4 minute read

New legislation pertaining to retirement funds

INDUSTRY NEWS New legislation pertaining to retirement funds

A set of proposed tax bills with significant changes to retirement reform and additional steps toward a so-called “two-pot system” for retirement savings were published by the National Treasury in the middle of 2022.

Advertisement

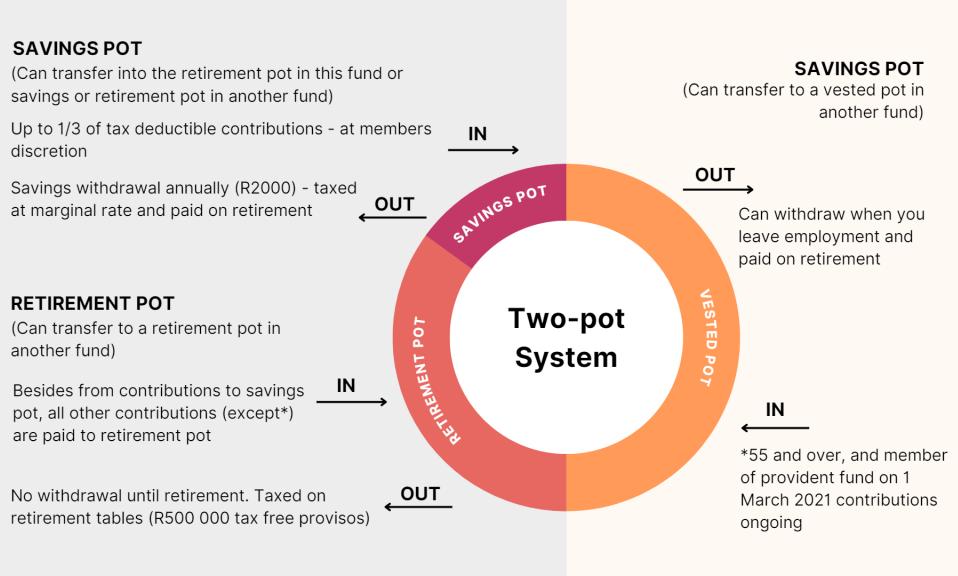

Introducing the two-pot system

In the event of an emergency, the two-pot system would enable retirement fund participants to withdraw one-third of their pension assets once a year while keeping the remaining two-thirds for retirement. This is regarded as a better alternative to people resigning from their jobs to access their pensions or provident funds. According to Treasury, this system will allow South Africans to save for non-retirement objectives (e.g. emergencies) via their retirement funds while maintaining more of their assets for retirement.

The basic workings of the two-pot system Terminology – the pots

Vested pot: This is the member’s accumulated retirement savings in the fund before the implementation date and comprises both the current vested rights and non-vested rights (introduced from 1 March 2021). Savings pot: This is one-third of retirement savings in the fund that the member can withdraw/access without termination of their employment or leaving the fund. Retirement pot: The two-thirds of contributions that can only be paid upon the member’s retirement (even if the member’s employment is terminated).

Summary of the fundamentals of the two-pot system

1. Existing fund members do not need to re-enrol to access the two-pot system because existing funds will be modified to do so. To do this, each fund will need to revise its regulations. 2. Up to the aforementioned caps, contributions are still tax-deductible; however, any contributions that exceed R350 000 annually or 27.5% of your taxable income must go into your retirement pot. 3. The vested pot refers to all contributions and growth made before March 1, 2023, and it must be valued at the time of implementation for rights to vest. There will be no changes to the restrictions that were put on such contributions. 4. The savings pot and retirement pot will only build up from contributions to the fund made after 1 March 2023.

5. Any withdrawals out of the savings account will be taxed at the appropriate marginal rate and added to

the member’s taxable income for that tax year. 6. Only one withdrawal from the savings pot is permitted a year; it must be at least R2,000. You may withdraw all or a portion of the money that has accumulated in your savings pot as of the annual withdrawal date. 7. When the member reaches retirement age, he or she has two options: either add the savings pot to the retirement pot to buy an annuity or withdraw the entire amount as cash, which will be taxed in accordance with the retirement lump sum tables. The lump sum tables have more favourable tax rates (maximum of 36%) relative to the marginal rate tables that apply to annual withdrawals preretirement from the savings pot (maximum of 45%). 8. The entire retirement pot must be used to purchase an annuity when you retire. The minimum amount that can be used to purchase an annuity is R165 000, amounts less than R165 000 in the retirement pot can be withdrawn as a lump sum. 9. A member may still take money out of the vested pot before retirement, and this withdrawal will be taxed in accordance with the retirement lump sum tables. 10. Although no amounts can be transferred out of the retirement pot, transfers can be made into it from other pots (vesting, savings or retirement). No transfers can be made into the savings pot, unless from other savings pots. The retirement pot and the savings pot must be held in the same retirement fund – for example, you cannot hold the savings pot in your old employer’s fund and the retirement pot in your new employer’s fund.

Importance of a financial plan

Retirement planning is a proactive activity that affects people’s quality of life both now and in the future. Additionally, retirement planning involves more than just being a member of a pension, provident, and/or retirement annuity fund. To maintain your quality of life after retirement, you must properly plan your finances and estimate your financial retirement needs well in advance before retiring. We at Cornerstone, cannot stress enough the importance of having a solid financial plan. It guarantees that your financial goals have been achieved and that could positively impact your savings. Because of this, retirement planning is an intricate continuing process that must be started years before the actual retirement date and needs to be reviewed annually. Whether you’re just starting, buying a first home and getting married, or gearing up for retirement, priming your investments and paving the way for succession, we’ll help you to visualise a future that works for you, and plan for it accordingly. At Cornerstone, we’ll make sure that your financial plans are perfectly aligned to make the most out of life, no matter which chapter of your story you’re in.

Cornerstone Financial Services Group,

marketing@cornerstonefsg.co.za, www.cornerstonefsg.co.za