7 minute read

Old Farmer’s Almanac Calls for Mild Winter, Spring for Texas

For more than 200 years, the Old Farmers’ Almanac has published long-term weather forecasts that many tout as remarkably precise. And while many consider the Almanac “useful, with a pleasant degree of humor,” the weather forecasts have been about 80 percent accurate throughout the years, which is considered a high mark.

So what does the 2021 Almanac have in store for Texas?

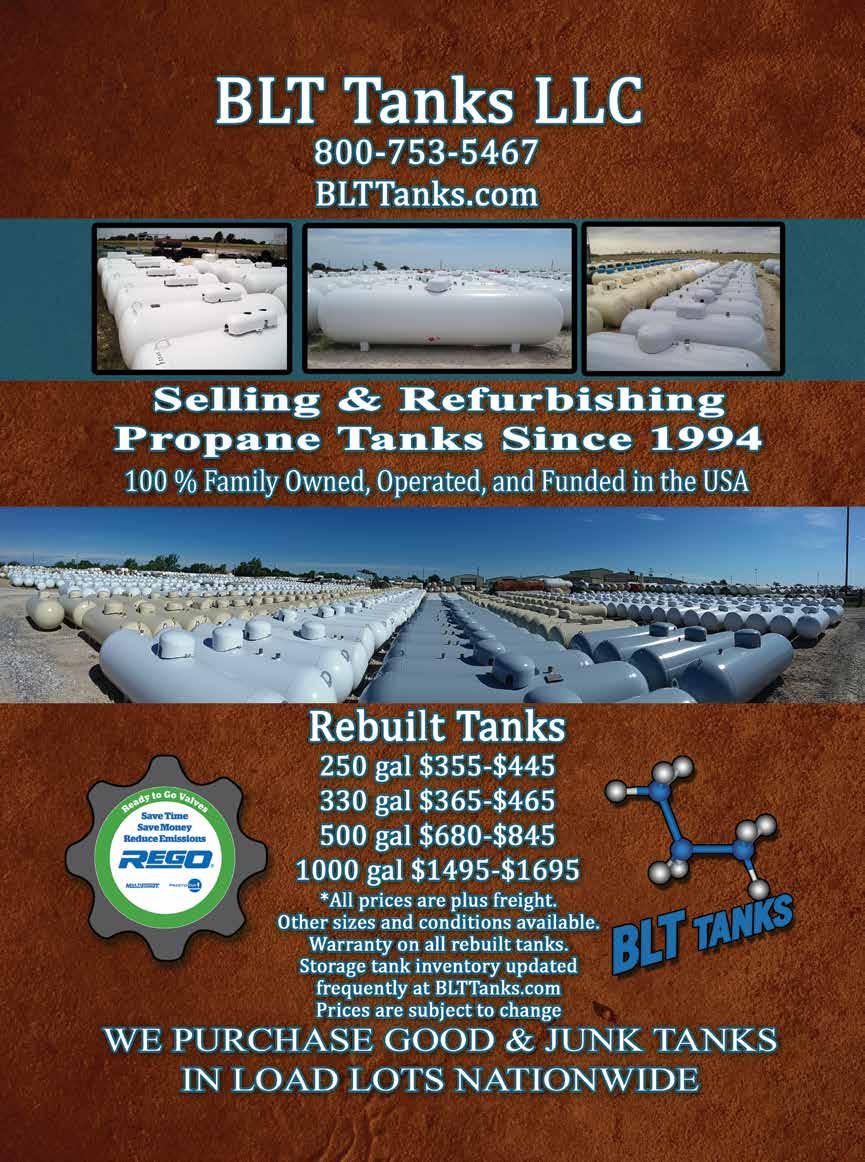

Advertisement

For this coming winter Texas weather will mix intervals of tranquil weather with occasional shots of cold and wintry precipitation, but overall may seem to be a bit “temperamental.”

“The coldest periods will be in mid-November, early to midDecember, and late January. The best chance for snow will be in late January.”

The Almanac goes on to predict that April and May will be cooler and rainier than normal, and summer will be cooler than normal with the hottest periods in mid-June, mid- to late July, and mid-August. Rainfall will be below normal in the north and above normal in the south.

This same pattern holds for next fall, as well, with below average temperatures in September and October predicted.

On a national scale, winter will be colder than normal in Maine, the Desert Southwest, the Pacific Southwest and eastern Hawaii, and near or above normal elsewhere. Snowfall will be greater than normal in the Northeast, Wisconsin, Upper Michigan, the High Plains and northern Alaska. It will be below normal in most other areas that receive snow (including Texas).

While spring will be milder here in Texas, it will be warmer than normal in the northeastern corner of the country, from Iowa northward through the Upper Midwest and westward through the southern Intermountain region, the western Desert Southwest, Alaska and western Hawaii.

The Almanac additionally says to “Watch for a tropical storm threat in Florida in mid-May.”

Better Business Bureau Scam Tips: Protect Yourself

By Rob Starr

Small business owners can be the victim of scams and frauds just like individual consumers. Crooks might see you as a softer touch than big businesses but with deeper pockets than typical consumers.

We reviewed the Better Business Bureau (BBB) scam reports to identify scams targeting business owners. We found at least ten. And we’ve supplied tips for how to protect yourself and your business.

Here are some tips to protect your business from fraudsters and scammers. These are based on the BBB tracker reports and other information:

1. Fake Checks

There are a few scams small businesses need to watch for. These are often the same as ones directed at consumers, like fake checks.

