5 minute read

Identify and describe different sources of short term financing

ALTERNATIVE SOURCES OF FUNDS

Advertisement

Debt financing: Funds raised through various forms or borrowing that must be repaid. Equity financing: Funds raised from operations within the firm or through the sale of ownership in the firm. Short-term financing: Borrowed funds that are needed for one year or less. Long-term financing: Borrowed funds that are needed for a period longer than one year.

SOURCES OF SHORT-TERM AND LONG-TERM FINANCING

OBTAINING SHORT-TERM FINANCING

Trade Credit

Trade credit: The process of buying goods and services now and paying for them later.

Promissory note: A written contract with a promise to pay.

Family and Friends

Friends and relatives are sometimes willing to help a small business by lending funds.

OBTAINING SHORT-TERM FINANCING

Commercial Banks and Other Financial Institutions A promising and well-organized venture may be able to get a back loan. Short-Term Loans Secured loan Unsecured loan Line of credit Revolving credit agreement Commercial finance companies

OBTAINING SHORT-TERM FINANCING

Factoring Accounts Receivable Factoring: The process of selling accounts receivable for cash. Commercial Paper Commercial paper: Unsecured promissory notes of $100,000 and up that mature (come due) in 365 days or less. Credit Cards Credit cards provide a readily available line of credit to a business. Can be risky.

OBTAINING LONG-TERM FINANCING

Financial managers ask themselves three questions when setting long-term financing objectives: 1. What are the organization’s long-term goals and objectives? 2. What are the financial requirements needed to achieve these long-term goals and objectives? 3. What sources of long-term capital are available, and which will best fit our needs? Long-term financing comes from: 1. Debt financing 2. Equity financing

DEBT FINANCING

By Borrowing Money From Lending Institutions

Term-loan agreement: A promissory note that requires the borrower to repay the loan in specified installments.

Risk/return trade-off: The principle that the greater the risk a lender takes in making a loan, the higher the interest rate required.

DEBT FINANCING

By Issuing Bonds Bond: A corporate certificate indicating that a person has lent money to a firm. Institutional investors: Large organizations–such as pension funds, mutual funds, insurance companies, and banks–that invest their own funds or the funds of others. Interest: The payment the issuer of the bond makes to the bondholders for use of the borrowed money. Maturity date: The exact date the issuer of a bond must pay the principal to the bondholder.

DEBT FINANCING-BY ISSUING BONDS

Different classes of bonds: 1. Unsecured or debenture bonds 2. Secured bonds Sinking fund: A reserve account in which the issuer of a bond periodically retires some part of the bond principal prior to maturity so that enough capital will be accumulated by the maturity date to pay off the bond.

EQUITY FINANCING

By Selling Stock

Stocks: Shares of ownership in a company.

Initial public offering: The first public offering of a corporation’s stock.

From Retained Earnings

Retained earnings are often a major source of longterm funds for small businesses who have fewer financing alternatives.

EQUITY FINANCING

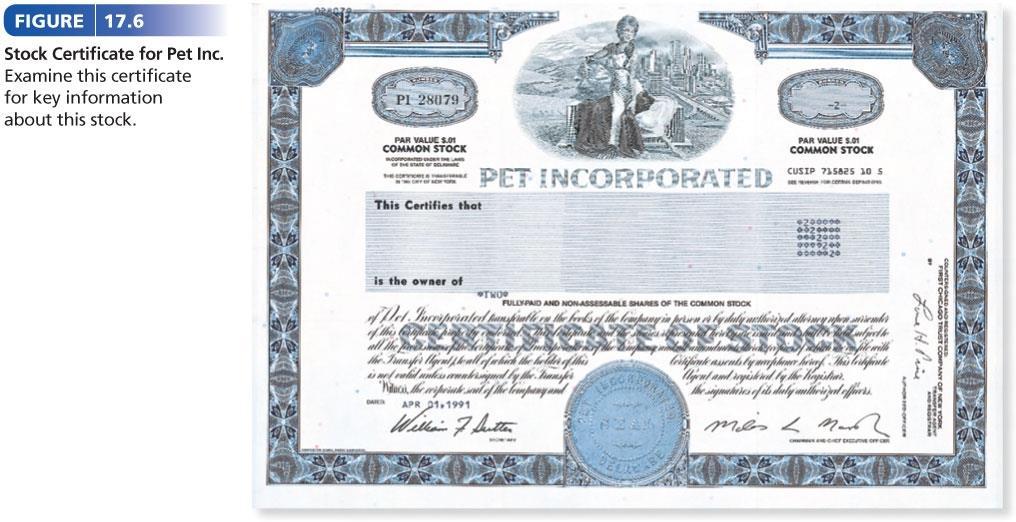

From Venture Capital Venture capital: Money that is invested in new or emerging companies that are perceived as having great profit potential. From Selling Stock Stock certificate: Evidence of stock ownership that specifies the name of the company, the number of shares it represents, and the type of stock being issued. Dividends: Part of a firm’s profits that may be distributed to shareholders as either cash payments or additional shares of stock.

STOCK CERTIFICATE

EQUITY FINANCE-- FROM SELLING STOCK

Common Shares: The most basic form of ownership in a firm; it confers voting rights and the right to share in the firm’s profits through dividends, if offered by the firm’s board of directors. Holders of common stock can: 1. Vote for the board of directors and on issues affecting the company 2. Share in the firms profits through dividends Preferred shares: Stock that gives its owners preference in the payment of dividends and an earlier claim on assets than common shareholders if the company is forced out of business and its assets are sold.