4 minute read

Texas Land Markets

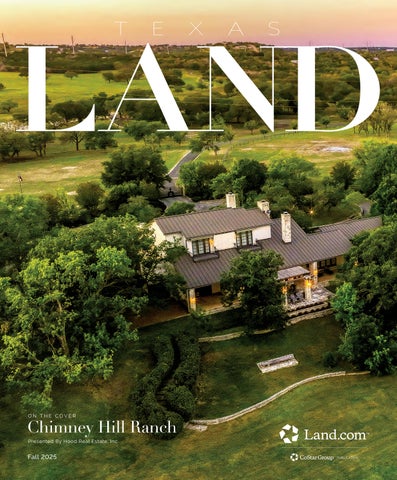

from Texas LAND Fall

MARKET

Texas Land Markets

Second Quarter 2025

REPORT BY CHARLES E. GILLILAND, PH.D.

Research Economist, Texas Real Estate Research Center at Texas A&M University

Sales volume in Texas land markets continued to languish in the doldrums with preliminary 2025 second quarter reported sales falling 12 percent from the already meager 2024 totals to 3,005 sales. The final reports should reduce the shortfall as the final data reaches the Real Estate Research Center. That volume amounts to a 64 percent drop from the 8,350 sales reported in 2021 but trails 2024 by only 156 sales. The preliminary acreage ebbed less than 1 percent from the second quarter 2024 total to 279,850 acres.

Driven by the higher per acre prices, total dollar volume moved up 3.7 percent to $1.39 billion. Price also moved up 4.4 percent over 2024 second quarter prices to $4,963 per acre.

Total Dollar Volum $1.39 Billion

Price Per Acres Increased to $4,963

Sales Dropped from 2024 12%

The Number of Acres Increased 279,850

Source Texas Real Estate Research Center

Panhandle and South Plains

Prices in this region continued to climb 5.0 percent to $1,911 per acre with the number of acres dropping 16.5 percent to a total of 45,325 acres. The number of sales dropped 28.3 percent to 264 sales while total dollar volume dropped 12.5 percent to $86.6 million. The slow volume and dropping total dollar volume suggests that demand remains weak.

Far West Texas

The meager volume of sales, 18 over four quarters, yields little evidence of general market trends in West Texas. However, the average size of transactions, at 17,323 indicates sales included some large properties, up 68.8 percent from a year ago. The price settled at $612 per acre, down 9.6 percent.

West Texas

Prices were substantially higher despite weakened sales volume, recording a price increase of 17.9 percent to $2,727 per acre. The price climb accompanied a pronounced slip in volume to 428 sales, down 11.6 percent from the second quarter of 2024. The strong price did not overcome the weak number of percent acres as total dollar volume declined 23.6 to $178.3 million. These developments suggest that sales may have occurred disproportionately in better quality land.

Northeast Texas

Sales volume continued to languish, falling 34.4 percent from a year ago mounting only 660 transactions. Reporting problems may have contributed to this continuing dearth of activity. However, prices did recover, rising 3.4 percent to $8,637 per acre. A total of 24,085 acres sold a declining of 21.1 percent. Dollar volume also fell 18.5 percent to $208.0 million.

Gulf Coast–Brazos Bottom

New price records continued to be set, settling at $11,054 per acre, up 16.5 percent. While volume dipped 2.3 percent to 473 sales, total dollar volume rose 10.8 percent to $196.3 million with total acreage slipping 4.9 percent to 17, 754 acres.

South Texas

Prices in this region continued to weaken producing a 4.1 percent regional price drop to $5,937 per acre. At 273 sales in preliminary volume reports, activity dropped 11.6 percent while total acreage inched up 1.1 percent to 23,201 acres. The price drop and volume decline drove total dollar volume down 3.0 percent to $137.7 million.

Austin-Waco-Hill Country

Prices declined 1.6 percent to $7,309 per acre. However, sales volume dropped 5.6 percent to 889 transactions contributing to a drop in total dollar volume of 11.4 percent to $309.4 million as total acres sank 9.9 percent to 42,335 acres.

The Future

Dry conditions ranging from moderate to exceptional drought plague much of south and far west Texas. Despite relief from drought in much of Texas, reservoirs in the area west of San Antonio and Abilene remain at very low levels. These drought conditions continue to aggravate disputes over water deliveries with both New Mexico and Mexico

In addition to worries about water, the screw worm fly has reappeared in Mexico. Memories of infestations prior to the eradication program have sparked concerns spread of the fly to rural Texas will mean for livestock and wildlife.

In general, markets appear to be probing for price levels that will induce buyers to leave the sidelines and pull the trigger. Market price performance has improved despite the lackluster volume of sales. Anticipated price weakness has vanished amid continuing price increases. °