4 minute read

XI. Growth, Achievement and the Turn of the Century

Growth, Achievement and the Turn of the Century

Our Bank

Advertisement

In 1996, Kennebec Savings Bank closed more than $48 million in residential mortgage loans, an increase of $15 million over 1995 totals. ese amounts represented historically high levels for the Bank. Kennebec Savings Bank also experienced growth in its asset base and ended the year at $253 million, making it one of the larger and best-capitalized mutual community banks in Maine.

Also that year, the Bank introduced the Kennebec Savings Bank MasterMoney™ debit card. is was the rst card customers could use to both make ATM withdrawals and purchase items using checking account funds. Landscaping of the Bank’s lot at the Memorial Circle in Augusta enhanced the appearance of the neighborhood with much-needed green space and colorful plantings. In recognition of this e ort, the Bank received the 1996 Beauti cation Award from the Augusta Tree Board.

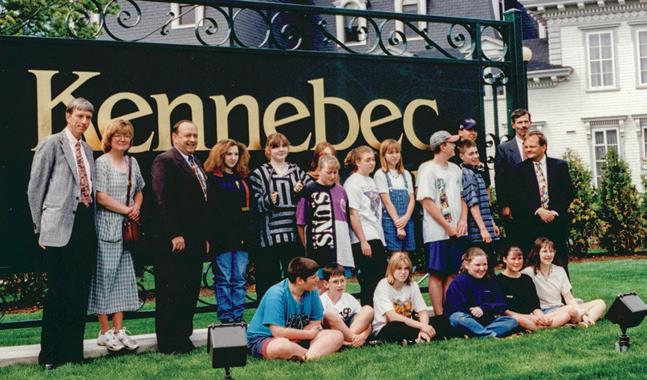

An expansion of the Bank’s branch and ATM network in 1997 provided even more accessibility, convenience and service to customers. Kennebec Savings Bank opened its rst o -site ATM at the corner of Riverside Drive and North Belfast Avenue in Augusta. e Bank also opened a new and expanded Waterville branch located at the site of the Bank’s original Waterville o ce on upper Main Street. In conjunction with the grand opening, the Bank provided a major contribution to the Waterville Regional Arts and Community Center.

Opposite: The Bank opened its first off-site ATM at the corner of Riverside Drive and North Belfast Avenue in Augusta in 1997.

Left: The Bank was recognized in 1996 with a Beautification Award from the Augusta Tree Board for its work in landscaping its lot at the Memorial Circle in Augusta. President Bill Pelletier, Treasurer Jim Chase, and Executive Vice President Mark Johnston are pictured in the photo.

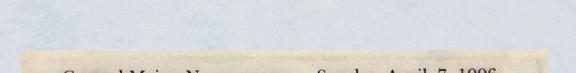

e expansion had been kicked o the year prior by the Waterville Fire Department, which used part of the site excavation to conduct practice re- ghting sessions. e Bank was pleased to be able to provide this important opportunity for our local re ghters to re ne and enhance their skills.

By 1997, the Bank was the leading real estate lender in Kennebec County, closing more than $49 million in residential mortgages and $10 million in commercial real estate loans. anks to the introduction of the Premier Checking banking product, which provided free checking, debit cards and checks, it also opened more than 1,000 checking accounts that year. Two new deposit products were introduced in 1998. e rst was a money market savings account, a short-term, higher yielding account that allowed customers easy access to their funds. e second, the KSB Kids Club Savings Account, was a low-balance account designed to encourage the development of good savings habits in children. It came with a specially designed passbook, a commemorative piggy bank, an above-market interest rate, and—the best part—a tour of the Bank vault, which the kids just loved.

Left: The Waterville location held a grand opening following a major expansion project in 1996.

Right: Children who opened a KSB Kids Club Savings Account were given a commemorative mint-scented piggy bank.

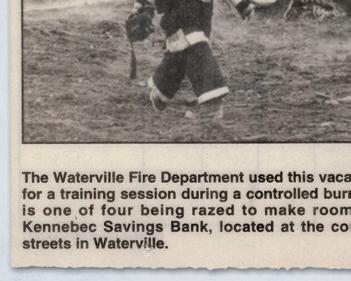

In 1996, the Bank provided the Waterville Fire Department with the opportunity to conduct a training session on the site of a building scheduled to be razed. For a number of years, Kennebec Savings Bank employees participated in a clean-up day for Camp KV, a children’s day camp located on 70 acres of land on Maranacook Lake in Readfield.

To commemorate the turn of the century, the New Century CD was introduced in 1999. It generated approximately $18 million in deposits. At the same time, the Bank’s IT and Operations departments were in full gear ensuring all systems were Y2K ready.

A satellite o ce opened in Granite Hill Estates retirement community in 2000. is full-service branch made banking services much easier and much more accessible to the residents of that facility. e Investment and Trust Services Department was also established in that year with the hiring of Amos Byron as the Bank’s trust o cer.

By the end of the rst year of the 21st century, the Bank had $352 million in assets and its earnings exceeded $3.8 million. It closed 550 residential mortgage loans for more than $40 million and more than 300 home equity loans and lines of credit exceeding $6 million.

Left: Kennebec Savings Bank held an event at Granite Hill Estates when the Bank opened a satellite location at the retirement community in 2000.

Right: Amos Byron served as the Bank’s first trust officer when the Investment and Trust Services Department was established in 2000.