened back up, but nobody came,” he recalled of the dark months of 2020. “We tried to survive in a different way by selling some products, even delivering some products.”

Rashid explained that they delivered balls, bats and protective gear to some playgrounds to help them survive economically.

The cricketeer said the shutdown lasted a couple of months and that after reopening, they only allowed one person to be in the batting cages in their entire 10,000-square-foot building. That has since loosened up, he indicated.

From February on, after vaccinations picked up, some things looked brighter. “But still for a lot of customers, it’s not comfortable for them to come indoors,” Rashid said. “Still, we are in bad shape.”

He said the business has rebounded to about 30-40% of pre-pandemic levels and he’s hopeful that they’ll tack another 10-20% on to that by, say, July.

Like Fernandez, Rashid is impressed by the level of help that Peachtree Corners city officials have supplied. As Rashid put it, “From anybody, any time we went to the city, we got the highest level of service — and from their heart. At every single step, they always stood by us to help.”

He feels that a combination of limited occupancy and stringent cleanup measures are helping keep patrons confident and the threat of COVID at bay. Rashid said that, among other measures, they’re utilizing an anti-COVID fogging machine each hour to disinfect the entire facility.

Rashid noted that the landlord has offered some discounts and that, with a little bit more help on that score and from the city, “we will definitely be surviving. If we can survive 2021, this business will survive for a decade, I think,” he said.

He pointed to the growing popularity of the sport, saying he’s formed a cricket team himself and that his business supports others with marketing and other help. There is an active league in the Cumming area, he said, and the city of Johns Creek has offered batting cages and other practice facilities for cricketeers.

Asked about whether he thought government in general was doing enough to help smaller enterprises during the pandemic, he replied this way in an e-mail. “Small business is the heart of the U.S. economy. If this is true, government should identify real injured business proactively. Government is doing a lot, but it’s random.” ■

Teesha Yoga

Latesha Grant hung out her shingle at Teesha Yoga in February of last year, just as the term Coronavirus was becoming familiar to the American public.

Grant said the ancient practice of yoga is an embodiment of “trying to find your true inner self through a healthy lifestyle.” Lifestyle habits became a huge consideration as the pandemic tightened its grip.

She has been quick to tell potential students that those who were surviving COVID with little to no lasting harm were those with strong immune systems and such qualities as good range of motion and a healthy diet. The CDC has said another version of the same thing, pointing to such risk factors as smoking, obesity and a weakened immune system as making severe COVID-19 illness more likely.

“Unfortunately, I opened my studio in February of 2020, so it was the very tip of COVID being known to other countries before it came to us,” lamented Grant.

She said her business was literally nothing for about seven or eight months. She offered virtual classes for those not comfortable coming to the studio but was still forced to cut back staff and utilize personal funds to keep going.

A CARES Act grant which came through the city eased the pressure, she indicated, aiding with rent, utilities, payroll and some marketing to keep the name of the business and its services in the public eye.

The big expense has been her lease, and that debt has placed the survival of the business in doubt. “I’m still drowning,” she said. “I could be confident, but you also have to be realistic. Confidence doesn’t pay the bills.”

Grant also said she applied for help under the Paycheck Protection Program but was unable to get any allocation. And she thinks government could do more to help small business enterprises.

At what could be called the other end of the spectrum, she said her employees were understanding when she had to cut staff, and those in her classes have been nothing short of “fantastic “in terms of their support.

Now that the pandemic numbers and restrictions have eased, she’s seeing some improvement but has been cautious about the process, bringing back a couple of instructors and returning to in-person classes, albeit with limited class sizes and distancing. She leads sessions equipped with a microphone so that people who choose to be in a separate individual room can hear and follow along.

Also on hand is a diffuser regularly spraying a mist designed to help keep her business clean and safe. And Grant asks students who come in for a session to wear a mask until they actually get on their mats.

She maintained that what she offers has been beneficial to some struggling with the uncertainty and loneliness of the last 16 or so months. In her words, “I have had students express to me verbally that they had thoughts of suicide and that just being able to come and express themselves and release the tension and frustration that was all bottled up (was good). Coming to yoga actually helped them to get a sound mind and to clear negative thoughts.”

Grant began her yoga practice back in 2000 while a student at the College of Charleston and has been teaching for more than a decade, racking up multiple certifications. As business begins to trickle back in, she’ll put that hard-won knowledge to more use.

“We just want to be able to be here and help change the community,” she said, noting that her business also offers services such as nutritional counseling, a yoga therapy program for teens and a kids’ yoga program.

“What I give out here can save lives,” Grant said. ■

Above, Latesha Grant wants Yoga to be accessible to all and create the space for well being.