5 minute read

COMMODITY OUTLOOK

By: Jon Leonard, Director, Supply Chain Management

Grain markets have eased of late, without any significantly bullish information to continue supporting the trek upwards. Concern still exists over the Black Sea Grain Initiative, which is set to expire on March 18. Thus far, vessels have been able to leave the region without much incident. The U.N. are Russia are expected to meet soon to discuss renewing the grain deal. After a year of conflict, the World needs orderly flow of exports to occur, or markets will react swiftly to the upside. South American production too is in focus, as less than favorable weather has trimmed Argentina’s output significantly. Brazil has had a much better season, but it remains to be seen just how much their production can offset a lack thereof in Argentina.

Advertisement

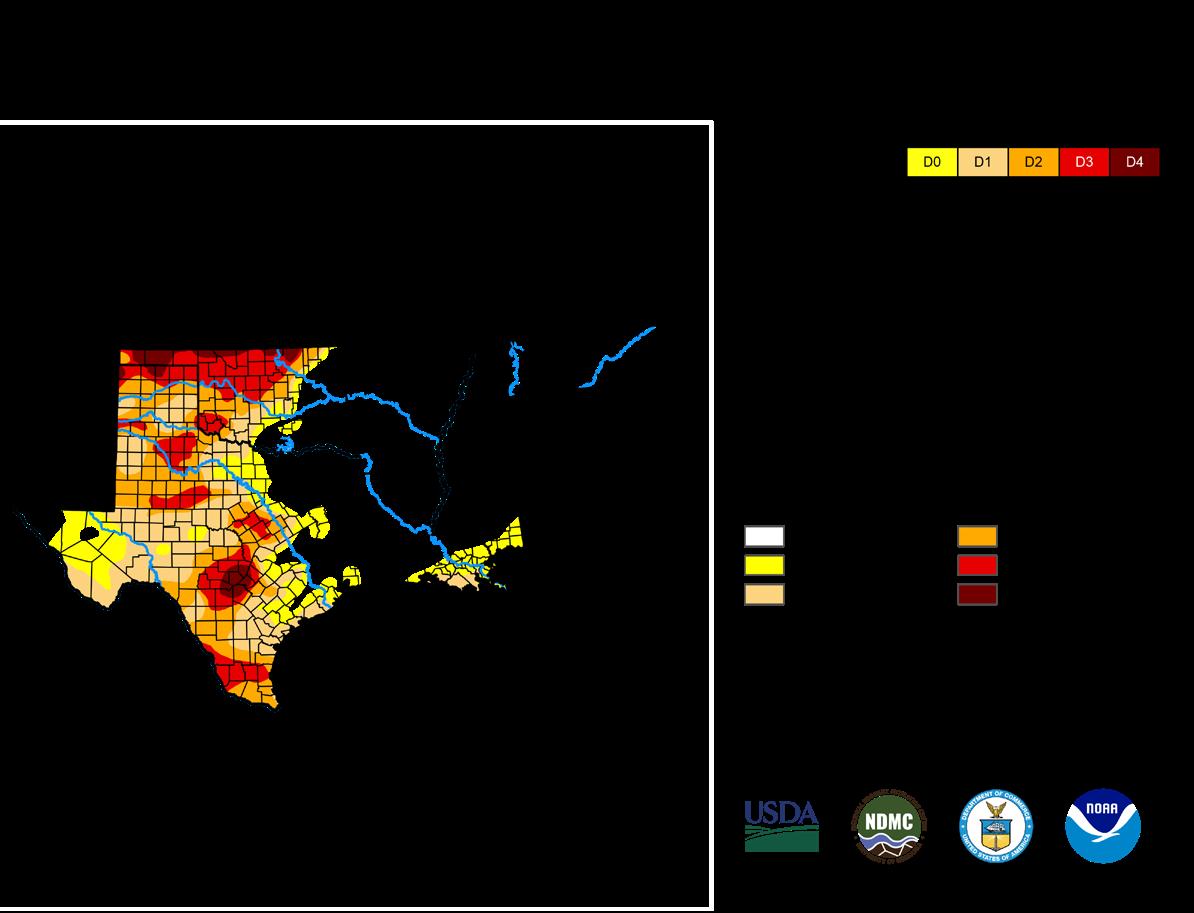

On Wednesday March 8, USDA released their World Agriculture Supply & Demand Estimate (WASDE) for March. They revised the U.S. balance sheets by reducing corn exports by 75 million bushels, long expected by the trade. Consequently, corn ending stocks for 2022/23 were modestly raised to 1.342 million bushels. USDA cut soybean ending stocks by 15 million bushels to 210 million bushels, slightly more than the trade expected. They accomplished this by raising soybean exports by 25 million bushels, while reducing domestic crush by 10 million bushels. No changes were made to the wheat balance sheet. Turning to South America, USDA aggressively lowered Argentine corn and soybean production estimates, with perhaps more downward revisions to come. Ultimately, all led to a slight build in World stocks for corn, almost unchanged for soybeans, and a slight reduction in wheat stocks. Logistics have continued to be challenging for agricultural products throughout the winter. Thankfully, the U.S. economy was able to avoid a nationwide rail strike in December, as the results would have been disastrous for all. That said, rail performance has suffered mightily for all Class 1 railroads. Still trying to recover from the pandemic to meet current demand, they continue to struggle to hire enough workers for the crews needed to operate. Though we’ve experienced a mainly mild winter across our region, many of our inputs originate from across the Northern Plains and Upper Midwest, where several winter storms did impede the ability for rail cars to move. That’s a normal occurrence most years, but crewing issues only compounds the problem. While there are signs that velocity improves in the months to come, the recovery effort is still in process. As we mentioned in our last outlook, U.S. inland waterways were at near record lows following the continued drought across much of the U.S. and Mississippi River basin. It took until the New Year to see