3 minute read

AVOIDING THE BOOKS

When I ask lawyers why they decided to jump off the entrepreneur cliff and open their own practice, I get a few different answers. All of those answers revolve around time and money.

More time with family and do the things they love doing. Which requires a certain amount of money. It would make sense that they monitor these two things, time and money, like a hawk to make sure you’re getting what you originally set out to get from all this, right? Nope, in fact many practice owners run from basic accounting requirements (if this is you, for the love of law please keep reading). So why are you running from the thing you set out to gain?

Advertisement

If you’re person that only looks at financials but doesn’t use them to make business decisions, passes this type of stuff off and never wants to see it, or if you avoid doing it all together, you’re certainly not alone. You just don’t speak the language of numbers.

Warren Buffet said “Accounting is the language of business”. Some of you just need to learn a few key terms and concepts.

There is nothing in your business that can’t be measured using numbers. Seriously, what does your firm do that cannot be tied back to your finances? Whatever your doing, money is a part of the plan. So getting a grip on it seems like a good idea.

Before you can create the financial picture of where your legal practice stands, you must set a solid foundation on which to build your financial house.

Garbage in = garbage out

If you’ve never heard this saying before, please remember me as the one who introduced this to you because then I will feel special. If your accounting records are incomplete or behind, Houston we’ve got garbage going in and therefore garbage coming out. If you’re not sure about the quality of data that you’re feeding your books PLEASE, for the love of law, ask an accountant to review your bookkeeping processes.

Your Law Practice Management Software (LPMS) should match your books should match your bank account and what auditors look at.

As accountants, it’s our goal to keep you in compliance so that, if you are ever audited, you don’t end up with a terrifying bill. Let me tell you one of the easiest ways for an auditor to find discrepancies in the books. Let’s say you use LPMS and an accounting software. and auditor is going to ask you for revenue reports from LPMS for the entire audit period in question. Then they’re going to compare those side-by-side to not only your accounting software but to your bank statements and the tax return for that period. Here’s what they usually find:

Revenue

LPMS says: $750,000

Accounting Records say: $725,000

Bank Statement says: $723,000

Tax Return claimed: $725,000

Guess what the auditor is going to do? They’re going to take the highest revenue reported (LPMS coming in at $750,000) compared to what you reported on your tax return ($725,000) and cut you up for the difference. Now you’re the one who’s guilty until proven innocent. That’s $25,000 that you’re going to owe additional taxes on, and you can bet your tail that there’s going to be penalties and fees to boot. Now, hopefully you don’t roll over so easy and do a little digging to find an honest mistake. Maybe you had a case that settled, and you were supposed to get $25,000 but everything fell through, and you just forgot to let LPMS know that. See how your software’s communicating is so important?

Your COA should be in line with your practice area(s) and tell a story

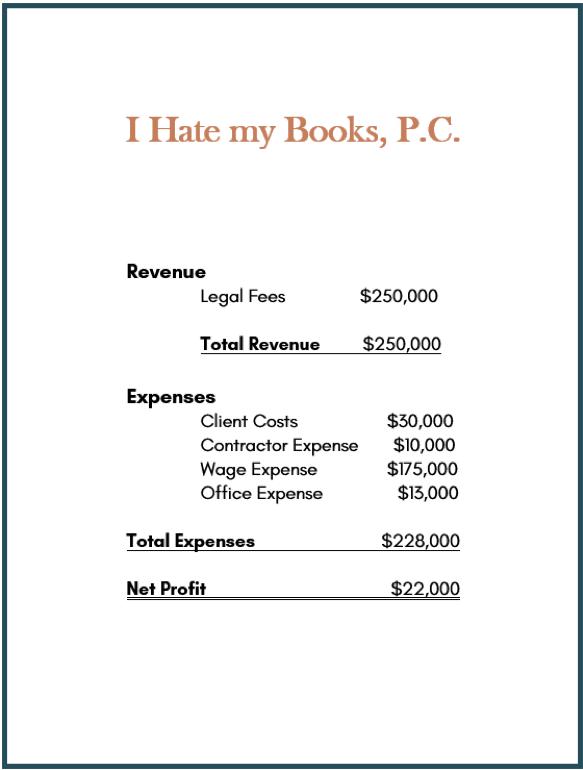

Yay, this is my favorite! Yes people I’m a nerd, I’m well aware and I own my nerdiness. I’m going to make this short and sweet. If your books look like this:

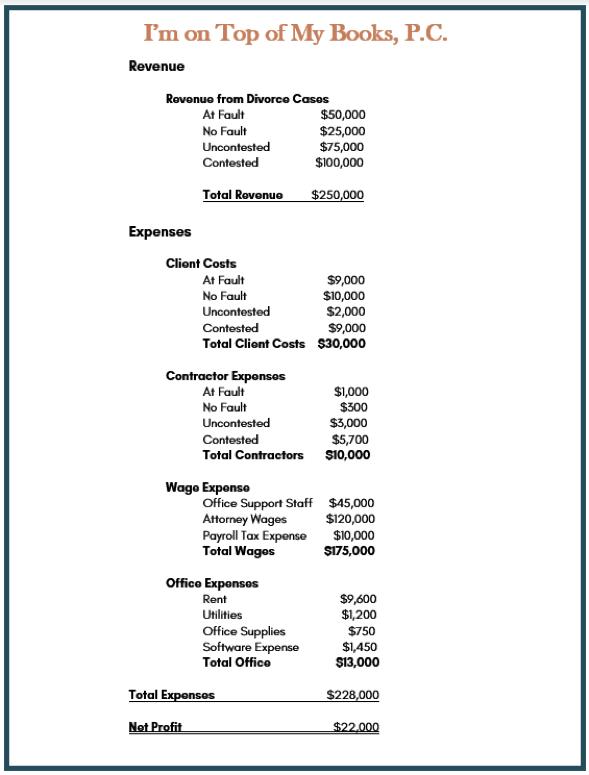

You’re going to want to work on getting them to look like this:

Now while these examples are super generic and made up, they prove a point. What point is that? In example #1, the only thing I can tell you about your legal business is that you’re profitable, but we have no idea why that is. In example number 2 I can tell you that your most profitable service is by far, uncontested divorce cases with a 93% gross profit margin before overhead expenses. I can also tell you that your least profitable service is no fault divorce cases coming in with a 59% gross profit margin before overhead. Based on this, you’ll want to look for areas to either cut down time involved, automate processes, increase your fees, or a combination of the three.

Your chart of accounts is how you describe your revenue and expenses and the organization of the financials.

You can’t measure what you can’t see, and financial clarity can be one of the sharpest tools in your entrepreneurial box.

Chelsea Williams, Core Solutions Group, Inc.