Keep an eye out for overpayments. A new supplier sends you a payment for more than you charged. Scammers will ask for the difference back. Make sure the name and business address line up.

Watch out for shipping scams. Fraudsters hire businesses to ship out of state products. They ask you to pay for certificates and reimbursement, checks bounce. Bad checks are missing signatures or bank logos.

The BBB also cautions against sending or transferring money to people you don’t know.

2. BBB Impersonators

These fraudsters claim they are from the BBB. They tell small businesses they

can get on a referral list for a fee. Watch out for phony emails that say a complaint has been lodged against your enterprise. That’s another way these cheats try and scam you.

Don’t click on or respond to anything you are suspicious of. Phone the BBB contact number to verify the information is real.

3. Phony Debt Collection

Brian Patrick, CEO of Pest Strategies, describes how this works to rip businesses off.

“Sometimes, bogus invoices find their way in your list of ‘to-pay’ transactions,” he writes. “Hiring a reliable bookkeeper or accountant is an excellent way to check their credibility.”

4. Password Phishers

Scammers use business tools like emails to steal data like passwords. They use them to get into online bank accounts, cloud-based business files, or social media profiles. Look for texts or emails telling you to provide personal information. Fake invoices and generic greeting s like ‘Hi Dear’ are red flags too.

Think you’re the victim of a phishing attack? Set your security software to update automatically. Use multi-factor authentication on accounts. Passcodes you get via text messages are good.

The BBB also advises you to check privacy settings on all social media accounts.

5. Investment Schemes

“Some investment scammer might try to pull you in with making a lot of money by investing a little,” writes Lindsey Maxwell, Co-Founder at Where You Make It. “If it sounds too easy, chances are it’s a scam.”

Offshore investment scams are big. The BBB suggests you watch out for jargon. Words like “guaranteed” should be a red flag.

6. Employment Scams

Are you self employed and looking for work? You might be a target for scammers according to the BBB. Here are a few things to watch for.

If you’re offered a job straight away without even an interview.

You’re asked for credit card numbers to get a project underway.

There’s no valid website or proper contact information. Small businesses need to look for the same info as consumers. An email, address, snail mail address, and a website are good.

Not sure of the project or job you’re being offered.? There are Better Business Bureaus all across America. Look to see if the company making the offer is listed with the BBB in your area. You’ll see what their rating is.

The BBB even reports there’s a scam whereby the cheats try and charge you for training.

7. Fake Government Programs

More and more these come at small businesses through social media. Still, fraudsters use email and text messages too. Watch out for debt collectors from fake agencies that look real. The BBB says you should be suspicious of calls to your business saying you’ve won government sweepstakes too.

These days business needs to be wary of bogus COVID related relief programs. Fake economic impact checks where businesses need to pay fees are common.

Only get info about stimulus payments from the IRS. Look for notifications at your local BBB too. The bureau has good resources.

8. Identity Theft of Owners or Businesses

This is like identity theft for consumers. But it involves stealing a company’s assets, credit information and quite often client lists. Beyond legal penalties, a business’s reputation can be damaged. You can even be held personally liable in some situations.

Getting good cybersecurity software is proactive. Fake invoices are a red flag If you think your business has been victimized, submit a complaint to the Federal Trade Commission.

9. Fake awards or recognition

Scammers know that business people like to be recognized. Unfortunately, that can lead to trouble. Eric Sachs, the CEO at Sachs Marketing Group. explains:

“This scam comes via email usually but sometimes phone calls,” he writes.

Business people get told they’re on a list for something like a high-achieving status club.

“Only you have to pay a fee to accept and the recognition is non-existent.”

Look for the right contact information. Find the URL and make sure there’s more than just an email address on the website. Follow up on phone numbers and snail mail addresses.

10. Too Good To Be True Leasing

“The contract typically constricts the business owner to a long-term agreement,” writes Erik Rivera, CEO of ThriveTalk. This one’s a scam because leasing is a competitive industry and better rates are always around the corner.

“A longer contract can legally bind the businesses to continue using an almost obsolete item or equipment.”

Reading trade publications will help you stay on top of innovations in your industry. Staying informed can help you avoid this scam.

Why Would the Better Business Bureau Call Me?

The BBB might call your small business. There are legitimate reasons to contact you this way. Like explaining the benefits of BBB accreditation.

Still, you need to be suspicious if the caller asks for personal information like credit card or bank numbers. Best to call the local BBB office if you suspect the call is a scam.

How Can I Verify A Company is Legitimate?

Verifying if a company is credible is important. Especially for a smaller enterprise that wants to network or take a new supplier on. Go to BBB.org and use the front page search for businesses. In the search results, you can then filter by those that are BBB accredited. The BBB rating as well as complaints and reviews will be listed there.

Article reprinted from https://smallbiztrends. com/, an award-winning hub of more than two million entrepreneurs, business owners, influencers and experts. Created in 2003, the site has grown into a hyper-engaged community of small business owners who learn from each other.

FEATURING SPECIALIZED PROGRAMS FOR LP GAS DEALERS

• Worker’s Compensation • General Liability • Business Auto Insurance • Property • Commercial Umbrella Building and Maintaining Confidence in the Insurance Industry since 1949

Member

Contact John S. Porter, CIC Mark D. VanDover, CIC Miles T. McFann Rhonda Wood

1305 South First Street • Lufkin, Texas (936) 634-3326 • 1-800-223-1289 Emails: john.porter@lumbermen.net • mark.vandover@lumbermen.net mmcfann@austin.rr.com • rhonda-wood@lumbermen.net • www.lumbermen.net