tensions ease as water levels recovered, and we still see some untangling being done as barge lines work to get back into position after a major disruption. As luck would have it, recently we have seen river levels almost too good. Current water levels on the Mississippi River can see flood stage at Memphis and flows on the Arkansas River were hot enough to impede barge traffic in the last few weeks. Spring rains are welcomed, but we can have too much of a good thing. Fortunately, we have also seen some improvement in availability of truck drivers, helping the inbound pipeline of grain and ingredients. Diesel prices have declined over the past few months, easing the strain on carriers, and giving them the confidence to hire. At LNC, our ability to source ingredients through different modes of transportation is just half of the equation. It’s ultimately the outbound side that impacts our customers the most. LNC made a tremendous effort over the last year to bolster the ranks of our driver workforce, while investing significant dollars in more trucks and trailers. Customer feedback has shown that it has enhanced our ability for the timely delivery of feed to better serve our customers during peak season. Though much of the U.S. has seen improvement in drought conditions, unfortunately it persists for too many of our customers. The latest U.S. Drought Monitor released Thursday March 9, continues to show improvement across much of Texas and Oklahoma. Just three months ago, 57% of our serviceable area had been classified as moderate drought or worse. Today, the latest maps show that we’ve decreased that by 20% moving towards abnormally dry, or even to no drought at all. Unfortunately, drought remains intense for much of Kansas – very concerning for pasture conditions, but also impactful for grain and forage production this Spring. We remain hopeful that the weather pattern continues to shift, and we start to recover our moisture profile to support rebuilding the cow herd.

Over the course of the past year, we had been expecting feed prices to remain high to very high, and they did just that. Whether it be the war in Ukraine, U.S. Drought, sub-par U.S. Crop production, or concerns about South American crop production – we’ve had too many supply disruptions for markets to relax. Today, we still have some of those same issues in play, but the market has solved for at least some of them. Much higher interest rates combined with “high prices curing high prices” has reduced demand for grain and ingredients both export and domestically. Recently, corn futures have declined some 70 cents, while soybean meal remains quite high from a historical perspective. Though it may take some time, we expect ingredient prices to decline moderately, resulting in lower feed prices as we enter Spring and transition into Summer.